Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) has launched its 2025 Phase 2 surface exploration program at the Majuba Hill Copper-Silver-Gold Project in Pershing County, Nevada. This initiative follows the completion of a five-hole drill campaign. AI-guided targeting identified the location of MHB-36, the fifth hole in the program conducted earlier this year. The new phase targets multiple breccia zones across the property, using an integrated porphyry-driven, magmatic-hydrothermal breccia model to guide exploration.

Among the areas being assessed are the Southern and Northern Breccia Zones and a new target called the Ball Park Breccia. These zones are being evaluated through updated surface mapping, core analysis, and an expanded soil sample grid, which includes 93 additional samples. The company will also employ ExploreTech's AI-driven geophysical modeling system to refine induced polarization (IP) and resistivity targets across the 789 Resistivity Zone.

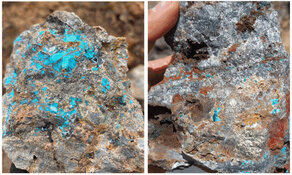

The recently completed Phase 1 program focused on deep copper-bearing breccia zones identified from the previous drill campaigns. One of the core holes, MHB-36, reached a depth of 1,100 feet (335.3 meters) and intersected multiple 5 to 20-foot intervals containing supergene and hypogene copper mineralization. The copper, observed as chalcopyrite, was found in veins and disseminated within rhyolite porphyry and Triassic-age metasediment roof pendants. A notable interval included 5 feet grading 1.21% copper from 741.5 to 743 feet (225 to 226.5 meters).

In the press release, Buster Hunsaker, a consulting geologist for the company, attributed the targeting success for MHB-36 to ExploreTech's AI platform. "The ExploreTech process gives Giant Mining a solid vectoring tool," he said. "The presence of the copper (as chalcopyrite) is directly related to the magmatic-hydrothermal breccias, and the ExploreTech process pointed us straight to the anomalous zone."

The Majuba Hill project, which spans 9,684 acres, is located approximately 113 kilometers southwest of Winnemucca and 251 kilometers northeast of Reno. It benefits from access to well-maintained county roads, local labor, power infrastructure, and water. According to company materials, approximately 89,395 feet of drilling has been completed to date, with an estimated replacement value of US$12.1 million based on current costs.

Majuba Hill also has a history of production, having yielded 2.8 million pounds of copper, 184,000 ounces of silver, 5,800 ounces of gold, and 21,000 pounds of tin during early 20th-century underground mining operations.

Copper Sector: Electrification Demand and Structural Supply Challenges

UBS maintained a constructive view on the copper market in an August 11 report, projecting that copper prices would remain above US$10,500 per metric ton through mid-2026. The firm cited an ongoing supply deficit and added that recent U.S. trade measures, introduced on August 1, imposed tariffs on semi-finished copper goods and copper-intensive derivatives, while excluding key input materials such as cathodes, ores, and concentrates. UBS indicated that short-term price declines were expected to be limited.

A report published on August 23 by CoinSage forecasted that global copper demand would reach US$339.95 billion by 2030. The report attributed this growth to increasing electrification in transportation, expansion of renewable energy infrastructure, and rising investment in artificial intelligence data centers. According to the report, copper demand from electric vehicles and renewable sources was projected to grow at a compound annual growth rate of 6.5% between 2025 and 2030. It also referenced the International Energy Agency's estimate that global copper consumption could double by 2040. CoinSage noted that geopolitical risk in key producing regions, as well as recent U.S. tariffs of 50% on certain copper imports, had contributed to shifts in inventory and increased market volatility.

Crux Investor, in a sector analysis released on August 30, identified three primary drivers of long-term copper demand: electrification, infrastructure supporting artificial intelligence, and rising consumption in emerging markets. The report highlighted that electric vehicles require roughly four times the copper used in conventional internal combustion engine vehicles. It also pointed to growing demand from offshore wind projects and data centers. On the supply side, the report identified persistent challenges, including falling ore grades, deeper deposits, and longer permitting timelines. Crux noted that some major producers were reallocating capital from developed jurisdictions to South America in response to permitting and cost pressures. The report concluded that copper's designation as a critical mineral in the United States underscores long-term strategic importance, even as near-term regulatory constraints continue to affect project development.

Analyst Highlights Technical Indicators and Project Advancements at Giant Mining

*In a report dated June 9, technical analyst Clive Maund provided an assessment of Giant Mining Corp., with particular focus on the company's continued exploration progress at the Majuba Hill copper-silver-gold project in Nevada. The report described the project as "rapidly advancing" and positioned within the broader context of domestic clean energy priorities and critical mineral strategies.

Maund referenced the company's 2025 Spring drill program, noting the completion of hole MHB-34 as a key development. He also highlighted the project's location and infrastructure access, including proximity to roads, electrical power, and water sources. The analysis referenced prior-year drilling results, which Maund described as showing "impressive grades," and suggested that the geological setting could be indicative of a larger mineralized system.

From a technical market perspective, the report identified recent price action as consistent with accumulation patterns. Maund interpreted the chart structure as forming what he called "a large bullish Cup & Handle base," supported by volume trends that, in his view, pointed to the development of an intermediate base. He stated that the chart "looks ready to break out into a major new bull market."

The report concluded with a "Strong Buy" rating on Giant Mining Corp. across short-, medium-, and long-term time frames. Maund cited a potential trading range between CA$0.60 and CA$2.00, based on technical chart formation, drilling activity, share structure, and the company's presence in a mining-friendly jurisdiction.

Giant's Data, Drills, and Digital Tools

The latest exploration builds on a multi-year effort to delineate and expand known mineralized zones. In 2025, Giant Mining drilled 5,484.5 feet (1,671.7 meters) across five diamond drill holes as part of its Phase 1 program. These included MHB-32, which intersected visible azurite, malachite, and chalcocite from 527 to 537 feet, and MHB-33, which was completed to a depth of 950 feet. Core samples from these holes were processed at the company's Elko facility and submitted for analysis.

In addition to technical advancements, Giant Mining has fully financed its next phase of drilling at Majuba Hill. The project continues to show characteristics typical of large porphyry copper systems, with mineralization open in all directions and consistent exploration results over multiple phases from 2020 through 2025.

According to the company's August 2025 investor presentation, the Majuba Hill project plays into a broader macroeconomic trend. Copper demand is projected to increase significantly due to its use in electric vehicles, renewable energy infrastructure, and grid modernization efforts. The project's Nevada location, cited as the top-ranked mining jurisdiction by the Fraser Institute in 2022, provides a favorable regulatory and operational backdrop for ongoing work.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Giant Mining Corp. (CSE: BFG;OTC:BFGFF;FWB:YW5)

Ownership and Share Structure

According to Giant Mining Corp., approximately 15.1% of its shares are held by insiders. The remaining shares are held by retail investors. Giant Mining Corp. has a market capitalization of approximately CA$18.49 million.

The company's current share structure includes 77,106,097 shares issued and outstanding, 35,609,865 warrants, 850,000 options, and 375,000 restricted share units.

The company's shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017.

The company's Warrants are traded on the Canadian Securities Exchange (CSE) under the ticker BFG.WT.A and BFG.WT.B.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 9, 2025

- For the quoted article (published on June 9, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.