Some of the most important moves in junior mining stocks do not begin with drill results. They begin with the market quietly changing its mind.

That appears to be what is happening now with KO Gold Inc. (KOG:CSE), as the shares have reached and exceeded the first technical target near CA$0.30, confirming a breakout from a long base and raising the possibility that the market is beginning to reprice both the company and the Otago Gold District more broadly.

This technical development matters because it is occurring against the backdrop of a proven gold camp that has produced millions of ounces, continues to operate today, and is now seeing renewed exploration directly beside producing headframes.

About the Company

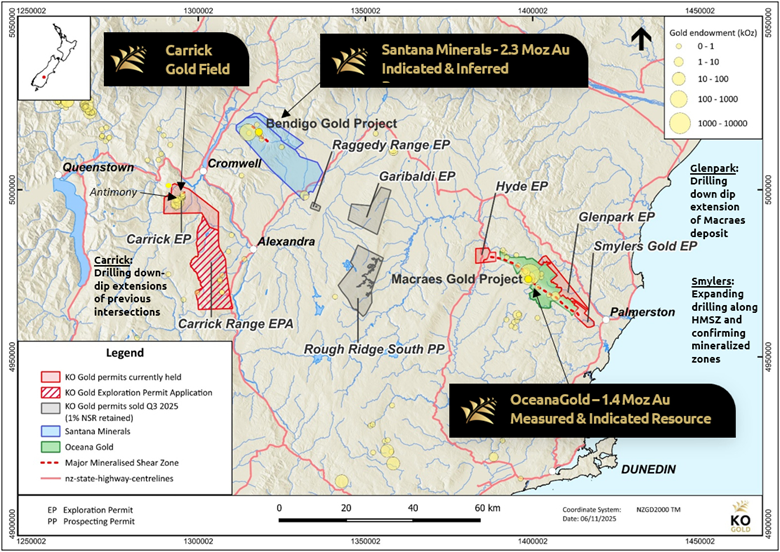

KO Gold Inc. is a Canadian-listed junior exploration company trading on the Canadian Securities Exchange under the symbol KOG. The company is focused exclusively on gold exploration in New Zealand's Otago Gold District on the South Island.

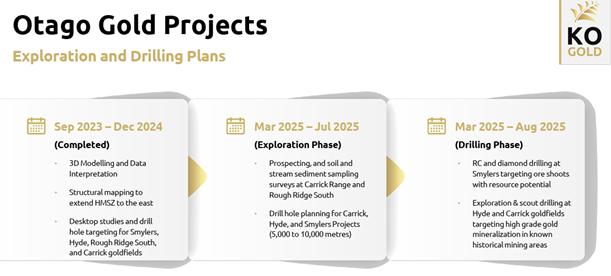

Rather than spreading capital across multiple jurisdictions, KO Gold has taken a concentrated, district-scale approach. The company controls one of the largest exploration land positions in Otago, with a combined project footprint of approximately 400 square kilometers, covering multiple exploration permits.

KO Gold's strategy is to identify and advance hard-rock orogenic gold systems, the same deposit style that underpins both historic and current gold production in the district. Several of its projects are drill-ready, while others provide longer-dated optionality across underexplored structural trends.

Understanding the Otago Gold District: A Proven Camp, Hiding in Plain Sight

The Otago Gold District is located on New Zealand's South Island and has a gold production history dating back to the mid-1800s. Early mining focused on high-grade alluvial and hard-rock deposits, helping establish mining towns, infrastructure, and a culture that still supports the industry today.

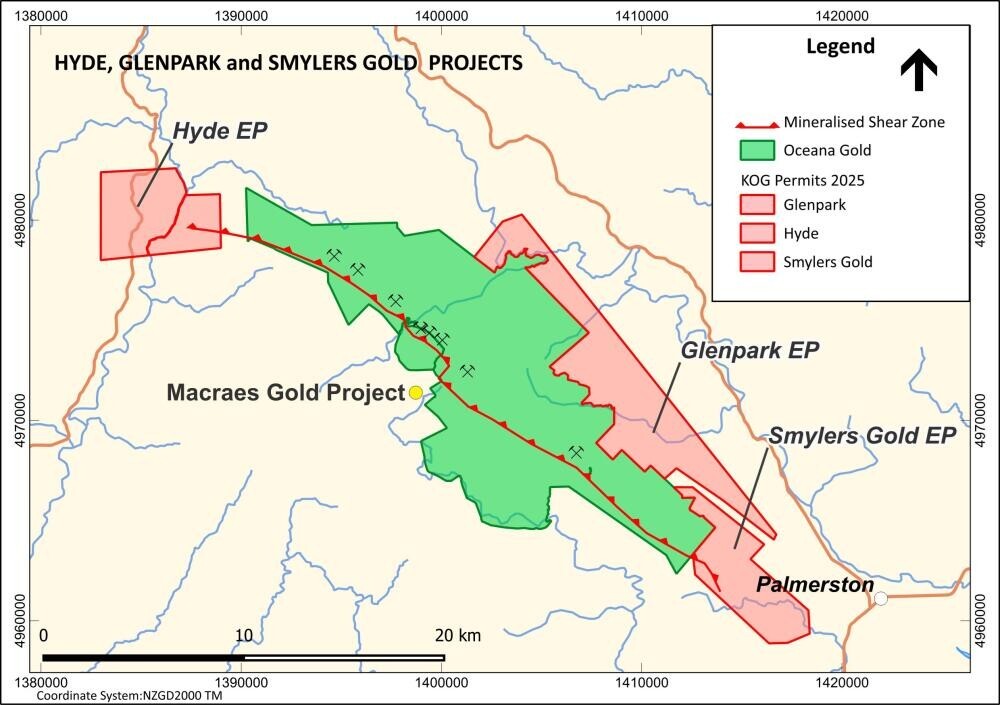

Modern production in Otago is anchored by the Macraes Gold Mine, operated by OceanaGold, New Zealand's largest active gold mine. Macraes has produced more than 5 million ounces of gold since 1990 from a combination of open-pit and underground operations. It is a long-life operation with existing mills, roads, power, and a skilled local workforce.

Geologically, Otago hosts classic orogenic gold systems developed along large regional shear zones within the Otago Schist Belt. These structures are extensive, laterally continuous, and capable of hosting multiple deposits along strike and at depth. Importantly, they are district-scale systems, not isolated occurrences.

This is why Otago today resembles other gold districts before their modern discovery cycles fully unfolded. A comparison often made by geologists working in the region is to West Africa's Birimian belts two decades ago: known gold, limited modern drilling, and substantial upside once systematic exploration began.

Several companies are active in Otago, but only a few truly matter from a scale and influence perspective.

OceanaGold dominates production and infrastructure through the Macraes Mine. Santana Minerals is advancing the Bendigo-Ophir Gold Project, including the Rise and Shine deposit, which hosts a multi-million-ounce gold resource and is viewed as a potential next mine in the district. New Age Exploration controls a substantial land position across Central Otago, targeting similar systems.

KO Gold stands out for one reason: land dominance. With over 400 square kilometers under control, KO Gold holds one of the largest exploration footprint in the district, exceeding that of many peers combined.

In practical terms, KO Gold is exploring where others are already mining, and where future mines are likely to be built. This is exploration in the shadow of the headframe, not greenfield speculation in an unproven belt.

The Smylers Gold Project: Exploring Beside a Mine That Built a Company

The Smylers Gold Project remains KO Gold's most advanced and strategically important asset.

Smylers lies directly on strike from the Macraes Gold Mine along the Hyde-Macraes Shear Zone, a major gold-bearing structure extending more than 30 kilometers. Macraes itself was the asset that transformed OceanaGold from a junior explorer into a mid-tier producer.

What makes Smylers compelling is not just its location, but the work already completed. Multiple drilling campaigns by prior operators and KO Gold have confirmed gold mineralization from surface to depth across several target areas. Every drill hole completed to date has intersected gold, a critical early signal in orogenic systems.

Reported drill intercepts include multi-gram gold intervals over meaningful widths, consistent with grades mined at Macraes. Mapping, soil geochemistry, geophysics, and drilling have now confirmed more than four kilometers of mineralized strike, with the system remaining open in multiple directions.

Recent results suggest the development of higher-grade ore shoots, the essential building blocks of economic deposits in this style of system. The exploration thesis is straightforward: identify the shoots, demonstrate continuity, and let scale do the work.

Management With Discovery and Mine-Building Experience

KO Gold Inc. is led by a management and technical team with direct experience in discovering and advancing gold projects.

President and CEO Gregory Isenor, P.Geo., has more than five decades of industry experience and has been involved in discoveries that ultimately became mines, including projects in West Africa later acquired by major producers.

Vice President of Exploration Paul Ténière, P.Geo., combines hands-on exploration experience with deep capital markets expertise, having previously served as a senior mining listings manager at the TSX and TSX Venture Exchange, and currently as a director or officer of several junior mining companies. The board includes individuals who have worked on globally significant gold and copper deposits that later became producing mines.

Technical Analysis Update: First Target Achieved, Breakaway Gap in Play

From a technical perspective, KO Gold has reached an important inflection point.

The shares have met and exceeded the first upside target near CA$0.30, breaking out from a multi-month base that formed after a prolonged corrective phase. This level represented both the top of the consolidation range and a key psychological threshold.

The breakout was accompanied by a sharp expansion in volume, the strongest seen since the prior cycle peak. In junior exploration stocks, this type of volume surge is often the tell that the move is being driven by new demand rather than short-term trading.

Of particular note is the appearance of what may be an early-stage breakaway gap on the chart. Breakaway gaps typically occur at the beginning of a new trend and reflect an abrupt shift in market perception. While it is still early, the structure suggests that the market may be transitioning from accumulation to advance.

From here, two technically healthy paths are possible. The first is a controlled pullback toward the CA$0.28–CA$0.30 zone, which would allow the stock to test former resistance as new support. The second is continued consolidation above CA$0.30, followed by a push toward higher resistance without filling the gap.

Above the first target, the next upside objectives remain CA$0.50 and CA$0.60, corresponding to prior congestion and cycle highs. On a longer-term basis, the completed base supports a big-picture target near CA$0.90, should exploration success and broader market conditions align.

As long as the shares hold above the breakout zone, the technical risk-reward profile remains favorable.

Conclusion

KO Gold Inc. is not a story built on theory. It is built on geography, structure, and history.

The Otago Gold District has already produced millions of ounces of gold and continues to do so today. The same regional structures that fed past and current mines extend directly onto KO Gold's ground, and no other explorer controls as much of that prospective terrain in the district.

With the first technical target now achieved, expanding volume, and what appears to be the early formation of a potential breakaway gap, the market is beginning to recognize a story that has quietly been developing for several years.

The company has also recently closed a financing, positioning KO Gold to advance its projects well into the 2026 exploration season and maintain momentum at a time when both gold prices and investor interest in high-quality jurisdictions are strengthening.

For investors willing to accept exploration risk in exchange for discovery leverage, KO Gold remains a Speculative Buy at the current price of CA$0.34. The chart suggests meaningful upside potential, particularly when viewed alongside the strength in the gold price and the growing recognition of this largely overlooked but proven gold district.

Additional information, maps, and technical details are available at www.kogoldnz.com.

Investors who want to read the original Streetwise Reports article can find it here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of KO Gold Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.