The metals markets are doing what they tend to do at this stage of the cycle. Gold and silver are pushing higher, capital is rotating back into quality jurisdictions, and investors are once again paying attention to companies that can combine ounces in the ground with a credible path to cash flow.

Against that backdrop, Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC)stands out as a company that is no longer just an exploration story. It is transitioning into a two-pronged value creation model in Nevada, pairing a past-producing, near-surface oxide project moving toward permitting with a growing, high-grade underground discovery that has genuine district-scale potential.

This combination is rare in the junior space, particularly with a tight share structure and a management team that has taken multiple projects from discovery through development and into production.

About the Company

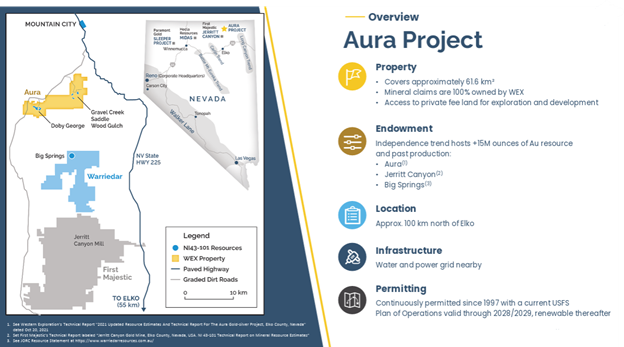

Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) is a Nevada-focused gold and silver company advancing its 100%-owned Aura Project, located roughly 100 kilometers north of Elko in one of the most productive mining jurisdictions in the world.

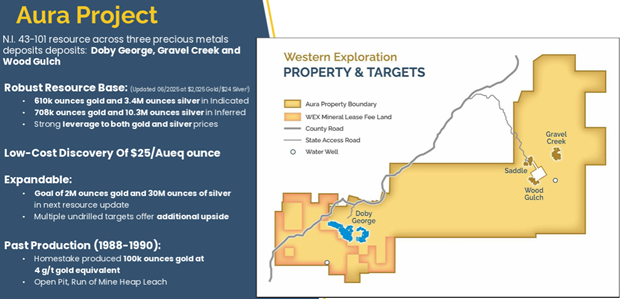

The Aura Project hosts multiple deposits along the prolific Independence Trend, an endowment that has produced well over 15 million ounces of gold historically. Western is advancing three known deposits within this land package: Doby George, Gravel Creek, and Wood Gulch. Importantly, the project benefits from excellent infrastructure, including road access, nearby power and water, and a long history of permitting and mining activity.

Nevada remains the top mining jurisdiction globally, and Western's land position sits adjacent to major producers, providing both operational advantages and strategic optionality.

The Project That Could Move the Market Capitalization

The real investment appeal of Western Exploration lies in its two-pronged development strategy at Aura.

The first prong is Doby George, a near-surface oxide gold deposit that was previously mined by Homestake between 1988 and 1990. Western has completed extensive drilling, metallurgy, and a Preliminary Economic Assessment on the project and is now advancing it toward permitting with the U.S. Forest Service.

Doby George is designed as a straightforward open-pit, heap-leach operation with simple processing and strong margins. At higher gold prices, the economics become particularly compelling. The long-term vision is clear: bring Doby George into production to generate meaningful cash flow that can help fund exploration and development elsewhere on the property, reducing reliance on dilution.

The second prong, and where the longer-term upside resides, is Gravel Creek, a high-grade epithermal gold-silver discovery that continues to grow. Over the past 18 months, Western has increased the Gravel Creek resource by more than 50% in gold ounces and over 80% in silver ounces, at discovery costs that are among the lowest in the sector.

Gravel Creek is shaping up as a future underground operation with geometry, grade, and metallurgy that are well-suited to modern mining methods. Management's stated goal is to grow the resource toward the 1.5-million-ounce gold and 30-million-ounce silver range over the next several years, and importantly, the system remains open in multiple directions.

This is not a single-deposit story. It is a growing gold district being unlocked using modern geological modeling, structural interpretation, and disciplined step-out drilling.

Management

One of the strongest aspects of Western Exploration (WEX) is its management and technical team.

President and CEO Darcy Marud, P.Geo., has been involved in multiple discoveries and mine developments throughout his career, including projects that were ultimately acquired by major producers. His experience spans the full cycle from grassroots exploration to permitting, construction, and production.

The broader team includes geologists and engineers who have played roles in significant gold discoveries such as El Peñon in Chile, Mercedes in Mexico, and Odyssey and East Malartic in Canada. This matters because advancing a project toward production is very different from simply drilling holes. Western's team understands how to de-risk projects methodically while keeping dilution under control.

That discipline is evident in the company's approach to financing, permitting, and long-term planning.

Market Capitalization and Share Structure

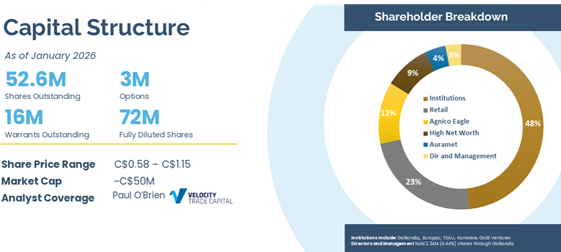

As of early 2026, Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) has approximately 52.6 million shares outstanding, with a fully diluted count of roughly 72 million shares. At recent prices, this places the company at a market capitalization of around CA$50 million.

This is a relatively tight structure for a company with a large, NI 43-101 compliant resource base, a permitted development pathway, and multiple exploration targets still untested. Institutional ownership is meaningful, and management and insiders remain aligned with shareholders.

In a sector where bloated share counts often cap upside, Western's structure leaves room for re-rating as execution milestones are met.

Technical Analysis

From a technical standpoint, Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) has spent the past year building a solid base after a prolonged correction.

The chart shows a series of higher lows forming along rising support, indicating that downside pressure has been absorbed and that accumulation is taking place. Price has repeatedly tested the CA $0.80–CA$0.85 zone, which has held as support, while overhead resistance near CA$1.20 remains the key level to watch.

A sustained move through that resistance would confirm a trend change and open the door to higher targets. Based on the structure of the base and prior trading ranges, initial upside targets sit near CA$1.45, followed by CA$2.00, with a longer-term target near CA$3.10 if the broader bull market in precious metals continues and company-specific catalysts are delivered.

Importantly, the technical setup aligns with the fundamental story. This is a chart that reflects patience, not speculation, and often those are the setups that work best when the sector turns decisively higher.

Conclusion: A Speculative Buy with Multiple Paths to Value Creation

In a market where gold and silver prices are moving higher, and investors are once again rewarding execution, Western Exploration Inc. offers a compelling combination of near-term development, exploration upside, and disciplined management.

The ability to advance Doby George toward production while simultaneously expanding the high-grade Gravel Creek discovery gives the company multiple shots on goal. Add in a tight share structure, a top-tier jurisdiction, and a chart that is beginning to confirm the story, and the risk-reward profile becomes attractive.

For investors comfortable with the risks inherent in junior mining equities, Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) is viewed as a Speculative Buy near CA $0.85, with the understanding that continued execution will be the key driver of valuation over the next 12 to 24 months.

For further information, readers are encouraged to visit the company's website.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.