Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) is now a producing gold company with a unique advantage; it generates cash flow while retaining significant exploration upside.

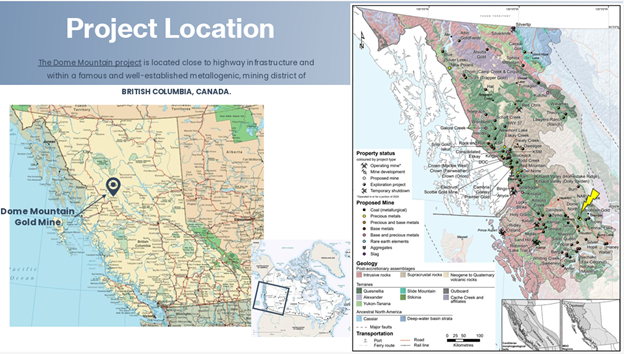

Its 100%-owned Dome Mountain Gold Project, located in British Columbia, Canada, is a fully permitted, past-producing high-grade underground mine with strong infrastructure, including year-round road access and a 10-year long-term milling agreement in place.

With 15 known high-grade gold and silver-bearing veins across the 22,000-hectare property, Dome Mountain offers Blue Lagoon a rare dual opportunity: steady gold production to fund operations and expansive targets for ongoing exploration along an 18Km trend.

Key Asset: Dome Mountain

Dome Mountain is located just 50 kilometers from the mining hub of Smithers, BC. The project benefits from starting up production during historically high gold and silver prices, positioning Blue Lagoon as one of the few juniors transitioning from development into sustained operations.

The main high-grade (~9g/t) Boulder vein remains open at depth and along strike. The company plans to advance exploration and drilling to further delineate its extensive vein system, with a goal of increasing both grade and tonnage, all with cash flow generated from gold and silver sales and therefore without further shareholder dilution.

Management Team

Blue Lagoon is led by CEO Rana Vig, an entrepreneur with decades of experience in the public markets. The team also includes seasoned geologists and technical advisors with backgrounds in mine development and operations.

In recent updates, the company has brought on experienced underground mining personnel to oversee operations and manage mineralized material throughput from stope development. The shift from exploration to production has been methodical and well-executed.

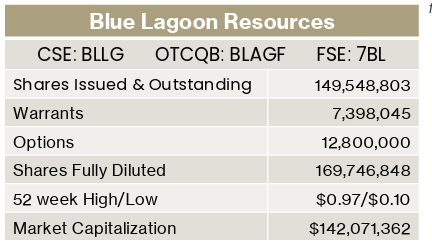

Share Structure

- Shares Outstanding: ~150 million

- Market Cap: ~CA$135 million (at CA$0.90 per share)

- Debt: Minimal

- Ownership: Management and insiders hold a meaningful position, aligning interests with shareholders.

The company is tightly held, and trading liquidity has increased significantly since the technical breakout in late 2025.

Technical Analysis

Blue Lagoon recently completed a confirmed breakout above long-standing resistance near the CA$0.55–CA$0.60 level, validating its first price target. The move has occurred on strong volume and was accompanied by a bullish crossover in MACD and an RSI breakout, both hallmarks of sustainable trend acceleration.

First Target: (Met): CA$0.55

Second Target: CA$1.10

Third Target: CA$1.50

Big Picture Target: CA$3.10

The chart shows a clean "Head and shoulder" structure inside a larger "Head and shoulder " structure that has resolved to the upside (basically a bullish accumulation pattern) , followed by higher highs and higher lows. The stock is now in a classic stair-step advance and trading above all key moving averages.

Previous resistance has now become support, and momentum indicators remain in bullish alignment. The price pattern is consistent with other small-cap producers that have re-rated as revenue visibility and exploration results continue to drive interest.

Conclusion

Blue Lagoon Resources has successfully made the leap from explorer to producer. The company now offers investors a combination of near-term cash flow, leveraged exposure to rising gold prices, and untapped exploration upside across its large and underexplored land package in British Columbia.

The recent technical breakout confirms growing market confidence in this transition. With a strong management team, expanding production, and a bullish chart structure, Blue Lagoon stands out as one of the few junior producers positioned for significant re-rating potential.

Given the strength in precious metals, the move into production, with exploration potential, and the breakout technical chart setup, we believe the shares are a Speculative Buy at current levels of CA ~$0.95 cents.

Investors interested in more information can find it here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,050.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Lagoon Resources Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.