After a long and difficult bear market for junior explorers, the setups that tend to matter most are not the loud ones, but the quiet rebuilds. When strong geology, disciplined management, and a tightening share structure align with a chart that finally turns, those moments deserve attention.

That appears to be the case today with Regency Silver Corp., a junior explorer advancing a high-grade silver–gold system in one of Mexico's most productive mining jurisdictions.

With new drilling confirming scale and continuity, and a chart that has shifted from base-building to early breakout behavior, Regency Silver is beginning to look like a company moving into its next phase.

About the Company

Regency Silver Corp. (RSMX:TSX.V; RSMXF:OTCQB) is a precious metals exploration company focused on silver and gold discoveries in Mexico.

The company's strategy is straightforward: acquire and advance high-quality projects in established mining districts, apply disciplined exploration, and grow value through discovery rather than financial engineering.

The company is led by a technically experienced team with a history of advancing exploration projects through discovery and development stages.

Regency has deliberately kept its focus tight, prioritizing geological upside and capital efficiency in an environment where patience has become an advantage.

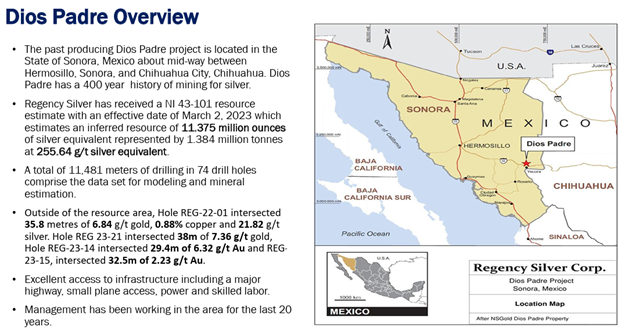

The Timely Project: Dios Padre, Sonora, Mexico

Regency's flagship asset is the Dios Padre Project, located in Sonora, Mexico — a jurisdiction known for large-scale precious metal deposits, strong infrastructure, and a deep mining workforce.

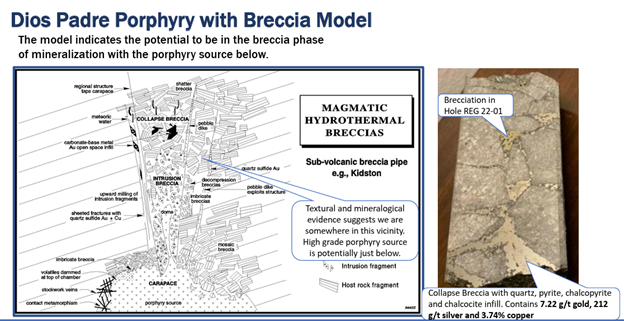

Dios Padre hosts a high-grade silver–gold breccia system that has already delivered compelling drill results. Recent drilling has continued to intersect strong precious metal mineralization over meaningful widths, reinforcing the interpretation that this is a large, mineralized breccia body rather than a narrow or isolated structure.

What makes Dios Padre particularly timely is the combination of grade and geometry. The system remains open laterally and at depth, and the breccia-style mineralization suggests the potential for both scale and continuity. Management has emphasized that ongoing drilling is targeting extensions of the known system, with geology supporting the possibility of a much larger mineralized footprint.

Equally important, Dios Padre is not an early-stage conceptual idea. It is a project with confirmed mineralization, expanding targets, and a clear exploration path forward, positioning Regency Silver to deliver steady news flow as drilling progresses.

Management

Regency Silver is led by an experienced technical and capital markets team with a strong understanding of how to advance exploration projects responsibly.

The company is headed by Bruce Bragagnolo, Founder, CEO, and Director, a mining executive with a long and proven track record of building and advancing precious metals companies in Mexico.

Mr. Bragagnolo is the co-founder and former CEO of Timmins Gold Corp., a company that successfully advanced from exploration to production and was listed on both the TSX and NYSE-MKT. He was also a co-founder of Silvermex Resources Inc., reinforcing his experience in silver-focused capital markets stories.

Earlier in his career, Mr. Bragagnolo served as a director of Continuum Resources Ltd. at the time it acquired the San Jose Mine in Oaxaca, Mexico. Continuum later merged with Fortuna Silver Mines in 2004, with San Jose becoming Fortuna's flagship asset. In 2022 alone, the San Jose Mine produced approximately 5.76 million ounces of silver and 34,000 ounces of gold, underscoring the long-term value created from that original acquisition.

With more than two decades of hands-on experience operating in Mexico, Mr. Bragagnolo brings deep jurisdictional knowledge, strong local relationships, and a clear understanding of how to advance projects from discovery through development, experience that is directly relevant as Regency works to unlock the potential of Dios Padre. Bruce has surrounded himself with equally qualified and experienced individuals, who are listed below.

Share Structure

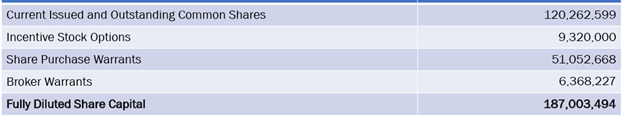

Regency Silver maintains a relatively tight share structure for a junior explorer at this stage of the cycle. The company avoided excessive dilution through the downturn, preserving leverage to exploration success as market conditions improve. Insider ownership remains meaningful, aligning management with shareholders and reinforcing a long-term value creation mindset rather than short-term promotion.

The company has 120.3 million common shares outstanding, providing solid liquidity while still offering meaningful upside leverage. In addition, there are 9.3 million incentive stock options, 51.1 million share purchase warrants, and 6.4 million broker warrants, bringing the fully diluted share count to approximately 187.0 million shares. Much of the warrant overhang stems from past financings that strengthened the balance sheet and funded active exploration, positioning the company with both financial flexibility and ongoing news flow.

Technical Analysis

Technical Outlook

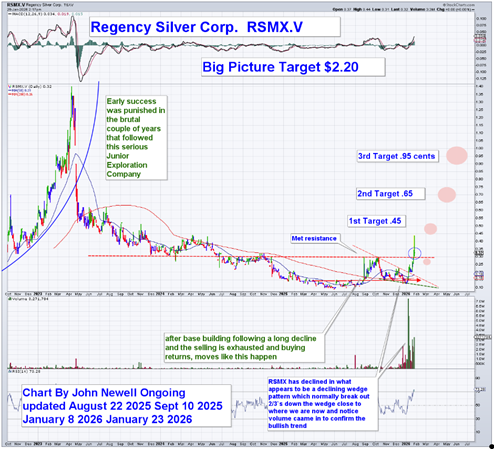

From a technical perspective, Regency Silver's chart has now made a meaningful transition since our last study in the fall of last year. After a prolonged decline that followed early exploration success, the shares spent an extended period building a broad base, a process that appears to have fully exhausted selling pressure.

More recently, the stock has broken out of a declining wedge pattern, a formation that typically resolves higher once confirmed. Importantly, this breakout was accompanied by a clear expansion in volume, providing confirmation that new buying interest has entered the stock. Rather than failing, the shares have held above former resistance, consolidating constructively near the breakout level, behavior consistent with a classic breakout-and-retest pattern and indicative of accumulation rather than distribution.

Based on the updated chart, near-to intermediate-term technical targets are now defined at approximately CA$0.45, CA$0.65, and CA$0.95. On a longer-term basis, if the broader precious metals cycle continues to strengthen and drilling at Dios Padre continues to deliver, the larger technical structure supports the potential for substantially higher prices over time.

Conclusion: A Speculative Buy

Regency Silver now sits at an interesting intersection.

The company controls a high-grade silver–gold system in a top-tier mining jurisdiction, drilling continues to confirm scale and continuity, and the share price appears to be transitioning from a long base into a new uptrend. Importantly, this is occurring as the broader precious metals sector shows renewed strength.

As with all junior exploration companies, risk remains. Results must continue to deliver, markets can turn quickly, and exploration success is never guaranteed. That said, the combination of geology, management discipline, share structure, and improving technicals makes Regency Silver a compelling speculative opportunity at current levels.

For investors comfortable with exploration risk and seeking leverage to silver and gold discovery, Regency Silver Corp. is considered a Speculative Buy at approximately CA$0.40.

For more information, visit the company's website: Here

For a previous article on Regency Silver, readers can find it here: Here

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Regency Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Regency Silver Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Regency Silver Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.