Many retail investors prefer ETFs over individual stocks. At PlayStocks, we prefer individual stocks, and today, I want to get into the pros and cons of both and why we prefer the stocks.

There is nothing wrong with holding the Gold ETF (GLD) as part of your portfolio. We suggest physical gold in the form of bars and coins, with the GLD more as a trading position. Today, I want to focus on the leverage you can gain with gold stocks and their related ETFs

There are advantages to the ETFs, mainly that they give you diversification in the sector, and as an individual investor, you have to do far less due diligence and research. You pay a price for this, but most don't realize it. Below are the top 5 gold stock ETFs by assets under management.

Physical Gold and the GLD ETF are up about +17% and you can see the gold stock ETFs have done better. This is only six weeks into the New Year, so it's not a long sample period. However, looking at 2025, gold was up +65% and the GDX ETF +153% and GDXJ +166% so more than double gold's move.

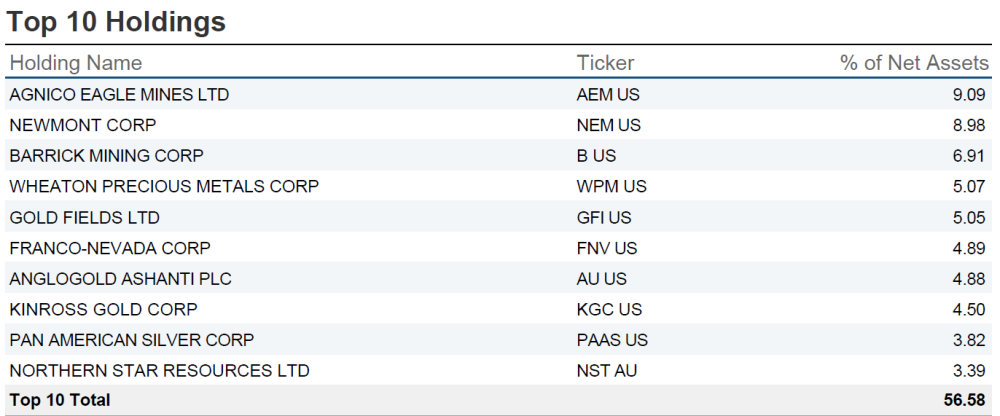

I am going to look at the GDX ( VanEck Gold Miners) ETF that has been around for a long time and is well-known. GDX currently holds 56 stocks, and over 50% of the holdings are the top senior producers, so they will have a major impact on the performance. The ETF will mostly track the large producers.

GDXJ holds more stocks at 97, and their top 10 holdings are more like the mid-tier producers, Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A), IAMGOLD Corp. (IMG:TSX; IAG:NYSE), Coeur Mining Inc. (CDE:NYSE), Hecla Mining Co. (HL:NYSE), Alamos Gold Inc. (AGI:TSX; AGI:NYSE), Evolution Mining Ltd. (EVN:ASX; CAHPF:OTCMKTS), Royal Gold Inc. (RGLD:NASDAQ), and First Majestic Silver Corp. (AG:TSX; AG:NYSE; FMV:FSE), to name a few.

The list contains two leveraged ETFs: the GDXU, 3 times leveraged, and the NUGT, 2 times leveraged. I have highlighted NUGT several times, comparing it to DUST, the two times short gold stock ETF. DUST is still getting way more volume and buying interest than NUGT.

The leveraged ETFs can do well in short-term intervals if you get the timing right. For the purpose of this newsletter, I am just comparing the differences of stocks to the basic (1-time) ETFs. You could buy gold stocks on margin to get a similar effect as a two times ETF.

Key Points and Differences

- The main pros of the ETFs are exposure to the sector with diversification and far less due diligence and research required compared to individual stocks.

- Either choice is easy to trade and has liquidity.

- If you buy one gold stock, you have added risk of a one-time event affecting that stock negatively. With mining, you can have an accident or failure at one of their mines. These are usually short-term but sometimes can last 6 to 12 months, occasionally longer.

- To buy gold stocks, you should buy a basket of at least 5 to 10 stocks to get diversification and avoid the one-stock mining risk.

- The big things you may be missing with ETFs are dividends and superior performance.

Many of the gold producers pay dividends, and these go up in a bull market. For instance, we bought AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) under $18, and now it is way higher, but importantly, it has been increasing its dividend. Based on their last quarterly dividend payment, our dividend yield on our buy price is 20.5% and I expect it will go higher. You will never get this with the ETF.

Performance - In 2025, the average gain of our 21 precious metal producers was +190% and our advanced juniors +260% far outperforming the ETFs and index benchmarks. At PlayStocks, we have been able to do much better than the ETFs most years, especially in bull markets.

That said, I must caution that past success does not guarantee future success.

I would like to give some more details on how we manage to outperform. Unlike the ETFs, we simply don't buy a basket of stocks to perform with the indexes. We look at value and choose stocks that we feel offer more value than their peers.

We look at different circumstances that the market is currently overlooking, see the example below with GoGold.

A very important factor, especially in flat markets and bull markets, is growth. We pay a lot of attention to stocks that have new mines coming on stream and mine improvements that will increase production without dilution to the share price. An example is Iamgold (IMG), which was up 205% in 2025 and 545% from our buy price in 2023.

We bought Iamgold because they were bringing their large Cote mine into production in 2025. The Côté mine achieved one of the quickest ramp-ups to commercial production for a large-scale open-pit gold mine in Canada. Côté produced 124,000 attributable ounces (199,000 ounces on a 100% basis) during its initial nine months of operation. At the end of 2025, the focus was on the ramp-up of the processing plant towards achieving the nameplate throughput rate of 36,000 tpd. In 2026, the Cote mine will provide a full 12 months production to Iamgold's bottom line

In late 2025, I suggested buying GoGold as it is a good example of the market overlooking an important fundamental.

GoGold Resources Inc.

Recent Price US$2.28 or CA$3.06

Entry Price - CA$2.85

Opinion – Strong Buy

GoGold Resources Inc. (GGD:TSX; GLGDF:OTCQX) has given up all its gains of 2026 and is at a support level on the chart.

They announced very strong quarterly results yesterday.

Highlights for the quarter ended December 31, 2025:

- Cash of US$245.6-million

- Record revenue of US$31.1-million on the sale of 486,928 silver equivalent ounces at an average realized price per ounce of US$63.88;

- Record operating cash flow of US$9.7-million, including record Parral free cash flow of US$18.1-million;

- Net income of US$13.3-million;

- Production of 456,179 silver equivalent ounces, consisting of 205,104 silver ounces, 2,914 gold ounces, 96 tonnes of copper, and 150 tonnes of zinc.

The CEO's comments are a good summary of results and a hint at what is coming

"Parral is producing record results for the company, with record quarterly cash flows and revenues. We generated revenue of $31.1-million in the quarter at an average sales price for the quarter of $63.88 per silver equivalent ounce sold, which is well below current spot price. Our consistently strong production resulted in record operating cash flows of $9.7-million in the quarter and net income of $13.3-million for the quarter, which is approaching last year's annual net income of $17.3-million," said Brad Langille, president and chief executive officer. "We ended the quarter with $245-million in cash, which has put us in an exceptional position to capitalize on our upcoming Los Ricos build, while we await our final permits."

These strong results were at US$63 silver, and now we are around US$80.

The stock is around US$3.00, but should be up a lot more than just flat with this jump in silver and gold. What the market is overlooking is there are almost 200 million ounces of silver equivalent at Los Ricos that is advanced and will soon start mine construction.

Their Los Ricos property actually has two large deposits, Los Ricos South with 108.6 million ounces silver equivalent and Los Ricos North with 87.8 million ounces silver equivalent. With this move in silver and gold, the market should have at least added another $1 per ounce for Los Ricos, which would add US$200 million to the market cap. GoGold has 433 million shares outstanding, so $1 per ounce increase in valuation is US$0.46 per share or CA$0.64. This stock should easily be over CA$4, and that is conservative. Los Ricos will add over 7 million ounces per year in production, which will more than quadruple current production.

GoGold's 3 main deposits hold about 210 million ounces measured and indicated silver equivalent. Buy this stock while it is still being valued at just around US$3.50 per ounce silver or a gold equivalent around US$225 per ounce. These were fair valuations a year and a half ago, not at today's gold and silver prices.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Anglogold Ashanti Plc., First Majestic Silver Corp. and Equinox Gold Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: GoGold Resources and IAMGOLD Corp. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.