The main focus of Carlton Precious Inc (CPI:TSXV; CPIFF:OTCMKTS) is a primary silver deposit located in southern Peru. Peru ranks third behind Mexico and China in global silver supply, having produced 3,100 metric tons (107.1 million ounces) of silver in 2023.

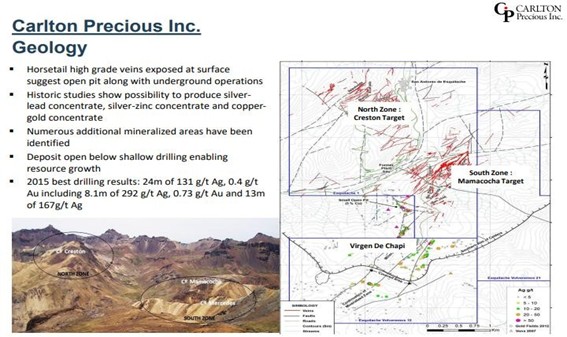

The South Peru Silver Belt is the home of the Esquilache project in a region that has historically produced the bulk of Peruvian silver. Esquilache was operated by Hochschild Mining, which conducted a gravity and grade mining operation in the 1960s before being shut down due to low silver prices.

The strategy for Carlton is to carry out a drill program around the edges of the known silver-gold-bearing system with a view to increasing the resource in advance of PEA.

With silver prices on the rise, initiatives such as these are historically treated well by investors, as raising money to advance a known resource involves significantly lower risk than grassroots exploration.

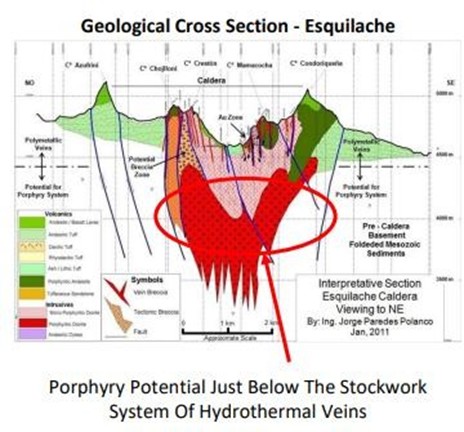

The geological model upon which management is relying is one that also involves deeper drilling with the objective of locating what they believe could be a large porphyry copper-molybdenum deposit, such as those found a hundred kilometres to the west at the Cerro Verde and Tia Maria copper-molybdenum mines.

These mines are located in a mineralized corridor called the "Cintura Porfiritica" (porphyritic belt), which lies adjacent to a similar corridor containing the Esquilache.

Deep drilling is believed to contain potential for deposits such as the one shown on page 21 in the model.

The Chairman of the Board and CEO for this company is Marc Henderson, a 30-year veteran of the mining sector who has been involved with numerous companies, including Aquiline Resources, Treasury Metals, Khan Resources, and Laramide Resources Ltd. (LAM:TSX; LMRXF:OTCQX: LAM:ASX)., where he is the current Chairman of the Board of Directors.

You may recall earlier discussions regarding Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), Daniel Bussandri, who currently heads up exploration in their Argentinian Taquetren Project. Daniel was the prospector geologist that found the monstrous Navidad Silver Deposit in Chubut province in southern Argentina but it was Henderson's Aquiline Resources that sold the deposit to Pan American Silver Corp. (PAAS:TSX; PAAS:NYSE) for over US$600 million in 2010, a brilliant move by any and all measures as Navidad later became embroiled in a massive tangle of political and environmental snafus that have impeded permitting and production. Also present on Carlton's board is Fitzroy Minerals'

Chairman Campbell Smyth, who actually introduced me to the company in early 2025. Having strong management is a "must" for shareholders, especially in the juniors, where both knowledge of and experience with the capital markets is an urgent necessity.

In an environment that has seen silver surpassing the highs set in 1980 and 2011 around US$50 per ounce, the junior silver explorer/developers will be the focus and in fact obsession of these new generations of investors and traders that have favoured Bitcoin over gold as a store of value but which are more than enamored with silver's dual role as a monetary substitute for gold and as an industrial metal with a primary role in the electrification movement. To own shares in a company with a proven silver resource carrying the potential for significant expansion will prove to be a sage decision now that this youthful horde has caught "silver fever".

The major drawback for CPI/CPIFF has been regulatory roadblocks to drilling in Peru. Recent political changes have made it far more difficult to secure drill permits in Peru, caused largely by the populist movements affecting many of the formerly mining-friendly jurisdictions, many of them in South America. However, this drawback is precisely the opportunity staring us in the face. Esquilache will get permitted. Speaking with Henderson just prior to Christmas, he indicated that the permits should be in place "by the end of January". Since it is now January, that involves a mere 4-week wait, at most, if he is correct. Once secured, the project becomes a complete no-brainer because there are tailings dumps at Esquilache containing more value in raw silver than the entire market cap of the company (only US$63m). Who knows how much high-grade silver the Hochschild Group left behind when they hightailed it?

CPI/CPIFF is my "dark horse" for 2026, and I place a target price of CA$1.00-CA$1.25 once permits are secured and drilling is underway. This could be one beautiful "event-driven" score.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Laramide Resources is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Carlton Precious Inc., Fitzroy Minerals, and Pan American Silver Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Carlton Precious Inc. and Fitzroy Minerals. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.