In the latter half of the Year of our Lord, 2025, we were all subjected to the insufferable hubris of the gold bugs who thrashed and trashed the "crypto-kings" to within an inch of their lives, proving once again that not only does "pride cometh before a fall" but its little brother "revenge" is most certainly "a dish best served cold."

As agonizing as it was to watch Peter Schiff post tweets and podcasts and emails and billboards on the Ventura Highway, shaking his finger at the Bitcoin Behemoths while mouthing the phrase "See? I told you so!", it was maddening to watch him luxuriate in the pleasure of getting the last laugh after four years of performance pummelling by the cryptojunkies.

Then, not to be outdone by the gold bugs, the silver bugs — otherwise known as the "metallic maniacs" — many of them recent defectors from the Bitcoin camp, launched a multimedia marketing program the likes of which has not been seen since Michael Saylor decided to leverage the heck out his Strategy Inc. (MSTR:NASDAQ) deal by being the only bid for Bitcoin last summer at the top around $457 per share (now $160). As successful as was that campaign in getting Bitcoin to $125,000, it earmarked the top of the cryptocurrency market and for the latter half of 2025 suffered the plight of the unloved. Silver, by contrast, is knocking on the door of $85 per ounce and continues to reject any takedowns while youthful investors, new to the

world of hard assets, continue to "buy the effing dip", a practice ingrained within them by central bank bailouts and liquidity injections designed purely to rescue stocks, whether or not they were in trouble. The action in the silver market is "vintage Gen-X tape management" because that generation is too young to have been carried out of the silver pit, blood streaming from the eye sockets, pockets hanging precariously from pants, and credit bosses and bank managers chasing the stretcher all the way to the Emergency Ward thanks to seven margin increases in a row in 1980 and five more in 2011 that led to margin calls the size and scope of Mount Everest.

Likewise, they have never had to endure a bear market like 1981-1982 or (God forbid) 1973-1974 that made thousandaires out of millionaires and paupers out of princes without as much as a nod. Silver is to 2026-2027 what Nvidia Corp. (NVDA:NASDAQ) was to 2023-2024 in that it has officially entered "cult status" and as Steve Eisman said about whether Tesla Inc. (TSLA:NASDAQ) might be considered a good short: "You must never short a cult." and that most certainly applies to silver and to a lesser degree gold.

Gold, however, is a decidedly different beast as it is the metal of choice for a group of investors that will always have a bid because that group has an endless source of citizen-based money called taxes with which to fund purchases. That group of deep-pocketed gnomes are the central bankers that have amassed enough gold in the past four years since the U.S. decided to steal Russian dollar reserves that they now own more gold than they do U.S. Treasuries. The buying in gold is robotic in nature. Just as the passive funds are robotic in their systematic monthly purchases of the Mag Seven for the past few years, the central bankers sit on the bid every day, all day with the icy resolve of a Friedland-esque brain surgeon and buy any and all gold that is posted for sale. And there is, pray tell, little evidence that such a condition will end any time soon.

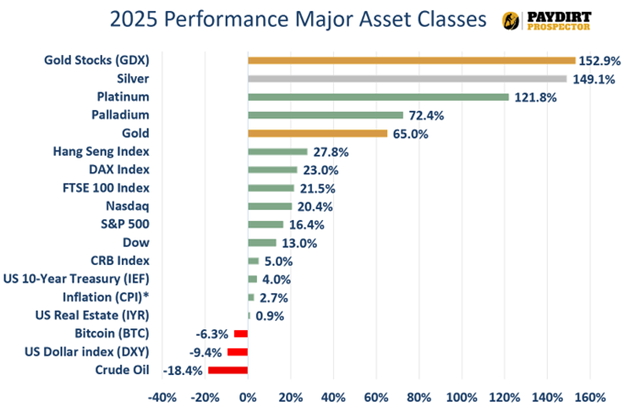

So as much as the gold and silver bugs resemble the Looney Tunes version of the Tasmanian Devil, they have been rewarded by the goddesses of market maven supremacy as the holders of the 2025 "brass ring" for outstanding returns in the face of serially robust stock markets.

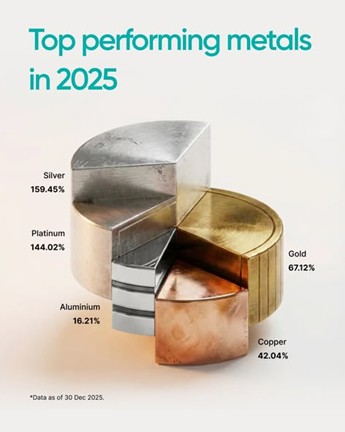

Noticeably absent from the chart shown above was the performance of another metal not generally known for its self-promotion nor for its place in the lap of the wild-eyed speculator or even armchair hard-asset collector. That metal is copper.

Silver, platinum, aluminum, and gold commanded the top spots in the metals performance charts but copper's 42.04% performance in 2025 has left it here in the early birthing hours of 2026 as the only one of the metals not sitting in an "overbought" condition on either daily, weekly, or monthly charts versus gold silver, and platinum all of which are overbought on the weekly and monthly charts.

Silver, platinum, aluminum, and gold commanded the top spots in the metals performance charts but copper's 42.04% performance in 2025 has left it here in the early birthing hours of 2026 as the only one of the metals not sitting in an "overbought" condition on either daily, weekly, or monthly charts versus gold silver, and platinum all of which are overbought on the weekly and monthly charts.

The copper market is the most perfectly-suited metal to the current perfect storm of diminishing supply and accelerating demand, exactly as I predicted last year and again in this year's GGMA 2026 Forecast Issue.

The difference in 2026, however, will be that the junior copper developers and explorers are going to quietly slide into the catbird seat beside the myriad of junior gold and silver deals which have dominated the attention of the Gen-X crowd during the past six months.

Under the cloak of darkness and with little fanfare or fuss, I expect the junior copper names to take up the mantle of lead dogs in the pack as the world suddenly recognizes that the only "critical metal" that really counts is copper.

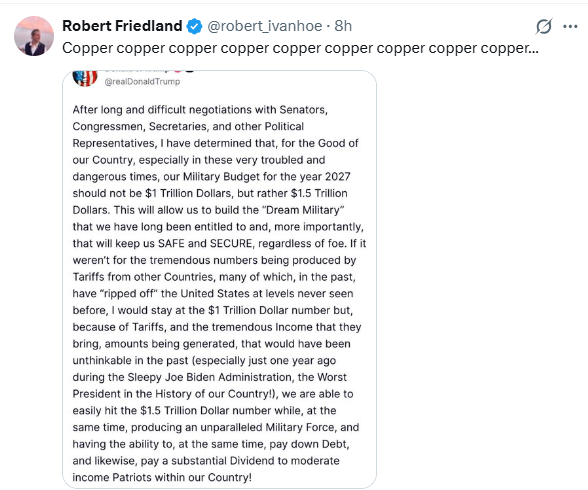

Now, I sound like a Chatty Cathy doll from the 1960's where you pull a string on the back of my neck and I repeat "BUY COPPER, BUY COPPER, BUY COPPER" until the doll runs out of AA battery power but there is no doubt in my mind that not only will the big base metals producers catch a bid in 2026 but so will the junior copper developers, not unlike what happened to the nickel developers and explorers back in 1993 after Bob Friedland discovered Voisey's Bay.

His Diamondfields Resources soared from the pennies into a $4.3 billion takeover by Inco by 1997, which earned Friedland the moniker of not only "billionaire" but also "genius" in his masterful handling of the deal.

So, when I see tweets like the one shown below, I am forced to pay strict attention and align my portfolios accordingly.

In the junior resource space, there have been lots of junior gold and silver stories that have seized the limited attention spans of the Gen-X investors, such as Prospector Metals Corp. (PPP:TSX-V; OTCQB:PMCOF; FSE:1ET0) that rose from a $0.10 low in April 2025 to a high of $1.61 in October. There is also Onyx Gold Corp. (ONYX:US) that was $.155 in January last year and hit $2.60 in July currently settling at $1.90 here in January.

Of the silver names, Highlander Silver Corp. (HSLV:TSX; HLSCF:OCTMKTS) soared from a low of $1.00 one year ago to a high of $5.86 by late December, as well as GGMA pick Silver North Resources Ltd. (SNAG:TSX.V; TARSF:OTCQB) that went from $0.07 last January to a high of $0.455 on December 22.

The junior precious metals names certainly had their fair share of the limelight in 2025 and deservedly so but I would hold out a copper story called Marimaca Copper Corp. (MARI:TSX; MC2:ASX)that was CA$4.11 in February of last year only to hit $12.51 a few days ago as copper tapped $6.115/lb.

The bigger news with MARI/MARIF was that they raised CAD $96.5 million in exploration and development funding for their project in northern Chile all in the past 12 months. What intrigued me about the Marimaca Copper Project is that their main asset is a copper-bearing oxide cap that has been the focus of a Definitive Feasibility Study underneath which there is a sulphide zone known as "Pampa Medina" which is eerily similar to the Buen Retiro Project currently being developed and explored by GGMA favorite Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB).

As I wrote earlier this week in an email alert:

"One of the dominant copper stories for 2025 was the ascent of Marimaca Copper Corp., which has had a range of CAD $3.00 in 2024 to the recent high of $12.15 last Monday. It carries a market cap of over USD $1.0 billion based largely on recent exploration results from its Marimaca Copper Project located in the Antofagasta Region of northern Chile, specifically in the Coastal Copper Belt, about 25 km east of the port of Mejillones and 45 km north of Antofagasta. Recent discoveries at a new zone called "Pampa Medina" in 2025 revealed a higher grade sulphide deposit located beneath the copper-bearing oxide zone upon which the company had been banking its future by delivering a Definitive Feasibility Study (DFS). This study confirmed robust capital intensity and a strong internal rate of return (IRR) of over 31%. The study highlighted the project's low operating costs and low execution risk due to its proximity to existing infrastructure in Chile, positioning it as one of the most attractive copper development opportunities globally.

What I just wrote about MARI/MARIF sounded very much like the Buen Retiro Project for FTZ/FTZFF where the copper-bearing oxide cap is the focus of a proposed pre-feasibility study for 2026. In fact, their partner should be Pucobre SA the vendor that retained the 30% clawback provision, the largest public copper producer in Chile.

When I pore through the Marimaca website, it is like I am reading through the various reports on Buen Retiro which is the one asset that completely de-risks Fitzroy by way of its imminent move to "producer" status versus "grassroots explorer" which entails an automatic rerating.

However, on December 2, CEO Merlin Marr-Johnson told us that "In the northern part of the old pit are we are now seeing disseminated chalcopyrite in drill-core that looks very similar to mineralized core seen at the Candelaria deposit. And off to the southeast we have also found late-stage-copper, which looks very similar to a newly-commissioned body within the Manto Verde complex and the recently approved, privately-held La Farola deposit next to Candelaria."

This type of disseminated chalcopyrite is identical to the sulphide mineralization found in the Pampa Medina zone of the Marimaca Copper Project. From the MARI/MARIF news release dated July 3rd, 2025, "Drilling targeted extensions of the shallow oxide-chalcocite mineralization at Pampa Medina and intersected ultra high-grade, bornite-chalcopyrite, disseminated chalcopyrite and high-grade oxide mineralization."

I raise these observations because it is my expectation that FTZ/FTZFF has news pending for next week and if they can confirm that the deeper drilling has revealed a "Pampa Medina-type" event at Buen Retiro, then our little jewel is going to eventually be valued at a similar market cap (USD > $1 billion)."

These are the types of under-the-radar stories that get pre-empted by the gold and silver bugs and which rarely bump the more popular and/or well-sponsored names usually featured by the high-profile "influencers" out their like Michael Gentile or Lawrence Lepard. However, I see all of that changing in 2026 as the Great Rotation takes hold.

A Failed Santa Claus Rally

Stocks ended the year with a failed "Santa Claus Rally" and while it missed by the slimmest of margins, only the DJIA was able to allow Santa to grace its table while the S&P was a "fail" and the NASDAQ 100 a "big fail".

With the First Five Days closing with an undisputed gain of 1.1% for the S&P 500 and a 1.02% gain for the NDX 100, there can be no "early warning" indicator for the month of January which means we must simply hurry up and wait for the Mid-Month Indicator ("MMI") which is the last tip-off in advance of the actual January Barometer ("JB") which has an 84% accuracy ratio in predicting the outcome for the year.

I erred last year in being too cautious and somewhat too aggressive in trying to top-tick popular (and thoroughly overvalued) names like Tesla Inc. and Nvidia Corp. and while I have made decent passes on both in the past, the hedges detracted from what would have made 2025 a record year and as it stood on New Year's Eve, it was a very good year, but not a record year.

Also failing to live up to its reputation as a good bet, volatility has been incredibly subdued since the end of November and went out for the year at the lows. One would think that with all of the global uncertainty that traders would gravitate toward additional protection but the lack of downside pressure since the middle of November has allowed traders a heightened sense of confidence in the broadening out of market breadth and bullish rotation away from the Mag Seven names into energy, materials, and precious metals.

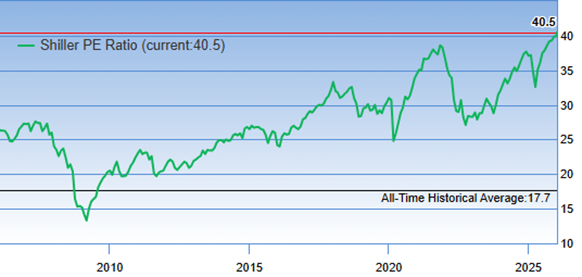

Nevertheless, since the VIX:US is bouncing along the bottom around its 2025 lows, I think it may be prudent to take on a position in the volatility ETF ProShares Ultra VIX Short-Term Futures ETF (UVXY:US) at any level under $35 largely because it has sported a 52-week range of $34.28 for the low and $266.05 for the high. With the Case-Shiller at a record P/E of over 40, stocks are vulnerable for a corrective setback that can only result in heightened volatility and a decent advance in the UVXY:US. I may have to wait awhile for this trade to pay out but with traders so incredibly smug and complacent, the wait should not be that long.

Welcome to 2026!

| Want to be the first to know about interesting Copper, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources, Fitzroy Minerals Inc., and Tesla Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Silver North Resources and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.