Over the weekend, I wrote an essay entitled "Patiently Climbing Aboard the New Golden Bull," in which I stated that not only are we in a new bull market in precious metals, but also I pegged my long-term target price for gold at US$7,189/oz, which, at a gold-to-silver ration (GTSR) of 50, implies a longer-term silver price of $143/oz.

Over the intermediate term, I see a move up to the $1,450/oz range, albeit not without a great deal of backing and filling and accelerated volatility. That sounds wonderful, doesn't it? You can just back up your Ford 150 and load it to the brim with gold coins and wafers and senior mining shares and why not buy a few million shares of a 5-cent penny dreadful because, after all, don't we all agree that "there's no fever like gold fever," and fifty-baggers are a walk in the park. Right?

Wrong.

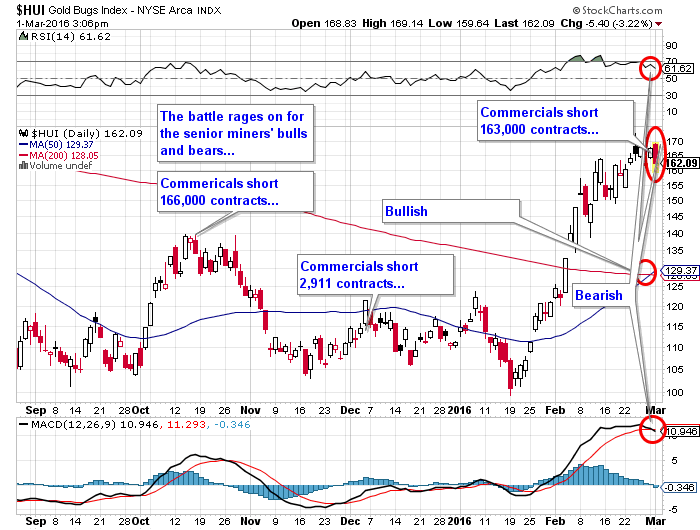

The Friday afternoon numbers for the COT, coupled with the most rapid advance in bullish sentiment since 2009, has set us up for disappointment and if we are not careful, severe short-term draw downs.

Before I proceed, it must be stated and stated clearly that I have two main accounts that I use for the precious metals, with one dedicated to long and intermediate-term positions and the other to short-term trading. I own large positions in a number of junior TSX.V explorer/developers and some of these have been held since 2010, which means that I have exposure to gold (and silver) literally 100% of the time. I never trade my physical; I seldom trade the high-quality miners; and I often hedge both by using ETFs or options. So when I tell the world that I am looking for a "better entry point" for my trading positions, I don't want to read a post in some chatroom that "Ballanger's bearish!" because, as you have read earlier in this missive, I am NOT a "bear." But make no mistake: I look for a bone-jarring correction in March-April that will singe the eyebrows.

Now I must have received two dozen emails and Skype messages in the past few days that are taunting and teasing every time gold has a $5 uptick and for the millionth time, I am long gold and gold miners so if my short-term caution proves wrong, I will STILL have seen portfolio values advance. It is not unlike October, when I looked like a hero because I hedged at $1,180/oz and watched the hedges advance sharply but at the bottom on Dec. 3, I had gained 10% on the hedges but the entire portfolio was still down from the mid-October highs over 30%. I recognize how frustrating it is for everyone in the bull camp when we are sitting with positions in the metals and miners acquired years ago and at much higher prices and just when you think the market is about to skate you back into profitability, these criminals not only short millions of ounces of synthetic, totally phony, never-to-be-delivered "gold," they get the Crimex to increase margin rates on gold, just like they did back in April 2013 just before the big $200 mugging that broke the 10-year trend line.

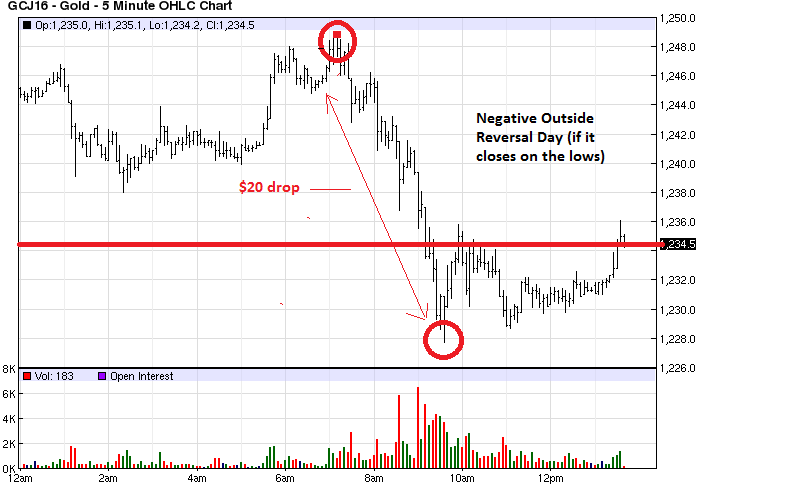

Drives us all crazy but the reality is that again today, thanks to massive intervention by the Bank of Japan (BOJ), the dollar-yen reverses from 112.16 and mounts a vicious squeeze that takes it to 114.18 before settling back to 139.50 and gold has a $20 reversal, taking moods from euphoria to depression in a wink of an eye. And all thanks to intervention by the BoJ on the first days of the month and the first day of a "jobs report" week. Talk about a set-up...

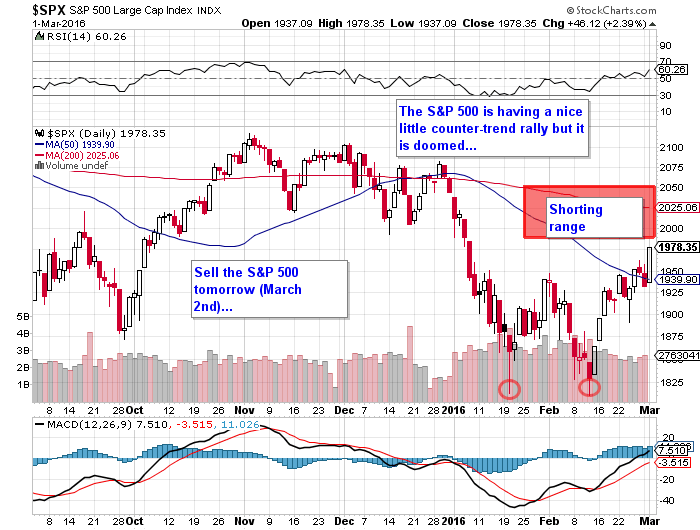

Shifting gears for a moment, I haven't talked very much lately about the S&P as my last move was to flatten most of the puts and the VXX position the day that we moved down to 1,812 and I made reference to the Bullard comments which transformed the market from freefall to 1,760 to rebound to 1,970. They turned oil and they turned junk bonds and they turned stocks almost all at the same time, and for the past two weeks, they've had a little fun. If I'm correct, Tuesday through Thursday will be the time to scale back in to short side, so I'm bidding for the VXX at $14.50-15.00 and the SPY March (18th) $195 puts at $3.50 all starting tomorrow and trying for 1/3 each of the three days.

Remember, we are in the very early stages of an absolutely breath-taking bull market in mining stocks and the precious metals but like the famous Aesopian fable, sometimes it's the tortoise that wins the race by simply plodding along and exercising patience and a tad of caution. And after being forced to eat of a dog-food can for the past few years, I intend to do just that as we move forward.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All images/charts courtesy of Michael Ballanger