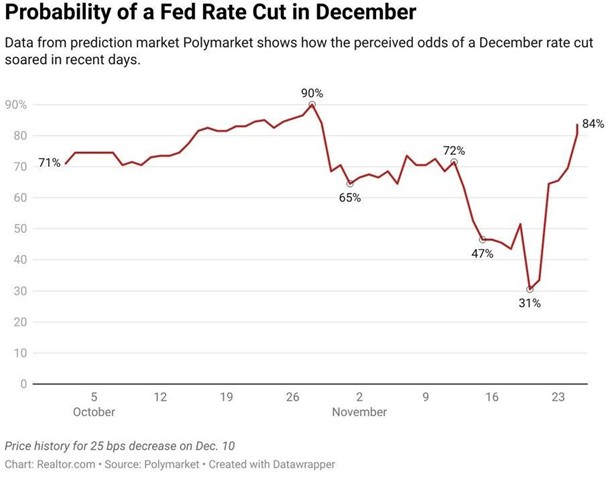

Expectations for a rate cut at the next Federal Reserve meeting are now overwhelming, as high as 86%. Are they correct? And what are the implications for the markets?

I think the odds are positive for a rate cut, though I would not put them as high as they currently are. (Odds have increased in the last week even further than what is shown in the graph on the next page.) But neither Jerome Powell nor Mr. Market asked me.

In recent weeks, there have been conflicting signals, inlcuding comments from different Fed members for and against (but most recently influential members in speaking in favor); the publication of the last Fed meeting minutes, which showed significant opposition to another cut; the lack of meaningful government data (which would lean to a wait-and-see approach); and most recently reports, probably leaked, that the ultra-dovish Kevin Hassett is the front-runner to replace Powell as the next Fed chair. But as the market sentiment moved strongly towards a rate cut, there was no push back from Powell; this Fed under the current chair has not liked to surprise the market, so the odds are for another cut.

How Should We Invest if Our Forecast Is Accurate?

But what are the implications for the market, and how should we invest? Although making predications is the fun part of investing, the truth is that it is not the most important part. Even if one could predict with uncanny accuracy every rate move, every political victory, every geopolitical move, one would not always be right in investing in that direction. If that sounds counterintuitive, it's really not. The most important part of being a successful investor — regardless of what one thinks will transpire and certainly not what one wants to transpire — is to consider the risk and reward of possible outcomes in the context of the prevailing market.

And here we come to the tricky part. The odds of a December rate cut fell sharply from the near the end of October until a couple of weeks ago. Both the stock market and the gold market — both of which are influenced by interest rate direction — reflected that.

Significantly, both stocks and gold had near-term lows as the interest rate forecast hit lows and have recovered sharply since.

Chicken or egg? It sort of does not matter, but as the odds of a rate cut increased, so did the stock market and the gold price move higher.

Other Factors Affecting Gold Prices

There are other factors, of course. Corporate earnings will affect the stock market. A U.S. invasion of Venezuela will boost the gold price. The commentary around any rate decision, of course, can also be important. It would be easy to assert that in the absence of October and November economic data, the Fed should hold steady.

But the key point is that a rate cut, the last Fed meeting of the year, is already priced into the market. That means that, ceteris paribus, a rate cut will have a modest positive effect on the stock and gold markets, but a failure to cut could see markets, particularly gold, fall back. That means that, on balance, the larger risk is of a pullback on no rate cut, rather than a surge upwards on a cut.

As I mentioned, there are other factors, and U.S. military intervention in Venezuela this weekend could see a spike in the gold price. Since geopolitical moves in gold tend to be short-lived, if that eventuality transpires, it might be a time to light up, selling whatever one is thinking of selling, and standing back from additional buying until after the Fed rate decision. Needless to say, this is not a recommendation to sell all gold and gold stocks, hoping to buy back at a lower price. Far from it, it is just a word of caution in what could be a manic few days ahead. Further out, I could hardly be more bullish on gold, as the dollar debasement trade continues, fiscal deficits in the U.S. and around the world get worse, and central banks are cutting rates before inflation is under control.

Is Another Round of QE Ahead?

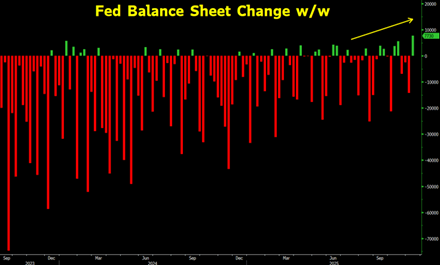

Apart from the direction of interest rates, another Federal Reserve policy move is of equal importance, and that is the ending of Quantitative Tightening and the move towards Quantitative Easing.

QT was officially over on December 1, but the reduction in the Fed's balance sheet had already dwindled to insignificance; $5 billion a month in the context of a near $7 trillion balance sheet is near meaningless.

Moreover, as we have discussed, proceeds from maturing mortgage securities are being rolled over into Treasuries. We are not at QE yet, but we are moving towards it, as the number of "green" weeks in the table has been increasing. When rate cuts fail to have the desired effect, and in the face of declining fundamental demand for treasuries against increased issuance, we expect the amount of green on the chart to increase further.

So whatever the next couple of weeks may bring, the outlook for gold further out remains very strong.

The Barrick Aga Continues

Barrick Mining Corp. (ABX:TSX; B:NYSE) confirmed press reports that it had reached an agreement with the Mali government to resolve all disputes related to the Loulo-Gounkoto complex. Operational control will return to Barrick, but the financial terms of the deal were not released. The Barrick executives in jail for more than a year, were released tonight.

It is not clear whether the ownership will stay at 80% Barrick, 20% the government, or change to 65/35 contemplated under the 2023 Mining Code (from which Barrick was meant to be grandfathered). It is also unclear what the government's royalty will be, nor the settlement of allegedly owed back taxes, as well as the disposition of gold confiscated by the government.

One hopes that the critical financial details will be released soon, perhaps after other terms of the agreement are enacted. Bloomberg reported that Barrick agreed to pay the government $431 million to regain control of the mine. Even at worst case, and with high risk premiums, the mine adds over $1/share to Barrick's NAV over what analysts are currently carrying the asset.

Separately, the Financial Times reported that Barrick had held talks with Newmont to acquire its 40% stake in the Pueblo Viejo mine in the Dominican Republic. Citing "people close to the situation," the report said that the talks fell through at the last minute over taxes. Some board members reportedly blamed former CEO Mark Bristow for the failure of the talks. This is likely the transaction referred to in the company's last quarterly analyst call when it stated it had purchased gold collars for a potential opportunity.

Barrick's interest in the mine represents almost 10% of its NAV; the Newmont stake is valued at over $5 billion.

Lastly, lead independent director Ben van Beurden has stepped down as a director. Former CEO of Shell, he joined the board only in May and was named lead director in August.

We are holding Barrick for a re-rating.

Franco's Panama Stream Could Resume Next Year

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) may see the restart of its stream revenue from Cobre Panama after the Panamanian president indicated there would be an announcement in the first quarter of 2026.

Mine owners First Quantum had been aiming to reach an agreement and mine restart by year's end.

It is estimated that it could take nine months to get production after the reopening of the mine.

Hold.

Altius Receives Final Payment for Royalty Sale

Altius Minerals Corp. (ALS:TSX) said it had received the final contingent payment of US$25 million for the sale of two-thirds of a 1.5% royalty on the Arthur Gold Project to Franco-Nevada; it continues to hold the remaining 0.5% royalty. The payment follows the conclusion of the arbitration process with AngloGold over the extent of its royalty. This was not unexpected.

The exploration teams at Anglo, Callinan (acquired by Altius), and Renaissance (acquired by Orogen) will be honoured at the PDAC in March for the discovery, hailed as "one of the most significant greenfield gold discoveries in the United States in over a decade."

Altius is a core holding for us, though we are holding off on additional buys.

Orogen Sees Lower Royalty Ounces on Mine Transition

Orogen Royalties Inc. (OGN:TSXV; OGNNF:OTC) reported a jump in net income for the third quarter to $1.32 million from $0.25 million in the year-ago quarter. Although royalty revenue (from Ermitaño) was up, ounces were down, 28% on the prior year, a record quarter.

This was not unexpected, as the grade of production has been slowing as the Ermitaño deposit moves towards depletion, and the Santa Elena mines moves east towards the Luna deposit.

Last quarter and likely this quarter will see the trough of production, and then, once production is focused on the Luna deposit, production will stabilize and move up modestly. In two to three years, production will move further east to the exciting (though currently less well defined) Navidad and Winter deposits (see Bulletin #922). So Orogen will continue to see royalty revenue from the mine for the next six or seven years, with ounces increasing next year and beyond.

Hold.

Lara's Property Acquisition Closes

Lara Exploration Ltd. (LRA:TSX.V) said that the acquisition of an exploration license adjacent to its Planalto Copper Project has closed, with the issuing of 164,777 shares as well as staged conditional payments (see Bulletin #984).

Continue to buy.

TOP BUYS this week, in addition to the above, include Kingsmen Creatives Ltd. (KMEN:SI), Midland Exploration Inc. (MD:TSX.V), and Fox River Resources Corp. (FOX:CSE).

| Want to be the first to know about interesting Critical Metals, Copper, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp., Franco-Nevada Corp., Altius Minerals Corp., Orogen Royalties Inc., Lara Exploration Ltd., Midland Exploration Inc., and Fox River Resources Corp.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.