The Gold Report: Congratulations on the new Exploration Insights partnership, Brent and Joe. How is working on the newsletter side different than the analyst side?

Joe Mazumdar: A lot of the work for a sell-side analyst involves chasing news as it's released with little time for sober second thought. In my opinion, writing for Exploration Insights is more amenable to taking a longer look at the implications of events. The difference can be as wide as between writing for a daily newspaper such as the New York Post and for The Economist.

TGR: Do the two of you see the market similarly? In what ways do you differ?

JM: Over the past decade or so, Brent has tended to focus on lower market capitalization, low liquidity exploration companies that provide a high potential reward but with a high risk. Brent's letter provides the subscribers of Exploration Insights the benefit of his experience to offer companies in this category that are filtered for red flags. I try to provide the same filtering for the subscribers but for higher market capitalization, more liquid developers and producers.

Brent Cook: I've been on a number of field trips with Joe around the world, and he is a master at looking at the financial situation behind a mine and company, plus the geology. In November, I got a lot more positive on this sector and started buying. But I expected the initial bump would come in the mid-tier companies. That's where Joe's expertise comes in. The first two companies he brought to the table were Claude Resources Inc. (CRJ:TSX) and Lake Shore Gold Corp. (LSG:TSX). Claude is up over 60%, and Lake Shore has had a takeout offer from Tahoe Resources Inc. (TAHO:NYSE; THO:TSX) since his recommendation in early December.

I'm not out of exploration at all. That's my passion. But Joe's participation gives the newsletter more coverage of the solid assets that could be the first to be rewarded.

"Newmarket Gold Inc.'s jewel in the crown is the Fosterville gold mine."

As to what I am doing with my money, I'm probably half in small to mid-tier producers and developers. I have another 25% in early-stage exploration projects. I'm keeping aside about 25% for new discoveries that are difficult to predict but will occur. I'm convinced we are going to find some companies that are in the very early stages of making a discovery and I want to be able to pounce on those before the rest of the market figures it out. That's where we make our real ten-baggers.

TGR: Last summer when we talked, Brent, you compared the mining market to a wasteland. As we approach the other side of the junior mining equity valuation desert, how will we know if it is an oasis or a mirage?

BC: I envision the past four years as a tribe of the unwanted crawling across a foreboding abyss comparable to the Great Salt Lake desert in the middle of summer. It's just been brutal. As we made our way across the salt flats people just lost the will, went broke and in general fell to the wayside one by one until there was only a small group of us left. But I think we've finally stumbled onto a bit of water. It does not appear to be alkaline. I think this is for real, but we have to remember that Donner Pass lies up ahead. You know how that turned out for the unprepared.

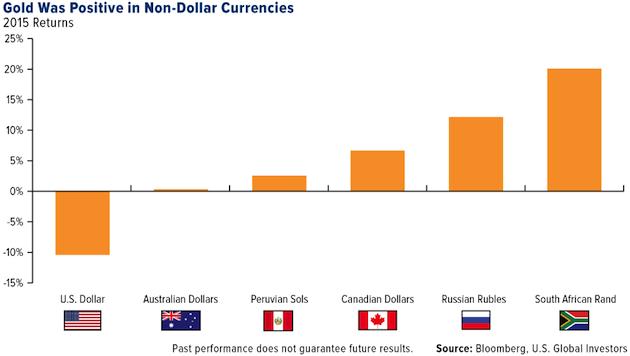

JM: Over the last year and a half, one of the reasons that companies like Claude, Richmont Mines Inc. (RIC:NYSE.MKT; RIC:TSX) and Lake Shore have outperformed the market is because gold had been going up in multiple currencies, just not the U.S. dollar. We've already seen 12+ months of appreciation of the gold price in the local currencies of stable jurisdictions like Australia and Canada. So some of these equities saw significant price appreciation a while ago. Claude is up 220% from its 52-week low.

A true gold bull market requires gold rising in all the major currencies. Just recently we have begun to see gold go up in the U.S. dollar as investors became frustrated with the uncertainty in the U.S. economy and the potential actions of the U.S. Federal Reserve. Will they raise rates or keep them the same or even lower them? All that uncertainty adds to the allure of gold as a safe-haven asset.

"Lake Shore's land package in Canada puts Tahoe Resources Inc. in a stable jurisdiction."

Now we're sitting at a decent gold price for a lot of the people who were on the cusp at $1,000 per ounce ($1,000/oz) and $1,100/oz. Suddenly, a lot of stocks with marginal assets are close to their 52-week highs. We've seen very liquid, large market capitalization companies that are highly levered with a lot of debt, like Barrick Gold Corp. (ABX:TSX; ABX:NYSE), up almost 80% year to date. The mid-tier producers like Lake Shore Gold are up 60–65% year to date.

We know that the last few years of protracted financing risk in a low gold price environment has led to a paucity of development projects and downturn in exploration expenditures. As the gold price environment turns, the ones that should reap the benefits are the companies that are executing this contrarian strategy.

TGR: Something that often happens when gold starts to go up again is that we see quite a bit of mergers and acquisitions (M&A). You already mentioned the Lake Shore–Tahoe deal, but some of the mining companies got in trouble for doing bad deals last time around. Tell us what you think about the Lake Shore-Tahoe deal. What makes for a good deal? Do the miners have the discipline to know the difference this time around?

JM: Usually, when we see a rise in the gold price, we see investor interest in the sector in the form of demand for equity. We've also seen financings in the form of precious metal streams. Next comes interest from the industry, which have been reflected as private placements in companies and M&A.

Tahoe and Lake Shore are indicative of the way M&A has been for the last few years. It's been selective and very suitor-specific. It's normally in the form of friendly acquisitions as companies want to avoid bidding wars and getting involved in overly dilutive transactions. The only multiple bid we have seen over the past few years was the acquisition of Osisko Mining Corp. (OSK:TSX) by Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) and Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), when they successfully outbid Goldcorp Inc. (G:TSX; GG:NYSE).

A variation of the theme is the recent investment by Goldcorp in Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE), which has one of the largest land packages in Nevada not owned by a major. Then OceanaGold Corp. (OGC:TSX; OGC:ASX), which already owned a chunk of the company, raised its stake to 19.9%. It's unusual to see two companies vying for part of the same exploration play. This renewed interest in exploration is good for the market as a whole.

TGR: Was it the location that made Gold Standard Ventures attractive to both companies?

JM: Yes, absolutely. It's the jurisdiction (Nevada) and the size of the land package. Other than Barrick and Newmont Mining Corp. (NEM:NYSE), no company has that size of a land package in Nevada. Gold Standard Ventures is considered to be a good vehicle for a major company to get leverage to a Nevada footprint.

TGR: Is jurisdiction also the allure in the Lake Shore-Tahoe deal?

JM: Tahoe's biggest asset, Escobal, is in Guatemala, which is a very high geopolitical risk jurisdiction but a very high-quality deposit—high risk, high reward. Its first venture into diversification involved open-pit heap-leach projects in Peru with Rio Alto Mining Ltd. (RIO:TSX.V; RIO:BVL).

Lake Shore's land package in the Timmins district of northern Canada puts Tahoe in an even more stable jurisdiction. Lake Shore Gold's asset portfolio is underground, similar to Tahoe's asset in Guatemala, so the company has relevant experience. Tahoe also gets exposure to the local currency. What we liked about Lake Shore was the ability of the company to grow its asset base organically with a plant that is expandable. So if more resources are found, they need not come at the end of the mine life.

TGR: Do you think the shareholders will approve that deal?

JM: We have seen some news lately about the significant change of control fees for some senior executives from Lake Shore Gold that have some investors concerned. But I believe that most will take advantage of the bid and potentially hold the more liquid Tahoe to retain exposure to the silver market. Or they will re-invest their gains in the sector.

Regardless, I believe it's a positive for the sector to see quality assets in stable jurisdictions starting to be taken over. Both underground and open-pit deposits in stable jurisdictions such as Canada have continued to attract demand on the M&A front.

TGR: Do you see Claude and Richmont as takeover stories as well?

BC: I invested in Richmont almost a year ago and, yes, I do see Richmont as a potential takeover further down the road. Claude has done an excellent job of turning its mine around. I don't know that it's large enough to interest anybody, though. What do you think, Joe?

JM: It could be, however, it is isolated in central Saskatchewan with a big land package with a smaller production profile than Lake Shore Gold. The nice thing about Lake Shore's plant is its capacity to expand with ore that was proximal to it. With Claude, you get higher grade than Lake Shore and a large land package, but I don't see much upside to expanding the plant in the near to medium term.

I want to highlight that when we selected these companies, a potential M&A bid did not underpin the investment thesis. We believed that the management teams at Lake Shore, Claude and Richmont would be able to grow their asset bases organically, as well as generate free cash flow. The key was generating free cash flow while paying down their debt facilities, which is something not very many companies were able to do in this cycle.

TGR: When we talked last time, Brent, you gave us nine names of fully funded companies that you thought could make it to the other side of the wasteland. Now that we're starting to see water, which ones did you welcome to the promised land?

BC: With junior exploration companies, it's especially critical to keep tabs on their progress. To constantly re-evaluate results against your original investment theses: what the drilling is showing, the metallurgy and what the local politics are. That's a long way of saying we have sold some of that list since then. We are still holding Dalradian Resources Inc. (DNA:TSX) and Guyana Goldfields Inc. (GUY:TSX). As to Midas Gold Corp. (MAX:TSX), it just completed a large financing with Paulson & Co. Inc., which is very positive.

TGR: What does a company like Dalradian need to do now that we're in a new stage in the market?

BC: Dalradian has a very consistent, high-grade, narrow-vein deposit in Northern Ireland. It just released another 50 drill holes that continued to confirm our investment thesis that this is a narrow, high-grade deposit with a lot of upside potential, shows good continuity, and has a good chance to be permitted by the local government. It's a simple deposit, and we expect Dalradian to put out an updated resource later this year followed by a feasibility study, which should look pretty darn positive. Of the ones we discussed, I would put Dalradian at the top.

TGR: How does Midas plan to use the new financing to add value to the company?

BC: This is really important. Although it's a dilutive financing, it also means that it is now funded to bring the Golden Meadows deposit in Idaho through the final feasibility and permitting process. That could take three years. This financing guarantees the company can make it right to that point and more. In the long run, I think it was a smart move because the financing uncertainty just had to be taken care of. Once it gets its permitting, this is a prime acquisition target for a major mining company.

TGR: You both put a lot of emphasis on the exploration side of Exploration Insights. Joe, you just returned from Australia. What did you see there?

JM: The way this works is we take an interest in a company, we meet the management team, we talk about the potential of what they're trying to do, their strategy, then we decide whether this is a company we want to do more work on, like a site visit prior to adding it to the Exploration Insights portfolio. There is no guarantee that a site visit means we buy the stock, in fact more often than not we pass on the opportunity. I recently completed a site visit to Newmarket Gold Inc.'s (NMI:TSX; NMKTF:OTCQX) assets in Australia. Newmarket is unusual because its asset portfolio is in Australia, but it is a Toronto Stock Exchange-listed company. Its senior management team is based out of Vancouver.

Recently, Newmarket put an ex-Newmont operations guy from Australia, Darren Hall, on as the chief operating officer based out of Perth. I knew Darren back when I worked for Newmont, and then I met him again when I visited Newmarket's project in the Northern Territory, the Cosmo mine. Newmarket also has the Stawell mine in Victoria but the "jewel in the crown," in my opinion, is the Fosterville gold mine, which is also in Victoria.

All the mines are now underground operations, which have been running for an extended period of time with a long history. What piqued our interest is the new type of gold mineralization, which is coarse grained and late, recently encountered at the Fosterville mine. The discovery provides the potential for supplying the plant with higher-grade ore that is easier to recover using gravity than the current ore feed. The current ore feed comprises refractory ore that is treated with a bio-oxidation system and achieves recoveries in the low 90s.

The newly discovered, coarse-grained gold mineralization overprints the earlier, finer-grained, disseminated mineralization, and uses the same geologic structures. As both types of mineralization occur in the same location, the operation is already mining prior to establishing a maiden resource. The advantage of this new gold mineralization as it can be processed via a gravity circuit, which could provide higher recoveries at a lower cost.

So we are going to do some more work on Newmarket Gold to find out if the upside potential at Fosterville plus the gold leverage provided by the more marginal assets of Stawell and Cosmo justifies placing it in the portfolio. Management is trying to build a mid-tier producer in a stable jurisdiction that is free cash flow generating and exposed to a weak Australian dollar.

TGR: Brent, you went to Mexico and then Vancouver. What was the atmosphere in both of those places?

BC: I was in Mexico late last year looking at an Australian-listed company with assets in Mexico called Azure Minerals Ltd. (AZS:ASX). It made a silver discovery just south of the Cananea copper mine, which is probably the largest copper mine in Mexico right now. So it's well located. It's a nice-looking discovery, and I think it grows. We haven't bought it yet because there are nearly a billion shares out on this company and Teck Resources Ltd. (TCK:TSX; TCK:NYSE) has a backing right that needs to be sorted out.

TGR: What is your feeling about investing in Mexico from a safety perspective?

BC: It's really location specific. Azure is up in Northern Chihuahua near the U.S. border—no problems really. There are areas in Mexico where you don't go. That's always been the case. When I was exploring down there in the 1990s, I'd go into a small village near a prospect that I wanted to look at and the first thing I did was talk to the local mayor and have him assign me a guide who was not really there to guide me to places but to guide me away from where I didn't want to be. So you can still work there.

Evrim Resources Corp. (EVM:TSX.V) is a company we own. Its geologist, Alain Charest, knows the country like the back of his hand, so he knows where to go. He's exploring in the right areas and he knows how to get around. I think Mexico is actually a pretty good place to be looking but admittedly nearly as dangerous as Baltimore.

TGR: How was the atmosphere at the recent conferences in Vancouver? Were there places it just wasn't safe to go?

BC: There are a few places on Hastings Street I tend to avoid but otherwise no problems. Regarding the conferences, the geology and the exploration side of business—they're always optimistic. I don't care how bad it really is, they're always thinking there's a gold mine just around the corner. So it was a good week of meetings. But what really struck me is that a lot of the bad actors in this industry have moved on to other sectors. You're down to a higher-quality group of people who are still running businesses and doing exploration. I still think there are 600 too many junior exploration companies listed up there out of about 1,100. I don't know how you fix that problem because it's just such a tough business to make a discovery in, and it's so technically complex that anyone with a good story can often raise money when they don't deserve it. Nonetheless, there are some good people up there doing good work. I was pretty pleased with all the meetings we had. They were technically competent, solid people who, for the most part, understood what an economic deposit looks like versus an uneconomic one. You would be surprised how many people in this industry actually don't get that rather important difference.

TGR: You're both going to be speaking at the PDAC Convention 2016, correct?

BC: That's right. Joe is speaking Sunday, March 6, at 9:30 in the newsletter session. I'm on at 2:30 at the newsletter session, then I'm also on a session on Tuesday morning, March 8, where we're talking about what companies can do to improve their visibility. The title of my talk is Why Don't They Trust Us? It should be fun.

TGR: What do you hope that people will take away from your newsletter talks?

BC: I want to get into why is it so hard to actually make an economic discovery, what are the factors that make it so difficult and how, as investors, can we identify the fatal flaws as quickly as possible and move on. Then, if there are no fatal flaws, recognize that as well. I think that's the key to investing in this junior sector, identifying the fatal flaws as soon as possible and more importantly recognizing the legitimate discoveries.

JM: I'm going to be looking at project financing as we have seen a pick-up after some difficult years. Financing, I believe, can serve as a proxy for looking at asset quality, management or jurisdiction. If you see a company that is able to raise equity with no warrant at a small discount to where it's trading, that's a reflection of a decent asset in a stable jurisdiction. If you see somebody raising equity at a discount with a full warrant that's over a long period, you might want to be a little bit more wary of the asset quality. You can draw similar conclusions based on hedges and streaming. I will give attendees the warning signs so they can be their own analysts.

TGR: So both of you are not just teaching investors to fish, but also you're teaching them which fish to throw back. Thank you both for taking the time to share your insights.

Brent Cook brings more than 30 years of experience to his role as a geologist, consultant and investment adviser. His knowledge spans all areas of the mining business, from the conceptual stage through detailed technical and financial modeling related to mine development and production. Cook's weekly Exploration Insights newsletter focuses on early discovery, high-reward opportunities, primarily among junior mining and exploration companies.

Joe Mazumdar is an economic geologist/analyst at Exploration Insights. Prior to that he was a senior mining analyst at Canaccord Genuity and Haywood Securities prior to that. His experience includes director of strategic planning, corporate development at Newmont and senior market analyst/trader at Phelps Dodge. Mazumdar also worked in technical roles for IAMGOLD in Ecuador, North Minerals in Argentina/Chile and Peru, RTZ Mining and Exploration in Argentina and MIM Exploration and Mining in Queensland, Australia, among others. Mazumdar has a Bachelor of Science in geology from the University of Alberta, a Master of Science in geology and mining from James Cook University and a Master of Science in mineral economics from the Colorado School of Mines.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as a freelancer. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Tahoe Resources Inc., Gold Standard Ventures Corp., Guyana Goldfields Inc. and Newmarket Gold Inc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Brent Cook: I own, or my family owns, shares of the following companies mentioned in this interview: Lake Shore Gold Corp., Evrim Resources Corp., Dalradian Resources Inc., Claude Resources Inc. and Richmont Mines Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Joe Mazumdar: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.