Why Streamex Represents a Rare Opportunity

Despite gold climbing nearly 20% over the past year, Streamex Corp. (STEX:NASDAQ) has remained relatively muted—an unusual disconnect that many investors view as a strategic opportunity.

Adoption among institutional audiences remains limited, and the GLDY token has yet to reach widespread distribution. This sets up potential future demand as more institutions turn to yield-bearing precious metals in an inflationary and high-debt environment.

After securing US$35 million in new funding, Streamex is positioned to become the first tokenized precious metals platform to capture meaningful institutional interest.

Yield-Backed Real-World Asset Tokens

Real World Asset Tokens (RWATs) are not new in the crypto ecosystem, but few pair physical gold backing with yield. Streamex's GLDY token offers just that: holders receive exposure to gold while earning a target 4% annualized return.

A unique advantage of Streamex is that the "unit cost" decreases as gold prices rise — meaning higher gold prices make the platform more efficient, enhancing returns for early investors.

Investing in Streamex is, effectively, a leveraged play on the appreciation of precious metals, especially as sovereign debt yields falter under global fiscal pressure. For those concerned with inflation in highly indebted G7 economies like Japan (225% debt-to-GDP) and the U.S. (160%), GLDY provides dual protection:

- Direct exposure to gold without storage or security risks

- Participation in a yield-bearing, regulated digital asset

How GLDY Works

Each GLDY token represents a non-voting share in a Cayman SPV that holds physical gold, usually backed by one troy ounce per token. Gold is leased through Monetary Metals programs, generating additional GLDY tokens as yield — effectively paying holders in gold ounces.

GLDY is KYC-compliant, tailored for institutional and accredited investors, and marketed as a "regulated, yield-bearing, gold-backed stablecoin" as well as a "tradeable security." By design, it resembles a tokenized security more than a conventional stablecoin, aligning with evolving U.S. regulatory frameworks.

Once clarity around Real World Asset Tokens emerges, GLDY and similar assets could become a recognized, fully regulated investment class — rewards that early adopters may capitalize on today.

Operating Leverage: A Digital Gold Mine

Unlike traditional miners, Streamex's main costs are largely fixed: software, compliance, and administration. As gold prices increase, AUM automatically rises, creating margin expansion:

- Fee revenue grows alongside AUM

- The 4% yield becomes more valuable in USD terms

- Operational costs remain flat

This structure creates a scalable, low-capex model with strong margin potential.

Addressing the Institutional Yield Gap

Institutions want gold as an inflation hedge but typically avoid non-yielding bullion. ETFs like GLD charge ~0.40% annually, whereas GLDY pays ~4%.

In high-inflation environments, this spread between storage costs and yield isn't just a feature — it is a strategic necessity. Capturing even a fraction of the US$200B+ global gold ETF market could materially enhance Streamex's revenue profile.

Strategic Upside: Empress Royalty

Streamex holds a 9.9% stake in Empress Royalty Corp. (EMPR:TSX; EMPYF:OTCQB), a junior royalty company.

During gold bull markets, junior royalty stocks often outperform gold itself. Gains from Empress directly strengthen Streamex's book value without diluting STEX shares, providing optionality and potential liquidity benefits.

Growth Outlook and Analyst Support

Streamex is an asymmetric investment, currently trading at a fraction of traditional gold royalty companies' valuations. Several analysts have highlighted the company's early-mover advantage in tokenized real-world assets:

- Stiebert initiated coverage with a Buy rating, emphasizing Streamex's head start in gold token design, yield generation, and distribution capabilities. Stiebert projects US$3B of gold-backed token AUM by 2027, representing 0.75% of the ~US$400B gold ETF market, with a price target of US$11.

- Needham also started coverage with a Buy rating, highlighting the GLDY token's ~4% yield, strong potential distribution partners, and operating leverage. Needham estimates ~60% net income margin in 2027, with a price target of US$12.

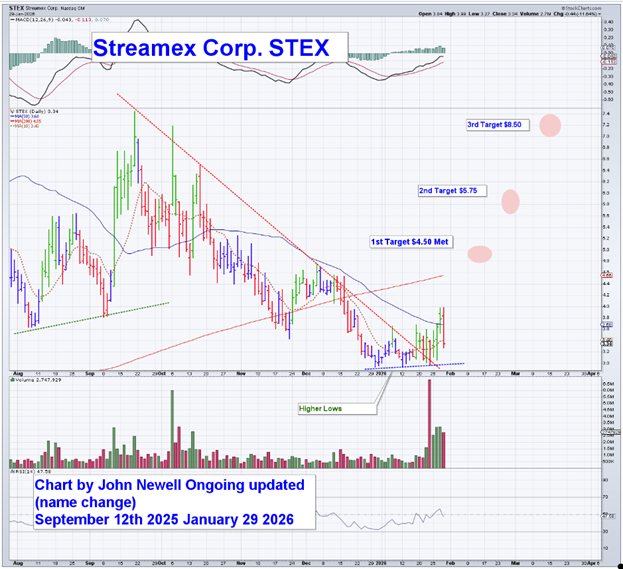

Additionally, technical analysis from John Newell points to a potential early-stage reversal for STEX. After breaking above a descending trendline with increased volume and higher lows, the stock has surpassed its 50-day moving average, signaling accumulation. Key levels highlighted by Newell suggest measured targets at US$4.50, US$6.75, and US$8.50, with consolidation near the US$3.10–US$3.20 range acting as support.

The above chart illustrates the breakout above the descending trendline, the surge in trading volume, and the formation of higher lows. The highlighted support zone (US$3.10–US$3.20) and projected targets (US$4.50, US$6.75, US$8.50) indicate potential upside for momentum-driven investors.

These analyst perspectives reinforce the bullish thesis for both fundamental and technical investors, highlighting Streamex's combination of institutional-grade token innovation and early market adoption.

Positioned for Growth and Investor Upside

With strong capital access, innovative product design, and strategic acquisition opportunities, Streamex is positioned to evolve into a diversified digital asset manager focused on yield-bearing precious metals. Both fundamental and technical indicators suggest early upside potential, making it a compelling consideration for investors seeking exposure to tokenized gold.

| Want to be the first to know about interesting Technology and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Streamex Corp.

- James West: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.