Drilling at Yellorex, Campbell Shear

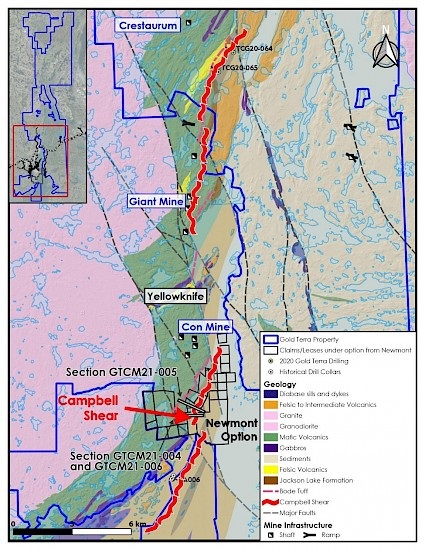

With the highly anticipated Phase 2 drilling program underway since July 16th, testing the Campbell Shear at the Yellorex zone immediately south of the Con Mine (Yellowknife City Gold project, Northwest Territories, Canada) and optioned from Newmont, Gold Terra Resource Corp. (YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT) was finally able to announce the first drill results. The assays of hole GTCM21-014 came back from the lab, and it was a solid result, with 4.57m @ 11.22g/t Au from 357m. As a quick reminder, the Campbell Shear produced approximately 5 of the 6 million ounces of gold produced at the former Con Mine (1938-2002), is the main reason Executive Chairman Gerald Panneton (of Detour Gold fame) joined the company, and is the priority target for management.

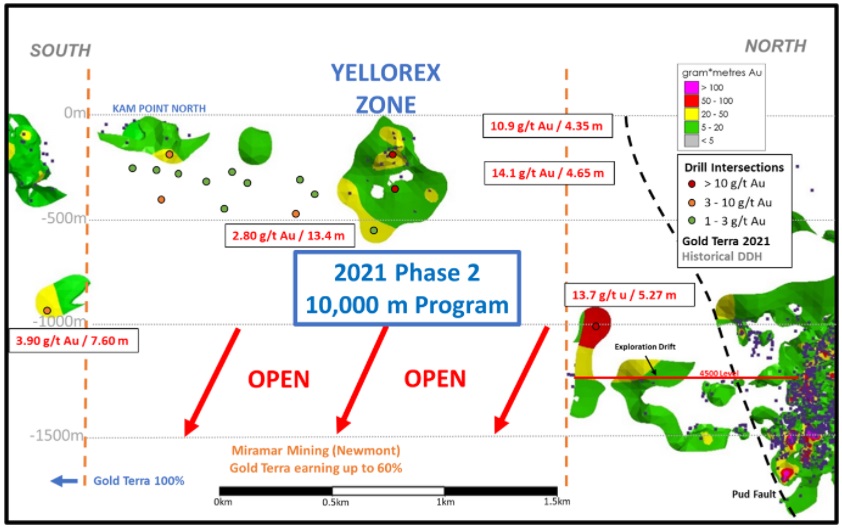

To date, the company has completed 8 holes totaling 2,770m from their Phase 2 drill program, and is testing another part of the Campbell Shear Structure, over a strike length of 1km, and also a depth of 1km. Gold Terra already encountered high grade gold during Phase 1 drilling (for example hole GTCM21-005 with 4.65m @ 14.1g/t Au). This Phase 2 drilling takes place at the claims under option from Newmont, and these are arguably the most interesting claims Gold Terra has, as the northern tip of these claims contains the part of the Campbell Shear that is adjacent to and on strike with the Con Mine, that produced 5Moz Au in the past. On a sidenote, Newmont owns the historic Con Mine itself.

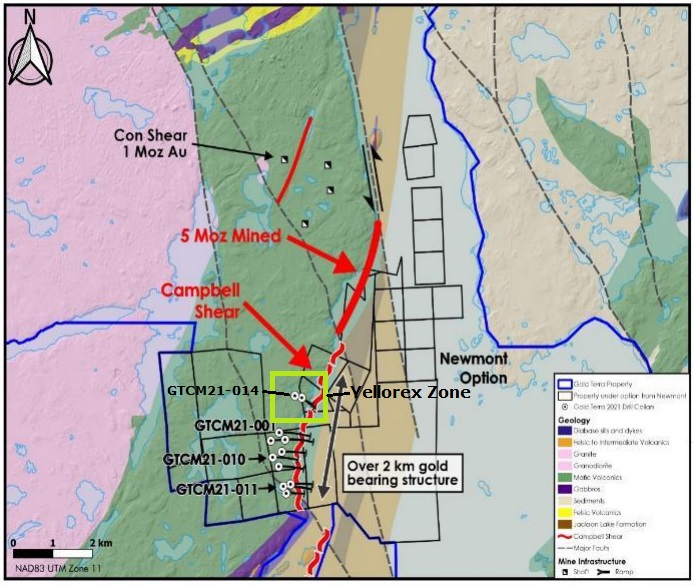

Below is a map in more detail:

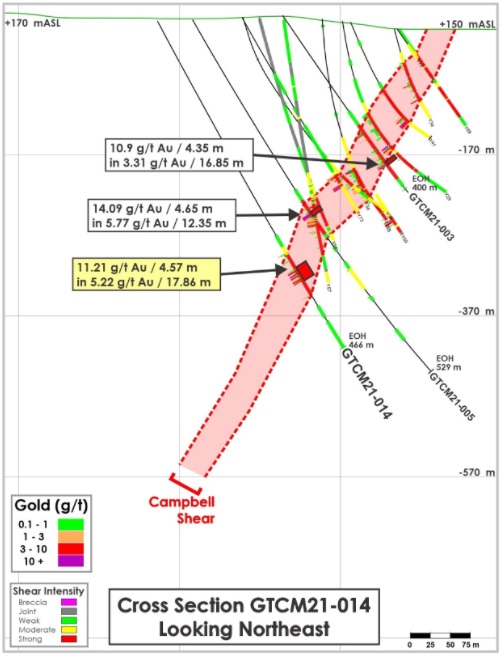

As can be seen on the map above, Gold Terra is looking to drill more to the north, towards the historic main orebody of the Con Mine (represented by the “5Moz Mined” tag). Future Phase 2 drilling will not only test the further extension of this zone, but will test additional shoots indicated by historical exploration, broadening the prospective target area for Yellorex. As can be seen in the section below, hole GTCM21-014 confirms the plunge continuity of the high-grade shoot intersected in hole GTCM21-005:

The current program is concentrating on the Yellorex Zone and South Con Mine area with a 50 to 100 metre drill spacing along strike and down dip. Compilation work has shown that the strong sericite alteration and quartz veined gold system is dipping to the west and steeply plunging to the south with an interpreted plunge length of more than 1.5 kilometres. The drill program will follow this plunge to test the continuity of the high-grade gold lenses at depth and along strike.

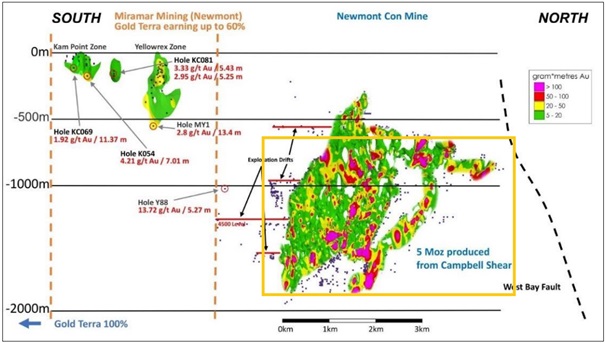

After talking to CEO David Suda, the plunging system is projected to reach estimated depths of below 750m to potentially 1,000m. The plan is to go deeper in 100m increments, following successful Yellorex mineralized intercepts. This is a welcome development, because as you probably know, in my view any multi-million ounce gamechanger potential at the Campbell Shear (this is the reason why Executive Chairman Panneton from Detour fame joined the company) should be searched for at depths below 500m, analogous to the nearby Con Mine, where the main orebody (5Moz Au) was found between -650m and -1800m, as can be seen in this long section across the Campbell Shear from north to south:

Besides simply aiming deeper with the drill bit, it is also a question of finding the mineralization styles that host high-grade gold. High-grade gold seems to occur within wider alteration zones with pervasive anomalous gold values, and these characteristics act as vectors to high-grade gold which will assist future drill programs on the Campbell Shear. Smoky quartz and sericite alterations are seen as favorite characteristics, and this was again confirmed at recent hole GTCM21-14.

Keep in mind this beautifully mimics the historically identified geological controls in the Con Mine, which consists of strongly sericitized and sheared mafic volcanic rock associated with arsenopyrite, pyrite and stibnite mineralization with the highest-grade gold in smoky quartz veins. CEO David Suda was quick to confirm this conformation in the latest news release:

"The Yellorex zone shows strong potential to add to our current resource of 1.2 million ounces of gold and underscores the significance of the Newmont Option Agreement to the future of the project. We are very pleased with the assay results from the first Phase 2 drill hole which confirm excellent continuity of the zone 80 metres below hole GTCM21-05 and reaffirms the validity of our geological interpretation. "

I’m curious for further stepouts along strike, but first we have to await the assays of the other 7 completed holes. According to Suda, we can expect the results to be announced around mid- October. As the Phase 2 drill program will see 10,000m of drilling and just 2,770m is completed, there is still 7,230m to go. The plan is to step out at 50 or 100m spacings, with the last holes hitting targets at or below 500m depth, as the geologists are following the mineralization down plunge, of which the trajectory and depths aren’t clear yet. In the following section the 3 red arrows make it clear that current mineralization is considered open at depth:

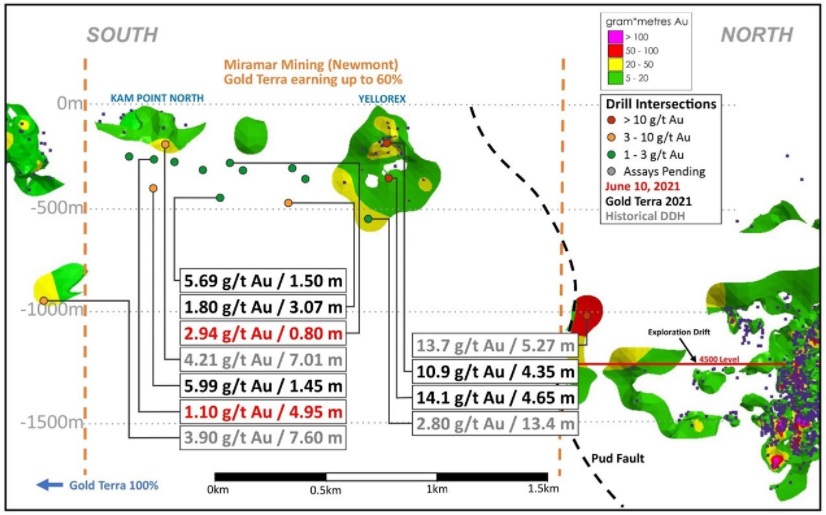

Management estimates the timeline for drilling the deepest holes to happen around late fall/ early winter, with the results hopefully coming back from the lab at early winter. During the summer, the last results of the 7,242m Phase I drill program were announced, and when looking at the same section again, it is clear why the current drilling is focusing on expanding Yellorex:

When estimating a mineralized envelope of Yellorex, I arrived at a hypothetical tonnage of length * width * thickness * density of 500m * 300m * 5m * 2.75t/m3 = 2Mt. The majority of mineralization (about 75%) is indicated by 5-20 gram*meters, about 25% by 20-50 gram*meters. On average I’m assuming an average grade at 5m thickness of 4 g/t Au, already resulting in a hypothetical 250koz Au, which would be a nice start for sure, hypothetically increasing the total resources to 1.45Moz Au for Gold Terra.

Keep in mind, the future resource potential with its exploration risks isn’t all there is for Gold Terra, the current resource of 1.2Moz Au is a pretty solid base for the company, as I estimated the economic potential at an after-tax NPV8 of US$235M in an earlier article, which would be 8 times the current market capitalization. A market cap which is becoming cheaper and cheaper, also due to tax loss selling, considering what Gold Terra owns. The treasury contains CA$3.9M, and the company has future plans to raise cash in the markets soon for additional drilling in 2022.

Conclusion

The first 8 holes of the Phase 2 drill program at Yellorex have been completed, and the first assay was received from the lab. An intercept of 4.57m @ 11.2g/t Au is solid, and surely will add ounces to the Yellorex envelope, already estimated by me at a hypothetical 250koz Au. It is my strong conviction that potentially game changing mineralization is located at depth, and fortunately Gold Terra has designed the Phase 2 program to target this as well. The deeper holes are expected to be completed late fall/early winter with assays coming back in early winter, and by that time it might be quite interesting to be a shareholder.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The Critical Investor Disclaimer:

The author is not a registered investment advisor, and currently has a long position in all stocks mentioned. Gold Terra is a sponsoring company. All facts are to be checked by the reader. For more information go to the website of the companies and read company profiles and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

All presented tables are my own material, unless stated otherwise.

All pictures, charts and graphics are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Gold Terra, a company mentioned in this article.