Maurice Jackson: Welcome to Proven and Probable. Today, we're going to highlight an early-stage exploration company focused on copper, gold and silver located in the Yukon, in Canada's prolific Minto Copper District, Granite Creek Copper Ltd. (GCX:TSX.V). Our featured company has seen its share price increase from $0.03 to $0.10 in less than 60 days. They're fully cashed up and ready to begin their 2020 field season. Joining us for a conversation is Tim Johnson, president and CEO of Granite Creek Copper.

Mr. Johnson, glad to have you back. It's been a while. And since that time, Granite Creek has achieved a couple of significant milestones, including a successful financing (click here) and the launch of your 2020 field season.

But before we get into that, Mr. Johnson, give us a basic overview of Granite Creek Copper and the Stu Copper-Gold project.

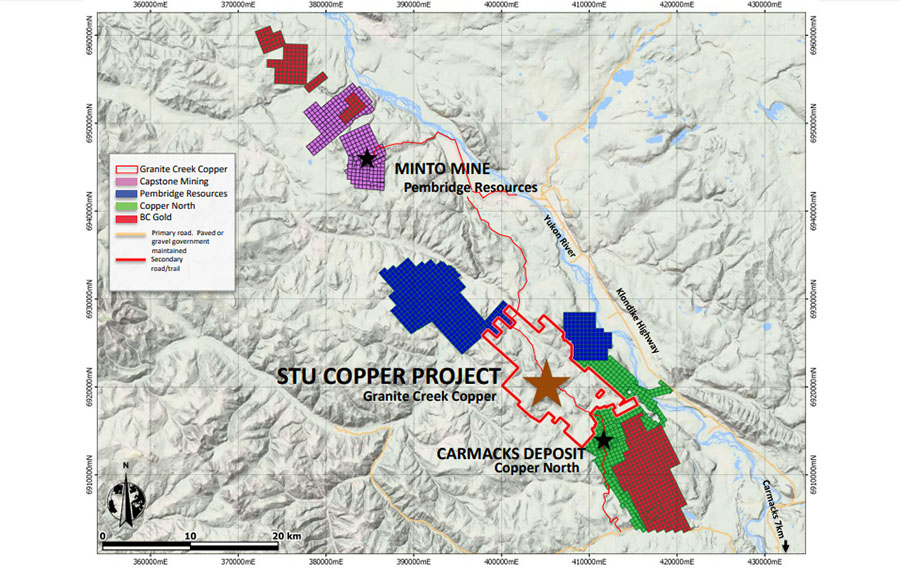

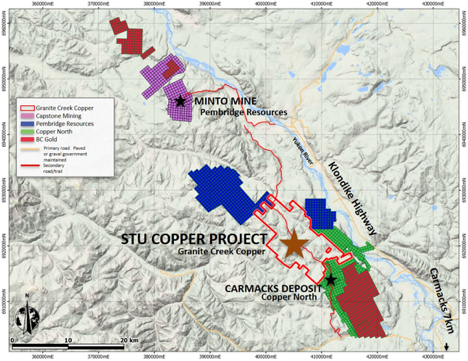

Tim Johnson: The Stu Copper-Gold project was acquired by the company in January of 2019. It was a land package that had been held by a Yukon prospector and he had, over the years since the 1980s, been acquiring claims and assembling this land package in a significant copper belt. GCX is located in central Yukon. The nearest town is the village of Carmacks, and we're on a paved highway from the capital Whitehorse, with good infrastructure. We have hydro within 20 kilometers of the property, along with good road access into the center of the property. We sit just south of the operating Minto mine and we are north and adjacent to the advanced-stage Carmacks deposit.

Maurice Jackson: In terms of progress to date, you've been rather aggressive, I should say, including securing an existing database containing some prior drilling, is that correct?

Tim Johnson: Shortly after acquiring the property, we were made aware of a private database that held information that had never been made public, and we were able to acquire that. And then, subsequently, we also acquired raw data from an airborne survey that was flown in 2008. And again, that survey had only a portion of it made public and no work had been done on that data. When you typically fly a geophysics survey. . .all sorts of post-processing work is done to help focus your efforts on the ground. None of that work had been done so it was quite a treasure trove of information that we were able to get and put together.

Maurice Jackson: Allow me to be the first, Mr. Johnson, to congratulate you and the entire team for successfully completing the financing and the beginning of your 2020 field work. What's the strategy there, and the plan, and take us through some of the geology that you're seeing and what that might mean in terms of opportunity for us.

Tim Johnson: Well, it all references back to that database that we acquired. So, the property was drilled in the 1980s, but the company that drilled at the time had the entire belt. What they discovered is that the Minto geology was much easier to figure out, as it was more exposed at surface. Therefore, their efforts were focused there and they never really completed their exploration program on what is now the Stu properties. They let that property lapse and, like I said, it's been held private since the 1980s. There was roughly 5,000 meters of drilling done and only 20% of that core was ever sampled. They only sampled the obvious high-grade material. There is a mineralized core on the property that's never been assayed.

What we've since discovered is that they weren't focused on precious metals and were using an in-house lab with very high detection limits on precious metals. Noteworthy to mention that a lot of stuff, say sub-gram gold material, wasn't even recognized. Granite Creek Copper's program this summer is going to focus on re-assaying as much of that core as we can using a modern lab with modern detection limits. And we hope that we're going to be able to bring some of those precious metals that we know likely are there, but had been previously below the detection limit, into our resource model.

Maurice Jackson: Let's go to the Stu Copper-Gold project. In terms of the district, it's all there. You've got highway, power access and an operator to the north. How does that all come together for the benefit of Granite Creek shareholders?

Tim Johnson: This is a key point for investors because it gives us three exit strategies. If we find a modest resource, we'll be able to do a toll milling or potentially some sort of an agreement with our neighbor to the north with an operating mill that we know is underutilized right now. They can take mill feed. If we find a larger resource, then we become a takeover target for them as they would want to secure that resource.

And if we find a larger resource yet, then we attract a major player to the belt. And we think probably the best value for investors, and the highest potential, is that we can show the larger players in the copper space the potential for the belt. We think there's multiple billion pounds of copper within the belt, from the Carmacks deposit to the south up to Minto, and that's what we want to prove up.

Maurice Jackson: Now that the financing is complete, please provide us with an update on the capital structure.

Tim Johnson: Granite Creek Copper has 60 million shares outstanding. We've got about a 100 million fully diluted, and that portion would bring in about $2.5 million in cash, should all those warrants be exercised. We have just about $1.5 million in the bank. And we also have, on top of that, securities of 30% ownership in Copper North Mining Corp. that gives our investors access to, or exposure to, an existing resource. We want to build on that resource on our own ground and see what the economics of putting those two resources together is going to look like.

Maurice Jackson: On March 23, the share price was $0.03. Fast forward 60 days later, Mr. Johnson, what is the current share price?

Tim Johnson: The current share price is $0.10. We're pretty pleased with that and we see upside potential for our share place.

Maurice Jackson: Last question, sir: What did I forget to ask?

Tim Johnson: You forgot to ask—or maybe I forgot to say—about the nature of our collaborative approach to development within the belt. We keep our neighbors informed of what we're doing, and they keep us informed of what they're doing. We think the best strategy here is to attract a large player to the belt. And we're only going to do that if we work together.

Maurice Jackson: Mr. Johnson, for readers that want to get more information on Granite Creek Copper, please share the contact details.

Tim Johnson: You can get a hold of us at www.gcxcopper.com.

Maurice Jackson: Granite Creek Copper trades on the TSX.V: GCX. Granite Creek Copper is a sponsor of Proven and Probable and we are proud shareholders for the virtues conveyed in today's message. Before you make your next bullion purchase, make sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio. From physical delivery, off-shore depositories, and precious metal IRAs. Call me at (855) 505-1900, or you may email [email protected]. Finally, please subscribe to Proven and Probable for mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Granite Creek Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Granite Creek Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Granite Creek Copper. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Granite Creek Copper, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.