Galway Metals Inc. (GWM:TSX.V; GAYMF:OTCQB) announced the results of 11 holes drilled in the Southwest deposit at its 100%-owned flagship Clarence Stream gold-antimony project in southwest New Brunswick, noted a news release. They showed strong continuity of gold mineralization within and along the margins of Galway's previously outlined resource pits.

"These results are important in supporting our infill strategy and in confirming extensions where mineralization remains open, both laterally and at depth," Galway President and Chief Executive Officer (CEO) Rob Hinchcliffe said in the release. "As we continue to connect zones between existing pit shells, the drilling is adding confidence to the resource model and highlighting opportunities for future expansion."

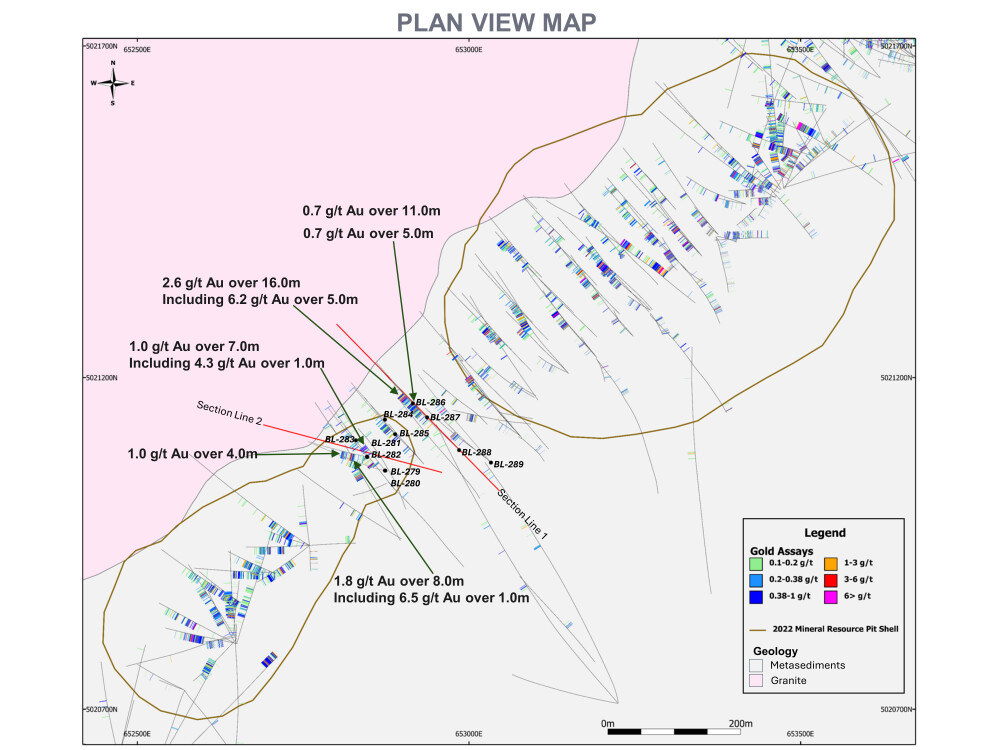

Of the 11 reported holes, BL-286 through BL-288 intersected wide, shallow zones of mineralization outside the existing resource, demonstrating continuity along the section to depth.

Holes BL-279 through BL-282 confirmed the presence of gold mineralization beneath the current outlines of the westernmost resource pit. For example, BL-279 returned 1 gram per ton gold (1 g/t Au) over 7 meters (7m). These results suggest that the existing resource pits could be connected and that the Southwest deposit could be expanded laterally and at depth.

Highlight intercepts of this batch of results included:

- 2.6 g/t Au over 16m, including 6.2 g/t Au over 5m (hole BL-286)

- 1.8 g/t Au over 8m, including 6.5 g/t Au over 1m (hole BL-282)

- 7.5 g/t Au over 2m (hole BL-289)

In other news announced in the release, Galway will receive up to CA$50,000 in funds from the New Brunswick Junior Mining Assistance Program, which the company will spend on future exploration drilling.

Notable Projects, Places, and People

1Headquartered in Toronto, Ontario, Galway Metals "offers investors exposure to two overlooked assets in proven jurisdictions," wrote John Newell of John Newell and Associates in a 2025 report.

The junior miner's primary focus, Clarence Stream, is high grade, amenable to open-pit mining, and has district-scale potential. Spanning 60,465 hectares, the property contains a 65-kilometer (65-km) strike length of prospective gold showings and anomalies along the Sawyer Brook Fault System. In some areas, mineralization is up to 28 km wide.

Clarence Stream already has a mineral resource estimate, expanded in a 2022 update. According to the NI 43-101 technical report, the total indicated resource is 12,400,000 tons (12.4 Mt) of 2.3 g/t Au for 922,000 ounces. The total inferred resource is 16 Mt of 2.6 g/t Au for 1,334,000 ounces.

"Perhaps the most overlooked element is the 25,000,000 pounds of antimony, a critical mineral now trading at significantly higher prices due to export restrictions from China," Newell pointed out. "What's even more compelling: Galway estimates current defined ounces represent less than 7% of the overall 65-km gold corridor, underscoring the scale and upside still ahead."

Initial metallurgical testing had already been done, and it yielded 90% recoveries of gold and antimony in both the North and the South zones.

Galway has an agreement in place to lease space inside and outside of the remaining, adjacent mill infrastructure from the previously operating but now shuttered Mount Pleasant tin-tungsten-molybdenum mine and mill adjacent to Clarence Stream, according to the company's website.

Clarence Stream's location, New Brunswick, is mining-friendly and offers abundant infrastructure. Airports, highways, rail, a seaport, and power are accessible. Neighboring towns are St. Stephen, St. Andrews, and St. George.

Galway's second project, Estrades, is a past-producing, high-grade, gold-rich polymetallic volcanogenic massive sulphide (VMS) mine in western Quebec's northern Abitibi, "one of Canada's most productive gold-zinc belts," Newell wrote. Along with Estrades, the company's 31-km land package there encompasses related Newiska concessions and adjacent Casa Berardi claims.

Galway is led by "a proven builder with skin in the game" in Robert Hinchcliffe, noted Newell, who is the explorer's largest shareholder. His experience includes selling Galway Resources Ltd. for US$340 million (US$340M), serving as chief financial officer at Kirkland Lake Gold Ltd., and working as a mining analyst on Wall Street.

2026 Outlook for Gold Bullish

With a stellar 2025 behind it, gold is positioned for continued growth and continued price ascension this year, experts say.

"Gold enters 2026 with a rare combination of strength and stability," noted an FXLeaders article dated Jan. 4. "Supported by accommodative monetary policy, persistent geopolitical risk, cooling labor market dynamics, and unprecedented central bank demand, the metal remains firmly positioned as a core asset in an increasingly complex global environment."

Recent price consolidation appears to be bolstering the basis for the next move up, and gold may challenge US$5,000 per ounce (US$5,000/oz) this year.

Bank of America, for one, believes this will happen, according to Head of Metals Research Michael Widmer, Kitco News reported on Jan. 5. The bank expects global gold supply to decline 2% and all-in sustaining costs in the sector to rise 3% to about US$1,600/oz in 2026.

For this year, Widmer expects the bullish environment to continue and gold to remain a hedge and an alpha source. He anticipates gold producers to see a strong increase in profitability, with total EBITDA projected to rise 41% to about US$65 billion. U.S. monetary policy could drive another rotation into gold, he added.

"I've highlighted before that the gold market has been very overbought, but it's actually still underinvested," Widmer wrote. "There is still a lot of room for gold as a diversification tool in portfolios."

J.P. Morgan Global Research forecasts the gold price to average about US$5,055/oz by Q4/26, then increase to US$5,400 by 2027E, according to Trading View on Jan. 4.

"While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted," said Natasha Kaneva, head of global commodities strategy at J.P. Morgan. "The long-term trend of official reserve and investor diversification into gold has further to go."

For Goldman Sachs, gold still holds the spot as its single favorite long commodity as 2026 kicks off. It expects central bank gold buying to remain robust, averaging 70 tons per month, this year and predicts a year-end 2026 gold price of US$4,900/oz.

Last year, the gold price hit new all-time highs, reported Leede Financial Inc. Ending 2025 at US$4,325/oz, gold rose 66% year over year (YOY) versus a 22.9% YOY increase in 2024 and a 13.1% YOY jump in 2023.

Sprott explained in a Jan. 6 Special Report that persistent inflation pressures, mounting geopolitical uncertainty, and growing central bank demand for gold fueled multiple metals' strong 2025 performance. Also, "years of underinvestment in mining and tightening supply met accelerating demand from energy transition, electrification and infrastructure spending, creating a favorable backdrop for metals prices," the report noted.

The Catalyst: More Drill Results

As they become available, Galway will release the pending results of another 32 infill and resource drill holes, noted the news release.

"We expect to report further meaningful results as the program advances," Hinchcliffe said.

Stock Offers 31% Return Potential

1In his latest report, Newell highlighted the advantageous jurisdiction of Galway's flagship project, the dual gold and antimony nature of the flagship project, the second asset with VMS upside, and the company head's proven track record.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Galway Metals Inc. (GWM:TSX.V; GAYMF:OTCQB)

Galway's stock price already surpassed Newell's first target (CA$0.50/share), reflecting a breakout above the then resistance, and his second target (CA$0.70/share), reflecting a breakout above midchannel resistance. The expert's third target (CA$0.90/share) and big picture target (CA$1.05/share) imply potential returns of 13% and 31%, respectively, from Galway's Jan. 6 closing price.

Newell's rating on Galway is Speculative Buy.

Ownership and Share Structure2

Insiders own 7.46% of Galway, of which President/CEO Hinchcliffe, the No. 1 shareholder, has 6.76%. Eight institutions have 18.88%. Of these, the Top 3 are Van Eck Associates Corp. with 4.54%, Caisse de Depot et Placement du Quebec with 3.4% and Mackenzie Investments with 3.35%. Retail investors own the rest.

Galway has 125.76 million shares outstanding. Its market cap is CA$71.24M. Its 52-week range is CA$0.32–0.93/share.

| Want to be the first to know about interesting Base Metals, Antimony and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Galway Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Galway Metals Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on August 8, 2025

- For the quoted article (published on August 8, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.