In a sensible universe, gold and silver would be experiencing a sustained adjustment following the meteoric ascent culminating in late January. The situation is further complicated by contradictory sentiment indicators and a ten-day absence of Chinese participation due to the Lunar New Year celebration.

Simultaneously, the DSI struggles with gold at 57 and silver at 52, signaling neither an impending peak nor a trough. I recently discovered an intriguing chart in an email from Jay Taylor. In truth, I appropriated the chart from Jay, but he had acquired it from Lukas Ekwueme on X, so I don't harbor excessive guilt, especially since I noticed that it was initially created by Crescat. Therefore, Lukas may have appropriated it from Crescat Capital, and Jay appropriated it from him, but I merely repurposed it from Jay.

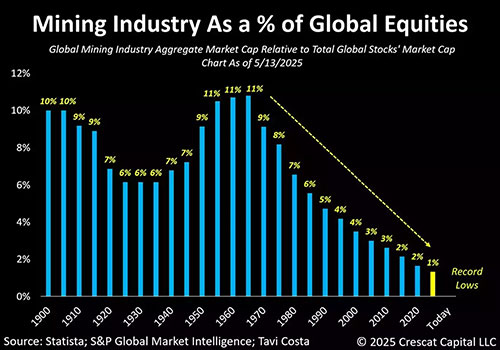

If you believe that your mining stocks are preposterously inexpensive compared to everything else in the world, it might be because they are preposterously inexpensive compared to shares globally. Crescat highlights that if mining shares merely reverted to their 1970 proportion of the total investment market, they would need to increase by 1000%. Unsurprisingly, many will rise even more. We may be in a correction, but this bull has a considerable distance to cover.

A company recently approached me with a compelling value proposition. They plan to commence production by processing tailings from a previous mining period spanning 1910 to 1990 at the Montauban lead/zinc/gold mine situated in Quebec. A prior study from the mining period indicated a resource of 12,000 ounces of gold and an additional million ounces of silver in the tailings. Moreover, the resource revealed 57,200 tonnes of mica that could also be extracted. Assuming a price of $400 per tonne for the mica, ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE) proposes a potential revenue of approximately CA$22.8 million solely from the mica.

A subsequent 43-101 resource estimate from 2010 identified 47,198 ounces of gold and 481,000 ounces of silver in the hard rock source from both the North Zone and the South Zone.

Recent exploration conducted by the ESGold Corp. (ESAU:CSE; ESAUF:OTCQB; Z7D:FSE) technical team suggests that Montauban appears to be a multi-lens VMS deposit with the potential for multiple stacked layers of VMS mineralization not recognized in previous mining work.

Management intends to progress the fully permitted low capex tailings reprocessing plant for cash flow while simultaneously conducting advanced exploration into the hard rock potential, thereby avoiding the share price decline prior to commencing hard rock production. With US$4,900 gold and US$75 silver, the economics support their strategy.

The company seems to be in a robust financial position, having completed a CA$4.5 million placement in December and secured a CA$9 million line of credit from Ocean Partners in November 2025.

Additionally, ESGold is developing a plan to undertake another tailings project in Colombia, which they refer to as the Bolivar tailings project.

With ongoing news and management changes implemented in mid-last year, the share price surged by 200% from CA$0.45 at the end of May to early July. Since then, shares have stabilized but have completely failed to acknowledge the skyrocketing advance of both gold and silver. Production is expected to begin in 2026 at Monaauban.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- ESGold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of ESGold Corp.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: ESGold Corp. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.