Streetwise Base Metals Articles

Richard Karn's Advice for Avoiding the Walking Dead

Source: Special to The Gold Report (9/24/14)

Starved of cash, nearly 150 mining companies listed on the Australian Stock Exchange went into bankruptcy during the fiscal year

that ended June 30, and another 23 have gone under since then. Richard Karn, managing editor of the Emerging Trends Report, believes a fresh wave of failures is expected when the quarter ends September 30, and a major shakeout at some point appears likely. But the situation isn't grim for all the specialty metal companies down under. In this interview with The Gold Report, Karn shares a handful of names with the wherewithal to survive the onslaught.

More >

Sprott Fund Manager Jason Mayer's Guide to Resource Stock Profits

Source: JT Long of The Mining Report (9/23/14)

Miners are having a tough time getting funded, and although Canadian oil and gas has performed well over the last few quarters, some companies might be overvalued. No wonder investors are confused. In this interview with The Mining Report, Jason Mayer of Sprott Asset Management examines near- and long-term plays that look poised to deliver returns, and shares his criteria for selecting profitable investments in volatile resource markets.

More >

Commodities Capitulation—A Blip or the Start of Something More?

Source: Chris Berry, Disruptive Discoveries Journal (9/22/14)

"By most accounts, commodity prices are at five year lows. Almost everything, from gold to silver to iron ore to wheat to corn, is falling—hard. ."

More >

Jeff Desjardins and James Fraser Look at Junior Miners in a Way that May Surprise You

Source: Brian Sylvester of The Mining Report (9/16/14)

It's never too late to find a new way to evaluate mining companies, and Jeff Desjardins and James Fraser of Tickerscores.com have developed one based on over 20 different criteria. Add in some near-term catalysts and the wheat separates from the chaff. In this interview with The Mining Report, Desjardins and Fraser share the names of companies with some of Tickerscores.com's highest junior mining scores.

More >

Filipe Martins: African Miners that Can Generate Cash Flow and Dividends

Source: Kevin Michael Grace of The Mining Report (9/9/14)

Low all-in gold cash costs are a good thing, says London-based GMP Securities Analyst Filipe Martins, but they don't tell the whole story. In this interview with The Mining Report, Martins argues that the best companies are those with strong free cash flow yields and a view to return cash to investors. Many of these companies have gold, copper, titanium and graphite projects in Africa, which boasts low-risk jurisdictions in addition to high-grade geology.

More >

Low all-in gold cash costs are a good thing, says London-based GMP Securities Analyst Filipe Martins, but they don't tell the whole story. In this interview with The Mining Report, Martins argues that the best companies are those with strong free cash flow yields and a view to return cash to investors. Many of these companies have gold, copper, titanium and graphite projects in Africa, which boasts low-risk jurisdictions in addition to high-grade geology.

More >

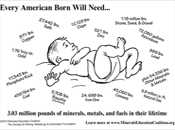

Today's U.S. 'Baby' Will Consume 3 Mlbs Metals and Minerals In Lifetime

Source: Lawrence Williams, Mineweb (9/1/14)

"The projected lifetime consumption of metals and minerals by today's U.S. baby extrapolated across the world presents an enormous challenge for the global resource sector."

More >

Canaccord's Luke Smith: Five Aussie Companies with Cash Flows, Low Costs and MOUs

Source: Kevin Michael Grace of The Mining Report (8/26/14)

Now more than ever, only select mining companies are attracting investors. Luke Smith, head of mining research for Canaccord Genuity in Melbourne, argues that low costs, increasing cash flows and improved net cash positions are crucial for gold companies. Solid contracts with end-users and strong institutional support are crucial for commodities. In this interview with The Mining Report, Smith highlights two undervalued Australian gold companies and three Australian companies in graphite and lithium that have already seen explosive share growth and appear poised for even greater gains.

More >

CEOs in Mining

Source: Visual Capitalist (8/20/14)

The CEOs of the top 25 gold, silver, copper, coal and base metals mining companies in the world are profiled in this infographic.

More >

Fund Adviser Björn Paffrath's Mantra: In the End, Performance Matters

Source: Brian Sylvester of The Mining Report (8/19/14)

Björn Paffrath, Switzerland-based fund adviser and newsletter writer, says there is certainly an elevated risk of a correction in the broad market but the upside in the mining sector is worth looking at as the market turns. Paffrath expects more M&A activity in the fall and says he's always looking for opportunities that really impact the performance of the funds. In this interview with The Mining Report, Paffrath shares some silver, base metals and tungsten positions.

More >

Minerals Versus Marijuana

Source: Douglas French, The Daily Reckoning (8/19/14)

"Rule, Casey, Cook, and James say now is the time to invest in natural resource plays, not run for high-tech or a product to get high with."

More >

Like Gold, Base Metal Stocks Offer Huge Investment Opportunities

Source: Lawrence Williams, Mineweb (8/1/14)

"Base metals stocks have been some of the best performers so far this year as they have risen off their nadirs."

More >

Paul Renken: Bottom-Fishing for the Best Junior Resource Equities

Source: Brian Sylvester of The Gold Report (7/28/14)

It's the lazy days of summer and Paul Renken, senior geologist and analyst with VSA Capital, is bottom-fishing. He sees a lot of value in unloved resource equities and spends much of his time sifting through the lot to find juniors that will get the increasingly sparse financing needed to turn potential into production. Renken offers an abundant catch of equity picks in this interview with The Gold Report.

More >

Doug Loud and Jeff Mosseri: Three Reasons Why Gold and Gold Stocks Will Rise

Source: Kevin Michael Grace of The Gold Report (7/23/14)

It's hard to see the present until it's in the past. What does this mean for gold? Money managers Doug Loud and Jeff Mosseri of Greystone Asset Management say that a bull market may have already begun. All the signs are there: rising political tension, a shortage of new supply and a cull of the weakest stocks. In this interview with The Gold Report, Loud and Mosseri list a dozen gold, silver and copper companies that should ride the crest of the wave.

More >

Jocelyn August: Upcoming Catalysts for Precious and Base Metals, Uranium and Oil and Gas Plays

Source: Brian Sylvester of The Mining Report (7/22/14)

Timing the market is sometimes more important than finding the right equities. But if you can time the market and find the right equities, that can be the most direct path to success. Jocelyn August, senior analyst and product manager with Sagient Research's CatalystTracker.com, follows catalysts that move resource stocks with regularity, sometimes 10% or more. In this interview with The Mining Report, August discusses some upcoming catalysts in the precious and base metals spaces, and names others in uranium and oil and gas.

More >

2014 Commodities Halftime Report

Source: Frank Holmes, U.S. Global Investors (7/14/14)

"After a disappointing 2013, the commodities market came roaring back full throttle, outperforming the S&P 500 Index by more than four percentage points and 10-year Treasury bonds by more than six."

More >

Rick Mills' Econ 101—Rising Demand and Falling Supply Equals Higher Metals Prices

Source: Kevin Michael Grace of The Mining Report (7/1/14)

Juniors can't fund their projects, which means that the majors' reserves will continue to shrink. Rick Mills argues that this process can have but one result: higher metals prices across the board. In this interview with The Mining Report, the owner and host of Ahead of the Herd.com highlights a half-dozen gold, silver, copper and nickel companies that will leverage these high prices, and introduces us to a Canadian company's unique cobalt project in Russia.

More >

It's Not About Discovering a Mine, It's About Discovering a Technology

Source: JT Long of The Mining Report (6/17/14)

Michael and Chris Berry are back for The Mining Report's second annual father-son interview in honor of Father's Day. While they don't agree on everything, they are aligned on the importance of disruptive discoveries to help companies succeed even in a sideways market. Flexibility and selectivity are their long-term strategies in any sector, from precious metals to commodities to rare earths.

More >

Less Correlation Among Commodities Demands More Careful Selection: Philip Richards

Source: JT Long of The Gold Report (6/16/14)

Commodities from coal to gold once traded in close correlation, but today the graph looks helter-skelter. This means Philip Richards of RAB Capital has had to think on his feet when choosing names for his company's Special Situations Fund. In this interview with The Gold Report, Richards explains how commodities markets have changed in recent years, and he lists companies of interest in the gold, silver, nickel, vanadium, zinc and oil and gas sectors.

More >

This Metal Problem Could Ignite China's Smoldering Crisis

Source: Peter Krauth, Money Morning (6/16/14)

"Despite some limited potential weakness in the very near term, the global picture for base metals looks to be heating up from both a supply and demand perspective."

More >

Mark Seddon's Catch-22: We Need More Tungsten, But Projects Can't Find Funding

Source: Kevin Michael Grace of The Mining Report (6/10/14)

Even as demand rises steadily, the world's largest non-Chinese tungsten mine will be exhausted by next year. So investors should be lining up to fund new mines, right? Not a bit of it, says analyst Mark Seddon of Tungsten Market Research. In this interview with The Mining Report, Seddon argues that a supply shortage could mean much higher prices, leading to handsome profits for those companies that get to market soonest.

More >

Finally, Good News for Mining in Peru: Ricardo Carrión and Alberto Arispe

Source: Peter Byrne of The Mining Report (6/3/14)

Ricardo Carrión and Alberto Arispe of Peru-based Kallpa Securities have a boots-on-the-ground view of the politics, legal battles and investment climate for precious metals mining in the Andes. In this interview with The Mining Report, Arispe and Carrión detail the new, positive developments afoot in this region and explain why investors should get involved now, before the rest of the world catches on.

More >

Ian Parkinson's Copper and Gold Names for a Fresh Round of M&A

Source: Brian Sylvester of The Gold Report (6/2/14)

Growth for the sake of growth is over, but that doesn't mean mergers and acquisitions in the mining space are finished, says Ian Parkinson, director of equity research-mining with GMP Securities L.P. Parkinson expects a fresh round of takeover bids for underperforming single asset producers and developers that could move the needle for state-owned enterprises and multinationals. In this interview with The Gold Report, we picked Parkinson's brain for some likely targets.

More >

Growth for the sake of growth is over, but that doesn't mean mergers and acquisitions in the mining space are finished, says Ian Parkinson, director of equity research-mining with GMP Securities L.P. Parkinson expects a fresh round of takeover bids for underperforming single asset producers and developers that could move the needle for state-owned enterprises and multinationals. In this interview with The Gold Report, we picked Parkinson's brain for some likely targets.

More >

Jeff Wright: Miners that Create Their Own Momentum

Source: JT Long of The Mining Report (5/23/14)

Jeff Wright of H.C. Wainwright & Co. doesn't anticipate a major shift in the price of gold near-term, so he doesn't expect the gold price to provide momentum for mining company stocks. Instead, he's looking at companies that can provide their own upward movement. Wright, an analyst, finds some promising candidates in some unlikely places, like environmentally friendly California, according to this interview with The Mining Report.

More >

What Will Shake Retail Investors Out of Their Shell Shock?

Source: JT Long of The Mining Report (5/13/14)

Mining companies may just have one more year of tough going. Speaking about what he calls "the trough of a turning point," John Kaiser of Kaiser Research Online makes the case for retail investors to look seriously at discovery exploration while waiting for metals prices—gold in particular—to move back into a supercycle. In this interview with The Mining Report, Kaiser shares the names of underpriced gold, silver and zinc juniors with staying power, and explains why scandium is a metal that could save the world.

More >

Chris Ecclestone: Right Size, Right Metals Signal Success for REE Projects

Source: Brian Sylvester of The Gold Report (5/5/14)

The rare earth elements sector is smaller than it was a few years ago, and Chris Ecclestone, mining strategist with Hallgarten & Co., thinks it needs to get smaller still. The only way to succeed, he tells The Gold Report, is by finding the right-sized project with the right REEs. He also shares his theories on China's manipulation of REE prices and touts the mineral wealth of Spain and Portugal.

More >