Torr Metals Inc. (TMET:TSX.V) received a five-year, area-based drill permit for its flagship Kolos project in south-central British Columbia (B.C.), covering two of the highest-priority copper-gold porphyry targets at Kirby and Lodi and the copper-silver-molybdenum Clapperton target, as announced in a news release.

"Securing this multi-year drill permit is a major milestone for Torr, clearing the way for our inaugural drill program at Kirby, Lodi and Bertha," President and Chief Executive Officer (CEO) Malcolm Dorsey said in the release. "A new discovery at Kolos could not only transform the regional exploration landscape but also offer a potential strategic source of proximal mill feed to help sustain long-term copper production in this tier one mining district."

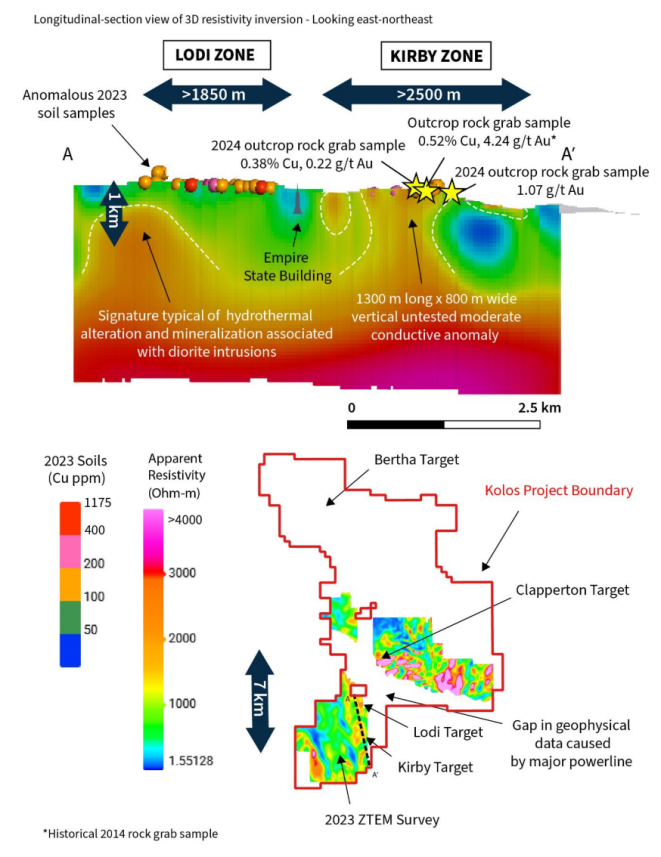

The undrilled Kirby and Lodi target zones host significant copper-gold mineralization at surface congruent with multikilometer ZTEM (Z-axis tipper electromagnetic) geophysical anomalies that extend to depths of more than 1 kilometer (km). Together with polymetallic mineralization at Clapperton, these targets form an untested 7-km-long, multicentered porphyry trend.

The undrilled Kirby and Lodi target zones host significant copper-gold mineralization at surface congruent with multikilometer ZTEM (Z-axis tipper electromagnetic) geophysical anomalies that extend to depths of more than 1 kilometer (km). Together with polymetallic mineralization at Clapperton, these targets form an untested 7-km-long, multicentered porphyry trend.

Geophysical and geochemical data align strongly with the high-grade results of outcrop samples. Moderately conductive and resistive geophysical anomalies extend 2,500 meters (2,500m) in strike length at Kirby and 1,850m in strike length at Lodi. These anomalies correlate with copper-in-soil values up to 1,175 parts per million copper and 725 parts per billion gold. Results of rock grab samples from coincident outcrop further confirm the anomalies as they returned 0.38% copper and 1.07 grams per ton gold within the Kirby target zone.

As for Bertha, among the target zones to be drilled this year, results of an induced polarization (IP) survey are pending, for the first time testing the potential for subsurface extension of high-grade copper mineralization in outcrop. The results will indicate whether or not Bertha shares the same large-scale geophysical-geochemical footprint as Torr's other undrilled copper-gold porphyry targets.

Torr initiated the IP survey last month after compilation results of historical geochemical data highlighted the Bertha zone as a standout copper-gold-silver target at Kolos, Streetwise Reports reported. Specifically, results of 2,090 soil and 27 rock grab samples outlined significant copper, silver and gold anomalies. After anomalous soils indicated two mineralized trends at Bertha, Torr expanded the IP survey coverage to 16.1 line kilometers from 11.7.

Many Porphyrys, Targets Identified

Headquartered in Edmonton, Alberta, Torr Metals is exploring for new copper and gold discoveries in proven, highly accessible, Canadian mining districts populated by big names and in areas with existing infrastructure and a growing need for near-term feed, according to its Corporate Presentation.

*"The company could hardly be better positioned, as it has a diversified portfolio of high-potential copper and gold targets, and the fundamentals for both of these metals could scarcely be better, with copper facing a supply crunch and a tidal wave of demand for gold incoming, due to the ballooning crisis of the financial system," wrote Technical Analyst Clive Maund in a May 7 company report.

The Canadian explorer owns three copper-gold projects whose land packages together total 1,300 square kilometers (1,300 sq km): Kolos, Filion and Latham.

"Torr's 100%-owned, district-scale assets are strategically located for cost-effective, year-round exploration and development," Maund wrote.

The entire 332-sq-km Kolos project is in the Quesnel Terrane, Canada's most productive copper belt, known for its copper-gold porphyry deposits and several types of gold deposits. Kolos is minutes away from Teck Resources Ltd.'s (TECK:TSX; TECK:NYSE) Highland Valley and New Gold Inc.'s (NGD:TSX; NGD:NYSE.MKT) 100%-owned New Afton copper-gold porphyry deposit (New Gold acquired the remaining 19.9% for US$300M in April 2025). Bertha shares geological similarities with the mid-tonnage high-grade New Afton deposit, which in 2015 was the highest gold-producing porphyry in British Columbia.

Another Kolos neighbor is HudBay Minerals Inc. (HBM:TSX; HBM:NYSE) , with Copper Mountain, to which Kolos compares favorably, noted Maund. He added that Kolos "finds itself in good company next to copper giants."

"There are a lot of targets at the Kolos project where significant grades have already been found," noted Maund.

Along with a compelling project in an ideal, prolifically producing location, Torr also checks the "People" box. Its management team collectively has a proven track record of launching 20-plus public companies, raising more than CA$1 billion to advance projects around the world, and creating shareholder value, notes the company's Fact Sheet.

Torr Metals' Filion project spans 251 sq km in northern Ontario, in an unexplored greenstone belt with high-grade orogenic gold potential. According to Maund, Filion has "huge discovery potential, especially as it is surrounded by 'heavy hitters' including the likes of Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Alamos Gold Inc. (AGI:TSX; AGI:NYSE), Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), and Hecla Mining Co. (HL:NYSE)." Filion boasts multiple undrilled targets.

Latham is Torr's other asset, a 689-sq-km copper-gold project in northern B.C. in the same prolific geological trend as the nearby Red Chris, Saddle North, Galore Creek and Schaft Creek copper-gold porphyry deposits, the company's website describes. Latham is close to major provincial infrastructure, including the Dease Lake Airport and Highway 37.

Now is Time to Buy Copper

From a technical standpoint, copper is a Buy, Technical Analyst Maund wrote in an Aug. 1 report, as it has dropped back into a zone of strong support where it is oversold.

"These tariff antics do not change the overall supply-demand situation for the red metal," Maund asserted.

He explained that after a significant price drop like that of COMEX copper last week, what typically follows is a more limited and measured retreat. Thus, it is likely the price will descend a bit more into the strong support zone of $4–4.20, then "mark out an intermediate base pattern that allows time for sentiment to recover before another uptrend can gain traction," wrote Maund. "Traders can look out for this."

According to Haywood Securities Analyst Pierre Vaillancourt in an Aug. 1 Market Commentary report, the now-in-effect 50% U.S. copper tariff on only semi-finished copper products "will be disruptive to global trade flows of the metal," but "the market should normalize toward parity again." He is bullish on copper, but the bleak global economic outlook may temper his view. He noted that the International Monetary Fund (IMF) recently lowered its projected global growth rate for 2025 to 3% from 3.3%. For the U.S., the IMF forecasts 1.9% economic growth for this year, down from 2.8% last year. China may be experiencing a similar trend as growth in Q2/25 was down from Q1/25.

Ron Struthers of Struthers Resource Stock Report is also positive on the red metal. In the Aug. 1 edition of his newsletter, he wrote, "In the medium term, I expect prices to move back up to the $5 area." (The COMEX copper price was US$4.42/lb at the end of trading on Aug. 4.)

MetalMiner wrote in an Aug. 4 article that the copper market "will remain choppy" due to the U.S. tariff that is "forcing a strategic rethink up and down the value chain." Strategic shifts likely are to result. For instance, U.S. manufacturers of copper-intensive products are accelerating plans to localize production. Many automotive and electronics original equipment manufacturers are figuring out which is more cost advantageous, to import duty-free cathodes and boost in-house wire and connector fabrication or import finished components at a higher cost.

As for copper's fundamentals, supply is in a deficit, reported John Zadeh in a July 11 Discovery Alert article. Current supply is growing at 1–2%, but demand is increasing at 3–4%, he pointed out.

"There aren't enough copper projects in the pipeline — not ones big enough to matter," Lobo Tiggre, CEO of IndependentSpeculator.com, told Investing News Network on July 24. "So I'm extremely bullish on copper. All those reasons to be bullish on copper are still on the table in front of us."

As for copper demand, according to a July 31 Reuters article, it is increasing faster than the industry anticipated. Fueling demand are the billions of dollars being invested globally to modernize and expand power grids for the digital and clean energy transitions requiring massive amounts of electricity. Other growth drivers, noted in Grand View Research's report on the copper market, include urbanization and infrastructural expansion, particularly in Asia Pacific and Latin America, and technological innovations in electronics, 5G infrastructure and smart devices. The construction, electrical and industrial sectors are creating the most demand.

The global copper market is predicted to expand at a 6.5% compound annual growth rate between this year and 2030, according to Grand View. During the forecast period, the market's value is expected to reach US$339.95 billion (US$339.95B) from US$241.88B in 2024.

As for where the copper price may go, Longforecast predicts it will hit US$7 per pound (US$7/lb) in 2029 and slowly work its way up in the meantime. The long range financial market forecaster sees copper ending this year at US$4.44/lb, then retreating slightly to end next year at US$4.35 then rising by year-end 2027 to US$5.29.

The Catalyst: Maiden Drill Program

With the required permits now in hand, Torr Metals is preparing to launch its first drill program at Kolos, targeting untested outcrop that has yielded grades up to 8.48% copper, notes the company's Investor Presentation.

The plan calls for up to 3,000m of drilling at Lodi, Kerby and Bertha, beginning with the latter in phase one.

Analyst: "What's Not to Like?"

Technical Analyst Maund rates Torr Metals a "Very Strong Buy" for all time horizons. He explains that the fundamentals have improved materially since the start of the year. In the interim, the company has been working progressively toward its objectives, and the prices of copper and gold have been climbing.

Meanwhile, TMET has been building out the handle of a cup-and-handle base pattern, as noted on its six-month chart. The stock's action during this period indicates that now is an excellent point to buy. The stock has unwound its earlier overbought condition, thereby restoring upside potential. After a gentle uptrend starting in December, the stock retreated to a support level. The accumulation line rose, even as the price reacted back due to upside volume predominance; this divergence signals a renewed advance.

"The case for a major bull market in Torr Metals is overwhelming, on both fundamental and technical grounds," wrote Maund. "With the stock at an excellent entry point after its recent dip, the question may fairly be asked, 'What's not to like?'"

The analyst noted the first target for a TMET upleg is CA$0.18–0.20 per share. This implies a 64–82% return from the stock's price both at the Aug. 4 market close and at the time of Maund's May report. The second target is CA$0.31–0.33, after which the share price is expected to climb to much higher levels.

Ownership and Share Structure

According to Torr, about 25% of the company is owned by management and close associates and about 9% by institutions. The rest is retail.

Top shareholders include Torr Resource Corp. (owned by Malcolm Dorsey) with 7.87%, Severin Holdings Inc. with 6.56%, John Williamson with 2.33%, Sean Richard William Mager with 1.28%, and Malcolm Dorsey with 0.09%, Refinitiv reported.

Torr has a market cap of CA$4.17 million and 52.25 million shares outstanding. It trades in a 52-week range between CA$0.075 and CA$0.17 per share.

| Want to be the first to know about interesting Gold, Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc., Agnico Eagle Mines Ltd., and Barrick Gold Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 7, 2025

- For the quoted article (published on May 7, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.