The TSX Venture Exchange (CDNX) is often dismissed as volatile or purely speculative. It functions as a long-cycle barometer of risk appetite and capital availability, particularly in sectors where discovery and development drive value creation.

Historically, the CDNX has:

- Traded at a premium to gold during expansionary cycles

- Re-rated sharply following prolonged periods of capital starvation

- Delivered its strongest performance after senior indices and underlying commodities had already moved

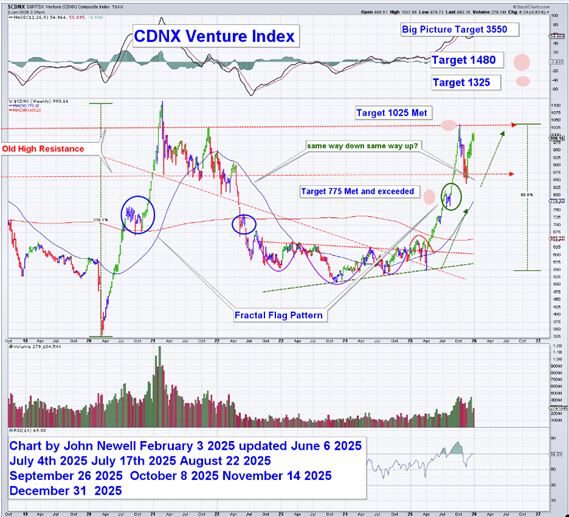

The long-term charts I've been maintaining show that the CDNX has spent more than a decade forming a broad base following the 2011–2012 breakdown. That base now appears to be resolving.

Key observations from the long-term structure include:

- The CDNX has already cleared its first major resistance zones near 775 and 1,025

- The current structure supports intermediate targets in the 1,325–1,480 range

- Longer-term measured moves project toward 3,500+ if the full cycle plays out

Importantly, these targets are not derived from short-term momentum indicators. They are based on time, symmetry, and historical valuation resets that have defined prior CDNX cycles.

The Valuation Disconnect: Metals vs. Miners

Gold trading above $4,000, Silver above $70.00, and improving base metal prices should, in theory, have already pulled junior equities meaningfully higher. They have not, and that disconnect is the opportunity.

This gap exists because:

- Capital exited the sector for more than a decade

- Research coverage collapsed

- Liquidity concentrated in mega-cap growth and passive vehicles

- Junior companies diluted heavily simply to survive

The result is a sector with real assets, improving fundamentals, and compressed equity valuations. From a charting perspective, this is exactly the environment where long bases form and where subsequent moves tend to be disproportionate once capital returns.

Why 'Overbought' Is the Wrong Lens

A common objection at this stage is that parts of the market appear overbought. On short-term indicators, that is often true. On long-term ones, it is largely irrelevant.

Every major small-cap and resource bull market has followed the same pattern:

- Early strength feels uncomfortable

- Pullbacks shake out weak hands (that's why they call it a Bull Market, it bucks off the weak hands, and most riders can't hold on more than 8 seconds!)

- Primary trends continue regardless

The CDNX charts show that prior secular advances did not begin from ideal sentiment or perfect technical conditions. They began when capital rotated reluctantly, and valuations were still depressed. From that standpoint, the current move is better described as a reawakening, not excess.

Why Junior Mining and Critical Minerals Matter

Small-cap equities do not move as a homogeneous group. Leadership matters.

Junior mining and critical minerals occupy a unique position because they:

- Sit at the front end of the supply curve

- Benefit disproportionately from rising commodity prices

- Offer nonlinear returns through discovery and re-rating

- Remain outside the focus of most large institutions

Many of the companies I chart today once traded at multiples of their current valuations during prior cycles, often with less advanced assets than they hold now. The charts reflect that history.

What This Means for Portfolio Strategy

From my perspective, the CDNX is not signaling the end of a move, but the beginning of a regime change.

For firms focused on identifying under-followed opportunities before they are widely recognized, this is precisely the environment where disciplined technical work adds value:

- Identifying long bases before breakouts

- Distinguishing false moves from structural shifts

- Prioritizing asymmetry over momentum

- Staying aligned with long-term trends through volatility

This is where technical analysis complements fundamental work, particularly in sectors where narrative tends to arrive after price.

Applying the Framework at the Company Level

I've been applying this same long-base, valuation-reset framework to individual junior companies that were once far more highly valued, then spent years repairing balance sheets, advancing assets, and rebuilding investor confidence.

Recent examples include Lux Metals Corp., Silver North Resources Ltd., and Triumph Gold Corp.

Each operates in established mining districts with tangible assets yet continues to trade at market capitalizations that reflect the prior cycle rather than the current commodity backdrop. In all three cases, the charts show multi-year bases evolving into higher lows, improving volume, and early-stage breakouts that closely mirror the broader CDNX structure. These are not momentum trades. They are examples of how patient capital can position ahead of a re-rating as fundamentals, technicals, and sector capital flows begin to align.

Lux Metals Corp.

As shown in the accompanying chart, Lux Metals Corp (LXM:TSXV; BBBMF:OTCMKTS) illustrates the type of junior that often responds early as the TSX Venture Index begins to turn higher.

After several years of base-building, the shares have broken above long-standing resistance and are now working through a classic point-of-recognition phase, supported by rising volume and improving trend structure.

Fundamentally, Lux has consolidated a large, high-grade gold project in Quebec's James Bay region, located on the same geological architecture that hosts the Éléonore Mine. With more than 52,000 metres of historical drilling and strong infrastructure, the company combines a credible asset base with a chart that reflects early-stage re-rating potential.

Silver North Resources Ltd.

Another example is Silver North Resources Ltd. (SNAG:TSX.V; TARSF:OTCQB).

After several years of consolidation, the stock has recently transitioned into a technical breakout phase, coinciding with steady exploration progress at its 100%-owned Haldane Silver Project in the Keno Hill District of Yukon.

With a tight share structure, multiple discovery-driven catalysts, and a chart that has shifted decisively from resistance to momentum, Silver North reflects the type of underfollowed junior that often responds early as risk capital begins flowing back into the CDNX.

Triumph Gold Corp.

A third example is Triumph Gold Corp. (TIG:TSX.V; TIGCF:OTCMKTS), which embodies the early-stage upside still available on the TSX Venture Exchange.

After several years consolidating its share structure and advancing the technical understanding of its 100%-owned Freegold Mountain Project in Yukon, Triumph is now breaking out — both technically and fundamentally.

With more than two million gold-equivalent ounces in current resources and exposure to copper, silver, and tungsten, the company is emerging at a time when the broader CDNX is only beginning to rotate back into exploration stories with scale, infrastructure, and optionality. Updated technical charts suggest a multi-year base has been completed, positioning Triumph with a structural tailwind as investor appetite returns.

Closing Thought

The strongest small-cap cycles do not begin when participation is broad or conviction is high. They begin when capital quietly returns to areas that have been ignored long enough to reset expectations.

The CDNX charts suggest we are at that point now.

Junior mining and critical minerals are not late. They are still catching up, and historically, that is when the most durable returns are generated.

I look forward to discussing how this framework can be applied systematically across under-recognized small-cap opportunities.

For reference, my original CDNX article can be found here.

My previous article on Lux Metals can be found here.

My previous article on Silver North can be found here, and my previous article on Triumph Gold can be found here.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- John Newell: I, or members of my immediate household or family, own securities of: Triumph Gold and LUX Metals. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.