Precious metals markets are back in motion, and when gold is working, investors inevitably start looking for leverage in smaller-capitalization companies. That's usually when past-producing districts, underexplored ground, and companies with real drill-ready targets begin to matter again.

That's the lens through which I view Adamera Minerals Corp. (ADZ:TSX.V).

This is a company operating in one of the highest-grade historic gold districts in the western United States, with multiple projects tied directly into known structures, existing infrastructure, and a very tight market capitalization.

At this stage of the cycle, those ingredients tend to get noticed.

About the Company

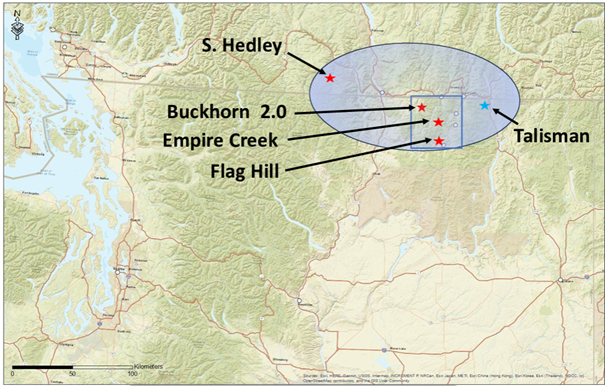

Adamera Minerals Corp. (ADZ:TSX.V) is a junior exploration company focused on high-grade gold, silver, and copper projects in Washington State and southern British Columbia. The company's core land position sits within the Boundary–Republic Gold District, an area that has produced approximately 18 million ounces of gold historically, with roughly 8 million ounces coming from the Washington side alone at an average grade of about 14.5 grams per tonne.

This is not greenfield exploration. Adamera has spent more than a decade assembling strategic land positions around historic mines, acquiring datasets from major producers, and advancing targets that are already permitted or close to being drill-ready. The company's strategy is straightforward: focus on high-grade, underground-style systems with small footprints, leverage existing infrastructure, and drill targets that can move the valuation quickly if successful.

The Projects That Could Move the Market Capitalization

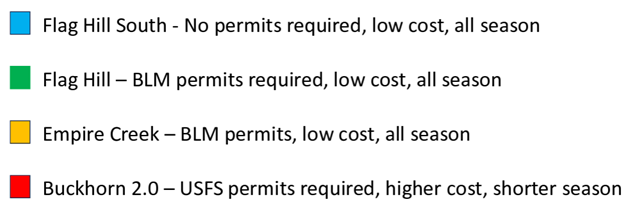

While Adamera controls multiple assets, the Flag Hill–Republic area stands out as the most immediate value driver.

The Republic Gold District is one of the highest-grade gold camps in North America. Historically, the district produced more than 4 million ounces of gold at an average grade of approximately 24 g/t, along with about 15 million ounces of silver grading over 110 g/t. Production in the district spans more than a century and includes multiple underground operations.

Adamera's Flag Hill project lies directly within this district and hosts an epithermal-style vein system. Historic drilling from the 1950s returned exceptional results, including a reported intercept of 41 g/t gold and 277 g/t silver at shallow depth. Despite these grades, the property has seen limited modern exploration.

Recent surface mapping and sampling have identified multiple veins returning gold values ranging from roughly 2 g/t to over 12 g/t. Importantly, many of these structures remain untested at depth. In epithermal systems of this type, grades often improve, and vein widths expand as drilling moves deeper into the system, particularly where boiling zones are encountered.

Flag Hill South adds another compelling layer. This newer acquisition is located on private land, significantly reducing permitting timelines and allowing for year-round drilling. Surface work has outlined a central vein returning values up to 9.1 g/t gold across meaningful widths, along with several parallel structures. The company has indicated that this area is drill-ready and scheduled for near-term drilling.

Beyond Flag Hill, Adamera also controls the Empire Creek project, located along the same regional structure that hosts Kinross Gold's K2 deposit. Soil geochemistry, arsenic anomalies, and historic drilling have outlined multiple untested targets, including past intercepts such as 10 g/t gold and 183 g/t silver over 15 metres. These are the types of intercepts that justify systematic follow-up drilling.

A key advantage across Adamera's project portfolio is infrastructure. A permitted 2,000-tonne-per-day mill owned by Kinross sits within the district on care and maintenance, alongside existing haul roads and power transmission lines. This infrastructure not only lowers potential development hurdles but also represents a realistic exit strategy in the event of a discovery.

Management

Adamera's management and board bring deep experience in high-grade gold exploration, mine development, and capital markets, with a notable concentration of expertise specific to Washington State and the Republic–Boundary district.

Chairman Yale Simpson, P.Geo., has more than 30 years of experience as a senior geologist, exploration manager, and executive across precious metals projects in Australia, Africa, Eastern Europe, and South America. He previously served as President and CEO of Exeter Resource Corporation, which advanced the Caspiche gold-copper project in Chile before being acquired by Goldcorp. His background in advancing exploration assets through multiple market cycles provides steady technical oversight as the company moves from target generation into drilling.

President, CEO, and Director Mark Kolebaba is a veteran exploration geologist whose career spans more than four decades. He has been instrumental in multiple mineral discoveries and has worked across early-stage exploration, feasibility studies, and operating mines. His experience with major mining companies, including BHP Billiton, Cominco, and the Northgate Group, is particularly relevant given Adamera's focus on structurally controlled, high-grade systems near historic producers.

The board adds rare district-level credibility. Directors Mark Jones and Christopher Herald were senior leaders at Crown Resources, the company that discovered the Crown Jewel deposit in northeastern Washington State. That discovery ultimately became the Buckhorn Mine after Crown was acquired by Kinross Gold Corp. in a transaction valued at more than US$200 million. Their experience navigating discovery, permitting, development, and M&A in Washington State directly aligns with Adamera's asset base.

Financial oversight is provided by Mark T. Brown, CPA, CA, who has more than 25 years of experience providing financial services to public resource companies, and Alejandro Adams, CPA, who previously served as Corporate Controller of Exeter Resource Corporation prior to its acquisition by Goldcorp and is currently CFO of Rugby Mining.

Taken together, this is a team that understands high-grade gold systems, the local permitting environment, and how value is ultimately crystallized through discovery or transaction.

Market Capitalization and Share Structure

At a recent share price of approximately CA$0.10, Adamera Minerals Corp. (ADZ:TSX.V) carries a market capitalization of roughly CA$3.5–4.0 million. This is based on approximately 27 million shares outstanding following recent financings.

On a fully diluted basis, including warrants and options, the share count sits in the mid-30 million range. By junior mining standards, this is a tight capital structure, particularly for a company with multiple drill-ready targets in a proven, high-grade district.

At this valuation level, even a modest exploration success could have an outsized impact on the company's market capitalization.

Technical Analysis

From a technical standpoint, the chart of Adamera Minerals Corp. (ADZ:TSX.V) suggests the stock has completed a prolonged basing phase.

After a sharp decline through 2024, the shares have formed a series of higher lows through the second half of 2025 and into early 2026. Trading volume has begun to expand on up days, while momentum indicators are turning higher from depressed levels.

The CA$0.10 level has emerged as a key support zone. Overhead resistance is defined near CA$0.14, CA$0.27, and CA$0.40. A sustained move through these levels would signal a confirmed trend reversal and open the door to a broader re-rating. On a longer-term basis, successful drilling could support materially higher valuations.

In simple terms, the chart is no longer working against the story. It is starting to align with it.

Conclusion

Adamera Minerals Corp. (ADZ:TSX.V) is a speculative exploration company, and outcomes will ultimately depend on drill results. That risk is inherent at this stage of the cycle.

However, the company operates in a historic, high-grade district, controls multiple drill-ready targets tied to known structures, benefits from existing infrastructure, and maintains a market capitalization that barely reflects the scale of the opportunity.

For investors seeking leverage to a strengthening gold market, Adamera represents a Speculative Buy around CA$0.10, with the understanding that success largely hinges on upcoming drilling programs.

As always, position sizing and risk management matter. But in a rising metal price environment, this is the type of setup that can often surprise to the upside.

More information is available at the company's website.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Adamera Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Adamera Minerals Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.