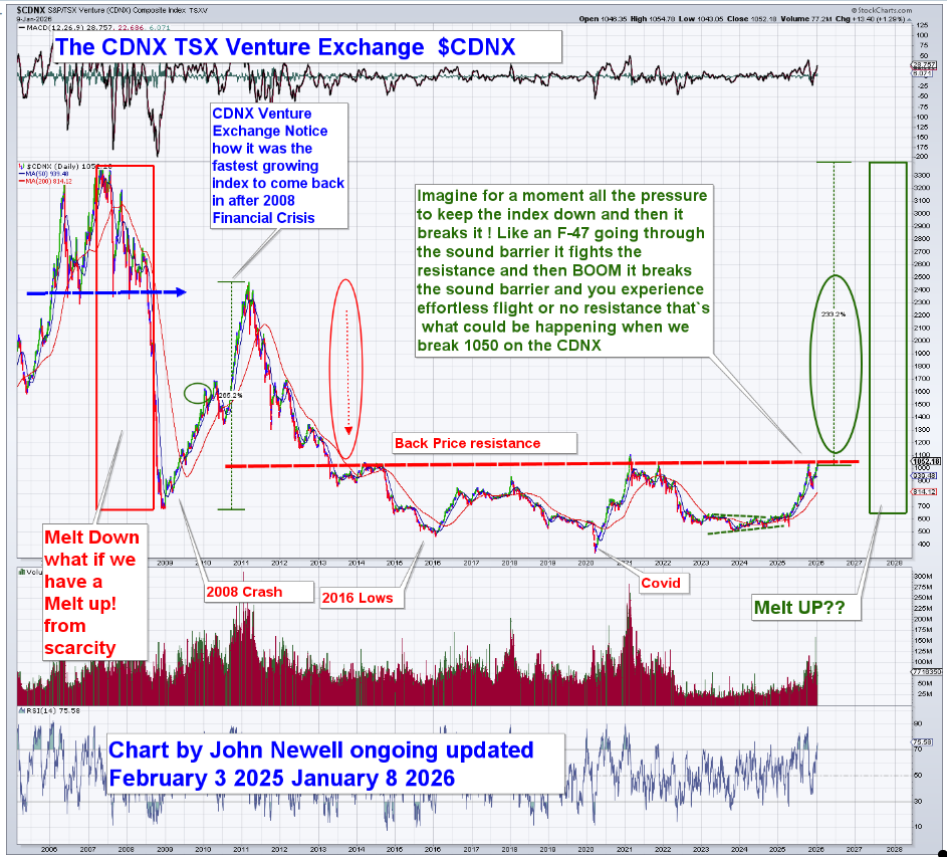

From a technical standpoint, the CDNX is completing one of the longest and most constructive base structures in its history.

What makes this setup compelling is not momentum, but time, symmetry, and compression, the elements that typically precede durable secular moves rather than short-lived rallies.

Structural Overview

Since the 2011–2012 peak, the index has undergone a full cycle of liquidation, repair, and reaccumulation. The decline into the 2016 lows marked capitulation, followed by nearly a decade of broad sideways movement. That range was not noise. It was balance sheet repair, dilution absorption, and investor apathy being fully priced in.

The current structure resembles a large, multi-year head-and-shoulders base, with the neckline centered near the 1,000–1,050 zone. Importantly, this level has now been tested multiple times from below and absorbed. Repeated tests without material downside follow-through tend to weaken resistance rather than reinforce it.

The right-hand side of the structure has tightened materially and now carries the characteristics of a bull pennant, not a topping pattern. Volatility has compressed, ranges have narrowed, and higher lows are evident. This is classic pre-expansion behavior following a prolonged period of pressure.

The Sound Barrier Moment

One way to frame the CDNX at this stage is through a sound-barrier analogy.

For years, the index has been pushing against overhead resistance created by capital exits, dilution, and skepticism. Each advance stalled under the accumulated weight of that pressure. Energy was being spent simply maintaining altitude rather than accelerating. That is what extended base-building looks like in real time.

As the charts now suggest, the CDNX is approaching the point where resistance no longer behaves in a linear fashion. Much like an aircraft approaching Mach 1, pressure builds ahead of the breakout. Progress feels noisy, unstable, and labored right up until the moment the barrier gives way. Once crossed, resistance collapses, motion smooths out, and forward movement requires less effort, not more.

Technically, that threshold aligns with the long-term neckline in the 1,000–1,050 zone. A sustained move through this area is not just another breakout attempt. It represents a transition from compression to expansion, from balance to imbalance.

History shows that when the CDNX clears major resistance after extended periods of neglect, advances tend to persist rather than fail. The move becomes trend-driven, not headline-driven.

Momentum and Participation

Long-term momentum indicators are not flashing exhaustion. Weekly and monthly oscillators remain elevated but controlled, consistent with the early to middle stages of a secular advance — not a terminal phase. Prior CDNX bull markets did not begin from oversold conditions. They began when momentum stayed elevated for extended periods as the price escaped long ranges.

Volume behavior supports this interpretation. Participation has expanded on advances, while pullbacks have remained corrective rather than impulsive. This is characteristic of accumulation, not distribution.

Key Levels and Targets

The 1,000–1,050 zone remains the critical pivot. Sustained trade above this area confirms that the index has transitioned from repair to expansion.

From there, the technical roadmap is relatively clean:

Intermediate resistance: 1,325–1,480

These levels correspond with prior congestion zones and measured symmetry from earlier advances.

Longer-term measured objective: ~3,500+

This target is derived from the width of the multi-year base projected forward. It reflects a full valuation reset relative to metals prices, not speculative excess.

Importantly, these projections assume time, not speed. Secular advances unfold over years, not weeks, and often feel uncomfortable while they are developing.

Risk Perspective

From a technical risk standpoint, the primary risk is not volatility, but misclassification—treating a structural shift as a trading move. Overbought readings are expected and historically persistent during the early stages of secular advances. Selling strength too early has been the dominant error in prior CDNX cycles.

Meaningful technical damage would require a decisive failure back below the neckline and a loss of the rising long-term trend. At present, the evidence argues strongly against that outcome.

Bottom Line

The CDNX is not signaling speculation. It is a signaling transition.

After more than a decade of base-building, the index is moving from capital starvation toward capital reallocation. When this index advances, it does so asymmetrically, as discovery leverage, optionality, and small floats begin to matter again.

From a long-term technical perspective, this is one of the most constructive setups the CDNX has presented in two generations. The charts suggest the market is still early in the process of repricing risk, not late in the move. The greatest danger is not the turbulence near the barrier, but stepping aside just as the index breaks into open air.

Translating the CDNX Breakout into Opportunity

When the TSX Venture Index enters a sustained expansion phase, it rarely lifts all boats evenly. Capital tends to flow first toward companies that have already survived the repair phase, those with cleaned-up balance sheets, credible assets, improving technical structures, and enough scale to matter when risk appetite returns.

In past CDNX cycles, the strongest performers were not necessarily the loudest stories, but the companies that spent the downcycle quietly rebuilding while investors looked elsewhere. As the index transitions from capital starvation to capital reallocation, these names often respond early, sometimes dramatically, as liquidity returns and valuation gaps begin to close.

The following companies are not intended as a complete list, but rather as representative examples of juniors that combine constructive charts with credible fundamentals. Each illustrates a different way exposure to a rising CDNX can express itself, from late-stage developers and near-term producers to higher-beta exploration names that historically show outsized moves once momentum broadens.

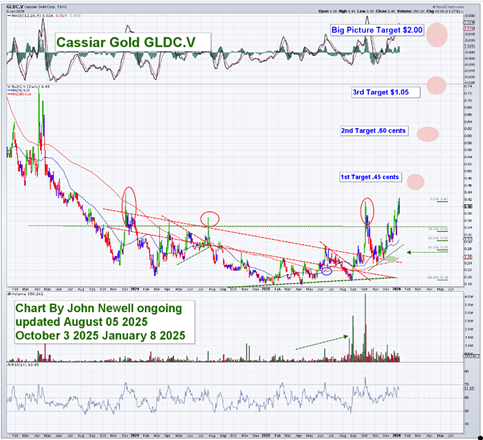

Cassiar Gold Corp.

Cassiar Gold Corp. (GLDC:TSX.V; CGLCF:OTCQX; 756:FRA) is a long-cycle reset story unfolding in one of British Columbia's historic gold districts.

After trading at materially higher valuations in the prior cycle, the company spent several years consolidating both its asset base and share structure while advancing work at the Cassiar Gold Project, a past-producing district with meaningful scale.

The chart reflects that repair phase, with a prolonged basing pattern now transitioning into higher lows and expanding volume.

In a strengthening CDNX environment, larger, district-scale projects with historical production and improving technical structure often attract renewed speculative interest as capital rotates back into exploration.

Lion Rock Resources

Lion Rock Resources (ROAR:TSXV; LRRIF:OTC) is advancing a high-grade gold, lithium, and tin exploration project in South Dakota's Black Hills, a historic mining district best known for the legendary Homestake Mine.

From a technical standpoint, the shares delivered a strong advance, followed by a disciplined correction that formed a declining wedge.

That structure has recently resolved to the upside, a classic continuation pattern within an emerging uptrend. With improving volume, rising momentum, and a series of higher lows now established, Lion Rock fits the profile of a discovery-stage explorer beginning to attract attention as risk capital returns to the TSX Venture market.

For a previous article on Lion Rock, see here, here, and here.

Blue Lagoon Resources

Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) represents a rare combination of near-term production exposure and longer-term exploration upside within the junior gold space.

Unlike most peers, the company has transitioned into production at its Dome Mountain Gold Project, shifting the risk profile from discovery toward execution.

The chart reflects this transition, with a rounded basing structure resolving into an early breakout phase.

In past CDNX cycles, juniors moving from development into production have often re-rated quickly once capital returned, and operational momentum became visible.

For a previous article on Blue Lagoon, see here.

Gold X2 Mining Inc.

Gold X2 Mining (AUXX:TSX.V; GSHRF:OTCQB; 8X00:FWB) is an early-stage gold exploration company that has recently repositioned following a corporate name change, often a signal of strategic refocusing and renewed market attention.

The company controls assets that collectively host approximately three million ounces of gold in the ground, based on historical estimates and prior technical work that are subject to confirmation.

After a prolonged decline typical of the last cycle, the shares spent several years building a broad base.

That base has now transitioned into a developing uptrend, marked by higher lows and expanding volume, positioning Gold X2 as a high-beta name that could respond disproportionately as speculative capital re-enters the sector.

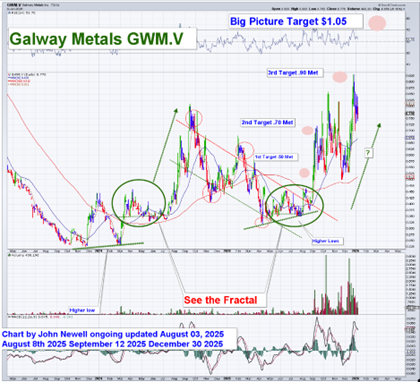

Galway Metals Inc.

Galway Metals Inc. (GWM:TSX.V; GAYMF:OTCQB) combines advanced-stage development with meaningful exploration upside across multiple Canadian jurisdictions.

The company controls defined gold resources and continues to advance projects with established geology and scale.

The chart reveals a repeating pattern of accumulation, breakout, and consolidation, consistent with a market gradually revaluing the company's asset base.

With higher lows firmly established and momentum improving, Galway fits the profile of a junior transitioning from neglect to recognition as confidence returns to the CDNX.

For a previous article on Galway Metals, see here.

Lux Metals Corp.

Lux Metals Corp (LXM:TSXV; BBBMF:OTCMKTS) is an underfollowed junior that often responds early as the TSX Venture Index begins to re-rate.

The company controls a large gold project in Quebec's James Bay region that hosts approximately 400,000 ounces of gold in historical, non-NI 43-101–compliant estimates, derived from extensive past drilling and work programs.

Lux has spent several years base-building both fundamentally and technically, and the chart now reflects that repair process.

Improving structure and volume suggest the shares are transitioning from accumulation toward recognition as capital rotates back into the CDNX.

For a previous article on Lux Metals, see here.

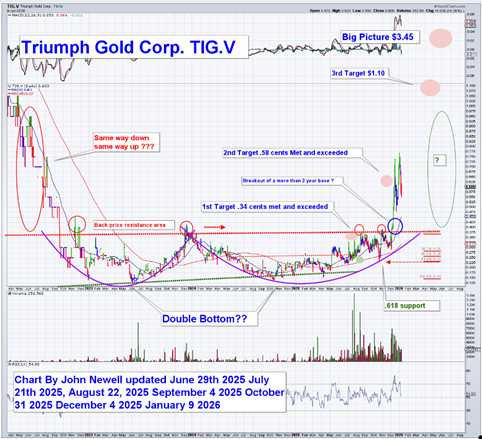

Triumph Gold Corp.

Triumph Gold Corp. (TIG:TSX.V; TIGCF:OTCMKTS) represents one of the more advanced development stories within the TSX Venture universe.

Its 100%-owned Freegold Mountain Project in Yukon hosts over two million gold-equivalent ounces in NI 43-101–compliant resources, providing tangible scale and optionality.

After several years consolidating its share structure, the chart completed a multi-year base and broke out above prior resistance, with volume confirming the trend change.

In a recovering CDNX environment, developers with compliant ounces, infrastructure access, and improved technical structure have historically re-rated as ounces in the ground regain value.

For a previous article on Triumph Gold, see here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Galway Metals is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion Rock Resources, Blue Lagoon Resources, Gold X2 Mining, and Galway Metals.

- John Newell: I, or members of my immediate household or family, own securities of: Triumph, Lion Rock, Cassiar, and Lux Metals. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.