If you fancy a 2-minute dose of culture this Sunday morning, head over to my comedy Substack and enjoy one of Shakespeare's greatest meditations about our short time here

Further to this week's commentary and the launch of BOLD, Interactive Investor now appears to have BOLD listed. I was able to buy some this morning. Most other brokers have been super slow, no doubt living in fear of the regulator (which takes priority over the customer in these dark times).

It's one thing to get your product onto the London Stock Exchange. It's another thing to get brokers to actually make it available. No wonder the UK is so rapidly losing ground to the rest of the world, if compliance won't even allow a gold-bitcoin ETF with a proven track record over many years and institutional-grade custody.

Anyway, I'm pretty good under the circumstances, it must be said.

It's difficult to express quite how much the FCA and other Blob bodies like it are holding this country and its people back. As long as they remain, the UK will lose ground. One of the few growth industries we have left is bureaucracy.

Anyway, here is this week's commentary, ICYMI

Silver Shining, Surging, Roaring

Meanwhile, it's difficult to look beyond silver.

In the welcome insanity of this silver bull market — and at the moment every bullion dealer appears to have sold out of the stuff (I'll have more on this as Pure Gold Company have been in touch and want to talk about the shortages) — my pick Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) keeps on giving.

This was a tough hold in the early days. I took flak and lost subscribers for recommending it in the 40-50c range, only to watch it sink below 30c. These things happen in mining bear markets, I'm afraid, and it takes some nerve to buy and then hold.

But I do know some readers managed to pick it up at 25c and, with the stock now at CA$2.60, they have made ten times their money.

Congratulations!

With silver now at $90, that $96 target I've been speaking about for some time now, based on silver's cup-and-handle pattern, looks like it's going to get taken out.

Here it is updated. The distance from the rim ($50) to the bottom of the cup ($3.50) is $46.50. So, according to the methodology, $46.50 plus the rim becomes the upside target: $96.50. We hit $93.50 this week, so we are pretty much there.

Note this is a log chart, which is why the downside looks so much bigger than the upside. Which brings me to my next point.

Many argue that, as this cup-and-handle pattern formed over so many years, we should be calculating the upside target on a percentage basis rather than a price basis. Such mentalities tend to creep in during bull markets, though they have a point. If you start using percentages, we are talking about a target above $700!

It's a mania, folks, driven by genuine shortages and sudden buying. It's difficult to know just where or when the top will be, but I do know it won't last forever, even if it currently feels like it will.

My instinct tells me silver wants to go higher still. But remember, folks, this is silver, so at some point it will all unravel. If it can disappoint, it will.

We can expect the unravelling to come at the moment when it can inflict the most possible pain on the most possible people. For now, the price is mocking the silver cynics. At some point, it will start mocking the permabulls.

Yes, you want to be greedy in a bull market, and you never feel like you own enough, but don't be too greedy, is all I can say. Keep taking that little bit off the table. And listen to that voice at the back of your head.

Word is that physical silver is trading at double the spot price of $90. Let's put that to the test. I have a 50oz silver bar. Its value, therefore, should be $4,500. Anyone want to pay me $9,000 for it, message me. It's yours.

Tax Loss Time

Given it's now mid-January, today I thought we should check on the tax-loss trade and see how that's progressing.

The short answer is nice, though it is a white knuckle ride.

The biggest win has been SOL Strategies Inc. (HODL:CSE; STKE:NASDAQ), which went from lows of $1.50 to $2.80 in a week and has since retreated a little.

No out-and-out losers, I'm pleased to say.

The weakest area has been the oil and gas trades, which are flat. They were derailed when a certain president had another president kidnapped. You might have heard.

So let's break it down company by company.

We'll start with the Bitcoin treasury companies.

These, of course, will sink or swim with the bitcoin price. They began the year well, as bitcoin rallied well after the Maduro kidnapping. It has since retreated a little, and so have the companies.

As this is a short-term trade, which for the most part we will want to have exited by March, if not before, I will use short-term charts dated from December 18, the day of my original missive.

We targeted Dec 19-22 as the day for lows, which, for the most part, has worked.

Strategy Inc. (MSTR:NASDAQ)

This is Michael Saylor's company and one to potentially hold beyond March in my view. Progressing nicely. As mentioned, I got some at $1.55.

SOL Strategies Inc. (HODL:CSE; STKE:NASDAQ)

To think I was once CEO of this company. I didn't get any of this one. It sinks or swims with Solana, which has swum and is now sinking a bit.

Strive (ASST: NASDAQ)

I picked up a little bit of this one at 78c. The low is 73c. This is not a good company, as I've mentioned before, even if it's a prime tax loss candidate, and I may well regret this one. I only bought it because of the chart.

Been a solid performer so far. I'm going to hold a little longer and trust in Bitcoin to rally.

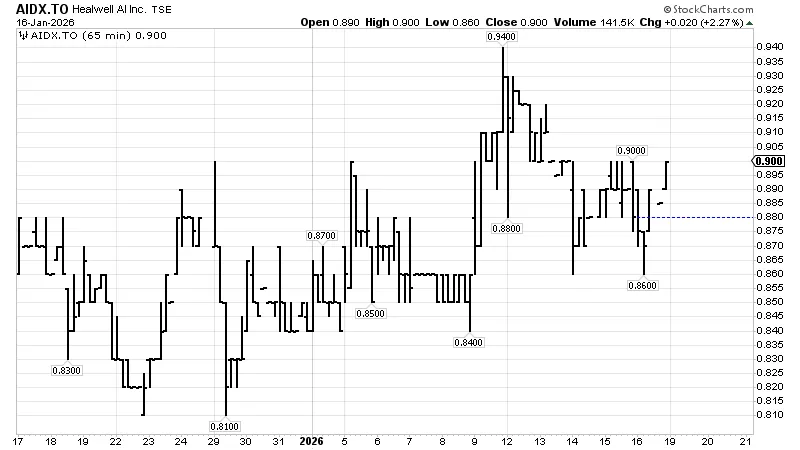

Healwell AI (AIDX:TSX)

Not a bitcoin treasury company, but tech and one my broker really likes this one. He thinks it's a $4 stock. I managed to get some below 85c. It's also moving in the right direction.

Energy

Vermilion Energy Corp. (VET:TSX; VET:NYSE)

I didn't manage to get any of this Canadian oil and gas play, though it's rallied nicely.

SM Energy Co. (SM:NYSE)

I got some at $18.60. I loved the chart. Then Trump kidnapped Maduro, and the U.S. oil plays sank. I'm a few pennies below breakeven. Go oil!

Lightbridge Corporation (LTBR:NASDAQ)

This uranium tech play never seems to stop giving. Remember it from a couple of years ago at $3. Them's were the days.

I got some at $12.80. We got the January reversal we were hoping for.

Given the uranium story more generally, this might be one to hold beyond March, though it's up and down like the proverbial.

Saves you from having to own a mine that will never get mined.

Marijuana

I added this one a little later - it is another reco from my broker, but a pain to buy in the UK, so it's more for my North American readers. Verano Holdings Corp. (VRNO:OTC; VRNO:NE). I got some at $1.65. It's doing what tax loss trades are supposed to do.

Metals

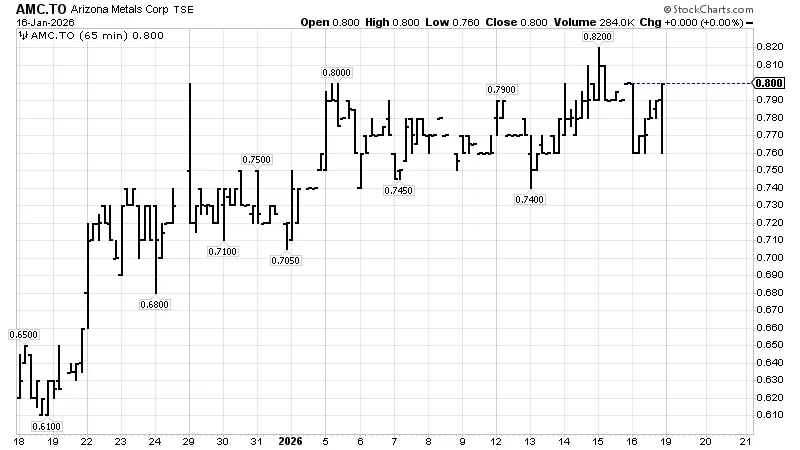

Arizona Metals Corp. (AMC:TSX.V; AZMCF:OTCQX)

This one moved so fast. I didn't get any. But it's done great for those who did.

NexMetals Mining Corp. (NEXM:TSX.V; NEXM; NASDAQ)

$5.09 I paid. It was doing great and then lost its mojo for a bit. There's a lot of stock that comes free trading in February, so I'm tempted to pull the trigger on this one fairly soon, though I love the chart over the long term.

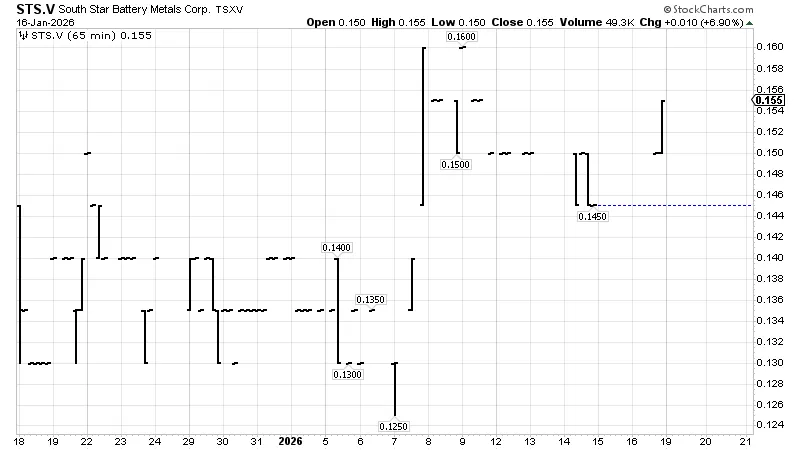

South Star Battery Metals Corp. (STS:TSX.V; STSBF:OTCBB)

This tinycap is too small and illiquid to be to be mentioning on these pages, but I could resist the chart. I got some at 13c. But, like NexMetals, a large placement comes free trading in February so I already have an eye on the exit. It's some ok. Though probably wasn't worth the risk. How illiquid is this?

So all in all, the trade is working well, the only loser has been SM, down a few pennies. I call that a pretty good return.

I'll keep you posted on progress.

And don't forget this public chart, which I have set up, so you can track these in real-time alongside me.

If you'd like to read more from Dominic, you can sign up for The Flying Frisby here.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver and NexMetals Mining Corp.

- Dominic Frisby: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.