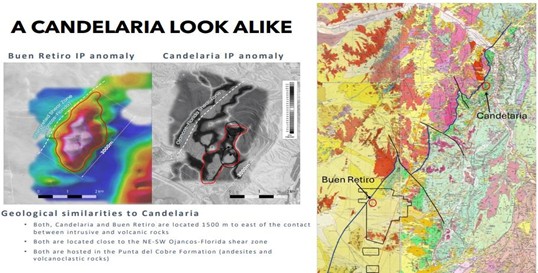

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB)(CA$0.45/US$0.329) is exploring and developing two highly-prospective assets in Chile, with Buen Retiro taking centre stage as its flagship asset. It is seen as a large, underexplored, iron-oxide-copper-gold ("IOCG") deposit that carries the potential to be on a scale similar to the Candelaria Mine 40 to the NW owned by the Lundin Mining Group.

(Forward guidance from Lundin has the mine producing 143,000 tonnes of copper and 80,000 ounces of gold in 2025.) The northern part of the Buen Retiro deposit is known to be IOCG-style with an oxide cap carrying economically viable grades of copper-gold mineralization. The southern part is a different type of mineralization, but it nonetheless carries similar grades in the oxides, allowing for a considerable estimate of scale to be present. The key to this project, in my view, lies in the exploration results of drill intercepts containing the mineralization beneath the oxide cap, as shown in the diagram on the next page.

From the standpoint of de-risking, the presence of the oxide cap and the existence of such pervasive copper-gold mineralization throughout the property significantly enhance the likelihood of economic viability for Buen Retiro, but it is the exploration upside that has me spinning.

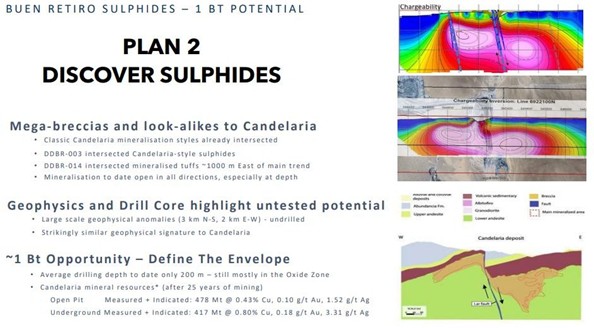

Last year at this time, I alluded to FTZ's "Plan 2" objective, which was to "DISCOVER SULPHIDES" in the deeper sections of Buen Retiro.

That was confirmed by CEO Merlin Marr-Johnson in a press release dated December 2, 2025, that stated: "Hole 43, 150 metres north of hole 42, is currently underway. Crucially, the core photographs look very similar to the style of mineralization from within the resource zone at Candelaria. These holes are the first time that Fitzroy has seen consistent sulphide mineralization of this nature, which further enhances the exploration model at this project."

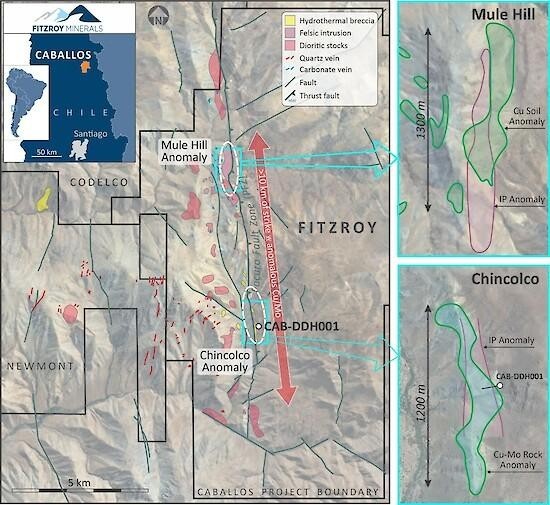

Also included in the Chilean asset portfolio is the Caballos Copper Project, which is located in the Valparaiso Mining District, surrounded by majors such as Freeport-McMoRan Inc. (FCX:NYSE), Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX), Codelco, and Los Andies Copper (LA:TSX.V), where the company reported "200 m at 0.83% CuEq, Including 42 m at 2.31% CuEq in New Copper-Molybdenum-Gold-Rhenium, Mineralizing System Identified at the Caballos Copper Project, Chile."

The stock responded with a move to CA$0.55 on huge volume, but the big news arrived shortly thereafter when a well-sponsored and oversubscribed LIFE offering raised CA$12,000,000 with institutional participation across the board. Momentum surrounding the discovery waned as winter arrived in June of last year, after which "technical issues" hampered progress, but since drilling resumed in the spring, it appears as though this project is back on track and due to report more exciting exploration results.

With a strong treasury and superb management team, FTZ/FTZFF intends to focus on both Buen Retiro and Caballos exclusively rather than allocate any of its precious working capital to other projects.

I view this as a critical decision, but it begs the question as to what to do with the non-core assets such as Polimet, Taquetren (Argentina), and Cariboo (Canada). I will look for developments in this area later in January.

My target price for FTZ/FTZFF is best assessed by looking at the least exciting of their endeavours. The copper-bearing oxide cap at Buen Retiro allows for a heap leach recovery process that can and will be put into action by Pucobre (Sociedad Punta del Cobre S.A.), the second largest copper miner in Chile (behind Codelco) and an expert in the mining of oxide copper deposits. It is my conviction that with an SXEW plant just up the road with a great deal of excess capacity, they desperately need "feed" for the plant.

Enter Buen Retiro.

Fitzroy has earned a 100% interest in this property, but Pucobre has a 30% "clawback provision" that, if exercised, returns all of the exploration money spent by FTZ/FTZFF times three, which is a huge benefit for the shareholders as it will minimize funding efforts for the working capital required to build the heap leach mining operation.

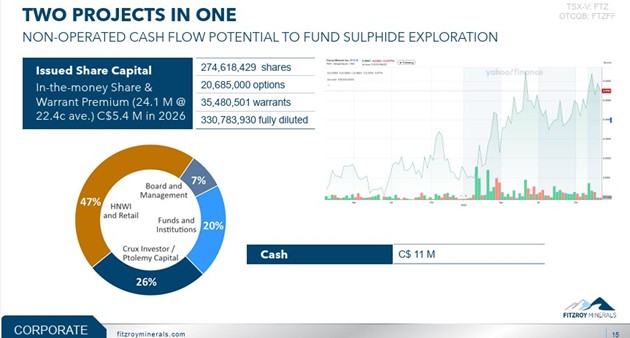

Once this is in production, estimated to be in late 2027, assuming copper prices cooperate, the project will generate an estimated US$80 million per year, which is US$56 million net to Fitzroy. Based upon comparable operations around the globe with similar operations, it should place a value on FTZ/FTZFF of around US$350 million or US$1.06 per share, a 322% advance from current levels. That assumes that all warrants and options are exercised, which will put another CA$10m (plus) into the treasury, resulting in fully-diluted capital of around 330,000,000 shares.

I place a high certainty on the likelihood of the oxide cap being mined in 2028 and beyond, with a pre-feasibility study in place by mid-2026. This is my minimum expectation for 2026 and the achievement of a US$350m market cap.

At this point, speculation takes over as to what could be lurking in the deeper sections of Buen Retiro. The Candelaria Mine Complex drives a CA$25 billion market cap for TSX-listed Lundin Mining Corp. (LUN:TSX; LUNMF:OTCMKTS) and is on its balance sheet at a value of approximately US$4 billion. As stated earlier, the December 2 news release confirmed the presence of sulphides in the deeper sections of the structure described as "Candelaria-style IOCG," so exploration results in 2026 are going to determine whether there is indeed a "Candelaria II" lurking below. If there is, then valuation for FTZ/FTZFF takes a bountiful leap forward with speculative potential to also have a US$4 billion book value, or around US$12 per share.

At this point, you add in Caballos, which has already confirmed a high-grade copper-gold-molybdenum discovery. If they confirm grade and scale here in 2026, you can only guess what investors will assign in terms of market capitalization, but it will certainly be substantially north of its current F.D. market cap of US$108 million.

This is a "must-own" junior, my top pick, and largest holding for 2026.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc..

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.