A very Happy New Year to you.

Today, New Year's Eve, is the final day of the tax year in Canada and North America, so it is the final day of the selling pressure created by tax-loss selling.

To us opportunists, that means it's likely the last chance to get positioned at tax-loss driven, rock bottom prices.

I just wanted to update you on the state of the play in the opportunities I've identified — one has moved quite sharply already.

But also several of you have asked for my take on the incredible action we have been seeing in the silver markets — so we'll start with that, because, silver, oh my goodness.

Monday saw the largest daily swing in silver history: from a high of $84 to a low of $70 is almost 20%. Even by silver's standards, that is something.

I'm reading about unprecedented shortages, premiums in Shanghai, metals exchanges unable to deliver, banks ranging from JP Morgan to Goldman Sachs caught in a short squeeze that is going to send them under, margin requirements about to be changed, hoarding in China along with export bans, "we are at a crisis point," and more. Some of it is true. Most of it isn't.

The boards are alive with the chat of silver. Everybody's raving about it. I don't know how many times I have heard, "this time it's different.'

Part of me agrees. This time, something does feel different.

But never forget: it's silver. It has the potential to disappoint like no other metal, and it has the capacity to create delusion.

This is a proper frenzy, folks. They don't usually end well. But they do end. The problem is that nobody knows quite when.

I have to say that while silver is of course massively overbought, I don't think we are anywhere near the end of the broader bull market in critical metals. In fact, I think we have barely two or three years in.

And yet silver is already so darn high!

One scenario is that we get an interim correction. The heat comes out of the market, and it trades sideways for a few months, until the general speculative frenzy is dissipated. That correction began this week.

Another is that we have just seen the top, and that's it for another ten or 20 years.

Another is that the blow-off top keeps on blowing off.

I favor scenario one. As I say, I think there is a strong likelihood that we are in a secular bull market for critical metals.

But with a frenzy like the one we are seeing, it still pays to be a bit defensive.

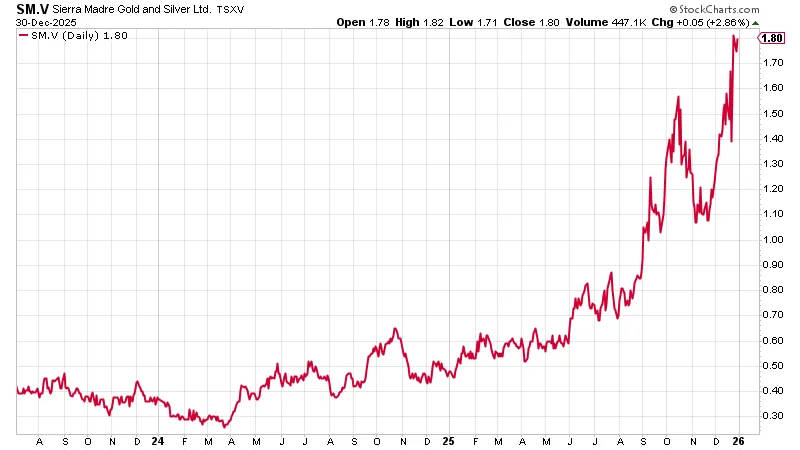

Our top pick in silver, Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX), has been great.

The company is growing nicely and solidly, expanding in just the right way at just the right moment.

How about that for a win?

We had to wait a while, and we spent over a year underwater, but it has come good.

And there is plenty left in the tank as the company is expanding in just the right way at just the right time.

I sold a little on the way up, out of discipline, as I said I would — and something I of course now regret doing — but I still have plenty, so if silver keeps on rising, I am happy.

But back to silver. The cup-and-handle pattern I identified is still in play. It projected to a silver price in the mid-90s, and by George, on Friday, we were only $10 or so off that. It's all happening so fast — such is the way with frenzies. But "if you can keep your head when all about you are losing theirs" and all of that.

The cure for high prices is high prices. Silver just needs to stay around these levels, and a lot of people will start cashing in the cutlery, if they aren't already, thereby increasing supply. The recycling business also starts to look very attractive, something we are well-positioned for, as does silver mining itself, and both will lead to increased supply.

I've got some bars somewhere I bought 15 years ago. I'm thinking I should try and find them, and sell them. If I'm thinking that, others are too. It all points to increased supply.

Nothing lasts forever with commodity prices, and currently, the greater fool theory is in play.

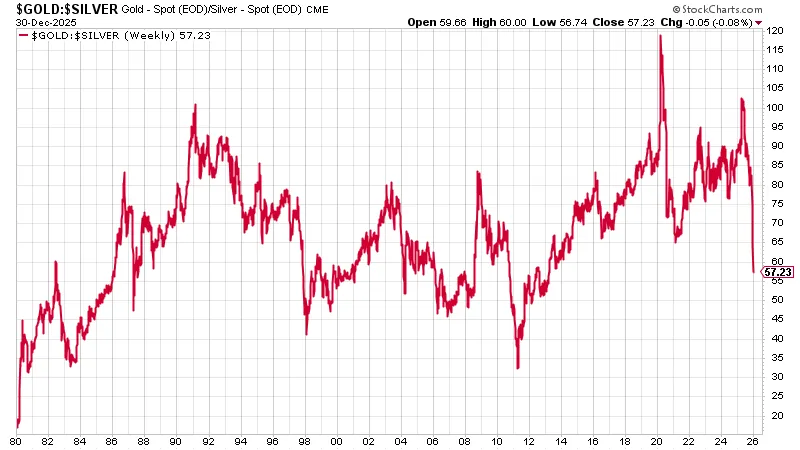

Here's 50 years of the gold-silver ratio. When silver had a role as money - it does not now and don't kid yourself that this will return, it won't: silver was never a store of wealth in the way that gold was, and we are never going to use it as medium of exchange, except in extremis, because currency is now digital — but when silver was money, that ratio was 15, roughly reflecting the amount of each metal there is in the earth's crust (there is 15 times more silver than gold).

But such sudden falls in the ratio as we have seen in the last three months do not last, unless this time it's different.

The ratio rarely goes beneath 50, and when it does, it doesn't stay there long.

| Want to be the first to know about interesting Silver and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver.

- Dominic Frisby: I, or members of my immediate household or family, own securities of: Sierra Madre Gold and Silver. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.