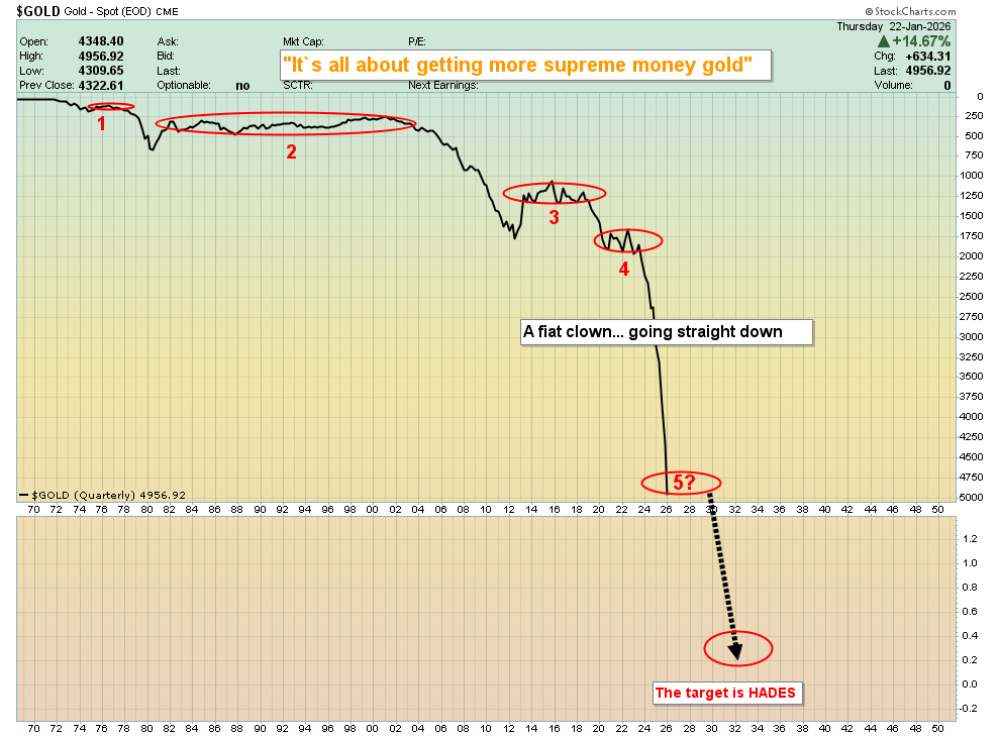

Geopolitics has faded (a bit) as the big gold price driver, but already the "Sell America" theme has replaced it. I would argue it is better termed "Sell American fiat and government bonds."

And it's really best termed, "Sell the fiat and bonds of governments of the world . . . and buy gold, silver, and miners with the proceeds!"

This glorious theme is finally in play, and here's a key look at the action:

All major government fiat currencies look almost identical to the US fiat shown here, in their collapse against gold.

What about bonds? Well, here's a look at the cream of the crop, collapsing against gold:

What about the stock market? The first problem with the stock market is that while the listed companies are private, the market itself is used by the government as a "poster boy" for the Main Street economy.

Citizens are struggling to make ends meet, and it's become an insult to pretend they look like the stock market.

The second problem is that politicians get their big campaign donations from wealthy stock market investors. The financial health of their donors is as important (and perhaps more important) than the health of the average voter.

It's likely only a matter of time before the wildly overvalued and government-massaged U.S. stock market ends up collapsing against gold . . . exactly like fiat and bonds are doing now.

Here's a stunning look at the weekly chart of the CDNX, which is the main index for junior resource companies:

At 4 pm today, I invite all junior resource investors to be prepared to raise their champagne (or mineral water) glasses, for a toast of what is likely to turn out to be. . .

The greatest upside breakout in the history of markets!

Without further ado, here's a look at two hot juniors, and I'll start it with the "bull flagification" chart of Southern Silver Exploration Corp. (SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE):

The price action is becoming more and more vertical, with flagpoles and bull flags and pennants appearing one after another.

A big one suggests CA$1.40 is the next pitstop for this significant junior silver stock. There is some Mexican exposure, which is a negative for some investors . . . but a positive for others. It's not a concern at this point for me.

Also, with silver potentially closing above US$100 on the same day as the CDNX likely stages its historic breakout, the stock is likely to hit my CA$1.40 target (and more!) long before there's any blowback from government legislation.

I recommend that all junior mining stock investors get access to the Canadian market, but SSV.V trades on the U.S. market also, as SSVFF.

Here's another hot CDNX stock, NexGold Mining Corp. (NEXG:TSX.V; NXGCF:OTCQX; TRC1:FSE):

I'm predicting they'll "walk the mid-tier talk."

Management looks good, and the jurisdiction (Canada) does too. So does the chart, and here it is:

Blastoff is here! Note the strong buy signal on the Stochastics oscillator (14,7,7 series) at the bottom of the chart.

Fiat-oriented citizens and governments are trying to scapegoat each other for their own failure to get involved with gold, silver, and the companies that mine these highest forms of money. Gold bugs of the world are wisely ignoring the bickering and focusing on enjoying what likely promises to be . . . a multi-decade ride!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "CDNX PMI Hotties On The Move!" report. I highlight key juniors in the CDNX Precious Metals Index (PMI), with buy and sell tactics included in the report! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NexGold Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of NexGold Mining Corp.

- Stewart Thomson: I, or members of my immediate household or family, own securities of: CDNX Stocks. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?