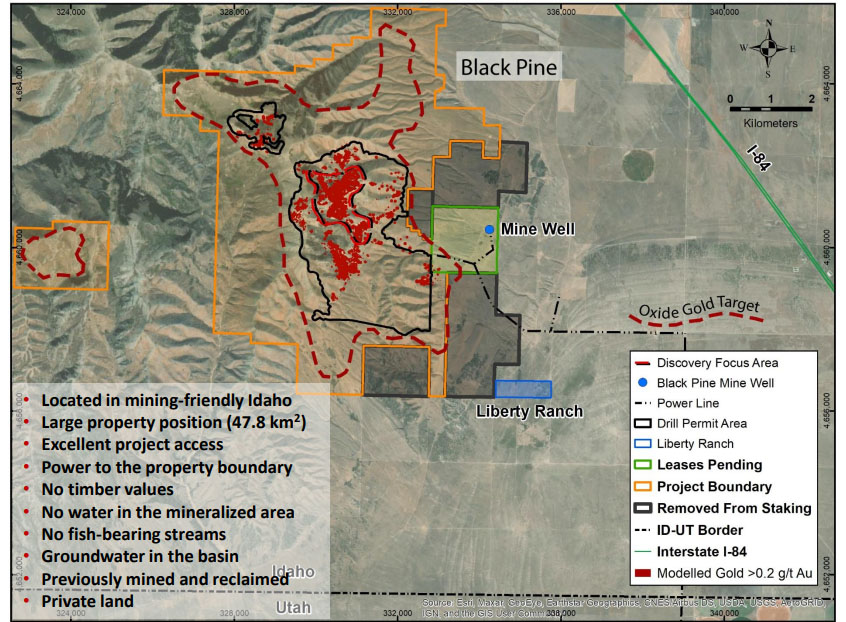

In a March 24 research note, Haywood Securities analyst Geordie Mark noted that Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQB) released the final results of its 2020 reverse circulation drill campaign at Black Pine and is now focused on completing a maiden resource estimate for the project, expected in mid-2021.

"We continue to be encouraged by ongoing exploration success at Black Pine and view the company to be well positioned for resource growth over the near term," Mark wrote.

As for the Black Pine resource estimate, Liberty Gold already contracted two firms, RESPEC and SLR Consulting, to undertake the initial resource estimation work, noted Mark.

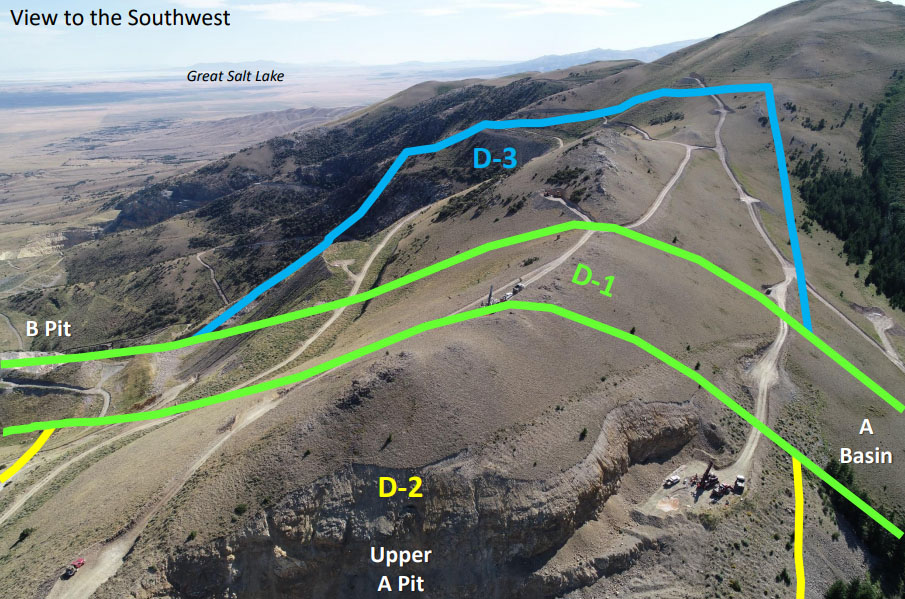

The analyst reviewed the drill results, which are from the last 35 holes placed in the D-1, D-2, D-3, Southeast Extension, M and Rangefront zones. The entire program consisted of 170 holes over about 46,000 meters (46,000m).

Highlights, Mark indicated, were from M and Rangefront, "where shallow zones of oxide mineralization were encountered across an expanding footprint and offer significant potential to build on the 2020 program." M continued to show shallow oxide gold in stepout holes to the southwest. For instance, hole LBP-256 returned 38.1m of 1.26 grams per ton gold (1.26 g/t Au) at 90m downhole. Liberty Gold plans to drill the M zone further this year.

Rangefront showed oxide gold at shallow depths to the southeast and northeast, such as 12.2m of 0.41 g/t Au at 62.5m downhole in LBP-276. Hole LBP-235 demonstrated 9.1m of 2.35 g/t Au at 244m downhole.

With Liberty Gold's amended plan of operations, the company now has access, in part, to areas between the M and Rangefront zones.

New drill results also indicated that D-3 returned high-grade intercepts at depth and D-1 and D-2 continue to demonstrate growth potential, the analyst indicated.

"Liberty Gold has demonstrated further confirmation of the targeted thesis of widespread oxide gold mineralization within the core Black Pine area and extensions continuing to demonstrate grade continuity and favorable heap-leach compatible metallurgy," Mark wrote.

The company plans to start additional drilling at Black Pine next month, to include 48,000 meters of reverse circulation and 8,000 meters of diamond drilling in about 200 holes. Liberty Gold will incorporate only a part of the findings from this upcoming campaign into the resource estimate expected mid-year and subsequent preliminary economic assessment expected in Q3/21. Also anticipated in the third quarter are results of the phase 3 metallurgical testing.

"Ahead of such catalysts, we highlight Liberty Gold's attractive valuation of 0.50x price:net asset value, predicated primarily on our 2,000,000 ounce gold resource estimate embedded in our Black Pine model," Mark wrote.

The gold explorer is now trading at about CA$1.43 per share, and Haywood's target price on it is CA$3.15 per share. Haywood rates Liberty Gold Buy.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Liberty Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.

Disclosures from Haywood Securities, Liberty Gold Corp., Research Report, March 24, 2021

Analyst Certification: I, Geordie Mark, hereby certify that the views expressed in this report (which includes the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report) accurately reflect my/our personal views about the subject securities and the issuer. No part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations.

Important Disclosures

▪ Haywood Securities, Inc. has reviewed lead projects of Liberty Gold Corp. and a portion of the expenses for this travel have been reimbursed by the issuer.

Other material conflict of interest of the research analyst of which the research analyst or Haywood Securities Inc. knows or has reason to know at the time of publication or at the time of public appearance: n/a.

Research policy is available here.