On January 7, 1839, the pioneering primary silver mine in America commenced operations. Christened Silver Hill, the mine is situated in Davidson County in the heart of North Carolina. The mine boasts a captivating history and backstory.

Attempts have been made over the decades to revive the mine, but depressed prices have thwarted success. With gold hovering near $4600 and silver at $85 per ounce, the financial calculus has shifted.

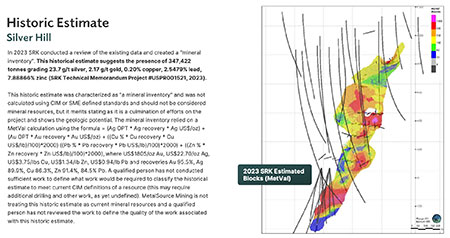

The Silver Hill mine is now in the hands of a diminutive Canadian junior dubbed Metalsource Mining Inc. (MSM:CSE; SFRIF:OTC; E9Z:FSE). In 2023, SRK was tasked with furnishing a historical estimate for Silver Hill, termed a mineral inventory, indicating 347,422 tonnes valued at roughly $513 in metal in the ground at current prices.

Metalsource Mining secured an option to acquire 100% of Silver Hill and an accompanying venture called the Byrd-Pilot Mountain Project in September 2025. The pact stipulated cash of $250,000, exploration totaling $1 million, and the issuance of 15 million shares over a period of time.

The Byrd-Pilot property encompasses approximately 1,032 acres and is situated in central North Carolina in Randolph County. Efforts by the USGS back in the 1980s unveiled the prospects for a gold-copper porphyry system. No drilling has transpired since the 1980s.

The leadership of MSM hit the ground running, riding the wave of escalating prices for gold and copper. At the moment of the option agreement, the shares hovered around CA$0.20. The tidings propelled the shares to CA$0.56 by mid-October before plummeting to CA$0.30 a month prior.

As soon as the agreement was inked, the leadership of MSM connected with Eric Sprott, who committed to a lead order of CA$1 million in a CA$4 million private placement. "Eric Sprott happens to be a giant fan of silver." They also enlisted Tom Kleeberg, previously founder and executive for the Haile Gold Mine. Tom possessed hands-on operational expertise at Silver Hill.

MSM signed an agreement with Boart Longyear to initiate a 2,000-meter core drill program at Silver Hill and Byrd-Pilot in early December. The drill scheme is to unite validation drilling of historical mineralization at Byrd-Pilot, along with targeting resource expansion at Silver Hill. Concurrently, Durango Geophysics is conducting a Magnetotelluric (MT) survey on both projects.

Metalsource orchestrated an additional private placement with Eric Sprott in late December for a supplementary CA$1 million at CA$0.30 with a half warrant at CA$0.40 valid for two years.

As of the moment of the placement, the company had finished hole four at Silver Hill. On January 2, the company declared it was amplifying the drill program at Silver Hill to a total of 1,400 meters of core drilling. It's the tranquil time of the year for the assay labs, so anticipate assays to arrive from ALS for the initial four holes imminently. Metalsource aspires to drill an extra four to six holes at Byrd-Pilot once the program is concluded at Silver Hill.

Investors in Metalsource stirred at the same instant investors awoke in silver metal. The shares have soared from CA$0.40 at the occasion of the last placement to a zenith of CA$1.05 as I compose this.

This is poised to be a fascinating tale. Eric Sprott is arguably the most astute mining whale in Canada. He enters early and pursues 1000% returns, and unearths them frequently.

Metalsource reached out to me to advertise. I wasn't swift enough or shrewd enough to seize some shares, but they compensate me for advertising, so I am partial. Conduct your own due diligence. It would be exceedingly worthwhile to meander through the presentation. It is an exemplary illustration of lucidity in conveying a multifaceted subject.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bob Moriarty: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: Metalsource Mining Inc. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.