I'm leading off this alert with another addition to my roster of Speculative recommendations, and as with Eskay Mining recently (also in British Columbia, as this newest one!), this is likewise a company I have known and followed for quite some time prior:

Inomin Mines Inc. (MINE:TSX.V; IMC:FRA)

Last Friday's close — CA$0.085

Following my oft-stated M.O. of the recent past — and despite my rather ambivalent view of the macro situation and broader markets here in 2026 — I still am of a mind that a part of our portfolio rejiggering, where resource stocks are concerned, particularly involves adding selective new positions in companies where, among other factors:

--> I know and have confidence in management

--> We have a worthwhile and sufficiently "sexy" project

--> A "Big Brother" presence exists to help reduce risk and provide some validation

--> There is a reasonable prospect for near-term "needle movers."

I have known C.E.O. John Gomez for many years; initially, meeting him courtesy of his work in the uranium industry and related capital markets activity (among other things, his work led to the creation of Investing News Network, on which I guest occasionally.)

Simply put, John is good people.

For some time now, his chief task in life has been shepherding tiny (under CA$5 million market cap) Inomin Mines along. As you see below, similarly to most micro-cap junior explorers, its share price ground somewhat lower over the last few years, as the "critical mass" that would allow for meaningful spending on its Beaver-Lynx pollymetallic project in south-central B.C., etc., remained elusive.

There have been a couple of notable exceptions to that overall lethargy, however:

First, for a short time in early 2022, MINE shares caught fire following the publication of some eye-catching assay results of both nickel and, especially, magnesium. Questions bedeviled the company, though, over the veracity of the numbers; yet on the assays and some early work on everything from recoverability to even carbon sequestration in a potential future mining scenario, Inomin relied on more than one third-party lab/expert.

The bigger issue, not allowing this brief momentum to stick, as I see it, was simply Inomin's tiny size and the then-lingering financing funk for most resource juniors.

Second, since bottoming last spring, Inomin shares have been steadily grinding higher. While part of this has to do with the overall better environment for metals (and as investors warm up to up-and-coming magnesium as a story), it's also in recognition of the importance of the company having Japan's giant Sumitomo on board!

A BIG part of my own moving toward a recommendation here at long last (albeit, still a speculative one) is the involvement of subsidiary Sumitomo Metal Mining Canada, Ltd. as Inomin's earn-in partner on Beaver-Lynx, the company's one major asset.

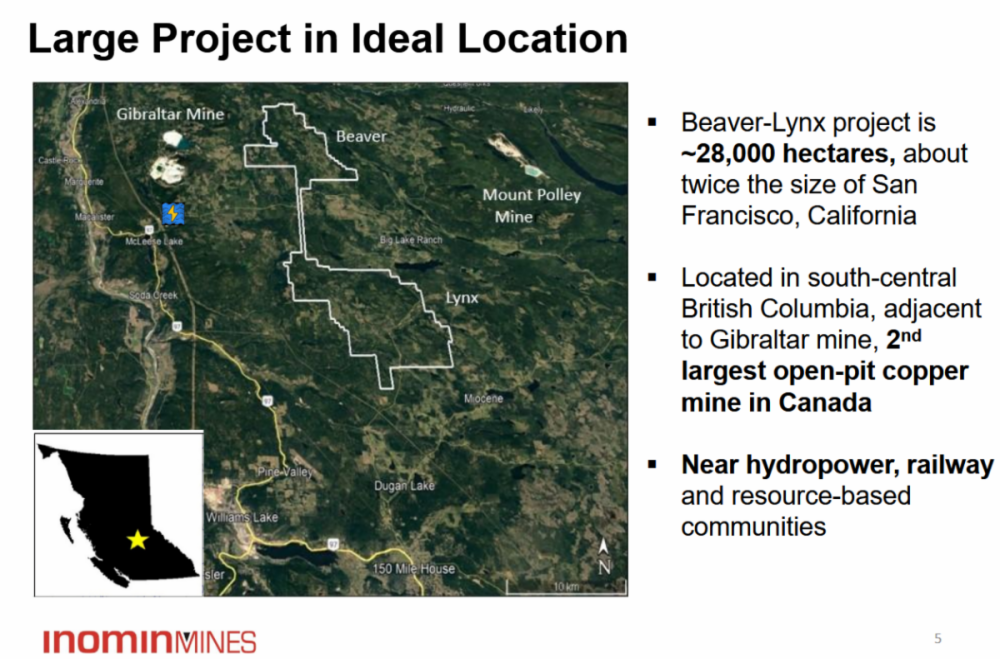

The 28,000‑hectare Beaver‑Lynx project, as you see below, is located approximately 50 kilometres north of Williams Lake and adjacent to the Gibraltar mine, Canada's second‑largest open‑pit copper operation. Mount Polley is to the east.

Notably, this area is much "friendlier" and pretty much year-round accessible ground, in contrast with some of the more remote areas farther north.

To date, sporadic exploration and drilling (primarily on northern targets at Beaver) have revealed modest but potentially meaningful levels of nickel, cobalt, and — more recently — PGMs platinum and palladium.

The BIG numbers — often 20%+ content — though have been reserved for critical metal magnesium, which is gaining stature for numerous advancing uses as you see in part below.

(NOTE: When you next spend some time at Inomin's WEB SITE HERE, be sure to especially check out its Corporate deck, where there is a lot of information as to magnesium's uses and why it's on deck as a more notable up-and-comer.)

In the near future, as our schedules allow, I'll follow up this introduction to Inomin with more color on a lot of things, visiting by video with John Gomez; so be on the lookout for that.

For present purposes, though, I wanted to get this out to you this morning, given the NEWS RELEASE that came out in the wee hours of the morning: and that is, the companies planning out 2026's drilling program which--as you'll read--seeks to expand on both past results at Beaver's South Zone as well as test prospective new targets at Lynx.

More specifics will be following.

Besides the encouraging (albeit still very early stage) drilling success prior, I'm animated by Sumitomo's interest in Beaver-Lynx, and it is also looking at the potential district-scale opportunity here.

Most of all — and your KEY takeaway for now — it's notable to realize that out of many dozens of projects in North America that Sumitomo "kicked the tires on" last year, it did a deal with JUST ONE COMPANY: Inomin.

So here again, I think once this latest news is out, affirming Sumitomo's seriousness, we could well see MINE's market cap re-rated further.

Thus, Inomin Mines is started as an Immediate BUY and added to my roster of speculative recommendations.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Inomin Mines Inc.

- Chris Temple: I, or members of my immediate household or family, own securities of: Inomin Mines Inc. My company has a financial relationship with: Inomin Mines Inc. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.