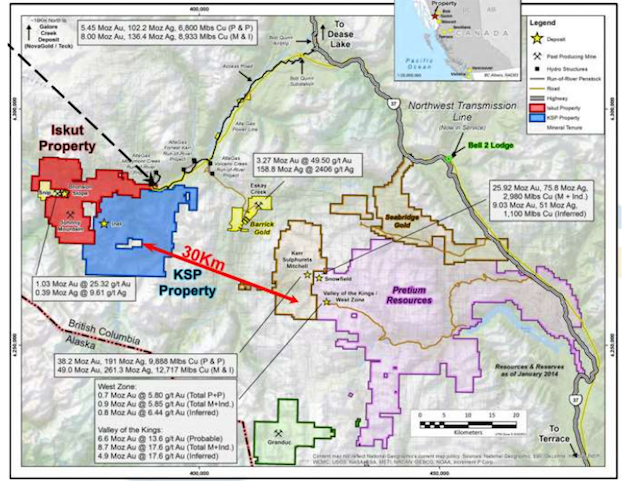

With Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) acquisition of SnipGold Corp. that closed last week, Seabridge gains 100% ownership of the Iskut property in northern British Columbia, as well as the adjacent KSP property that is subject to an earn-in agreement with Colorado Resources. These properties are located in an area labeled "The Golden Triangle," which is home to numerous high-grade discoveries, and is just 20 kilometers from Seabridge's KSM project.

Canaccord Genuity analyst Tony Lesiak views the acquisition favorably, writing in a June 22 research report, "Under the Plan of Arrangement, Seabridge will issue ~0.7M shares (1.4% dilution) valuing SnipGold at approximately CA$9.9 million. While the purchase price may be small, we see potential for a large impact."

"The large (294 sq km) highly prospective land package, historic high-grade profile (+25g/t Au), and potential synergies with KSM," inform his view. He also writes, "Given the potential of the property, we have assessed an initial $100 million valuation for the Iskut property, far exceeding the purchase price."

Seabridge recently raised CA$12 million of flow-through funding at a price of CA$24.08 per share. This funding will be used to fund the 2016 exploration program that includes 10,000 meters of drilling at KSM and 3,000 meters at Iskut. The 2017 drill program is much larger.

The drill program should result in increased news flow. "Overall we expect a catalyst-rich H2/16 for Seabridge based on the new high grade focus at Snip, potential for improved grades and mining rates at Deep Kerr at KSM, and potential improved project economics at KSM with the release of the revised prefeasibility study," writes Lesiak.

Canaccord's outlook on Seabridge is positive, as Lesiak writes: "KSM remains the world's largest undeveloped gold reserve and is fully permitted. Our positive outlook of KSM is underpinned by the location of the asset, the size/scalability, permitting status and potential improved economics."

Concerning the challenges of capital investment and partnership timing, Lesiak notes, "the capital intensity of KSM is in line with or below most other large greenfield opportunities and the perceived technical risks are greatly overstated, in our opinion."

Canaccord is maintaining its Speculative Buy rating and has increased its target to CA$21.50 from CA$20.00.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Seabridge Gold Corp. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Disclosures from Canaccord's research report are available here.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons quoted or interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.