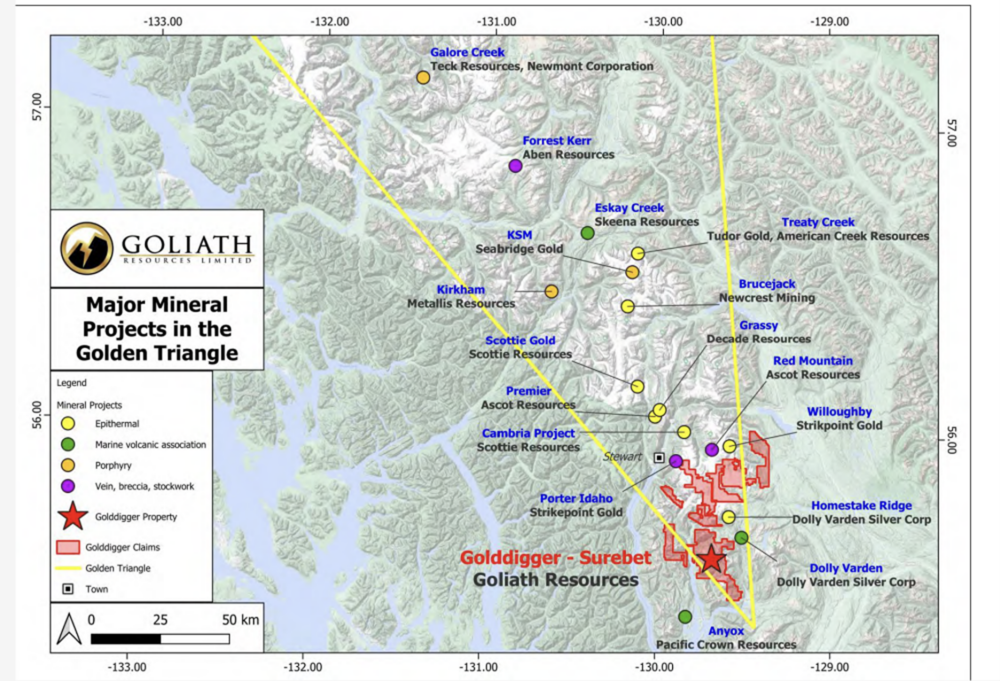

Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF:FSE) is a precious metals exploration company focused on the Golden Triangle of northwestern British Columbia, a region that has produced some of Canada's most significant gold and polymetallic deposits.

All the company's assets are in politically stable, mining-friendly jurisdictions with established infrastructure and a long history of development.

Goliath is also an active member of CASERM, a collaborative research initiative between the Colorado School of Mines and Virginia Tech, reflecting the company's emphasis on technical rigor and responsible exploration practices.

About the Company

Goliath is positioned as a discovery-driven junior exploration company with a strong balance sheet and a shareholder base aligned with long-term value creation.

Goliath is positioned as a discovery-driven junior exploration company with a strong balance sheet and a shareholder base aligned with long-term value creation.

In 2025 alone, the company raised more than CA$65 million, allowing it to execute aggressive drill programs without near-term dilution pressure.

As of early 2026, Goliath reports more than CA$50 million in cash, inclusive of proceeds from warrant exercises and equity holdings in McEwen Inc. (MUX:TSX; MUX:NYSE ), which have appreciated meaningfully since the acquisition.

The company has taken several shareholder-friendly strategic steps.

The board elected not to pursue a share consolidation, preferring to achieve higher valuations organically through exploration success.

Goliath has also fast-tracked its ownership position in the Golddigger Property to 100% while reducing the net smelter return royalty from 3% to 2%, lowering future royalty burdens and enhancing optionality for potential partnerships or corporate transactions.

In addition, the deadline to publish a maiden resource estimate has been extended to June 1, 2030.

Management's rationale is to continue expanding the mineralized system rather than constrain valuation prematurely by defining a resource while the system remains open.

Management and Key People

Goliath Resources Limited is led by a management and technical team that combines capital markets experience, discovery pedigree, and hands-on operational execution, a mix that is particularly important at the discovery and growth stage.

Founder, President, CEO, and Director Roger Rosmus brings more than 25 years of investment banking and public markets experience, with a strong background in structuring financings, building shareholder support, and advancing exploration companies through critical growth phases. Rosmus has demonstrated an ability to raise capital through multiple market cycles while maintaining a long-term focus on asset quality and discovery potential rather than short-term promotion.

Chief Financial Officer and Director Graham C. Warren (CPA, CMA) contributes over three decades of senior financial leadership across the mining, technology, and energy sectors. His experience spans public company reporting, treasury management, and corporate governance, providing financial discipline as Goliath advances large-scale exploration programs.

Independent Director Wayne Isaacs adds more than 30 years of resource-sector investment banking experience, offering capital markets insight and strategic oversight as the company continues to grow its profile among institutional and strategic investors.

On the technical side, Independent Director Rein Turna (P.Geo.) brings over 40 years of global mining and exploration experience and serves as the Qualified Person under NI 43-101. His depth of geological knowledge and experience with large mineral systems provides an important technical foundation as the Surebet discovery continues to expand.

Technical Advisor Quinton Hennigh, Ph.D., adds more than 30 years of discovery and deposit-scale geological expertise. Widely respected for his work on major gold discoveries in both the junior and major mining sectors, Dr. Hennigh plays a key role in refining geological models, identifying potential causative intrusive sources, and helping the team vector toward scale and higher-grade zones within the Golddigger system.

Advisor Vanessa Bennett, Ph.D., contributes extensive experience in geoscience, GIS, and data integration, supporting the interpretation and visualization of an increasingly complex and data-rich mineral system.

Senior Exploration and Corporate Development Consultant Bill Chornobay brings more than 30 years of experience in project generation, corporate development, and exploration management. With a track record that includes multiple discoveries and value creation totaling approximately $1 billion, Chornobay provides strategic oversight to ensure that exploration success is translated into long-term shareholder value.

Collectively, this team brings a rare combination of discovery expertise, capital markets credibility, and operational discipline, positioning Goliath to advance the Surebet discovery thoughtfully while maintaining flexibility as the system continues to grow.

The Project that Could Help Advance the Share Price

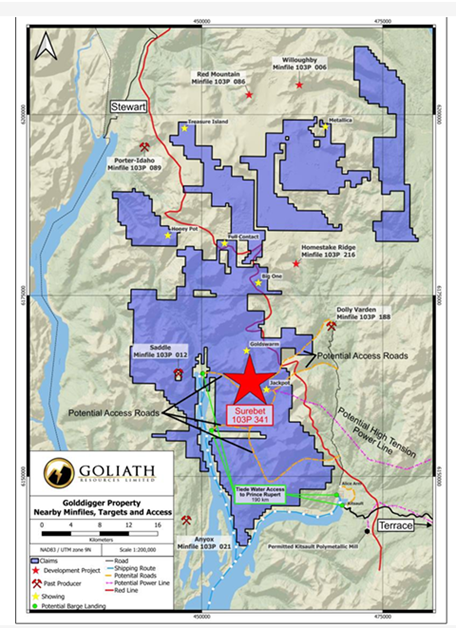

The company's primary value driver is the Golddigger Property, a 91,518-hectare land package located within the Eskay Rift in the Golden Triangle.

Goliath controls approximately 56 kilometers of the "Red Line," a key geological contact associated with gold-copper-silver mineralization and host to multiple world-class deposits.

The centerpiece of the property is the Surebet Discovery, a high-grade gold system that had never been drilled prior to Goliath's work due to historical glacial cover. Since beginning exploration, Goliath has drilled more than 150,000 meters with a reported 100% hit rate for gold mineralization. Approximately 92% of all drill holes have intersected visible gold observable to the naked eye.

The 2025 drill program totaled 64,300 meters across 110 holes and expanded five main gold-rich zones: Bonanza, Surebet, Golden Gate, Whopper, and Eldorado. These zones collectively comprise 46 mineralized lodes across an area of roughly 1.8 square kilometers, and all remain open laterally and at depth.

The updated 3D geological model incorporates all 2025 gold assay results and confirms strong continuity and scale across the system. Notable intercepts include high-grade, mineable-width intervals such as 34.52 g/t AuEq over 39.0 meters in the Golden Gate Zone and multiple bonanza-grade intervals across the Bonanza and Surebet zones.

A key geological breakthrough has been the discovery of gold mineralization within Eocene-aged intrusive dykes, previously considered barren by historical models. Geochronological work conducted in collaboration with the Colorado School of Mines dates the system at approximately 50–55 million years old, supporting the presence of a causative intrusive "motherlode" at depth.

Metallurgical testing has returned encouraging results, with gold recoveries of 92.2% at a 327-micron crush, including 48.8% free gold recoverable through gravity alone. No deleterious elements have been identified, and cyanide is not required for gold recovery in the test work completed to date.

Infrastructure further strengthens the investment case. The Golddigger Property is located on tidewater with barge access to Prince Rupert, near the former Kitsault mine site, which hosts permitted mill infrastructure, power, docks, and housing capacity. Additional road access, power corridors, and proximity to communities such as Alice Arm materially reduce future development risk compared to more remote Golden Triangle projects.

Market Capitalization and Share Structure

As of late January 2026, Goliath Resources Limited trades at a market capitalization in the low-to-mid hundreds of millions of dollars, based on a share price in the approximate CA$2.20–CA$2.40 range and the current issued share count.

The company's capital structure is as follows (approximate, from the company presentation):

- Shares issued and outstanding: ~152.6 million

- Warrants: ~7.0 million

- Options: ~14.4 million

- RSUs: ~8.0 million

- Fully diluted shares: ~182.0 million

While Goliath is no longer an early micro-cap, its valuation remains modest relative to the scale, grade, and continuity being demonstrated at the Surebet Discovery, particularly when compared to advanced Golden Triangle peers and past acquisition benchmarks for high-grade Canadian gold systems.

Importantly, ownership is tightly held. Approximately 19% of the issued shares are held by management and insiders, aligning leadership directly with shareholder outcomes. The register also includes long-term strategic investors such as Crescat Capital, McEwen Mining Inc., Rob McEwen, Eric Sprott, Global Commodity Group, and other institutional and high-net-worth resource investors.

This combination of a meaningful market capitalization, strong treasury position, and concentrated ownership tends to reduce downside volatility while preserving leverage to exploration success. It also places the company in a valuation range where further technical and geological de-risking can have an outsized impact on share price performance.

Technical Analysis of the Stock

From a technical standpoint, the chart continues to confirm that Goliath has transitioned from a prolonged basing phase into an emerging primary uptrend, with price now working through a classic post-breakout consolidation.

The multi-year downtrend has been fully resolved. The prior decline was absorbed by an extended basing pattern that included a well-defined double bottom, a full gap fill, and a 0.618 retracement of the entire advance, a level that frequently marks the reset point for stronger trends. From that base, the stock began carving out a consistent series of higher lows, signaling accumulation and improving market sponsorship.

The most important technical event remains the decisive breakout above the long-term downtrend line and overhead resistance. This was not a single-day event. Price pushed through resistance, consolidated constructively, and then advanced into the first measured move. The initial target of CA$2.25 has been met and exceeded, validating the breakout and confirming that the longer-term trend has turned higher.

Since that advance, the stock has entered a healthy consolidation phase, digesting gains within a rising channel. Of note, the current price behavior is beginning to resemble a fractal pattern like the prior impulse move: a sharp advance, followed by a controlled pullback that holds above rising support and the 50-day moving average. This type of structure is often seen mid-trend rather than at a top, particularly in discovery-driven names during improving metal markets.

As long as price continues to respect the rising trend line and the pattern of higher lows remains intact, the technical bias remains constructive. This consolidation appears to be working off short-term overbought conditions rather than signaling distribution.

On the upside, the next key resistance and target zone remains CA$4.10. A sustained move through that level on expanding volume would suggest the start of the next impulse leg, opening the door to the third measured-move target near CA$8.25. On a longer-term basis, the broader structure supports a big-picture objective near CA$11.50, a level that would likely only be approached if the market moves from early recognition toward full valuation of the underlying discovery.

From a risk-management perspective, the technical thesis would begin to weaken only if the stock were to break decisively below rising trend support and fail to recover it. Until that occurs, pullbacks should be viewed as part of an ongoing trend rather than a change in direction.

In summary, the chart continues to do what strong discovery stories do in favorable metal environments: base, break out, confirm, and consolidate before the next advance. With the first target achieved and the structure intact, the focus now shifts to whether the current consolidation resolves higher toward CA$4.10 and potentially beyond.

Conclusion

With a growing high-grade gold discovery, strong technical and metallurgical results, excellent infrastructure, a well-funded treasury, and a tightly held share structure supported by experienced resource investors, Goliath Resources Limited appears well-positioned for further rerating.

At current levels, the shares are ranked a speculative buy at ~ CA$2.40 and offer speculative investors exposure to a potential Tier-One gold system in a strengthening gold market. While exploration risk remains inherent, the combination of scale, continuity, funding strength, and clearly defined technical upside supports a Speculative Buy rating for investors comfortable with exploration-stage risk.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goliath Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Mcewen Inc.

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.