The Gold Report: Gold has fallen in the second half of March. Why?

Oliver Gross: I think it's a correction after the strong rally since December. And the situation in Ukraine has quieted down. We've also seen a strong uptrend since the beginning of 2014 and now it feels like a healthy consolidation.

TGR: Since December, we've had a very significant rise in gold equities. What is the cause? Gold rising from $1,180/ounce ($1,180/oz)? Or is it a cyclical change?

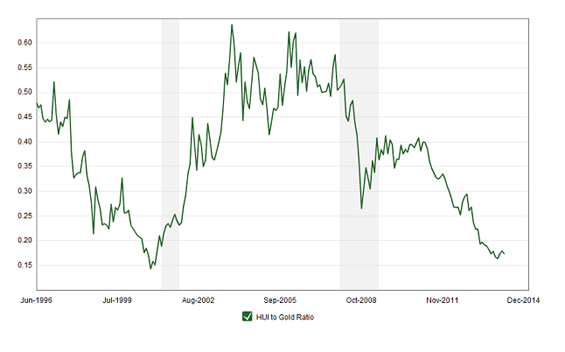

OG: It's a combination of bottom-building in the gold price and the end of the bear market, which resulted in one of the heaviest selloffs ever. The gold equities [NYSE Arca Gold BUGS Index (HUI)] to gold price ratio hit a multidigit low in 2013 (HUI:Gold). We have a solid double-bottom formation in the gold price in place and the end of the selling pressure from the gold exchange-traded funds (ETFs) and exchange-traded products.

"Columbus Gold Corp. is developing one of the most promising early-stage gold projects in South America."

We also see continuous strength in the physical gold market, especially the huge buying power from China, now the world's largest gold consumer and producer. And you can assume that China isn't a speculator regarding its aggressive purchases, but rather a prudent long-term investor. Maybe it has already developed a gold-backed yuan currency model that could be the new world currency.

The first quarter is always very important for equities. More and more market players have now realized the tremendous performance potential in gold mining stocks and joined the recent rally.

HUI:Gold Ratio (1996–2014)

Source: macrotrends.net

TGR: The NYSE Arca Gold BUGS Index has risen even as the broader market has been shaky. What do you make of that?

OG: It wasn't a surprise, as valuations in the gold mining sector were not far from complete depressions. In addition, the gold producers have reformed after the big selloff in their equities. We have noted a significant change in business philosophy and a newfound drive to create a more robust and sustainable business model. The gold producers have successfully changed their focus from growth at any cost to maximization of profitability, growth in capital efficiency and real shareholder value.

"Red Eagle Mining Corp.'s key deposit, San Ramon, has a fantastic return on investment."

The gold producers' income margins at price levels around $1,300/oz are still extremely slim. So there is a fantastic leverage in place, and with higher gold prices, the margins are going to explode. With a new gold bull market, which could lead to gold prices far above $2,000/oz in the next two to three years, we might see new, all-time highs in the NYSE Arca Gold BUGS Index. But I believe the next bull market rally will be more specific and focused on the best-in-class stocks.

TGR: Could we see the broader equities markets taking substantial losses, even as precious metal stocks increase in price?

OG: That would make sense, as we have had a very strong bull market in the broad equity markets and a very tough bear market in precious metals and other mining stocks.

TGR: The Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.MKT) has risen significantly higher than the majors. Does this surprise you?

OG: The Market Vectors Junior Gold Miners ETF fell from an all-time high of nearly 180 points at the end of 2010 to a historic all-time low of only 29 points at the end of 2013. So its strong rally didn't surprise me. Most important has been the astonishing rise of trading volume. This is the key in every turning point. The juniors, with their low valuations, usually have far higher leverage, and that is the reason why we see even more volatility in both directions.

Source: bigcharts.com

It's a very good sign that the juniors have outperformed the majors, as appetite for risk in the junior mining space is essential. We have seen a strong increase in financings and financing volumes in the junior gold equities market during Q1/14. That's a very healthy development.

TGR: There was a significant drop across the board in gold and silver equities in March. Was this mere profit taking, or have we reached an intermediate plateau?

OG: It really feels that we have seen the bottom now, and the bottom-building process always takes some time. The next few years will be a very attractive period to invest in high-quality resource companies.

TGR: How do you determine the price buy limits for the stocks you recommend? In other words, why are stocks good buys at one price and not another?

OG: When it comes to choosing mining stocks, I put a strong emphasis on deep research and fundamental analysis. This is crucial in a market where more than 80% of all junior mining companies will ultimately fail. It's all about quality and investors always have to be very, very picky in selecting picks that could become their favorites.

"True Gold Mining Inc. is developing one of the most promising and profitable gold projects worldwide."

After my thorough due diligence and conversations with managements and fund managers, I select my favorites, which I buy for the middle to long term. The other crucial factor is timing. For instance, you could have invested in the best-of-class companies from 2011–2013, and it wouldn't have made any difference, as the whole sector was punished. But when the timing is right, which seems to be now, it doesn't matter if an investor buys a great junior mining company at $1 or $1.50/share.

TGR: What are the specific criteria you seek in your research and analysis?

OG: I seek experienced and excellent management teams with strong track records and large networks; companies with healthy cash balances, solid financing outlooks and tight share structures with patient and successful investors; and projects that are decent-sized, attractive and well-located with exploration and expansion potential, projects that are economic even in low metal price environments. Aggressive project-development schedules are also very important. I also want to see strong and clear ambitions.

TGR: What gold companies come to mind in this respect?

OG: Columbus Gold Corp. (CGT:TSX.V) is led by very smart and prudent people. Most are well-versed geologists and genuine resource experts. Additionally, they have experienced financial experts and a strong network of investors and supporters. Columbus is developing one of the most promising early-stage gold projects in South America, the Paul Isnard project in French Guiana.

"Pilot Gold Inc. has a very impressive gold discovery at its Kinsley Mountain project."

Paul Isnard already contains a 5+ million ounce (5+ Moz) deposit. Exploration potential is outstanding. The resource contains a higher-grade ore body with decent grades of about 2 grams/ton (2 g/t) gold. The whole deposit is very flat and the continuity and quality of gold mineralization are favorable. There is still a lot of work to be done, but I see solid potential for a large-scale, very profitable gold mining operation.

Columbus' management acted to avoid heavy dilution yet develop its project on a fast track by making a deal with the Russian company Nordgold N.V. (NORD:LSE), one of the top 20 gold producers worldwide. It speaks for itself that four substantial gold companies are already involved in Paul Isnard: Nordgold and its well-capitalized project partner, the French producer Auplata S.A. (ALAUP:PA), mid-cap producer IAMGOLD Corp. (IMG:TSX; IAG:NYSE) and Sandstorm Gold Ltd. (SSL:TSX.V; SAND:NYSE.MKT), which bought a lucrative net smelter return last year.

TGR: What else do you like in that region?

OG: In Guyana, there is Sandspring Resources Ltd. (SSP:TSX.V) and its Toroparu project, which has 10 Moz gold and decent copper credits. I have tracked this company for years and decided to recommend it after its agreement with Silver Wheaton Corp. (SLW:TSX; SLW:NYSE). This is a game changer. I hear that Silver Wheaton selected Sandspring over 50 other juniors with decent gold assets.

The overall economics of Toroparu project are pretty good, with a solid return on investment. It has great support from the Guyana government. With the Silver Wheaton agreement, Sandspring now has the funds to reach the feasibility stage. I also like the company's high insider holdings, more than 25%. This is a perfect leverage play for me at its current valuation, as it will benefit greatly from what we expect will be a significant upturn in the gold price.

TGR: What other regions do you like in South America?

OG: I like the Antioquia Department in northwest Colombia, which is still widely underexplored. This is home to Continental Gold Ltd.'s (CNL:TSX; CGOOF:OTCQX) Buriticá project, one of the world's best. It already boasts 6+ Moz of over 10 g/t gold and will soon publish a new resource estimate. I believe it will ultimately contain 10+ Moz. This could be a huge cash cow.

Continental Gold has a great management team with a fantastic track record, including CEO Ari Sussman and Chairman Robert Allen, the company's largest shareholder. In December 2012, Continental raised CA$86.3 million (CA$86.3M), a truly outstanding amount for a junior gold company. This financing avoided dilution and enabled one of the largest gold exploration programs in South America. With a current cash balance of more than CA$100M, the company is perfectly positioned to bring Buriticá to feasibility and the final milestones in the permitting process.

TGR: Do you like any other companies in Antioquia?

OG: Not far from Buriticá, Red Eagle Mining Corp. (RD:TSX.V) has found a lucrative, 5+ g/t gold ore body at its Santa Rosa project. Its key deposit, San Ramon, has very attractive economic numbers, even at lower gold price levels, and a fantastic return on investment. Also, there is great infrastructure access, which leads to positive cost reductions. Red Eagle is on track to reach feasibility this year. It also has great exploration and expansion potential at its huge flagship property.

"Santacruz Silver Mining Ltd. has a tremendous portfolio of promising Mexican projects."

What really makes this special is the low capital expense (capex) of about CA$85M. Financing shouldn't be a problem, as Red Eagle is backed by two financially sound, strategic investors that own more than 30% of the company. The first is Liberty Metals & Mining Holdings LLC, which is a daughter company of the insurance giant Liberty Mutual of Boston. The second-largest shareholder (after management) is Appian Natural Resources Fund L.P., a new mining-focused fund that is led by two successful former J.P. Morgan bankers.

Red Eagle's CEO, Ian Slater, is a smart and talented manager who has put together an amazing team that is doing fine community work in Colombia.

TGR: This is a stock that is trading at only $0.335/share.

OG: Absolutely great leverage there. It did its IPO at $1.25.

TGR: Do you like any gold companies in Brazil?

OG: Brazil Resources Inc. (BRI:TSX.V; BRIZF:OTCQX). Its genius chairman is Amir Adnani, the mastermind behind Uranium Energy Corp. (UEC:NYSE.MKT). Brazil Resources is his new darling, and he has huge ambitions. The company has a strong team of resource experts and well-connected finance people, as well as an excellent share structure and shareholder structure. It is backed by the Brasilinvest crew, which has attracted funds of more than $16 billion ($16B) since its establishment.

Other prominent investors and backers of Brazil Resources are the Casey Group and Sprott. So it's a pretty good sign that most of the outstanding shares are in strong and highly qualitative hands.

Brazil Resources owns a huge and promising land package of gold mining concessions in Brazil, including a multimillion-ounce gold resource with plenty of exploration potential.

In addition, the company holds a highly interesting land package next to Fission Uranium Corp.'s (FCU:TSX.V) Patterson Lake South discovery in Saskatchewan. This project is in a lucrative joint venture with a uranium major, AREVA SA (AREVA:EPA), so it could be a very profitable offtake.

One my friends from Vancouver is a strong supporter of this story: Mr. Gianni Kovacevic is a great investor with a huge network and the chief editor of The MEDAP Letter, which has Brazil Resources in its resource portfolio.

With Brazil Resources we have a great team, very attractive projects, sufficient funds, first-class investors and a strong schedule. These are the fundamentals I want to see in a junior gold story.

TGR: You mentioned ambitious management. Which other teams come to mind?

OG: Two gold juniors I follow closely are True Gold Mining Inc. (TGM:TSX.V) and Pilot Gold Inc. (PLG:TSX). Both companies are led by the masterminds of Fronteer Gold, which was acquired by Newmont Mining Corp. (NEM:NYSE) in a $2.3B deal. The former president and CEO of Fronteer is Mark O'Dea, one of the most skilled managers in global junior mining. He is now the executive chairman of True Gold and the chairman of Pilot. Both companies are backed by first-class strategic investors and mining companies and have great financials. I really like the business philosophy and the strong ambitions of the stunning head management here.

TGR: What can you say specifically about these companies and their projects?

OG: True Gold is developing in Burkina Faso one of the most promising and profitable gold projects worldwide: Karma. It is already approaching mine financing and the start of construction. In gold mining today, it's all about margin, and True Gold owns a margin leader with district-sized potential.

Pilot Gold has had a very impressive gold discovery at its Kinsley Mountain project in Nevada this year. This could be a world-class gold deposit comparable to Fronteer's Long Canyon deposit. In Turkey, the company is developing the huge TV Tower project, which is in a joint venture with resource giant Teck Resources Ltd. (TCK:TSX; TCK:NYSE). TV Tower seems to contain several decent gold, silver and copper deposits and has great development and exploration potential.

TGR: Do you like any other African companies?

OG: My favorite among the major gold producers is Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE). And I have a Buy rating on explorer Legend Gold Corp. (LGN:TSX.V), which has just joint-ventured with Randgold in an amazing land package below the biggest gold mine in Mali.

TGR: And elsewhere in the world?

OG: I have a Buy rating for junior producer Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT). Its San Francisco gold mine in Mexico is one of the lowest-cost producers in the world. And I have a Buy rating for developer Dalradian Resources Inc. (DNA:TSX) in Northern Ireland. Its Curraghinalt project is one of the highest-grade gold projects in the world.

TGR: You favor very few silver companies as compared to gold. Why?

OG: When things get serious, gold is the best storage of wealth and the best protection against turbulence. Silver's role will always be a combination of industrial metal and investment asset. And most silver supply comes from base metal mines as a byproduct, so its producers don't really care about the silver price.

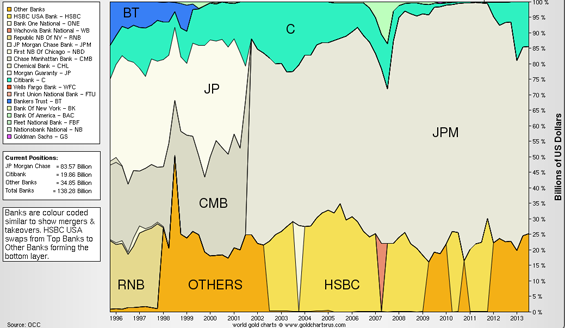

Moreover, the silver market is extremely tight and thus even more so than gold subject to manipulation by the likes of J.P. Morgan, Goldman Sachs, HSBC and other influential players in the paper markets. I try to play the trends regarding the gold-silver ratio, which remains extremely high. If this trend reverses, I will buy more silver and silver mining stocks.

TGR: It sounds as if you are sympathetic to the manipulation argument made by the Gold Anti-Trust Action Committee (GATA).

OG: COMEX is the biggest gold exchange in the world and has by far the most influence on daily and short-term gold prices. J.P. Morgan and the others I mentioned are the biggest players in COMEX, and we can assume they have the biggest influence on daily and short-term gold prices. Facts don't lie: J.P. Morgan and other big financial players control more than 80% of all precious metals derivatives and you can assume that these influential players always know about the crucial positioning at the COMEX.

It seems that these players are always doing the opposite of what they say publicly. For example, Goldman published a gold report in 2013 in front of the huge selloff. It made more than $500M in this selloff, then turned around and reinvested heavily in gold. So it also made millions in the recent gold price recovery. Goldman has recently invested more than $80M in the SPDR Gold Trust ETF. We can assume that Goldman and J.P. Morgan are, in fact, long on gold. That also demonstrates to me that the gold price bottom is in.

Source: goldchartsrus.com

TGR: Which silver companies are you keen on?

OG: I like two. The first is Wildcat Silver Corp. (WS:TSX.V). It is led by Richard Warke, the man behind the glorious Ventana Gold story, which was bought out for $1.56B in 2011.

The company is developing the Hemosa project in Arizona, which has the potential to be the only large manganese producer in the U.S., as well as one of the largest silver producers in North America.

Hermosa will reach the feasibility stage this year. Its economics are solid, and it should be a big cash cow, considering the next bull market and anticipated higher silver prices. Insiders own more than 30% of Wildcat. The company has also attracted Silver Wheaton as a strategic investor. Wildcat offers one of the best leverages on the silver price in a portfolio. Its valuation is far below $0.50 per silver ounce.

TGR: And the second is?

OG: Santacruz Silver Mining Ltd. (SCZ:TSX.V; 1SZ:FSE). This could be another First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE). Santacruz already achieved production at its Rosario mine in Mexico and has a tremendous portfolio of promising Mexican projects. I think Santacruz has the right people to succeed.

TGR: Which companies stand out in the junior copper sector?

OG: I like two in Arizona and one in Nevada. My favorite is Augusta Resource Corp. (AZC:TSX; AZC:NYSE.MKT) and its world-class Rosemont copper project near Tucson. Richard Warke is a director. Augusta is currently in a takeover battle with its largest shareholder, HudBay Minerals Inc. (HBM:TSX; HBM:NYSE). I believe that Augusta is worth more and remains a Hold recommendation. Mostly likely, a higher takeover price will be reached. When Rosemont gets its final construction permit—this should happen in Q2/14—it will lead to a lucrative revaluation.

TGR: What's the other in Arizona?

OG: Curis Resources Ltd. (CUV:TSX.V; PCCRF:OTCPK) and its Florence copper project. Like Augusta, Curis is in the final phase of the permitting process. I see excellent potential here for a revaluation after it gets its final permit. Florence will be a highly profitable copper mine with strong investment returns and an attractive and financeable mine capex. This story is led by the successful Hunter Dickinson Inc. mining crew, and the company has a very tight share structure.

Curis is employing a revolutionary in situ production method at Florence. It did its homework thoroughly and had great samples from BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), one of the former operators. Especially interesting is the recent strategic investment by major copper producer Taseko Mines Ltd. (TKO:TSX; TGB:NYSE.MKT). So Curis is a promising potential takeover target.

TGR: What's your Nevada copper pick?

OG: Nevada Copper Corp. (NCU:TSX) and its Pumpkin Hollow project. In view of its last cash balance, its overall valuation is extremely low—its enterprise value is really choked right now. But with the strong support of its largest shareholder, Pala Investments, it will be able, in my opinion, to put the first phase of its project into production. There is also tremendous development and expansion potential here.

TGR: Do you think that the recent downturn in gold equities might scare off investors who have become gun-shy since 2011?

OG: The last three to five years in gold, especially junior mining, have been really traumatic and unnerving for investors. I really hope, however, that they will not be unduly influenced by the high volatility in these markets and sell after a 30% or 50% rally when there's potential for a 300% to 1,000% rally.

We have just seen the bottom. The cyclical nature of this market should lead to gains in best-in-class mining stocks of 500% to 1,000% and more. Investors must be not only long-term ambitious but also patient.

TGR: Oliver, thank you for your time and your insights.

Oliver Gross is a passionate resource expert, prudent investor and adviser with more than 10 years of experience in the mining and junior sector. He is the chief editor and analyst of the newsletter Der Rohstoff-Anleger (The Resource Investor), which specializes in the global junior resource sector. It is backed by the GeVestor Financial publishing group, the largest online publishing house in Germany.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Columbus Gold Corp., Continental Gold Ltd., Red Eagle Mining Corp., Brazil Resources Inc., True Gold Mining Inc., Pilot Gold Inc., Timmins Gold Corp., Fission Uranium Corp. and Santacruz Silver Mining Ltd. Streetwise Reports does not accept stock in exchange for its services.

3) Oliver Gross: I own, or my family owns, shares of the following companies mentioned in this interview: Augusta Resource Corp., Brazil Resources Inc., Continental Gold Ltd., Red Eagle Mining Corp., Silver Wheaton Corp., True Gold Mining Inc. and Wildcat Silver Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.