Streetwise PGM - Platinum Group Metals Articles

Osisko Gold Royalties Tracks Gold

Source: Bob Moriarty for The Gold Report (11/29/16)

Bob Moriarty of 321 Gold discusses recent precious metal price movements and Osisko Gold Royalties' leverage to the gold price.

More >

Precious Metals Stocks May Be Poised for a Major Upswing

Source: Clive Maund for The Gold Report (10/31/16)

Technical analyst Clive Maund outlines why he believes the correction in gold and precious metals stocks is coming to an end.

New CUSIPS Remove Barriers for Traders in Physical Precious Metals

Source: The Gold Report (10/6/16)

By assigning CUSIP numbers to physical precious metal assets, including gold and silver bar bullion, Delaware Depository and CUSIP Global Services have made it easier for investors to trade and track the commodities on traditional platforms.

More >

The CME Read My Book

Source: Bob Moriarty for The Gold Report (9/15/16)

Bob Moriarty of 321 Gold discusses the benefits of trading on the gold/silver ratio and gold/platinum spread, and the new contracts the CME is launching next month.

More >

If You Want to Own Only Two Gold Stocks, Buy These

Source: Adrian Day (9/9/16)

The year's strong performance of most gold stocks has left newcomers wondering what to buy, says money manager Adrian Day. In such circumstances, he believes investors are better off paying up for quality than looking for something "cheap" down the food chain. Day reviews two favorite gold companies, one large, one small, that he says give broad exposure to the sector.

More >

The Precious Metals Sector and the Fed. . .

Source: Clive Maund for The Gold Report (8/26/16)

Technical analyst Clive Maund reflects on how Federal Reserve statements may affect markets, and explains why he thinks the precious metals markets are due for a correction.

More >

Is It Time to Dump Gold and Buy Platinum?

Source: Bob Moriarty (6/20/16)

Bob Moriarty explains why precious metals investors may want to look beyond gold to a commodity with a long history and an interesting relationship to the yellow metal.

More >

Five Junior Mining Companies Creating Value Through Exploration

Source: Special to The Gold Report (6/9/16)

The drill bit is essential to junior mining companies. Only through active exploration can investors separate the companies with potential from those without. Mick Carew of Haywood Securities discusses five companies on track to create value through the drill bit.

More >

How Investors at the California Capital Conference Picked the Next Top Small-Cap Companies

Source: Staff of The Gold Report (12/7/15)

If only someone could bottle the experience of finding an overlooked company, investing for pennies a share and cashing in for 10, 20 or 30 times what you paid. Priceless, right? But how to find those companies? Small caps aren't covered by the mainstream press and analysts the way blue chips are, and determining value of an early-stage company before profit and loss statements take on real meaning and big questions about science and markets are answered can be difficult. That is why veteran investors like Tom Swaney, president of California-based Harwood Capital Inc., like to meet management in person at events like the California Capital Conference.

More >

Four Reasons Investment Strategist Joe McAlinden Likes Hard Assets, Especially Gold

Source: Special to The Gold Report (11/2/15)

In September, former Morgan Stanley Investment Management Chief Global Strategist Joe McAlinden announced in an interview with The Gold Report that he had reversed his view on commodities. In this interview, he predicts that the gold price could double in the next two year and envisions even more upside for the mining equities.

More >

Andrew Pullar's Plan: Go Long, Set Goals with World-Class Assets

Source: Brian Sylvester of The Gold Report (10/5/15)

Andrew Pullar, CEO of The Sentient Group, a private equity fund, says his plan for investment success is all about identifying companies with long-life, low-cost, world-class assets and supporting them through to production. In this interview with The Gold Report, Pullar plots the course for a handful of what he believes are world-class mining assets.

More >

Survival Secrets from Colorado Resource Investing Front Lines

Source: JT Long of The Gold Report (10/1/15)

Top experts and select companies traveled to Colorado last week for a pair of conferences focused on the survivors in the natural resource mining sector. The Gold Report reached out to some of the discerning voices there and asked whether the barrage of headlines from the Federal Reserve and China impacted the mood, and what companies they would be following up on when they returned to their offices. While the Precious Metals Summit was geared toward development-stage companies and the Denver Gold Forum was mostly populated by large, producing mining companies, everyone seemed fixated on survival. For those of us watching from home, experts we talked to were kind enough to name some of the standout companies they saw in boothland.

More >

Why a Fed Rate Hike Could Be a Blessing for Gold Prices: Brien Lundin

Source: JT Long of The Gold Report (8/27/15)

Like a true contrarian, Gold Newsletter publisher Brien Lundin looks beyond the headlines to understand what is really moving precious metals prices. He has concluded that the mainstream media may have it all wrong. Suspected anchors on the gold price, such as an interest rate increase and devaluation of the yuan, could actually be a rallying cry for commodities, he says in this interview with The Gold Report. And, he points to a baker's dozen of companies poised to take off when the arrows turn.

More >

Haywood's Mick Carew Explains Why Now Is an 'Opportune Time for Consolidation' in the Mining Space

Source: Brian Sylvester of The Gold Report (8/24/15)

Mick Carew, a research analyst with Haywood Securities, hopes we have found the bottom of the commodity cycle but expects M&A activity to continue apace through the rest of this year and into 2016 as low metals prices force the hands of underfunded management teams. Carew says M&A is commonly viewed as a potential indicator of a swing in market sentiment, and in this interview with The Gold Report, he discusses a handful of his favorite names, some of which could become M&A targets.

More >

David Smith: Love and Fear Trade Buying Will Drive Metals, and These Miners Higher. . .This Year!

Source: Brian Sylvester of The Gold Report (4/1/15)

Despite their recent underperformance, David H. Smith, Senior Analyst with The Morgan Report, remains bullish on precious metals, especially silver and palladium, as the "love trade" heats up and the global economy adds more debt to the system. Smith believes that the secular bull run in precious metals will be reignited later this year and that investors should take advantage of the regular volatility native to silver prices. In this interview with The Gold Report, Smith provides some of the silver and platinum group metals equity names he owns and that could offer significant upside, even from current prices.

More >

A Fickle Exploration Ranking

Source: Kip Keen, Mineweb (3/2/15)

"If we're getting a perspective on exploration potential in a more perfect world without major obstacles to prospecting (like war and drug runners), it's one polluted by erratic confidences."

More >

PDAC Kicks off with Bold Predictions

Source: Brian Sylvester of The Gold Report (3/2/15)

The annual conference of the Prospectors and Developers Association of Canada (PDAC) is under way in Toronto and the mood on the floor and in the Investors Exchange is, as one might expect, cautiously hopeful, even if about a dozen booth spaces are unoccupied.

More >

What's in a Global Mining ETF?

Source: Kip Keen, Mineweb (2/26/15)

"The group's fortunes are tightly tied to the balance between metal supply and demand."

More >

Heiko Ihle: Back to Precious Metals Equity Investing Basics

Source: Brian Sylvester of The Gold Report (1/26/15)

Investing in mining equities can get rather complicated but Heiko Ihle, managing director at H.C. Wainwright & Co., says precious metals equity investors need to focus on just three criteria: jurisdiction, management and asset viability. In this interview with The Gold Report, he explains his rationale and discusses several of his preferred gold and silver names.

More >

So Bad It's Good: Surviving 2014

Source: JT Long of Streetwise Reports (11/25/14)

As we approach Thanksgiving in the States, Streetwise Reports

reached out to some of our most popular experts for perspective on the natural resource market during this volatile time. While some thought 2014 was so bad it was good—for contrarian investors—others will be all too happy to see the year in the rearview mirror.

More >

Chen Lin Says Gold Miners Need to Produce at $1,000/oz or Less to Survive

Source: Kevin Michael Grace of The Gold Report (11/17/14)

How low can gold go? Chen Lin expects a probable near-term low of $1,000/ounce. The author of the What is Chen Buying? What is Chen Selling? newsletter says that at that price we can expect a bloodbath of companies, both large and small. Gold cannot be kept down forever, however, and once the bottom is in, those miners that have survived will be in an enviable position, able to buy lucrative assets at bargain prices. In this interview with The Gold Report, Lin identifies several producers and one near-term project uniquely positioned for the next bull market.

More >

A Year of Hard-Wrought Lessons for Platinum

Source: Duduzile Ramela, Moneyweb (10/20/14)

"Mechanization is becoming more viable; we're going to see a more skilled workforce..."

More >

Will Russia and South Africa Become the OPEC of Platinum?

Source: Teresa Matich, Resource Investing News (10/12/14)

"Bloomberg reported last Wednesday that Russia and South Africa will meet next month to discuss their mutual interest in the white metals, and the possibility of bolstering prices."

More >

Rick Rule: Seeing a Bullish Transition in Junior Gold Miners

Source: Tekoa Da Silva, SprottGlobal Resource Investments (9/26/14)

"The market itself is very healthy. You are seeing a transition. . .a transition that doesn't suggest, but rather screams that [junior resource issues are] under accumulation—which is a very, very bullish sign."

More >

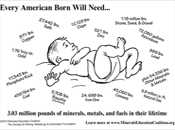

Today's U.S. 'Baby' Will Consume 3 Mlbs Metals and Minerals In Lifetime

Source: Lawrence Williams, Mineweb (9/1/14)

"The projected lifetime consumption of metals and minerals by today's U.S. baby extrapolated across the world presents an enormous challenge for the global resource sector."

More >