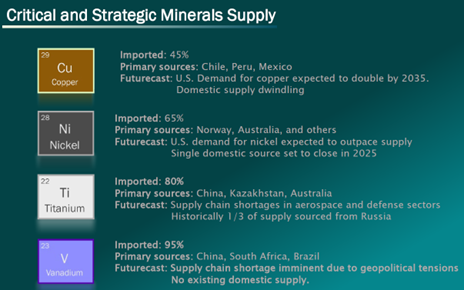

Green Bridge Metals Corp. (GRBM:CSE; GBMC:OTCQB) is a junior exploration company focused on building a portfolio of North American critical mineral assets tied to copper, nickel, titanium, and vanadium.

These are metals that sit at the center of electrification, infrastructure renewal, and defense supply chain priorities in both the United States and Canada.

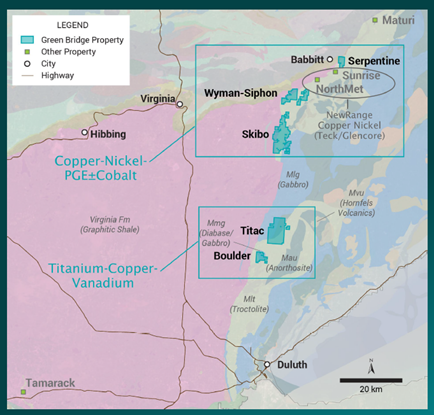

The company has quietly assembled a district-scale land position spanning Northern Minnesota's Duluth Complex and Northern Ontario. What sets Green Bridge apart at this stage is not just the commodity mix, but the combination of scale, jurisdiction, infrastructure, and a defined technical pathway that includes existing mineral resources, permitted drill targets, and a clear progression toward development decisions.

The timing is notable. While the market remains selective with exploration equities, capital has begun to gravitate toward companies that can demonstrate realistic development potential in Tier One jurisdictions. Green Bridge's Minnesota assets, led by the Serpentine project, are being positioned to meet that bar.

About the Company

Green Bridge Metals describes itself as a North America-focused critical minerals company with a strategy centered on acquiring projects that already have historical work, known mineralization, and a technical foundation. The goal is to reduce early-stage exploration risk while preserving meaningful upside through expansion drilling and resource upgrades.

As outlined in the December 2025 corporate presentation, the company's portfolio includes five critical mineral projects, three of which already host mineral resources. The primary focus is on copper and nickel, with additional exposure to titanium and vanadium, metals that are increasingly classified as strategic due to supply chain constraints and limited domestic production in North America.

Green Bridge operates exclusively in Canada and the United States, jurisdictions that benefit from established mining frameworks, infrastructure, and growing federal support for domestic critical mineral development.

Key Property that could revalue the Company

Serpentine Project, Duluth Complex, Minnesota:

The Serpentine copper-nickel project in northern St. Louis County, Minnesota, is the cornerstone asset and the primary near-term value driver for Green Bridge Metals.

According to the company's technical disclosures, Serpentine hosts a large-scale magmatic copper-nickel sulphide system with both Indicated and Inferred mineral resources. The current estimate outlines approximately 21.6 million tonnes of Indicated material grading 0.69% copper equivalent and approximately 280 million tonnes of Inferred material grading 0.53% copper equivalent. Importantly, platinum group elements were not included in the historical estimate and represent potential future upside

Serpentine is located along trend with major Duluth Complex deposits, including NewRange's NorthMet and Sunrise projects. NorthMet has been designated a FAST-41 project by the U.S. government, underscoring the strategic importance of the district for domestic critical mineral supply.

From a development perspective, Serpentine benefits from existing infrastructure that many copper juniors lack. The project is accessible by paved roads, rail, and power, and sits within a region with a long history of mining and skilled labor. Green Bridge has already secured permitted drill pads for the 2025–2026 season, providing a clear path toward infill drilling and advancement toward a Pre-Feasibility Study

The company has outlined a 25,500-metre infill drill program, along with metallurgical, environmental, and engineering work, designed to improve grade continuity, expand higher-grade zones, and support economic studies. Management has indicated that Serpentine is being positioned for a potential PEA as early as 2026, subject to results and market conditions.

Management and Technical Team

Green Bridge Metals Corp. (GRBM:CSE; GBMC:OTCQB) is led by David Suda, President, CEO, and Director, who brings more than 15 years of capital markets experience, including senior roles at Beacon Securities and Paradigm Capital. His background combines capital raising, corporate strategy, and sustainability-focused investing, which aligns with the company's critical minerals mandate.

The board includes directors with deep experience in finance, mining, and asset development. Notably, Robert G. Krause, a geologist with over 40 years of exploration experience across the Americas, adds strong technical oversight, while other directors bring expertise in accounting, transactions, and long-term asset management.

On the technical side, the company is supported by a Minnesota-based team with extensive experience in the Duluth Complex. Advisors and geologists associated with Green Bridge have been directly involved in regional exploration, metallurgy, and resource development, which is particularly important for complex polymetallic systems like those at Serpentine and TITAC.

Share Capitalization

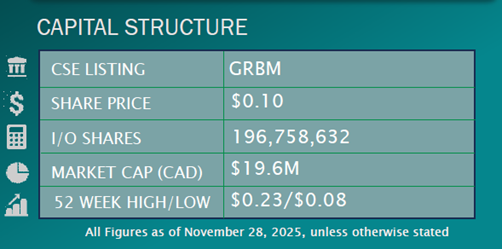

Based on the corporate presentation, Green Bridge Metals Corp. has approximately 196.8 million shares outstanding, with a market capitalization of roughly CA$19.6 million at a share price of CA$0.10, as of late November 2025.

The company completed a CA$6 million financing, which management has described as bringing in new institutional and strategic investors. This funding is significant because Green Bridge's growth strategy is execution driven. Advancing Serpentine through infill drilling, metallurgy, and economic studies requires sustained capital, and the company now appears positioned to fund meaningful work programs without immediate dilution pressure.

Technical Analysis

The updated GRBM chart continues to reflect a classic junior resource cycle, but with an added layer of insight that strengthens the setup.

Following a sharp advance in 2024 that culminated in a spike near the CA$0.50 level, the stock entered a prolonged corrective phase that lasted most of 2025. That correction unwound speculative excess and forced price into a broad basing process, which is often a necessary precondition for a sustainable next move.

As of December 19, 2025, the GRBM chart shows it is trading near CA$0.09. Price has stabilized after a steady decline, and selling pressure appears to have diminished. The 50-day moving average, currently near CA$0.11, and the 200-day moving average, near CA$0.14, are both flattening. This loss of downside slope typically marks the transition from a downtrend to a neutral or basing phase.

Momentum indicators support that view. RSI is holding in the high-40s, neither overbought nor oversold, which is consistent with consolidation rather than renewed weakness. MACD remains compressed around the zero line, a common condition when a stock is coiling ahead of a directional move.

What makes the current setup more compelling is the potential fractal pattern highlighted on the chart. The circled price action from early 2024 shows a period of sideways consolidation and higher lows that preceded the prior upside breakout. The current structure, outlined on the right side of the chart, displays a similar rhythm: tightening price ranges, reduced volatility, and gradual stabilization near long-term support.

Fractals are not predictive on their own, but when they appear in conjunction with basing behavior, flattening moving averages, and improving momentum, they can offer a useful roadmap. In this case, the implication is that GRBM may be transitioning from correction into an early accumulation phase, like the one that preceded the last advance.

Your chart also marks a clear Point of Recognition (POR) zone in the mid-teens. A decisive move through approximately CA$0.14–CA$0.16, ideally accompanied by expanding volume, would signal that the base has resolved to the upside and confirm a trend change.

If that confirmation occurs, the upside targets remain well defined. The first objective near CA$0.20 represents an initial retracement and logical resistance level. Higher targets at CA$0.30 and CA$0.40 would likely require a combination of favorable market conditions and company-specific catalysts, particularly continued progress at the Serpentine project.

On the downside, the most important risk level remains the recent base near CA$0.08. A failure at that level would suggest the basing process is incomplete and that additional time may be required before a sustained advance can develop.

Conclusion

Green Bridge Metals Corp. (GRBM:CSE; GBMC:OTCQB) offers a combination that is increasingly rare among junior explorers: exposure to multiple critical minerals, projects located in Tier One jurisdictions, existing mineral resources, and a defined pathway toward development.

Serpentine provides the scale and infrastructure necessary to attract broader market attention if drilling and technical work continue to deliver. From a technical perspective, the stock appears to be completing a long corrective phase and building a base that could support a new advance as catalysts emerge.

For investors who understand the risks associated with junior exploration and early-stage development, Green Bridge Metals is considered a Speculative Buy, with confirmation improving on a breakout through the mid-teens and upside potential toward CA$0.20, CA$0.30, and CA$0.40 under favorable market and company-specific conditions.

Investors looking for more information can visit the company's website at www.greenbridgemetals.com.

| Want to be the first to know about interesting Critical Metals and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Green Bridge Metals Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.