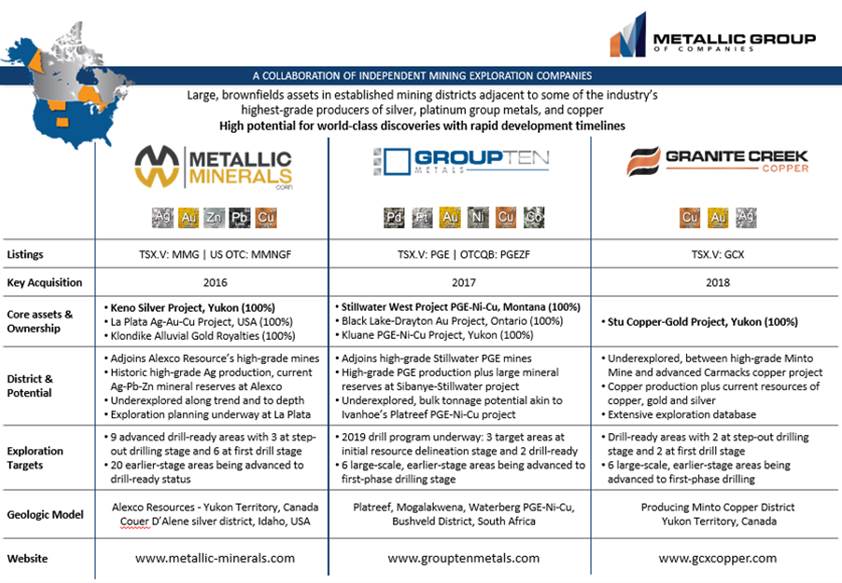

Maurice Jackson: Joining us for our conversation today is Greg Johnson, of the Metallic Group of Companies. here to discuss some exciting updates that are occurring simultaneously as each member company respectively continues to demonstrate their proof of concept, and also to discuss exciting recent results in developments with Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCMKTS), specifically. Mr. Johnson, for someone new to the Metallic Group of Companies, please introduce us, and share the opportunities they present for shareholders.

Greg Johnson: Well, we have had the opportunity over the last couple of years, Maurice, to bring together a group of very experienced explorationists, recognizing that we've had this bear market cycle and that we were going through a consolidation period, and to build on the experiences that we had in the past that were so successful. Myself, I'm one of the original co-founders at NovaGold, and many of the people with me in the Metallic Group are NovaGold alumni who were involved in the acquisitions and expansion of those assets. We also have some great people from Ivanhoe, Stillwater Mining and GoldFields—its a terrific team that's got a long track record of successful exploration.

We stood back and said, okay, the last cycle that ran from 2000 to 2011 at the peak, and then we've gone through a bear market from 2011 to around early 2016, and now we've been building a base for the last several years. It looks like to us, and to many analysts in the sector, that we're now just in the beginning phases of what could turn into the next multi-year metals bull market.

So, collectively we considered what were the key elements at NovaGold that stood out and allowed us to create so much value. And, Maurice, those included the fact that we had come through a bear market, that we had a highly experienced team in place, and that we had positioned that group into assets that had the potential to be tier 1 assets at the bottom of the metal price cycle. Basically, we were ready to move on them as the cycle started to take off in 2001 and that was just a tremendous period of value creation.

In the Metallic Group, what we've done this time, looking around at the available opportunities, the things that have come to the fore have been not large greenfields assets in very remote locations, but in this cycle, what we've been focusing on are these opportunities in brownfields districts; districts where you already have producing mines, you already have the infrastructure, you already have a mill and power and all those things that make project development straightforward and lower cost. We've been able to go after assets that had they been controlled by majors they would've already acquired all the ground in the district around them. Because these were smaller companies, there were district-scale land positions around these producing assets that we were able to pick up—often requiring several acquisitions—and in which we saw the potential for tier 1 assets, with the application of some new exploration models and new technologies.

We were able to do this at the bottom of the metal price cycle, so in that way very similar to NovaGold, and with these assets now in place in the three Metallic Group companies, we think we are uniquely positioned to be able to advance these assets in gold and silver, with Metallic Minerals; in platinum group metals and battery metals with Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE); and in copper and gold with the newest company in our group, Granite Creek Copper Ltd. (GCX:TSX.V).

Maurice Jackson: You say that conservatively, but if one looks at the business acumen for anyone listening to our conversation right now, the commanding land packages that you have, they are remarkable, and it just goes to show that the combination of these synergies with proven professionals within the Metallic Group of Companies, with key acquisitions during the low part of a metal price cycle, the opportunity to maximize shareholder returns is just brilliant. The probability is certainly increased with your management team, here. Mr. Johnson, can you provide us with some examples of how these opportunities came together and what distinguishes the Metallic Group of Companies from their peers?

Greg Johnson: As I indicated, many of the people involved in the group were part of the original NovaGold team and, so, we looked back on that experience and identified the factors that made a difference in terms of that tremendous value creation. I'll just take just a second, Maurice, to walk through the NovaGold assets and the history there just a little bit, and then we'll touch a bit on how we're applying a similar approach in terms of strategy with the Metallic Group.

In those early days at NovaGold, it may be hard to believe when you look at a company today that has a US$3.5 billion market cap, but it was the same size in 2001 as Metallic Minerals, Group Ten, or Granite Creek are today. But, we were positioned in that bear market cycle, very similar to today, to be able to go after the Donlin Gold asset which, today, is a 50/50 partnership with Barrick and NovaGold. We picked that asset up at the bottom of the gold market cycle in 2001 and, over the next several years, saw a massive, fourfold expansion of that resource base to some 40 million ounces of reserves and just huge value creation during that period because all the ingredients were in place. We were in the right part of the market cycle, we had the right team in place, and we had an asset that was big enough to be of interest to the major mining companies and, therefore, the market paid attention. And so, over those next couple of years, we just saw tremendous new interest come in.

The second asset that we identified was the Galore Creek copper-gold-silver asset. We picked this up at the bottom of the copper market cycle in 2003 from Rio Tinto. Today, that's 50/50 owned by Newmont and Teck; it's in the final permitting and construction phases. When you look at the value of their purchase plus the money invested in that asset, it's over a billion-dollar asset. So again, illustrating from those humble beginnings the kind of value creation that's possible.

The third opportunity that came along in the NovaGold history was the Ambler asset, now in Trilogy Metals, which was a spinout out of NovaGold, originally called NovaCopper. We picked that up at the bottom of the zinc market cycle, expanded the resource significantly, advanced that through the various engineering phases, just like the other two, to de-risk it and create value. And today, Trilogy alone has a US$300 million market cap. When you look at the commitments by its partner, South32, they're going to spend another $150 to $200 million. So, another half a billion dollars in value and it again illustrates how much value can be created in these situations.

In the Metallic Group today, many of the people involved were part of the team responsible for those NovaGold acquisitions and the expansion and de-risking of those assets, and what we've done here in this cycle is to go after four unique opportunities. The first one, in the second half of 2016, was Metallic Minerals' acquisition of the eastern half of the Keno Hill Silver District, one of the world's highest-grade silver camps in the Yukon Territory. We picked up and consolidated that portion of the district and the targets that we're looking at here are similar to recent Alexco discoveries: effectively, 50 million ounce plus high-grade silver deposits. We see the potential to create similar value to the operating company Alexco, next door, which currently has about a $400 million market cap whereas, at the peak of the last cycle, Maurice, they were a billion-dollar company.

The second opportunity that came into the Metallic Group was the lower Stillwater Complex in Montana. We picked up this asset in 2017, at the bottom of the platinum group metal and nickel prices, recognizing the potential that it could host disseminated bulk tonnage, nickel, copper, platinum group element deposits, similar to what are being worked in South Africa by Ivanhoe and Anglo, in some of what are the most profitable platinum mines or projects in the world. Just a few months after we announced that acquisition, Sibanye acquired Stillwater Mines, a company similar in size to Alexco, for $2.2 billion, for their two adjacent mines and they've since developed a third. So those developments have daylighted and crystallized the potenteial value that we recognized as well.

The third opportunity came in 2018 with the Stu copper-gold project for Granite Creek. This is in the Carmacks-Minto copper belt in the Yukon and was initially discovered by Alexco's predecessor, United Keno Hill Mines, but later developed by Capstone Mining. At one time, the Minto mine was the highest-grade open-pit copper mine in the world. We see the potential here, a piece of property that's been really off the market for more than 50 years, but has the same geologic characteristics as the Minto mine. And we see the opportunity here for a billion-pound copper system, similar to what's already been produced at Minto, that would come along with very significant gold and silver credits. So, what's our target for value? We think you could create a Minto/Capstone type market value with further exploration there. Pretty exciting.

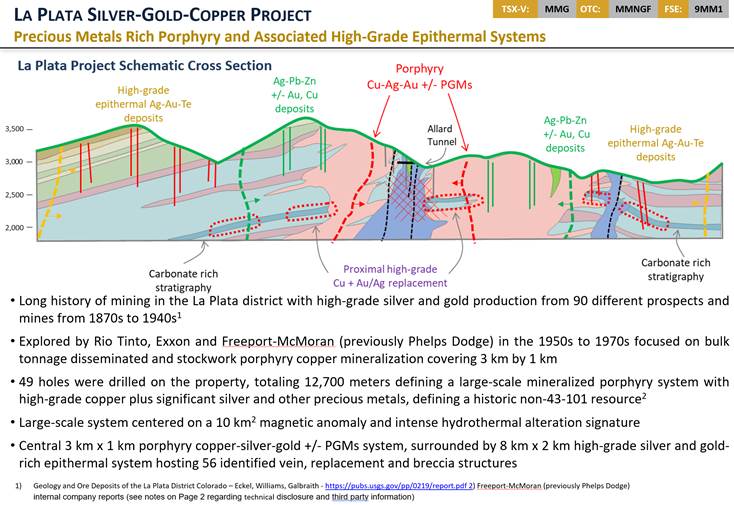

The fourth, and most recent, opportunity that came into the group was the La Plata asset and this one is, again, quite interesting. It's kind of a hybrid between a Keno Hill silver district with high-grade silver and gold and at the center of the district is a precious metals-rich porphyry system very similar to Galore Creek, which our team was part of the key expansion and advancement of. So, this is a great fit for our team's expertise. What we see here is a combination of significant silver and gold, precious metal systems and, potentially, a bulk tonnage type system at the center, based on historical drilling work by Rio Tinto and Freeport in the district. We're excited to see this asset move forward and, again, a benchmark for value might be Alexco/Galore Creek.

We've assembled what we believe are assets that have the potential to become tier 1 assets for the majors into the portfolio of each of these individual Metallic Group companies with their respective focus in silver and gold, platinum group metals and nickel, and copper-gold. In addition, we are keeping the overhead low between the three companies, with a shared office, back-office team, CFO and dedicated technical teams for each of these metal types, as well as significant management expertise in project financing. So, we think this is a fairly unique situation. There are other groups of companies, but we believe the Metallic Group's experience in value creation and application of a common business strategy toward the acquisitions and advancement of these assets in these proven productive districts has the potential to deliver superior returns for investors. We're excited to be taking these projects forward in each of the three Metallic Group companies.

Maurice Jackson: You provided some historical context about the market timing for NovaGold, let's see how that fits into the narrative here because things have been basically a roller coaster since the early part of 2016 when we had a significant run that fizzled out only to resume a couple of years later. And now, here we are in 2020 where we are in these uncharted and unprecedented times. Greg, where do you see the metals markets going, for base and precious metals, respectively?

Greg Johnson: That's a really interesting question. Let's bring in a couple of charts here to illustrate; there's a great chart that was put together by the Incrementum Group that does an excellent job of illustrating these long-term commodity cycles and where we are today. In this chart, they've taken the Goldman Sachs Commodity Index and they've divided it by the S&P 500 to give you a reference for a relative value between commodities and the broad market equities. What this chart does a great job of showing is that, since 1970, we've had three major commodity cycles, with the most recent one starting with the 1999–2001 bear market, peaking in the 2009–2011 period, and culminating in a bear market that we believe is just wrapping up now. It shows that those cycles are decade-long in length and that, even before the market crash or instability that we saw back here just recently in March, commodities with this benchmark were at one of the lowest real prices in decades.

So, the adage is, of course, if you're going to do well, you want to buy low and sell high. Well, we have good indications that, very similar to 1999 and 2001, we're at the beginnings of a multi-year bull market. We are certainly nowhere near a top for commodities and mining, with precious metals, in particular, we are in a pretty unique position; a position that you only see once every decade or so, in terms of value. I think there's a tremendous opportunity here with what's happening with central banks, and probably what's going to happen to stimulate the global economies, and that we're going to move toward even greater fiscal stimulation that's likely to include infrastructure development. This is going to be good for metals, starting with precious metals and later to move into the base metals.

And, Maurice, if we drill down in more detail with this last cycle—let's take 1995 to present—we saw a trough period in the commodity sector in 1999–2001. Of course, your listeners will recall that was the dot-com bubble when those equities were very highly valued and, of course, mining shares and commodities were out of favor. What you can see in the second, more detailed chart, is that this breaks out that Goldman Sachs Commodity Index into its three main components: energy is shown in orange, base metals in green, and the precious metals in purple. So, you can see that the exact timing of the lows and highs aren't exactly the same for each. There are some differences there but, in general, they troughed in the 1999–2001 period. They peaked in the mid to late 2000s and they all rolled over together in a bear market that many analysts say saw the first bottoming in late 2015, early 2016. It's been moving laterally since then.

The precious metals now indicate that we are in the early stages of building on a new, likely multi-year cycle. We think there's a lot of similarities with that prior major cycle where we are just coming out of a bear market, experiencing undervaluation, underinvestment in the precious metals and mining sector in general, and that things are getting started with the precious metals as the lead once again. With base metals, there's probably going to be a bit of a lag, but we think that the likelihood is that they're going to kick in as well. Investors have one of these opportunities currently in the sector to be getting in at what may be one of those rare situations that only come along every decade or so.

Maurice Jackson: The market conditions are shaping up to what may be one of those historical opportunities and, given what you shared, a lot of these stocks are still massively discounted, despite the moves we've seen so far, year to date. Let's discuss the value proposition before us in small-cap exploration/development shares and, in particular, the Metallic Group of Companies.

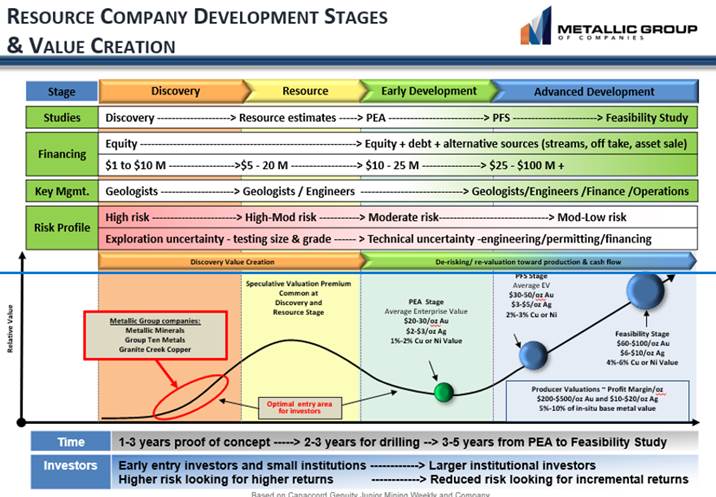

Greg Johnson: I think you raise a good point. I mean, oftentimes, investors recognize that historically the small-cap shares can have much greater leverage and greater gains and if we look specifically in the mining space, we've got this chart here that illustrates large-cap, mid-cap, and small-cap mining. Since the peak of the last cycle in 2011, we've used the GDX for the large-cap shares, the GDXJ, which is $400 million market cap and higher, for the mid-cap, and then the Toronto Venture index, as an index reference for the small and micro-cap companies. What we can see is that we've been going sideways since 2016, coming out of that bear market and that, even with the recent market turbulence, the large-cap shares, as they've been showing free cash flow, growth in earnings and potentially expanded dividends, are starting to attract new investment.

We can see that the GDX has now surpassed its values from late last year. The GDXJ has gotten to the same level and is starting to break out again. It's early days on the small-cap names and they're just beginning to rebound, as well. But if we look back historically, the mid-caps on a percentage basis are likely to surpass the large caps. The micro-cap, small-cap names, just to get back to their previous bull market ranges, may need to see many multiples of current prices and we would anticipate that, as this market matures, more interest will flow into those smaller-cap names. If you take an example of Barrick or Newmont, could they double or triple from here? Sure, that's possible. Are they going to go up to five or tenfold? Probably not likely. But these smaller-cap names, because of their heavily discounted values that they were trading at and their potential through exploration, these names have much more leverage and could result in turbocharging peoples' portfolio, if they've selected high-quality names.

Maurice Jackson: Let's do a compare and contrast, if we could, with NovaGold and the gains they delivered to shareholders versus their peers.

Greg Johnson: Sure. Looking back at that past cycle, if we look at the metals themselves in that period from 2001 to the first half of 2007, the metal prices for gold and copper went up three- to six-fold. The large-cap ETF, like the GDX or XAU, went up tenfold, but, because of the resource definition, expansion, and de-risking that you saw in NovaGold, the returns for early investors were as high as a 100X. So that was ten times the performance of those broad indices in that situation. We're not arguing today that we're looking at another NovaGold necessarily, but it illustrates the kind of leverage that that kind of pre-production company can deliver in the right market conditions, with the right asset and the right team.

Maurice Jackson: One of the many shared virtues, and a common theme, of the Metallic Group of Companies is that they provide speculators exposure to different commodities, all located in North America, in prolific high-grade mining jurisdictions. All three have the objective to table a maiden 43-101 resource in the next 12 to 24 months. All three are planning to drill this year and all three have key news flow expected. Talk to us about these exciting times.

Greg Johnson: We're already starting to see investors who haven't been looking at the mining space for five, sometimes ten years, coming back and recognizing the caliber of these assets in the Metallic Group companies, the potential, the background of the team and the track record of success. And so, it is exciting times for shareholders of the companies and, I think, for investors who are maybe just now looking at the exploration and development space.

Maurice Jackson: Let's move to Metallic Minerals, the first company in the group, which was launched in mid-2016 with the initial acquisition of your high-grade, or should I say ultra-high-grade, silver project. Since then, you've added a second very high-quality asset in Colorado. Now, one company with two very exciting projects both with very promising potential. Take us to the Yukon first and share the recent developments at the Keno Hill Silver Project.

Greg Johnson: The Keno Hill Silver District is one of the highest-grade silver districts in the world. It's had this tremendous history of nearly 300 million ounces of past production and current resources. You've got the recent discoveries by Alexco Resources in the district that have demonstrated the potential for new discoveries. Metallic has built, over the last several years, the second-largest land position in the district, consolidating that land alongside Alexco and, recently, we have been announcing some of our advancements as we've prioritized the targets, moved several into advanced stage development, and identified discoveries of large-scale earlier stage targets that we're advancing in parallel.

Maurice Jackson: Mr. Johnson, Metallic Minerals caught speculators' attention last week with its press release discussing new modeling along with an extended channel sample coming in at over 7,000 grams per tonne silver. Put that into some kind of context for us.

Greg Johnson: That was an exciting news release on our Western Keno targets, including Formo, which is an area that had an historical open-pit mine at surface, is right on the highway and features several levels of exploration/development. Those channel samples on those three levels basically illustrate that we have silver grades of over 1,000 grams per ton, which are very significant grades for any silver deposit, and that we have several shoots that are open at depth and are on-trend with some of the biggest producers in the district. We're going to be announcing additional results on some of the other target areas, including the expansion work on the East Keno targets where we've defined another 10 multi-kilometer targets. So it is an exciting time for the company, and particularly for the Keno Silver Project.

Maurice Jackson: Your neighbor in the Keno Hill District, Alexco Resources, it looks like it is going to be restarting production soon. Where does Keno Hill fit into the global silver picture in terms of silver grade, production, and potential?

Greg Johnson: We understand that Alexco is waiting for that final permit to restart production and that could land at any time. We point to the tremendous geologic work that it has done over the last several years: it built nearly a hundred million ounce resource and demonstrated that this historical district has a lot more to be discovered. Geologically, one of the closest analogs to the Keno district is the Coeur d'Alene Silver District in Idaho. A lot of your listeners might be familiar with Coeur d'Alene as several major silver focused mining companies come from there, including Coeur and Hecla. That district has produced over a billion ounces of silver from similar type high-grade vein systems to Keno Hill. They are mining at three kilometers depth in the Coeur d'Alene district. The deepest mine in Keno Hill is just 300 meters depth, so we are really just getting started there.

Last year, Alexco drilled some of the deepest holes in the district, at 400 meters, and then a couple of test holes at 500 and 600 meters which showed that mineralization keeps going. We would anticipate, as a similar system, that with further exploration it's going to continue to depth. We see Keno Hill as lining up with some of those major silver districts of the world, like Coeur d'Alene or some of the well-known ones in Mexico and South America and that it's just underexplored for its potential. With our recent acquisitions and consolidation alongside Alexco, we're very bullish on the opportunity there.

Maurice Jackson: What is on the deck for the Keno Project over the next three to six months?

Greg Johnson: As we speak, we are mobilizing our teams to the sites and we're going to be kicking off activities. We'll be drilling both on the advanced-stage targets at Keno as well as doing refinement test work, including geophysics, on some of the early-stage targets in anticipation of also drilling some of those early-stage targets. So, it's going to be an exciting field program. We've got a series of news events that are in progress for Keno Hill and we look forward to updating our shareholders and the market on that news.

Maurice Jackson: Moving south, Metallic Minerals made a strategic acquisition last fall in the southwestern United States with the La Plata Project. What developments are going on there right now?

Greg Johnson: We are quite excited about La Plata. It shares many similarities with Keno Hill as a historical high-grade silver and gold producing district. It also has many similarities with NovaGold's former Galore Creek project. And so, as a high precious metals porphyry system, we're excited about the combined potential of those high-grade precious metal targets, as well as those bulk tonnage copper silver gold targets. The district hasn't seen exploration since the 1970s. It was held by Freeport up until the market low for copper in 2002 when the two parties that we acquired it from signed the agreement to purchase it at the bottom of the metal price cycle. And so, we are the first company to do modern systematic exploration at La Plata and we see a tremendous opportunity there to build on and to add value.

Maurice Jackson: Truly impressive to see an opportunity like La Plata, in terms of exploration potential and great infrastructure. This seems like the perfect fit for Metallic Minerals. Please take us through the next steps as far as the La Plata project and what you have in store for us.

Greg Johnson: Shortly after the acquisition, which we announced last October, we kicked off district-wide surface sampling and remote sensing studies. This winter, we've been doing block modeling on the drilling and our recent sampling and we expect to be able to deliver the results from that soon. But, I can say we're already seeing a multi-kilometer scale system. We see significant precious metals enrichment in the district around the porphyry system itself. The modeling work that we're doing on the drilling and surface sampling above the porphyry system suggests we've got something quite special here and we're excited to be applying some of the same tools that have been so successful at Keno Hill on the La Plata project.

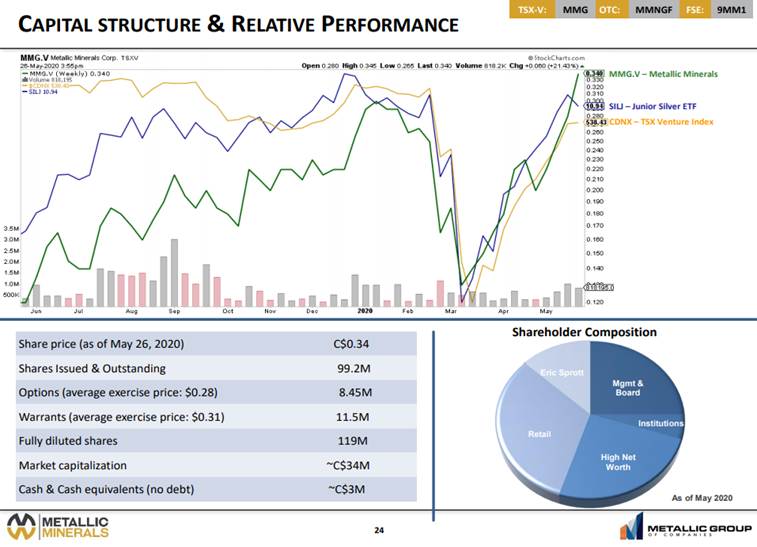

Maurice Jackson: Switching gears, Mr. Johnson, please share the current capital structure from Metallic Minerals.

Greg Johnson: We have about a hundred million shares outstanding and have about $3 million in the bank, with no debt, so we are in good shape to be able to complete the next major milestones on the company without needing to raise additional capital. We have the luxury that, if the market continues to be robust and we want to accelerate our activities, we could take in additional funds but we're well positioned to do what we need to do on these projects, with the objective of being able to move toward first resources over the next year. I'm quite excited about that position.

Maurice Jackson: What would you like to say to current and prospective shareholders regarding the opportunity that is before us right now?

Greg Johnson: I think when we look at the sector, this is an exciting time for investors who are just starting to look at the mining space or maybe who have been in the mining space in the past, especially when looking at some of the high-quality exploration/development-stage names. These companies are still vastly undervalued, coming out of a nine-plus year bear market. We believe, based on the analysts that we follow, that the pathway ahead is leading into a multi-year bull market very similar to that following the 1999–2001 low. And that this, therefore, is a real opportunity for investors to get exposure to the sector and mainly, exposure to the better quality names, like Metallic Minerals.

Silver is still barely off its lows. If you look at the relative value of silver to gold, we recently saw that silver to gold ratio spike to over 120 ounces of silver per ounce of gold. Historically, the silver-gold ratio has been more like 50 to 1. So silver is vastly undervalued relative to gold and we don't think gold is overvalued. We think gold is going to continue building on what have been higher highs and higher lows, but we believe there's the opportunity that silver could significantly outperform gold as it starts to catch up, as it has done in other cycles.

Maurice Jackson: You and I were having a discussion about "silver stackers," those that advocate strong positions in physical bullion, and I shared that, at the intermediary level, you would only have the physical bullion. At the advanced level, is when you take a look at companies that have a proven pedigree of success with a track record, like Metallic Minerals, that are silver focused. So again, for someone who's a silver stacker, we encourage you to take a look at the following links, that are in the description box below, for both the Metallic Group of Companies and Metallic Minerals.

Mr. Johnson, thank you for coming on the program today. It's been a real pleasure, sir.

Greg Johnson: Thank you very much, Maurice. It's been great to talk with you again, and I look forward to hearing from you again, and perhaps from some of your listeners.

Maurice Jackson: All the best to you, sir.

For direct inquiries on the Metallic Group of Companies, please contact Chris Ackerman at 604-629-7800 ext. 1 or you may email: [email protected].

And as a reminder, I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, off-shore depositories, and precious metal IRAs. Call me directly at 855-505-1900. That number again is 855-505-1900. Or, you may email, [email protected].

And finally, please subscribe to provenandprobable.com, where we provide mining insights and bullion sales.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Metallic Minerals, Granite Creek Copper, Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Metallic Minerals, Granite Creek Copper and Group Ten Metals are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals, Granite Creek Copper and Metallic Minerals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals, Granite Creek Copper and Metallic Minerals. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Group Ten Metals, Granite Creek Copper, Metallic Minerals and Newmont Corp., companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.