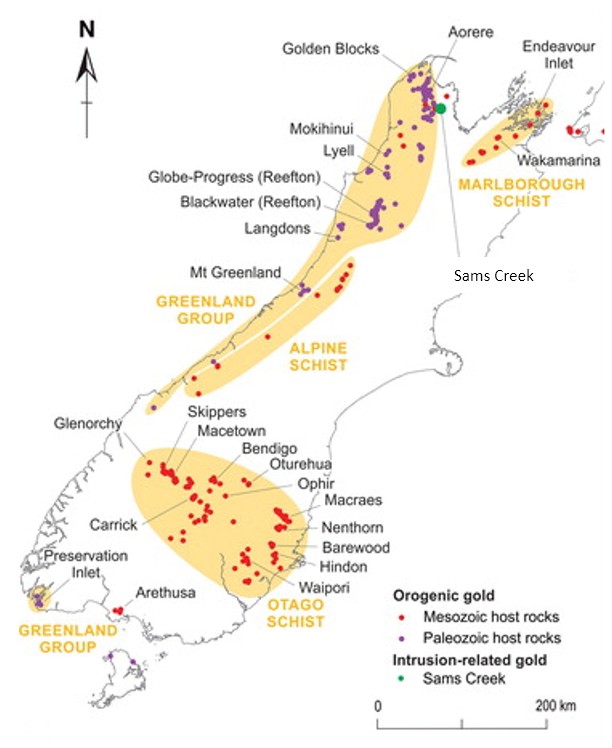

Some of the best gold discoveries do not happen in new jurisdictions. They happen in old ones that the market has stopped paying attention to.

New Zealand's Otago Gold District is a good example. It is not new. It is not speculative. And it is certainly not unproven. Yet outside of Australasia, very few investors could point to it on a map or name the companies quietly working there today.

That disconnect matters because the Otago region is a mining district that has already produced millions of ounces of gold, continues to do so, and is now seeing a new wave of modern exploration and development directly adjacent to operating mines. This is the kind of setup that historically produces meaningful discoveries, not because the geology is unknown, but because it has not been fully tested with modern tools.

One Canadian junior mining company has built a dominant exploration footprint across this district and is now advancing projects literally in the shadow of producing headframes.

About the Company

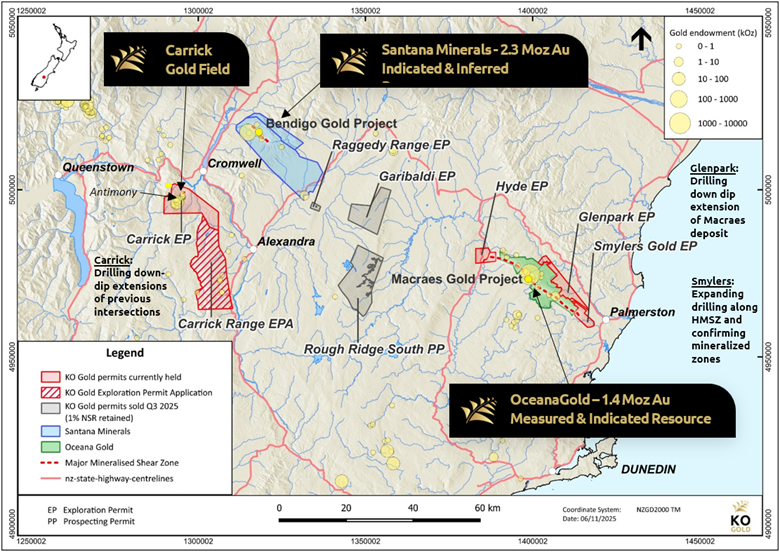

KO Gold Inc. (KOG:CSE) is a Canadian-listed junior exploration company trading on the Canadian Securities Exchange under the symbol "KOG." The company is focused exclusively on gold exploration in New Zealand's Otago Gold District on the South Island.

Unlike many early-stage explorers that scatter their efforts across multiple jurisdictions, KO Gold has taken a highly concentrated approach. The company controls a large land package in the Otago Gold District covering approximately 400 square km through four active exploration permits at Carrick, Hyde, Glenpark, and Smylers, all within close proximity to OceanaGold's active Macraes Gold Mine and near-term producer Santana Minerals' Bendigo-Ophir Project. In addition, KO Gold has an exploration permit application in the Carrick Range area awaiting final approval from the NZ government, located immediately south and contiguous with its Carrick permit. The Company also has a net smelter royalty (NSR) on three additional permits (Garibaldi, Raggedy Range, and Rough Ridge South) totaling 243 square km. This gives it exposure to multiple gold systems within a single, well-understood geological belt.

KO Gold's strategy is to identify and advance hard-rock orogenic gold targets, the same deposit style that underpins the district's historic and current production. Several of its projects are already drill-ready, while others represent longer-dated optionality across underexplored structural trends.

Understanding the Otago Gold District: a Proven Camp, Hiding in Plain Sight

The Otago Gold District is located on New Zealand's South Island and has a gold production history dating back to the mid-1800s. Early mining was dominated by high-grade alluvial and hard-rock discoveries, which helped build towns, infrastructure, and a mining culture that still exists today.

Modern production in Otago is anchored by the Macraes Gold Mine, operated by OceanaGold. Macraes is New Zealand's largest active gold mine and has produced more than five million ounces of gold since 1990 from a combination of open-pit and underground operations. It is a long-life, low-cost operation with existing mills, roads, power, and a skilled local workforce.

Geologically, Otago hosts classic orogenic gold systems developed along large regional shear zones within the Otago Schist Belt. These structures are extensive, laterally continuous, and capable of hosting multiple deposits along strike and at depth. Importantly, they are not single-deposit systems. They are district-scale structures.

This matters because Otago today looks a lot like other gold districts before their modern discovery cycles fully unfolded. The comparison often made by geologists working in the region is to West Africa's Birimian belts two decades ago: known gold, limited modern drilling, and enormous upside once systematic exploration began.

Today, several companies are active in Otago, but only a handful truly matter from a scale and influence perspective.

OceanaGold operates Macraes and remains the Otago Gold District's anchor producer, controlling approximately 146 square km of mining and exploration permits. It dominates production and infrastructure.

Santana Minerals is quickly advancing the Bendigo-Ophir Gold Project, including the Rise and Shine gold deposit, which hosts a multi-million-ounce gold resource and is undergoing a fast-track permitting process to become the next gold mine in the district within the next two years.

Multiple companies control substantial land positions across Central Otago, targeting similar hard-rock gold systems.

KO Gold controls approximately 400 square km across five permits (Including 210 square km under an exploration permit application) and additionally has an NSR on 243 square km across three permits. KO Gold sits in the top four of the largest exploration footprints in the district with respect to land position.

In practical terms, this means KO Gold is exploring where others are already mining, and where future mines are likely to be built. This is exploration in the shadow of the headframe, not greenfield speculation in the middle of nowhere.

The Smylers Gold Project: Exploring Beside a Mine That Built a Company

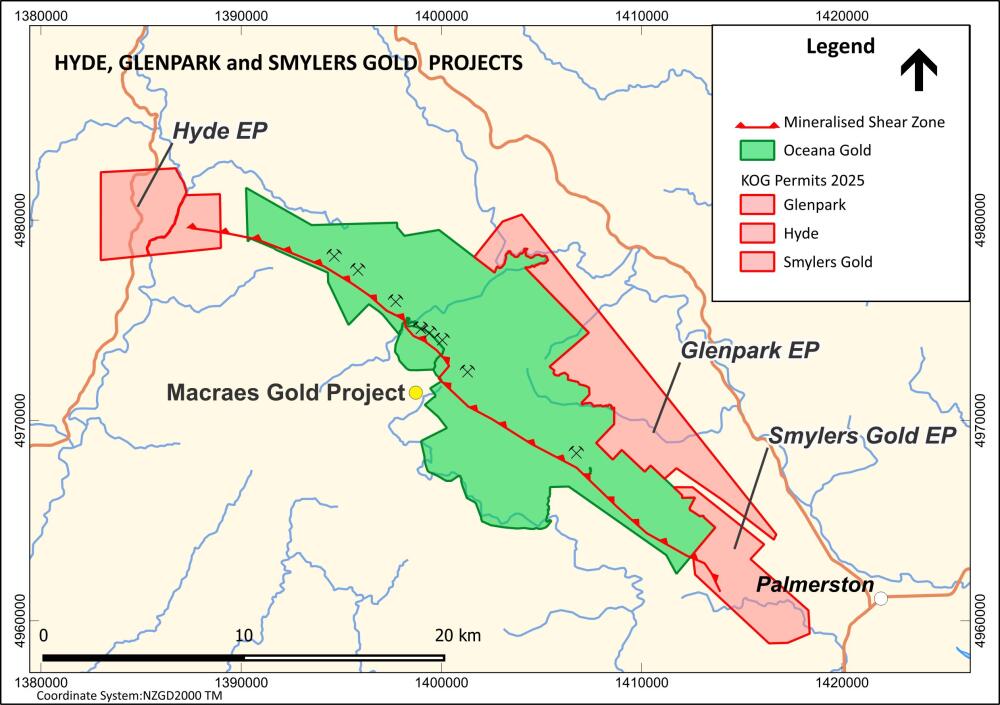

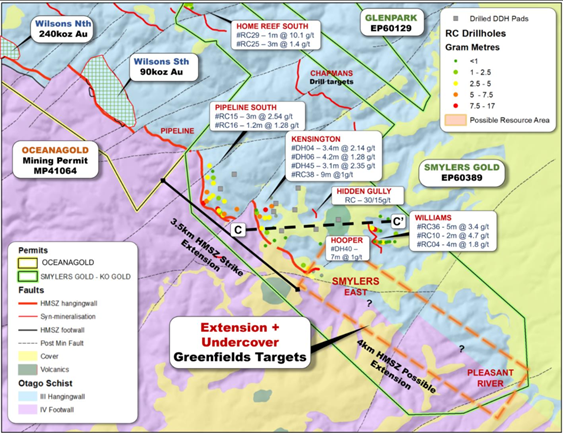

The Smylers Gold Project is KO Gold's most advanced and strategically important asset.

Smylers lies directly on strike from the Macraes Gold Mine along the Hyde-Macraes Shear Zone, a major gold-bearing structure extending for more than 30 km. Macraes itself was the asset that transformed OceanaGold from a junior into a mid-tier producer.

What makes Smylers compelling is not just its location, but the work already completed. Multiple drilling campaigns by prior operators and KO Gold have confirmed gold mineralization from surface to depth across several target areas. Every drill hole completed to date has intersected gold, a critical early signal in orogenic systems.

Reported drill intercepts include multiple multi-gram intervals over meaningful widths of over 10 meters, consistent with grades mined at Macraes. Mapping, soil geochemistry, geophysics, and drilling have now confirmed more than four kilometers of mineralized strike within the project area, with the system remaining open in multiple directions.

Recent results point toward the potential development of higher-grade ore shoots, the key building blocks of economic gold deposits in this style of system. The company's exploration thesis is straightforward: identify those ore shoots, demonstrate continuity, and let the scale of the system do the rest.

Management With Discovery and Mine-Building Experience

KO Gold Inc. (KOG:CSE) is led by a management and technical team with direct experience in discovering and advancing gold projects.

President and CEO Gregory Isenor is a Professional Geologist with more than five decades in the mining industry. He has been directly involved in discoveries that ultimately became mines, including projects in West Africa that were later acquired by larger producers.

Vice President of Exploration Paul Ténière is also a Professional Geologist who brings both hands-on exploration and mine-building experience and deep capital markets knowledge, having previously served as a Senior Listings Manager and mining expert at the TSX and TSX Venture Exchange. This combination matters in a public exploration company, where technical execution and disclosure discipline must go hand in hand.

The board includes individuals who have worked on globally significant gold and copper deposits that later became producing mines, adding credibility to the company's long-term vision.

Share Structure and Valuation Context

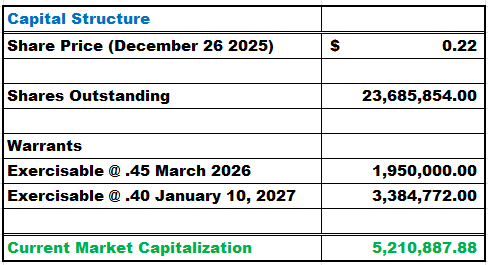

KO Gold Inc. (KOG:CSE) remains a micro-cap company with a modest share count and a market capitalization measured in single-digit millions of dollars. For a company controlling the largest exploration land position in a proven gold district with active production, that valuation stands out.

This is not unusual at this stage. Exploration stories in overlooked jurisdictions often remain mispriced until either drill results force a re-rating or a larger company decides the ground matters enough to secure it.

Technical Analysis

KO Gold's chart is showing the early signs of a meaningful trend change after a long corrective cycle.

The stock peaked last cycle near the CA$0.60 area, then entered a sustained decline that ultimately washed out into the mid to high teens. That downtrend was persistent and structural, with price spending most of the period below the 200-day moving average, which acted as overhead resistance and kept rallies contained.

What matters now is that the chart has stopped behaving like a downtrend. Instead of continuing to make lower lows, KO Gold has been building a base for months, holding above rising support and gradually absorbing supply. That basing action is exactly what you want to see in a junior that is trying to transition from "post-correction" into "early accumulation."

The most important near-term development is the recent surge in volume on the latest push higher. In small-cap explorers, volume is often the tell. When a stock lifts off support on expanding volume after a long base, it usually signals that new buying is stepping in with intent, not just day-to-day noise.

From here, the chart has clear and logical upside checkpoints.

The first technical objective is CA$0.30, which is the top of the current structure and the first major resistance band. A decisive close above CA$0.30, followed by continuation, would confirm a breakout and shift the trend from basing to advancing.

If that breakout holds, the next upside levels are CA$0.50 and CA$0.60. These are natural targets because they align with prior congestion and the earlier cycle's reaction zones where sellers previously took control. In other words, they are levels where the market will likely pause, reassess, and potentially consolidate before making the next move.

On a bigger-picture basis, the chart supports a longer-term target near CA$0.90. That level reflects the larger cycle potential if the base resolves higher and the market begins to price the company for meaningful exploration success. In practical terms, CA$0.90 is not just a chart target; it is the type of move you typically see when a micro-cap explorer transitions from "unknown" to "discovered and owned."

Risk is also becoming more defined. As long as price holds above the rising support line and the base lows, the structure remains constructive. A breakdown back into the base would delay the bullish thesis, but right now the weight of evidence supports a developing uptrend with improving momentum.

In summary, KO Gold is setting up as a speculative breakout candidate. The base is established, volume has started to confirm, and the chart has clearly defined targets at CA$0.30, CA$0.50, CA$0.60, with a big-picture objective near CA$0.90 if the next leg is supported by catalysts.

New Zealand is One of the Best Mining Jurisdictions in the World

The Otago Gold District is re-emerging as one of the most compelling gold investment stories in the Asia-Pacific region, supported by proven production, advanced development projects, and a materially improved permitting environment.

Otago hosts OceanaGold's Macraes Mine, New Zealand's largest gold operation with more than three decades of continuous production, clearly demonstrating the district's ability to support large-scale, long-life gold projects. Building on this foundation, new development and district-scale exploration initiatives — most notably the Bendigo-Ophir gold project and extensive permit holdings by KO Gold — highlight significant untapped upside beyond historic mining areas.

Importantly, the New Zealand government introduced the Fast-track Approvals Act in early 2025, dramatically streamlining permitting for nationally significant resource projects. This framework reduces approval timelines, increases regulatory certainty, and enhances project visibility for developers and investors alike — marking a major shift in New Zealand's approach to responsible mineral development.

Reinforcing this momentum, New Zealand now ranks 12th among the top global mining jurisdictions on the Fraser Institute Investment Attractiveness Index, reflecting improved policy perception combined with strong geological prospectivity.

In summary, a proven gold district, accelerating permitting, and rising global competitiveness position the Otago Gold District as a high-quality jurisdiction for the next generation of gold discoveries and developments.

Conclusion: A Speculative Buy with Discovery Leverage

KO Gold Inc. (KOG:CSE) is not an idea built on theory. It is built on geography, structure, and history.

The Otago Gold District has already produced millions of ounces of gold at Macraes and continues to do so today with a new gold mine opening soon at Bendigo-Ophir. The same structures that fed past and current mines extend directly onto KO Gold's ground. In fact, no other explorer controls as much of that ground.

For investors willing to accept exploration risk in exchange for discovery leverage, KO Gold offers exposure to a rare combination: land dominance, proximity to operating mines, experienced management, and a district that the global market still barely understands.

On that basis, KO Gold is considered a Speculative Buy for investors seeking asymmetric upside tied to gold discovery in a very stable, mining-friendly jurisdiction.

For additional information, maps, and technical details, readers can visit the company's website at www.kogoldnz.com

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of KO Gold Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.