It's not often that a junior mining stock ticks all the boxes for managing real risk and enhancing potential reward.

The good news is that Algo Grande Copper Corp. (ALGR:TSX.V) ticks most of them.

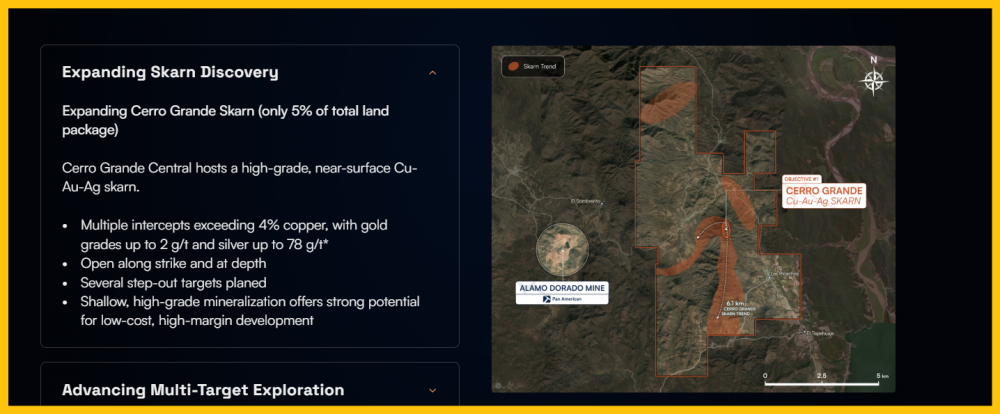

Algo Grande Copper Corp. is a North American exploration company focused on advancing the Adelita project, anchored by the high-grade Cerro Grande Skarn discovery zone, situated in the Sonora-Arizona Porphyry.

Recently, the company announced initial drill results from its inaugural drill program at the Adelita Project in Sonora, Mexico.

Drill hole AG_GC_002 intersected a total of 41.6 metres of cumulative skarn mineralization across five well-mineralized horizons, including three horizons not previously identified in historical drilling, confirming a material expansion of copper-gold-silver mineralization at depth at Cerro Grande.

"The (latest) results reinforce our conviction in the Adelita Project and strongly support continued deep and step-out drilling," said Algo Grande CEO Enrico Gay.

He continued, "The identification of three new skarn horizons materially expands the scale potential of Cerro Grande and confirms that Adelita represents a larger, more robust mineralized system than previously recognized. This outcome validates our acquisition and technical approach and strengthens the investment case as we advance the project and work to build long-term shareholder value,"

Strategic Advisor Dr. Peter Megaw, world-renowned CRD expert and co-founder of MAG Silver Corp. (MAG:TSX; MAG:NYSE American) | ~US$2.1B market cap) brings decades of discovery success.

He also brings a proven track record of turning early-stage projects into billion-dollar assets.

Dr. Megaw's firm, Megaw Exploration Associates, MXA, acts as the company's operational "on-the-ground" partner, providing end-to-end support, from geological modeling and target generation to drill planning and project evaluation.

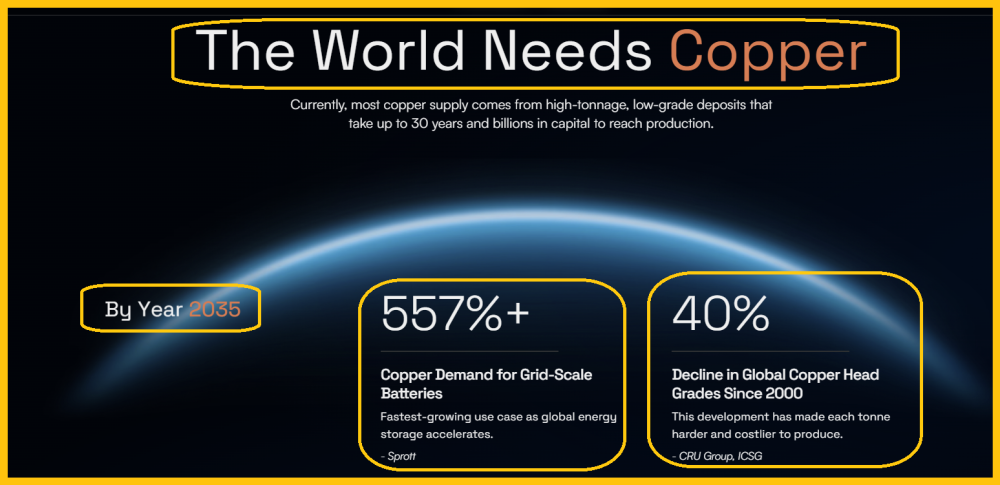

The Big Copper Picture

Data centres for artificial intelligence require enormous tonnage. Amazon is buying copper mine production, and Elon Musk has predicted the global population of robots will surpass that of humans, and he's already preparing to make millions of them in his factories.

That will require a lot of copper.

Supply bottlenecks are coming, and investors (both retail and institutional) will take more risk on juniors like Algo Grande as those bottlenecks occur.

Government Regulation & Investor Risk

Recently, the Mexican government has enacted more stringent mining laws, but these are already in place in other South and Latin American jurisdictions, and investors are investing there.

All junior stocks have lots of risks and lots of potential reward. Risk can be reduced with a great project and solid management. Algo Grande appears to bring both to the table.

Gold & Silver Component

Where there's copper, there's often gold, and sometimes silver too. That appears to be the case with the Adelita project.

Hedge fund superstar Ray Dalio wonders if capital wars are on the horizon, and if so, gold and silver could become the most critical metals of them all!

Technical Analysis: Buy Zones & Targets

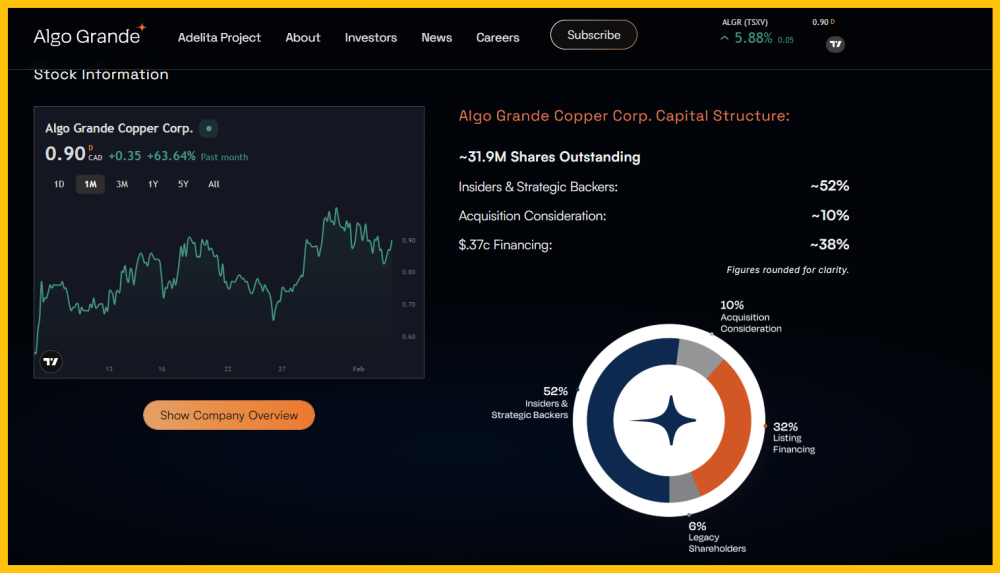

The company's relatively modest number of shares outstanding is impressive, and so is the enormous base pattern on the long-term chart:

Note the gargantuan volume coming into the stock after six years of "bottom feeder" action.

Gamblers could buy the stock now, ahead of the AGM (annual meeting), which is apparently going to happen on February 25. Junior miners often garner excitement ahead of the meet, like drills going into the ground do.

If there's a "price pop" going into the meet, partial profits could be booked. Longer term, the CA$6.00 resistance zone seems to be "calling" Algo to trade there, and it's certainly another spot to book profits.

Here's a look at the short-term chart:

A move above the key round number of CA$1.00 would be a very positive event. Aggressive investors could use a partial stoploss (preferably a mental one that doesn't disturb the market with the placing of a big sell order) under one of the recent lows.

Another key metric in play is relative strength, and here's a look at it via a key ratio chart of Algo Grande against the CDNX:

The stock is dramatically outperforming the world's most important juniors index on rallie,s and the pattern of higher highs and higher lows is intact.

- Short Term Target: CA$1.20

- Long Term Target: CA$6.00

A link to the Algo Grande website is here. If the company hits most of its milestones, the stock should continue to lead the CDNX, and it's now rated as an aggressive investor Speculative Buy!

| Want to be the first to know about interesting Copper and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Algo Grande Copper Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algo Grande Copper Corp.

- Author Certification and Compensation: Stewart Thomson was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Thomson is a retired Canadian financial advisor who has passed the Canadian Securities Course as well as additional technical analysis courses that were mandated by his former employer and approved by Ontario regulatory bodies. For the past 15 years, he has been editing and writing numerous financial newsletters that have a strong focus on charts. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.