Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE) recently reached its 52-week high, with shares closing at CA$0.21 on the TSX Venture Exchange and US$0.15 on the OTCQB as of May 13, 2025. The company's Canadian-listed shares rose 5.13% from the previous day, reaching a level not seen since mid-2023. MarketWatch reports that trading volume on May 13 exceeded 230,000 shares, significantly above the 65-day average of 170,610, representing a 135% increase in volume. The intraday high matched its 52-week peak of CA$0.225, while the 52-week low remains at CA$0.09.

This surge follows a number of White House initiatives on domestic mining, and comes amid continued investor attention on domestic sources of critical minerals, particularly as copper and gold markets experience sustained strength. Stillwater Critical Minerals is advancing its Stillwater West project in Montana, a 100%-owned asset within the Stillwater Igneous Complex, a region with a long history of mineral production and active operations by neighboring Sibanye-Stillwater.

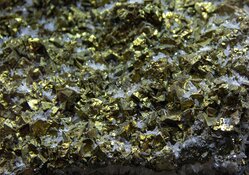

The company's recent progress includes the expansion of its geological model to span 20 kilometers of strike and the identification of multiple large-scale conductive targets from a 2024 airborne magneto-telluric (MobileMTm) survey. These targets are aligned with both contact-style and Platreef-style polymetallic sulfide mineralization and are prioritized for upcoming drilling. According to a March 27, 2025 news release, Vice-President of Exploration Dr. Danie Grobler stated that the most conductive zones "correspond with net-textured to massive sulfides," and are located near the footwall contact, with some already intersected in prior drill campaigns.

Stillwater's inferred resource stands at 1.6 billion pounds of nickel, copper, and cobalt, along with 3.8 million ounces of palladium, platinum, rhodium, and gold across five deposits. CEO Michael Rowley emphasized in a company release that Stillwater West's scale and grade align with U.S. government priorities for building a secure, domestic supply of critical minerals, calling the project a "foundational component" of national policy objectives.

Capital Shifts to Juniors in Critical Metals Sector

In a May 9 interview published by Ahead of the Herd, Rick Mills discussed why commodities, including critical and base metals, were attracting renewed attention. He pointed to repeated historical patterns, stating, "every time there's been a reset in the global monetary system, it's happened three times in '29, ‘69 and '99, you get this huge investment into bottomed commodities." Bob Moriarty of 321Gold added that the shift toward hard assets was less about enthusiasm for commodities themselves and more about disillusionment with traditional finance. "They are not investing in commodities because of commodities," Moriarty explained, "they're choosing to not invest in these paper assets that are blowing up."

In a May 13 report from Stockhead, commodity prices rallied sharply following news that the U.S. and China had reached a temporary trade truce. Tariffs were eased across both sides, fueling optimism and reviving demand for key inputs. "Commodities, though, were the main winners," the report stated, highlighting the rebound in iron ore above US$100 per tonne, alongside gains in copper and oil. The article underscored that stabilized trade relations with China had "breathed life back into a market that had been gasping for air."

According to a May 13 report from the World Economic Forum, rare earth elements and other critical minerals have become central to the global energy transition, powering essential technologies such as electric vehicles, wind turbines, and solar panels. The Forum noted that demand for these materials has surged and is expected to triple by 2030 and quadruple by 2040, citing projections from the International Energy Agency. However, supply remains vulnerable due to the concentration of mining and refining in a few countries, particularly China. The Forum emphasized that unlocking new sources through policy, investment, and innovation—alongside improved recycling and collaborative global efforts—will be key to ensuring secure and resilient supply chains.

Upcoming Catalysts and Strategic Positioning

Stillwater Critical Minerals is preparing for a drill campaign in 2025 aimed at expanding its current resource base across five Platreef-style deposits. These polymetallic deposits are modeled after South Africa's Bushveld Complex and are known for bulk-tonnage nickel and copper sulfide systems enriched with platinum group elements (PGEs) and gold.

The company's updated 3D model from the 2024 geophysical program confirmed continuity within the mineralized Peridotite Zone, an 800-meter-thick layer that hosts all five of Stillwater West's NI 43-101-compliant resources. Drill highlights from this zone include intercepts such as 401 meters at 0.27% nickel equivalent (NiEq) and 13.2 meters at 2.31% Ni with 1.51 grams per tonne 4E (platinum, palladium, rhodium, and gold).

Stillwater is also progressing toward metallurgical studies and a preliminary economic assessment. A planned resource update is expected to reflect additional drilling results. The company maintains a strategic relationship with Glencore, which holds a 15.4% equity stake and a seat on the technical committee. This partnership provides access to global expertise in magmatic systems and has supported multiple financing rounds, including a CA$3.9 million investment in June 2023 and an additional CA$2.0 million in May 2024.

Streetwise Ownership Overview*

Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE)

Stillwater's collaborative projects with the U.S. Department of Energy and academic institutions like Cornell University are advancing research into carbon capture and hydrometallurgical recovery, potentially enabling future environmental offsets and processing innovations. Additionally, U.S. government initiatives continue to prioritize the Stillwater district, with the neighboring Sibanye-Stillwater operation recently named one of ten priority mining projects by the White House.

With its extensive land package, historical production base, and drill-confirmed scale, Stillwater West remains a key asset in the broader push for domestic mineral security. The company's stated goal is to become a primary U.S. source of low-carbon critical minerals, aligning its resource expansion strategy with both national policy shifts and long-term electrification trends.

Ownership and Share Structure

Management and insiders own approximately 20% of Stillwater, according to the company.

Executive Chairman and Director Gregory Shawn Johnson owns 2.86%, President and CEO Michael Victor Rowley owns 2.56%, Independent Director Gregor John Hamilton owns 1.65%, Independent Director Gordon L. Toll owns 0.44%, and Vice President of Exploration Daniel F. Grobler owns 0.23%, according to Reuters.

Institutions own approximately 25% of the company, high net-worth investors own about 37%, and Glencore Canada Corp. owns 15.4%. About 18% of the company's shares are in retail, Stillwater said.

There are about 233 million shares outstanding with 180.5 million free float traded shares, while the company has a market cap of CA$49.93 million and trades in a 52-week range of CA0.0900 - CA0.2250.

Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Stillwater Critical Minerals is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. \

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.