The Gold Report: At the subscriber investment summit in Toronto in March 2015, you had a talk titled "Life in a Zero Yield World." What is wrong with that world?

Eric Coffin: A zero yield world is the result of four or five years of central banks essentially buying the hell out of the bond market, which is what the European Central Bank (ECB) is doing right now. And buying those bonds, also known as quantitative easing (QE), drives down yields. QE has helped the U.S. and will probably help the European economies but it creates a lot of distortions. We tend to see a lot of money driven into high-risk areas, like heavily leveraged commodity and exchange-traded funds (ETF) bets and things like art and collectibles, because there are these large money pools that can raise capital at close to zero rates, and that tends to make people take greater risks. How that ends remains to be seen, but central bankers realize that they need to start weaning economies off of QE because when you generate that much risk capital and start creating that many distortions, it quite often doesn't end well.

TGR: Can these economies successfully be weaned off QE?

EC: Maybe. On one side there is the "wealth effect," which is the positive impact on the economy from people seeing their portfolios get larger. And that was always part of the plan. Most economists describe the wealth effect as a side effect of QE, but I don't think policy makers at the U.S. Federal Reserve or the ECB think that way. The problem with the wealth effect is it mainly benefits—you guessed it—the already wealthy. I think that is why it hasn't generated higher growth yet or higher inflation except in "one percenter playgrounds" like the fine art market. The U.S. economy is not doing that great overall and the ECB is trying to climb out of its fourth recession in the last five or six years. In both cases much of the money driving these economies is washing in and out of the equity markets and traders are focused on what central bankers are going to do.

In the last few months we have seen huge market swings based on things said by either U.S. Federal Reserve Chairman Janet Yellen or ECB President Mario Draghi. It's not healthy. If we step back and take a 10,000-foot view of the markets, anybody with a finance background knows that an ECB rate cut or for that matter a Fed rate boost of 25 or 50 basis points is not going to make any difference in the real world. But with so much of the money chasing bureaucratic decisions, it is creating distortions and now the Fed has got to find a way to carefully ease out of QE. But if the Fed surprises the markets, the markets are going to get clobbered. It's a tightrope walk for Yellen.

TGR: Throughout these last few years your job has been to clear up some of the market distortion for mining investors. What are some macro indicators that mining investors should follow and why?

EC: It's a good idea to keep your eye on inflation indicators because metal prices are heavily influenced by inflation expectations. I follow the Treasury Inflation Protection Securities (TIPS). TIPS are basically inflation-indexed securities and there are ETFs for these that are heavily traded. These get bought as inflation protection; the way the price of those mutual funds and ETFs swings up and down gives us a read on traders' inflation expectations. In the last few months, with collapsing oil prices, the bugaboo in the market has been deflation. But in the last little while we have seen a massive flow of funds into these inflation-protected mutual funds and ETFs. It's a bit of a head scratcher because consumer price index numbers still look flat.

May 30 in Vancouver

When it comes to the U.S., obviously everybody watches the jobs report. That has a big impact. One thing I've been watching closely is real wage gains. Even though the U.S. has seen its unemployment rate drop from about 12% to 5.5%, wage gains for average American workers—80% of the workforce—remain at around 2% before inflation, so after inflation it was next to nothing. People on Wall Street predict that the economy is going to accelerate by 3–5% but I don't see how that happens unless we start seeing real wage gains because 70% of the U.S. economy is consumer spending. You have to pay people money before they can spend it.

I watch currencies, too, because part of the gold trade is currencies, and until recently, gold has followed the euro fairly closely.

TGR: Yellen recently said U.S. equity markets look "frothy" and recent U.S. dollar weakness seems to back that view. How do you expect gold to perform through the end of the year and perhaps beyond that?

EC: I've been a bit disappointed that gold hasn't traded better in the last few sessions but it seems that gold traders are particularly focused on the Fed raising rates. The consensus seems to be that it is going to raise rates in June and that will not help the gold price. But I was one of the few people who didn't expect the euro to go to U.S. dollar parity or below earlier this year. The euro has instead had a nice bounce and that's largely because many international investors have decided that European stock indexes are the next big thing, so there's been huge fund flows into Europe.

"Columbus Gold Corp. put out a new resource estimate on its flagship Paul Isnard gold project."

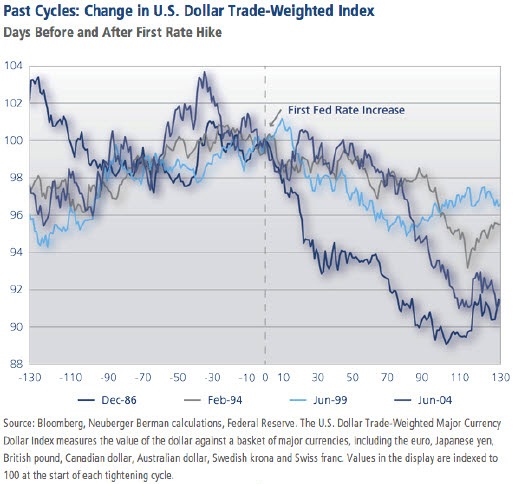

It's market gospel right now that if the U.S. starts raising interest rates, the U.S. dollar has to go higher and higher, and that's seen as negative for gold. In a recent edition of Hard Rock Analyst (HRA) there was a chart (reproduced below) that showed the trace of the U.S. Dollar Index through the last four tightening cycles when the Fed went from cutting rates or neutral to raising rates. In all four cases the U.S. dollar dropped once rate increases started. It was a "buy on rumor, sell on news" situation. In a couple of cases it fell about 10% within four months of the start of tightening. The ECB and Bank of Japan trying to hold their currencies down may complicate things this time but still we may get better action on the currency side than people expect. It's quite conceivable that gold could get through $1,300 per ounce ($1,300/oz) relatively quickly once it dawns on people that the dollar index isn't going to the moon.

We also may see stronger gold demand in China if there is a significant correction in the Shanghai market, which has more than doubled in the previous 12 months. If we look at a long-term chart of the Shanghai exchange going back about 30 years, these big bull runs have happened four or five times, closely followed by equally big drops. I don't know when the top is going to be in, but it looks pretty parabolic; moves like that tend to end badly.

TGR: Against that backdrop, where do you see the light at the end of the tunnel in the junior mining equities market?

EC: A few companies on my list have performed better recently and they all have one thing in common: a specific event—a resource number, a new economic study or discovery—that was significant enough that it allowed the market to rerate the stock. It feels as if we are finally seeing the wheat get separated from the chaff—and that has to happen. Seeing an increased focus on the relatively small percentage of companies that have good projects and good management is not going to give us the mother of all bull markets, but it will give us a decent market with room for gains—in that subset of companies.

We all should focus on the small set of companies that really know what they're doing because until we see a large move in commodity prices, that's the only place where we're going to see gains. This is not one of those markets where it's a matter of who has the biggest copper or gold resource; it's about who has a resource that makes sense or has the discovery potential for one. The other performer has been producers that, after three years of putting up crappy numbers, are finally starting to see their numbers improve. Three years of cost cutting and focusing on margin per ton seems to finally be starting to pay off. If they can do this with a flat gold or copper price, what happens when the commodity prices go up 20–30%? They're going to blow the doors off.

TGR: The Market Vectors Junior Gold Miners ETF (GDXJ:NYSEArca), as a proxy for junior miners, hit a $21.29/share low just after the Prospectors and Developers Association of Canada (PDAC) conference, but has been trending higher since. Would you consider that a leading indicator?

EC: I think so. Most of the companies on the Market Vectors Junior Gold Miners ETF are small producers and a bunch of these companies seem to be turning the corner. One is Claude Resources Inc. (CRJ:TSX), which went through three or four pretty horrible years but has since drilled off larger zones of high-grade material. The company is mining that now and putting up better numbers. That attention to the bottom line is evident across the space and it's starting to pay off for companies like Claude.

The other thing we have seen recently is more merger and acquisition activity and that feeds into the index too. For example, AuRico Gold Inc. (AUQ:TSX; AUQ:NYSE) receives a takeover offer from Alamos Gold Inc. (AGI:TSX; AGI:NYSE) and the share price moves up 20–30% percent the minute the offer becomes public, which helps lift the index. So in that sense the Market Vectors Junior Gold Miners ETF is a leading indicator. We're not at the point where any company with the word gold in its name is going to go up, but the performers are getting some traction again.

TGR: In several HRA posts you've talked about the all-important funding season for junior miners. How is it shaping up?

EC: It hasn't been great. A few companies on my list have done sizable placements and most of the companies that I follow aren't running on fumes anyway; that's part of the reason I'm following them. In general, the end of May is seen as the end of the financing window until October. We don't have a lot of it left. It would be nice to see even a small move in the gold price to help free up a little cash.

TGR: Several companies that you follow closely have published either revised preliminary economic assessments (PEAs) or resource estimates. Please tell us about some.

EC: Columbus Gold Corp. (CGT:TSX.V; CBGDF:OTCQX) put out a new resource estimate on its flagship Paul Isnard gold project in French Guiana. It didn't have a huge impact but it brought the grade up to 1.44 grams per ton (1.44 g/t) in a 4.5 million ounce (4.5 Moz) resource, and moved about 75% of that resource from the Inferred to the Indicated category. That's important because if a company is doing feasibility-level studies, the engineers can't configure anything below Indicated. All of that Inferred material may be quite real and eventually become part of a mine but it can't be included in a feasibility study. I expect Columbus to put out a PEA in less than a month.

TGR: How is Columbus Gold going to finance further development? Will it sell or option assets in Nevada?

EC: I don't think management has decided yet. Columbus has an option agreement on Paul Isnard with Nordgold N.V. (NORD:LSE), a successful, mid-sized Russian gold miner. In order to get 50.01%, Nordgold has to bring Paul Isnard to feasibility and spend $30 million ($30M). It will probably spend $30M to finish the feasibility study, but once that's done there is a fairly complex formula to determine who pays what; Columbus could end up with as much as a 20–30% carried interest.

If the feasibility economics are strong enough, I wouldn't be shocked to see Nordgold make an offer to buy Columbus. That may turn out to be a cheaper option for Nord if it wants 100% of Paul Isnard. Columbus certainly has a lot of projects in Nevada and management wants to option some of them, but it has raised money and is waiting on drill permits for a large, yearlong drill program on its Eastside property in Nevada. Andy Wallace, a former director, stepped aside to run that drill campaign. He is credited with the discovery of several gold deposits there. He obviously rates Eastside very highly.

TGR: What are some other companies with news?

EC: Another company that just put out a PEA is GoldQuest Mining Corp. (GQC:TSX.V). As my readers know, I've been pounding the table on that one over the last few months because I really like the project and have known GoldQuest Chairman Bill Fisher and CEO Julio Espaillat for about 14 years. I saw them take the Cerro de Maimón copper-gold volcanogenic massive sulfide project in the Dominican Republic and improve it to the point where it went into production and got taken out by Australia-listed Perilya Ltd. (PEM:ASX) for about $190M. Cerro de Maimón is still in production and remains profitable.

GoldQuest discovered Romero a few years ago, quickly proved up 3 Moz gold equivalent and put out a PEA last year that the market basically dumped on. But what the company is doing now at Romero is exactly what I saw Fisher and Espaillat do at Cerro de Maimón. The company put out a new PEA in late April that focuses on mining the higher-grade material. The deposit is kind of a blob and well suited to highly efficient, low-cost underground mining. The capital cost is under $150M, including $20M in contingencies. The after tax internal rate of return is 34%; the after tax net present value is about $220M. GoldQuest was a $0.06/share stock three weeks ago. It's $0.17/share now. With a decent gold market it will probably go higher because it looks financeable.

TGR: What's the next step for GoldQuest?

EC: The company will move to the prefeasibility stage. The Romero resource is fairly closely drilled so most of the resource in the mine plan is already in the Indicated category. The company would only need a few holes of resource drilling to have enough for a prefeasibility study. That means it can get through the prefeasibility for perhaps $2M and probably get it done before the end of the year. At some point GoldQuest will want to raise money because it wants to keep working the rest of the Tireo Belt. Precipitate Gold Corp. (PRG:TSX.V), a company I helped found, is next door, and it has a new discovery that's the same model. The Tireo Belt has never really been fully explored there.

TGR: You follow a handful of companies with projects in the Yukon. What are some newsworthy stories there?

EC: Kaminak Gold Corp. (KAM:TSX.V) put out a PEA last year on the Coffee project, and it is a pretty impressive document, a lot stronger than many people expected because when you think Yukon, you think high capital and operating costs. The key to that project is good metallurgy and near surface geometry. In early May, Kaminak published an extensive metallurgical study that's being done as part of its feasibility study. The numbers are very good with average recoveries in the range of 85–95%. For something north of 60 degrees, the metallurgy is quite amazing.

TGR: If Kaminak could heap leach the Coffee ore, how would that change the economics?

EC: Even coarse material has 90%+ gold recoveries. If you have to do less crushing, you need less equipment and require less power, which is big because power costs are not cheap in the Yukon. And if you can get 90% recoveries instead of 70%, that's going to massively improve the bottom line.

TGR: Are there other stories you're following there?

EC: The other main one that I'm following in the Yukon is Rockhaven Resources Ltd. (RK:TSX.V). I visited its Klaza property last year and quite like it. You can drive to it without a big 4x4, and there is little tree cover where the company is drilling. Late in 2014 Rockhaven announced a 1.3 Moz gold equivalent resource at a cutoff grade of 1.5 g/t gold on its Klaza property. It's still open at depth and is now considered a "carbonate-base metal" style deposit. This deposit type often has big dip lengths, so you can go fairly deep and still stay in the bonanza zone. Continental Gold Ltd.'s (CNL:TSX; CGOOF:OTCQX) Buriticá project in Colombia and the Porgera mine in Papua New Guinea are the same model. I think Rockhaven still has a lot of room to expand Klaza.

TGR: Rockhaven raised $4.4M via a placement from Strategic Metals Ltd. (SMD:TSX.V). What did you make of that deal?

EC: Strategic Metals is the main holding company for the group that's backed by Archer Cathro, the premier exploration consultants in the Yukon. If somebody had shown up with a really good financing offer this spring, Rockhaven probably would have taken it. But it's my sense that the people behind Archer Cathro aren't willing to let this one go too cheaply. Doug Eaton, managing director of Archer Cathro and the second biggest shareholder of Rockhaven, was the person who convinced me to visit Klaza. Eaton has put a lot of his money into it and really believes in the project.

TGR: Are there any other stories you would like to share with our readers?

EC: One other company I've followed for a while is a company called Lion One Metals Ltd. (LIO:TSX.V). Lion One has a high-grade gold vein deposit in Fiji called Tuvatu. Tuvatu has about 800,000 oz but the grade is 9–10 g/t. It's open in just about every direction and there are many veins on the property that haven't been sufficiently tested. I'll be fairly surprised if at the end of the day that isn't a 2–3 Moz resource.

Lion One is run by Chairman and CEO Wally Berukoff, a well-known mining promoter who has had a lot of success. He helped found Miramar Mining, Northern Orion Resources and La Mancha Resources Inc.—all three of which sold for more than $500M. Berukoff is committed to getting Lion One into production. The cheapest financing it has done since it went public was CA$1/share. It's trading at around CA$0.45 with $5M in the bank. I'm expecting a PEA very soon from Lion One. Like some of the examples above, I think it will focus on high-grade ounces and should generate some impressive numbers. Importantly, Tuvatu has all required permits for mining in place.

TGR: Please give us one bulletproof call.

EC: Ha! Piece of cake! If you want something bigger and safer, I would look pretty hard at Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT). You want to buy it on weakness, if you can, but it's a well-run and profitable company. Bisha's a fabulous deposit in Eritrea. Nevsun started production at Bisha when gold was near its all-time high and gold dominated production for almost two years. As gold prices started falling the copper grades were coming up and Bisha has been primarily a copper mine for the last two years, and will be for another 1.5. Then it will shift to being predominantly a zinc operation, which should be just about in time for a couple of large zinc mines to cease production and zinc prices to rise.

The company has over $500M in cash and is generating about $20M/quarter in cash flow. Nevsun is drilling to expand Bisha at depth but also drilling out a nearby deposit called Harena, where it recently had some really nice drill holes. It's one of those companies where either there is some kind of deal to become a multi-mine company or a bigger company is going to make a takeover bid. One of those two things will happen by the end of 2016.

TGR: On May 30 you'll be speaking at the Metals Investor Forum in Vancouver, Canada. The theme of the event is that after a four-year bear, mining markets are poised to rebound. What should attendees expect?

EC: There are four of us speaking: Gwen Preston, Brien Lundin, John Kaiser and myself. For my part, I'm going to focus on companies that are advancing, even in a difficult market. Those are the deals that I think will get the most attention when markets start to improve. There will be presentations by all of the companies in attendance including some of the companies we just talked about. It's a daylong event with a catered lunch break and couple of long coffee breaks. That will give attendees a chance to talk to management one-on-one and ask follow-up questions. Subscribers love it.

TGR: Thank you for your time and insights, Eric.

Eric Coffin is the editor of the HRA (Hard Rock Analyst) family of publications. Responsible for the "financial analysis" side of HRA, Coffin has a degree in corporate and investment finance. He has extensive experience in merger and acquisitions and small-company financing and promotion. For many years, he tracked the financial performance and funding of all exchange-listed Canadian mining companies and has helped with the formation of several successful exploration ventures. Coffin was one of the first analysts to point out the disastrous effects of gold hedging and gold loan-capital financing in 1997. He also predicted the start of the current secular bull market in commodities based on the movement of the U.S. dollar in 2001 and the acceleration of growth in Asia and India. Coffin can be reached at [email protected] or the website www.hraadvisory.com.

Eric Coffin is the editor of the HRA (Hard Rock Analyst) family of publications. Responsible for the "financial analysis" side of HRA, Coffin has a degree in corporate and investment finance. He has extensive experience in merger and acquisitions and small-company financing and promotion. For many years, he tracked the financial performance and funding of all exchange-listed Canadian mining companies and has helped with the formation of several successful exploration ventures. Coffin was one of the first analysts to point out the disastrous effects of gold hedging and gold loan-capital financing in 1997. He also predicted the start of the current secular bull market in commodities based on the movement of the U.S. dollar in 2001 and the acceleration of growth in Asia and India. Coffin can be reached at [email protected] or the website www.hraadvisory.com.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Columbus Gold Corp. and Continental Gold Ltd. I The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Eric Coffin: I own, or my family owns, shares of the following companies mentioned in this interview: GoldQuest Mining Corp., Lion One Metals Ltd., Precipitate Gold Corp., Columbus Gold Corp. and Kaminak Gold Corp. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.