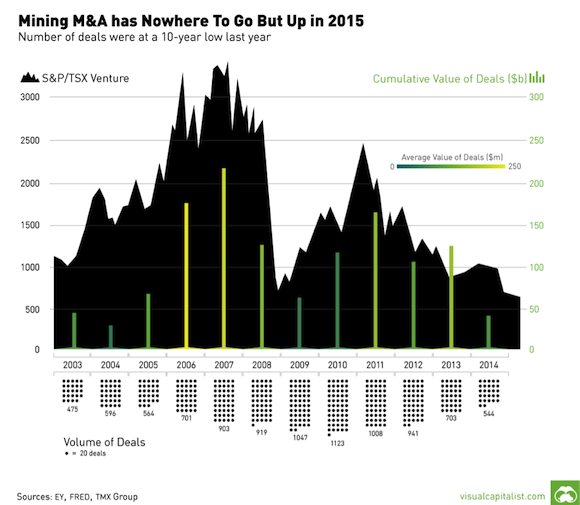

There are certain points in market cycles where buyouts just make more sense than in others. Chen Lin, author of the popular stock newsletter What Is Chen Buying? What Is Chen Selling, sees a recent flurry of mergers and acquisitions (M&A) as an indication that we are, indeed, at the bottom of the gold market and can expect more consolidation—and at a premium. "We saw the start of a new phase of M&A happening when OceanaGold Corp. (OGC:TSX; OGC:ASX) bought Romarco Minerals Inc. (R:TSX), and Romarco shareholders realized a big premium for that," he says. Add to that First Mining Finance Corp.'s (FF.TSX.V) merger with Gold Canyon Resources Inc. (GCU:TSX.V) and PC Gold Inc. (PKL:TSX). "Investors of those stocks were rewarded handsomely." He continues, "A lot of companies with good balance sheets will try to take advantage of this downturn to pick up properties at rock bottom prices. This is actually a good time for those companies that can afford to do M&A."

Lin clarifies that in many cases it is not the majors that are buying. "A lot of the big companies are in deep trouble. Many are selling assets. Barrick Gold Corp. (ABX:TSX; ABX:NYSE) was buying at the top of the market, and now it's selling at the bottom of the market." He is focusing on the mid-tiers like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), which teamed with Yamana Gold Inc. (YRI:TSX) to buy Osisko Mining Corp. last year. "The pattern I see is that those companies that have good cash flow in a strong financial situation use that to buy other companies to build their assets for the next upturn."

"Asanko Gold Inc. is on the list of possible takeover candidates."

Bob Moriarty, founder of 321gold.com, also observes that the bigger the company, the more it seems to buy at the top. "Barrick Gold, Newmont Mining Corp. (NEM:NYSE), Gold Fields Ltd. (GFI:NYSE), these guys are actually getting rid of assets. I think it's a mistake. They were buying assets at the top and paying too much, now they are selling those same assets at a big discount," he says. "The smart people are making acquisitions now at the cheapest prices in four years. Assets are basically being given away."

Moriarty also points to First Mining Finance as an example of a company taking advantage of the deals available right now. "First Mining is led by Keith Neumeyer as chairman, the same guy who started First Quantum Minerals Ltd. (FM:TSX; FQM:LSE) and First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE). He started two billion dollar companies and he is a very bright guy. I think that First Mining is going to be another big success. Neumeyer is doing all stock deals because he's hoarding his cash. He is buying gold for $20 an ounce ($20/oz) for printing up pieces of paper. That is a target that would have cost $100/oz five years ago."

"Klondex Mines Ltd. is one of the better performing miners in the world right now."

For another example of a smart mid cap almost stealing a project from a major, Moriarty cites Lundin Gold Inc. (LUG:TSX) picking up the $2 billion ($2B) Fruta del Norte in Ecuador for about $300 million ($300M) from Kinross Gold Corp. (K:TSX; KGC:NYSE). "The major got rid of it because they just lack the skill set to negotiate with the Ecuador government, which got greedy and wanted way too much money in taxes and essentially killed the project. Rick Rule and Lukas Lundin believe they can make it work and I believe them," he says.

Joe Mazumdar, an analyst at Canaccord Genuity, anticipates an overall increase in M&A for undervalued, quality projects in manageable jurisdictions that are advancing to commercial production; however the timing will be very suitor-specific. "Any potential suitor in the gold mining sector should be looking to fill a need and not a desire as both equity and debt holders remain wary of dilutive M&A and the consequent impairments that represent the vagrancies of the previous cycle. We believe that suitors will be seeking to fill holes in their future production profile with assets that are aligned with their comparative technical advantages in mining, processing or in permitting and financing. The asset location will also be an important factor as manageable jurisdictions will garner premiums in this market," he says.

As an example, Mazumdar cites the recent acquisition (October 2015) of the permitted, high grade Haile open pit gold project in South Carolina operated by Romarco by OceanaGold (Buy rated by Reg Spencer). "OceanaGold sought a low-cost gold project with a decent production profile, low execution risk (already permitted, in construction) and upside potential (underground)."

"Some smart people are consolidating junior resource companies while they are on sale; Newmarket Gold Inc. recently acquired Crocodile Gold."

Mazumdar adds, "Recent M&A has also been focused on the acquisition of assets divested by major gold producers as they seek to rid themselves of non-core assets to improve their balance sheets. Note the acquisition by OceanaGold in June 2015 of the Waihi gold operation in New Zealand from Newmont Mining Corp. (NEM:NYSE, Not rated). For its part, Newmont Mining divested Waihi but acquired the Cripple Creek gold mine in Colorado sold by AngloGold Ashanti Ltd. (AU:NYSE, Not rated). Cripple Creek represented a profitable operation in a stable jurisdiction that Newmont believed it could potentially improve (lower costs and improve recoveries)."

Exploration Insights author Brent Cook sees the $526M Probe Metals acquisition by Goldcorp Inc. (G:TSX; GG:NYSE) and the $205M Cayden Resources acquisition by Agnico Eagle as flukes. "That those companies paid so much for such early-stage projects was really a surprise. More common today is vulture activity. Most majors have acquired what they could, gotten rid of what they couldn't justify and are focused on trying to survive. Some desperation deals are going on now," he says. He doesn't anticipate a rush to acquire until gold prices start to increase.

There are exceptions. "Some smart people are consolidating junior resource companies while they are on sale," Cook says. " Newmarket Gold Inc. (NMI:TSX; NMKTF:OTCQX) recently acquired Australia-based Crocodile Gold in a $190M deal. Osisko Gold Royalties Ltd. (OR:TSX) is buying up Canadian explorers by funding Oban Mining Corp. (OBM:TSX). Oban's game plan is to acquire as much prospective ground as possible in anticipation of a gold price increase."

Cook singles out Premier Gold Mines Ltd. (PG:TSX) as another example of smart consolidation. The North American-focused explorer and developer acquired a 40% interest from Barrick Gold in the South Arturo mine project in the Carlin Trend in Nevada in June for $20M and a few other considerations. New guidance of the project in July estimated 2016 gold production at 200,000 oz at an all-in cost of $730/oz.

In mid-October, Alamos Gold Inc. (AGI:TSX; AGI:NYSE) announced it was acquiring Carlisle Goldfields Ltd. (CGJ:TSX; CGJCF:OTCQX), which has the Lynn Lake Gold Camp in Manitoba, Canada, in an all-share deal. Alamos already owned 19.9% of Carlisle and 25% of the Lynn Lake project. Carlisle's stock price shot up some 70% after the news. Alamos' shares dipped slightly along with the news that Alamos will be significantly reducing the dividend and issuing more shares.

Gwen Preston, editor and publisher of Resource Maven, says, "Everyone with a dollar is looking. The challenge with timing the market is that the exact bottom is apparent only in hindsight and money is scarce for taking chances." She sees that fear as particularly true of the majors. "They are afraid of making a mistake so they tend to be conservative and wait until they can see a clear upward trend and then they end up buying at the top."

As proof that deals are getting done, Preston cites the announcement in early October that Inca One Gold Corp. (IO:TSX.V) would be purchasing Standard Tolling Co. (TON:TSX.V) in a share exchange.

"Pretium Resources Inc.'s mine looks so good I think any gold major with the ability would like to buy it.

At the same time, she sees companies like First Mining Finance and Newmarket taking advantage of the opportunity to build their companies while the market is down. Many of these moves are not takeovers of entire companies in big splashy deals, but bite-size pieces as majors throw off non-core projects and mills get sold to any willing bidder to generate cash. "A lot of confidentiality agreements have been signed and a lot of site visits are taking place," she says.

"Right now any asset that can become the next low-cost producer is an acquisition target," according to Lin. "But the asset has to make sense."

Buyout Clues—The JV Signal

One sign that a major is coveting a property is the producer's investment in developing projects. Cook points to Agnico Eagle's $15M investment in Belo Sun Mining Corp. (BSX:TSX.V) at a 9% premium in May as significant.

Some acquirers have a pattern of taking over juniors after joint ventures. Lin points to OceanaGold as an example. "Two years ago, it took over a company called Pacific Rim Mining Corp. in El Salvador. It's very high grade and could be very easy, low-cost mining, a world-class asset. First, OceanaGold embarked on a joint venture with the company to try to fund its exploration and then the share price continued to be low, so it just bought the company out. That's a very typical story of a takeover. You do a joint venture, allowing the company to derisk the project, and then when the time is right, buy it out."

Mazumdar also sees investment such as equity placement in an exploration company as a common first date on the path to a possible acquisition. "When I worked for a major company in corporate development, we would commonly take up to a 19% stake in companies with assets that had the potential to evolve into a project worth acquiring and advancing. The stake translates to a confirmation of interest, but not necessarily a guarantee that the asset will eventually be acquired."

As a recent example, Mazumdar cites the acquisition in May 2015 of an equity stake in Gold Standard Ventures Corp. (GSV:TSX, Not rated) by (again) OceanaGold. "OceanaGold saw significant upside potential for Carlin-type deposits (low grade, open-pit heap leach and underground high grade) in the largest land package in the Carlin Trend not owned by Newmont Mining or Barrick Gold (ABX:TSX, Hold rated by Tony Lesiak)."

He clarifies, "We note this differs from the outright acquisition of Cayden Resources (de-listed) by Agnico Eagle Mines (Buy rated by Tony Lesiak) in 2014 for a high quality, land package (El Barqueño) in Mexico, which did not host a resource at the time."

Preston suggests watching companies with a history of doing deals. She has her eye on Eldorado Gold Corp. (ELD:TSX; EGO:NYSE), which bought out Sino Gold for $2B in 2009 and now owns 15% of Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX). "It is all about getting one foot in the door," she says.

Location, Location

Being located next door to a midtier or a major looking to grow can also weigh in the favor of a junior that could help to expand and replace ounces for a producer, according to the deal-watchers. "Many deals are obviously project dependent," Lin says. "If you are mining next to a major mine, it could be a good takeover target. That also happens during a boom in the market. The major wants to develop the mine and then it wants to buy out all the other small mines around it. Right now, the market is so weak, it's more likely to be a strategic investment for the future; assets that fit the acquirer's vision can be a value driver."

When Agnico Eagle announced the investment in Belo Sun, CEO Sean Boyd specifically called out the fact that Belo Sun's Volta Grande gold project is located in Brazil, a "favorable mining jurisdiction."

"Geography plays a big role," Cook says. "Merging projects in the same part of the world can eliminate overhead."

Derisked

"How derisked a project needs to be depends," says Cook. He uses the Kaminak Gold Corp. (KAM:TSX.V) Coffee gold project in the Yukon as an example. "It is a takeout target, but a lot of questions still need to be answered about the infrastructure capex costs. The more complex the project, the more derisked it needs to be before a buyer will pull the trigger."

Preston calls derisking vital to getting a deal done. "The majors screwed up in the last bull market by buying before they knew projects were viable and management paid with their jobs. They will be much more careful this time around." She points to True Gold Mining Inc. (TGM:TSX.V) in Burkina Faso as an example of a mine worth more than it is valued, but country risk means it needs to be more advanced before a buyer would want to pull the trigger.

"We saw the start of a new phase of M&A happening when OceanaGold bought Romarco Minerals Inc. and Romarco shareholders realized a big premium for that."

"We believe that the fundamentals of the gold market imply a medium- to long-term paucity of quality projects due predominantly to the lack of exploration and development underpinned by the relevant financing risk and the limited number of projects that actually generate a decent internal rate of return (IRR) in the current gold price environment," Mazumdar says. "Our coverage universe includes companies with gold development projects that are effectively being derisked on a technical (feasibility studies), execution (permitted and in construction basis) and financing (funded, all or partial) basis. Some of these companies, we believe, may generate an M&A bid as they are derisked to commercial production."

Naming the Targets

All of our experts have watchlists of companies they think could be acquirers and acquirees in the coming months. Lin doesn't think OceanaGold is done shopping yet. Like Mazumdar, in the wake of the Pacific Rim, Romarco and the Waihi gold mine deals, Lin took notice when OceanaGold announced a joint venture agreement with Gold Standard Ventures. "OceanaGold put in money to acquire 14.9% of Gold Standard Ventures as a premium to the share price and it is still buying Gold Standard Ventures stock on the open market. That's a typical sign, the interest of a major company in a junior," Lin says. "Gold Standard Ventures is currently drilling the south part of the deposit. Drillers already found a deep sulphide-based gold deposit on the north side. It's wide open space. There are lots of possibilities. Management now has a lot of capital to do exploration thanks to the recent investment from OceanaGold. That makes it an attractive takeover target."

Lin is watching a few other candidates that could be buyout targets. "One of my favorite stocks, Pretium Resources Inc. (PVG:TSX; PVG:NYSE), is developing its mine in northern British Columbia. It is very high grade, low cost. So that will be a nice takeover target for other companies, either in the development stage or after it gets into production. The mine looks so good I think any gold major with the ability would like to buy it."

"One exploration company that is very small right now, but just had a nice discovery and could be a takeover target, is Alexco Resource Corp. (AXU:NYSE.MKT; AXR:TSX) in the Yukon," says Lin. "It is its own high-grade silver district. At some point, I think a bigger company will come in because it has huge potential."

Moriarty is closely watching one with a number of very pressing clues. "As a condition of a funding last year, IAMGOLD Corp. (IMG:TSX; IAG:NYSE) pledged to use $500M in capital expenses or acquisitions and now only has a couple of months to do it. The company already tried to "steal" a project surrounding its own Côté ground owned by JV partner Sanatana Resources Inc. (STA:TSX.V). IAMGOLD management maintained that it needed the property for tailings and infrastructure. They walked away in November, but they would open themselves up to a giant suit from either their shareholders or from Sanatana if they don't buy Sanatana," he says. Moriarty estimates Sanatana has spent some $9.5M on the project and it would cost IAMGOLD between $50M and $70M to buy the company. Sanatana has about a $4M market cap right now. IAMGOLD could buy it cheap today or wait for gold to go up and pay a lot more money for it down the road. IAMGOLD paid $608M for Côté and admits it has to have the Sanatana ground to make Côté work."

Cook starts his quest for takeover candidates by naming the possible consolidators. "First Mining Finance is busy creating a "mineral bank" by buying companies in the Americas and Canada while prices are low. It has 19 total projects in Mexico, Newfoundland and Nevada," he notes. Possibilities for First Mining or another opportunistic consolidator on Cook's list include Kaminak Gold, Asanko Gold Inc. (AKG:NYSE.MKT; AKG:TSX), Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT), Premier Gold Mines and Richmont Mines Inc. (RIC:NYSE.MKT; RIC:TSX).

Preston puts Kaminak at the top of her list as well. "This company has done a really impressive job in the last few years derisking the Coffee project. The feasibility study in the first quarter of 2016 could entice a bid." She sees Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT) as "one of the better performing miners in the world right now. It is doing a good job at Midas and Fire Creek in Nevada building value. The problem is it would have to have a big buyer, so that may come later in the cycle." She also sees Sabina Gold & Silver Corp. (SBB:TSX; RXC:FSE; SGSVF:OTCPK) as a good example of an economic project trading below its peers, making it enticing for possible acquirers. "The challenge is that investors know it is undervalued and they probably don't want to be taken out at this price."

As a region, Preston sees the majors looking at the Yukon again. "Things are cheap there again and the government has put a lot of money into infrastructure and getting First Nations deals signed so that is a prospective area."

Mazumdar's examples include Torex Gold Resources Inc. (TXG:TSX, Spec Buy rated by J. Mazumdar), Asanko Gold (Spec Buy rated by J. Mazumdar), Roxgold Inc. (ROG:TSX.V, Spec Buy rated by J. Mazumdar) and Pretium Resources (Speculative Buy rated by J. Mazumdar). "Both Torex Gold and Asanko Gold are advancing, permitted, fully funded, high-grade open-pit projects (El Limon–Guajes and Phase 1 Obotan) in manageable jurisdictions (Mexico and Ghana) to commercial production in 2016. Roxgold is advancing a high-grade, underground project (Yaramoko project) in Burkina Faso to commercial production also in 2016. The Yaramoko project lies in a more challenged jurisdiction (Burkina Faso), but it generates the highest IRR of our coverage universe. Pretium Resources is advancing its high-grade Brucejack underground gold project in northwest British Columbia. Pretium Resources recently closed a US$540M financing package with a couple of private equity groups to fund the project (US$747M, company estimate)," Mazumdar explains.

"With respect to more advanced explorers that are derisking projects through advanced studies, we highlight Dalradian Resources Inc. (DNA:TSX, Speculative Buy rated by J. Mazumdar) that operates the Curraghinalt high-grade underground gold project in Northern Ireland. We believe the company is well funded to deliver a feasibility study in H2/16 followed by the submission of the permit application."

Mazumdar sums up the current M&A climate this way, "Potential suitors are seeking quality projects with valuation upside either technically and/or exploration related. Although grade is important, the potential generation of decent EBITDA and free cash flow margins in a stable jurisdiction is more critical."

Marin Katusa, founder of Katusa Research, has also been thinking about possible liquidity events. "Midas Gold Corp. (MAX:TSX) is a fantastic project that I believe a major will eventually want to own. It has a great management team, but it is suffering from two issues in this market: the permitting process—nobody cares about companies in that permitting period—and the cost to build that in this market. A company like Osisko Royalties or Goldcorp will come up and buy that asset," he predicts. "That asset is a past producer, very high grade and has over 5 million ounces of gold. That's why I've taken a large position. It has the right management team and the right project. It has the right type of geology in the right jurisdiction. That's a contrarian bet on gold. Most people are undervaluing it today, and that's when you want to buy."

Lin's advice is to find a good company and hold on to it. "When the market turns, they can often rise very quickly. I think M&A activity in the gold sector will accelerate."

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Klondex Mines Ltd., Asanko Gold Inc., Gold Standard Ventures Corp., Richmont Mines Inc., Pretium Resources Inc., Integra Gold Corp., Newmarket Gold Inc. and Romarco Minerals Inc. Gold Standard Ventures Corp. is a Banner Sponsor of Streetwise Reports. Goldcorp Inc. is not associated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Chen Lin: I own, or my family owns, shares of the following companies mentioned in this interview: OceanaGold Corp., Gold Standard Ventures Corp., Pretium Resources Inc. and Alexco Resource Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Joe Mazumdar: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. We note that Agnico Eagle Mines Ltd., Roxgold Inc. and Dalradian Resources Inc. are investment banking clients of Canaccord Genuity.

5) Gwen Preston: I own, or my family owns, shares of the following companies mentioned in this interview: Inca One Gold Corp. and Standard Tolling Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

6) Brent Cook: I own, or my family owns, shares of the following companies mentioned in this interview: Kaminak Gold Corp., Premier Gold Mines Ltd., Asanko Gold Inc., Nevsun Resources Ltd. and Richmont Mines Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

7) Bob Moriarty: I own, or my family owns, shares of the following companies mentioned in this interview: Gold Canyon Resources Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

8) Marin Katusa: I own, or my family owns, shares of the following companies mentioned in this interview: Midas Gold Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

9) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

10) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

11) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.