Precious metals have soared to unprecedented heights lately. China's January 1, 2026, mandate requiring silver export permits, given their 70% global processing share, could detonate a financial grenade akin to their REE chokehold. Something's exploding behind the scenes. On December 31, the Fed pumped about US$75 billion into repos and US$106 billion into reverse repos, eclipsing 2008's scale.

My mentions of the invaluable Daily Sentiment Indicator for gold and silver have aided readers. I urge serious investors to negotiate access with Jake. It's the ultimate sentiment gauge I'm aware of. Last Friday, Gold's DSI was 55, silver's 67, and copper's 66 - no imminent peak signs. But recall gold's plunge from US$188 in late 1974 to US$108 in September 1976 during the 1971-1980 bull run. Vicious corrections can punctuate the most rampant bull markets.

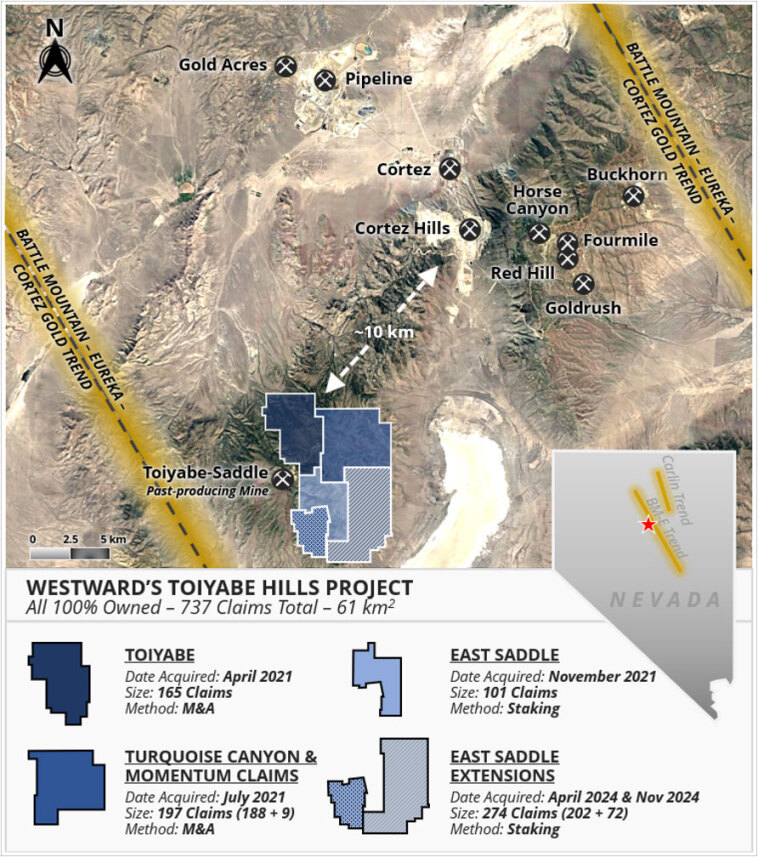

I've eagerly awaited months to spotlight Westward Gold Inc. (WG:CSE; WGLIF:OTC; IM50:FSE), given its immense potential. Their Toiyabe Hills gold project in Nevada seeks a proverbial needle in a haystack. But it's a golden needle in elephant country, encircled by bountiful haystacks. At current prices, a one-gram gold needle fetches $139. I've had extensive discussions with Chairman Quinton Hennigh about the project's prospects.

The Toiyabe Hills lie a mere 10 km from Cortez Hills, part of Barrick Mining Corp.'s (ABX:TSX; B:NYSE) Cortez mine, yielding about one million ounces ($4 billion+) annually. Placer Dome, the 1991 JV operator, struck Pipeline while drilling a condemnation hole. They replicated this in 2002, unearthing Cortez Hills via another condemnation hole. Curiously, pre-loading leach pads with ore makes drilling underneath cheaper. Placer's 2004 Cortez Hills drilling exposed a major 45 g/t gold structural corridor over 400 feet. Westward Gold is drilling a scant six miles from Cortez Hills.

Westward Gold's team boasts some of the world's preeminent Nevada Carlin-style geologists. They're convinced they're on the cusp of a momentous find. I've suggested to Quinton that conventional exploration holes may squander resources, and they should proceed directly to condemnation holes. He often disregards me.

On November 5, 2025, Westward Gold reported 10.7 meters of 0.94 g/t at their Campfire project within Toiyabe. Quinton noted similar assays have preceded Carlin-style breakthroughs. Westward must now pinpoint the structural system. December 22 brought results from three more phase 1 holes totaling 7,163 meters of RC drilling. Hole CF25-07 yielded another intriguing gold whiff with 3.1 meters of 0.80 g/t. I believe the company is much nearer to a 100 gram/meter intercept than the market anticipates. Quinton would deem that a discovery hole.

Four holes remain unreleased. Hole 10 appears promising. The company holds CA$5 million, sufficient for 8-10 holes. 2025's drilling window has closed until June. The company is amenable to a CA$5 million JV raise, and I suspect discussions are underway. At US$4,200 gold, your backyard soil is likely economical.

Friday's close valued the company at around CA$29 million. A 100-gram/meter hole could catapult it ten to fifteen-fold within six months. Mathematically and psychologically, the stock offers superb value. It will either evaporate or skyrocket. They're in elephant territory, portending a substantial discovery.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Westward Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Westward Gold Inc. and Barrick Mining Corp.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Westward Gold Inc. My company has a financial relationship with Westward Gold Inc. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.