Domestic Metals Corp. (DMCU:TSX; DMCUF:OTC; 03E:FSE) is a mineral exploration company focused on the discovery of large-scale, copper and gold deposits in exceptional, historical mining project areas in the Americas.

The company aims to discover new economic mineral deposits in historical mining districts within geologically attractive mining jurisdictions . . .

and to do it where economically favorable grades have been indicated by historic drilling and outcrop sampling.

Domestic Metals is led by an experienced management team and an accomplished technical team, with successful track records in mineral discovery, mining development, and financing.

Montana

The state of Montana is known as "Big Sky Country" for its vast, open landscapes, low population density, and expansive, dramatic horizons, with the nickname originating from a 1960s state marketing campaign. It is the fourth-largest U.S. state, featuring the Rocky Mountains, Yellowstone and Glacier National Parks, and a "Big Sky" resort town.

In a nutshell, it's an ideal state for mining, and supportive regulation ensures permits are fast-tracked for responsible explorers like Domestic Metals.

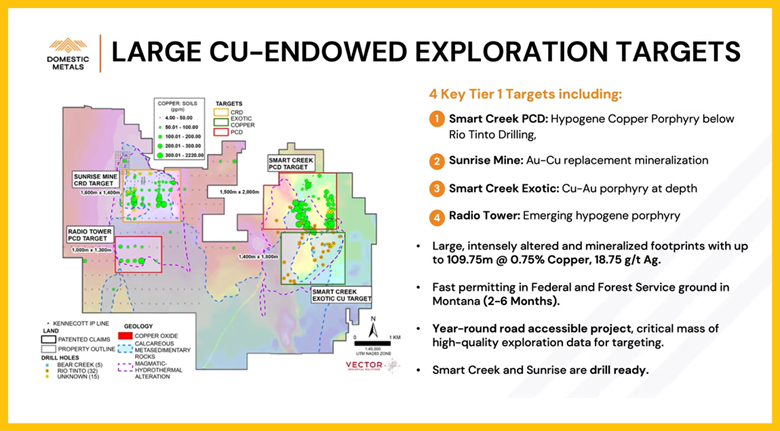

Domestic Metals has teamed with Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTNTF:OTCMKTS) on the exciting Smart Creek Project, which is drill-ready.

Savvy junior mining stock investors know the most money is usually made… by buying before the drills go into the ground.

With not just one, but four porphyries, the odds are growing that the company could be poised to get significant results from the well-executed exploration program.

Deep-pocketed Rio Tinto could then take the project into production. This could be a home run hit for Domestic Metals ... and for holders of the company's stock.

Company president Gord Neal is impressive as he discusses the current investor opportunity.

About Mr. Neal

- One of the founding members of MAG Silver Corp.

- Former VP Corporate Development for Silvercorp Metals.

- Past President of New Pacific Metals.

- Has raised more than US$750M in the resource sector and serves on multiple metals and mining company boards.

- Has served as a Senior Advisor in the Office of the Prime Minister of Canada

New Technical Advisor Dr. Peter Megaw, Ph.D., C.P.G

To begin the New Year, the company has been pleased to welcome Dr. Megaw, who has a Ph.D. in geology from the University of Arizona and more than 30 years of relevant experience focused on silver and gold exploration in Mexico.

He is a certified Professional Geologist by the American Institute of Professional Geologists and an Arizona Registered Geologist.

Dr. Megaw has been instrumental in a number of mineral discoveries in Mexico, including new ore bodies at existing mines, Excellon Resources' Platosa Mine, and MAG Silver's Juanicipio and Cinco de Mayo properties; discoveries for which he was given PDAC's 2016 Thayer Lindsley Award.

Peter has also been a Director of Relevant Gold Corp. since 2021.

Technical Analysis: The Bulls Take Charge

The chart action backs up the company's take on its prospects, and a look at the long-term chart is always wise. It provides a big picture view of the action as well as key price targets.

A massive surge in volume is clearly in play, and rightly so given the project, the jurisdiction, and the company's highly capable management team.

The next positive news announcement could see the stock surge to the short-term target zone of CA$1.00.

If one of the four porphyries is proven to be even a fraction of what the company is hoping for, the medium-term target of CA$3.50 is likely to be achieved.

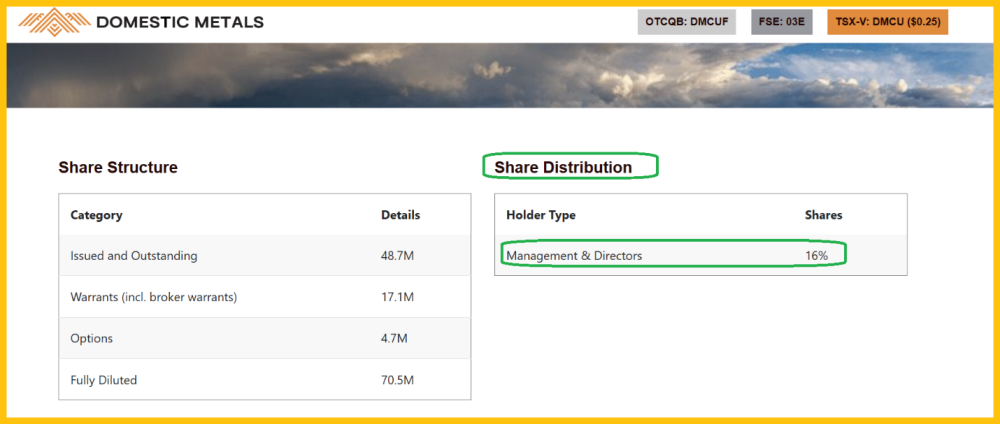

With a 16% stake, the company's management & board are clearly committed to seeing the project succeed.

The short-term technical action is also positive:

There's some exciting inverse Head & Shoulders pattern action in play on this chart, and the 14,3,3 series Stochastics oscillator is oversold.

A closer look at the daily chart action is even more intriguing:

The Stochastic oscillator (14,7,7 series in this case) looks enticing and implies a big rally from the right shoulder low could be imminent.

That inverse H&S pattern targets the CA$0.60 zone, which is likely to be a stepping zone en route to the main target prices, which are:

- Short Term: CA$1.00

- Medium Term: CA$3.50

- Long Term: CA$6.60

Conclusion

Critical metal copper, four porphyries, great management, a major league partner (Rio Tinto), a tier one jurisdiction, and all technical analysis lights are green! This makes the stock a Speculative Buy.

- Company Website.

- Stock Price at time of this article's writing: Approx CA$0.29.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Domestic Metals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Domestic Metals Corp.

- Author Certification and Compensation: Stewart Thomson was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Thomson is a retired Canadian financial advisor who has passed the Canadian Securities Course as well as additional technical analysis courses that were mandated by his former employer and approved by Ontario regulatory bodies. For the past 15 years, he has been editing and writing numerous financial newsletters that have a strong focus on charts. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.