Some business models quietly compound value while the market focuses elsewhere. The royalty model is one of them, and in precious metals, it has historically rewarded patience. That dynamic may be setting up again as silver fundamentals tighten and investors begin to look for leverage with less operating risk.

Silver Crown Royalties Inc. Silver Crown Royalties Inc. (SCRI:CBOE; SLCRF:OTCQX; QS0:FSE) is positioning itself as a pure-play silver royalty company at a time when silver is re-emerging as both a monetary and industrial metal. With an early-stage portfolio, visible growth in attributable ounces, and a technical chart starting to turn higher, the setup is becoming increasingly interesting.

About the Company

Silver Crown Royalties Inc. is a silver-focused royalty company designed to capture value from silver that is often treated as a byproduct or co-product by operators. Instead of owning mines or taking on operating risk, the company provides capital in exchange for contractual rights to future silver deliveries.

What differentiates Silver Crown is its focus on single-element silver royalties, registered on title, with minimum delivery obligations. This structure is intended to provide clearer visibility on future silver ounces while allowing operators to unlock value from silver that might otherwise go unrecognized. The company is building a diversified portfolio across Tier 1 jurisdictions in the Western Hemisphere, with an emphasis on disciplined capital deployment and long-term value creation.

Why Silver, Why Now?

Silver is entering a period where its dual role as both a monetary metal and an industrial input is becoming increasingly important. On the monetary side, rising global debt levels and ongoing currency debasement continue to support demand for hard assets.

At the same time, silver's industrial use is accelerating, driven by solar energy, electrification, and advanced electronics, where silver is often irreplaceable. With mine supply struggling to keep pace and silver increasingly produced as a byproduct rather than a primary metal, the setup points toward tighter fundamentals. Historically, these conditions have preceded periods where silver outperforms both gold and the broader precious metals complex.

Management and Board

Silver Crown is led by Peter Bures, Founder, Chairman, and CEO, a mining engineer with more than 25 years of experience across mining operations, capital markets, and royalty structures. His background spans equity research, portfolio management, and corporate development, giving him a strong understanding of both geology and capital allocation.

The broader team brings a mix of capital markets, legal, technical, and operational experience, with leadership backgrounds across royalty companies, mining operators, and financial institutions. The focus is clearly on building a scalable royalty platform rather than pursuing short-term production risk.

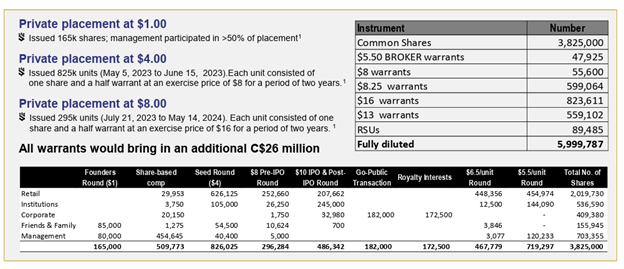

Share Structure

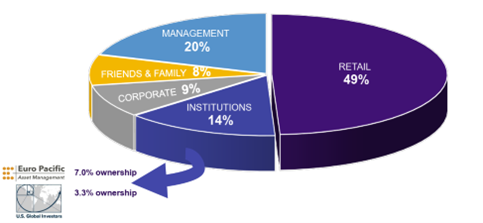

Silver Crown Royalties Inc. maintains a relatively tight capital structure for a royalty company at this stage. As of late October 2025, the company had approximately 3.8 million shares outstanding, with roughly 6.0 million shares fully diluted, implying a market capitalization in the low-$20 million range at recent prices.

Management ownership is meaningful and aligns interests with shareholders. Insider participation in prior financings and open-market purchases adds an additional layer of confidence for long-term investors.

Technical Analysis

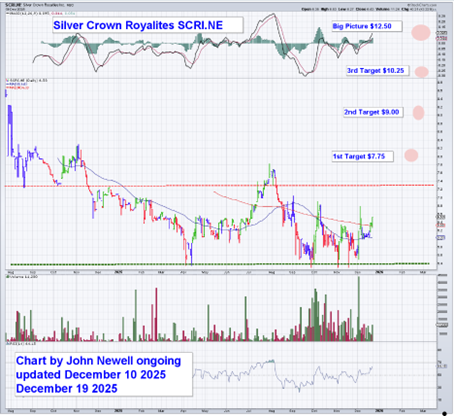

The chart of Silver Crown Royalties Inc. is showing signs of a constructive turn after a prolonged corrective phase. Following the 2024–2025 decline, the stock has been building a base marked by higher lows and improving volume, suggesting accumulation rather than distribution.

Price has moved back above key moving averages, and momentum indicators are trending higher without reaching overbought levels. A key resistance zone sits near the mid-CA$7 range. A sustained move above this level would confirm the breakout and open the door to the upside targets outlined on the chart:

- First target: CA$7.75

- Second target: CA$9.00

- Third target: CA$10.25

- Big picture target: CA$12.50

From a market technician's perspective, this is the type of setup that often precedes a broader re-rating when fundamentals and sentiment begin to align.

Conclusion

With a differentiated silver royalty model, experienced leadership, a growing portfolio of silver-linked cash flow, and a chart that is starting to resolve higher, Silver Crown Royalties Inc. stands out as a compelling speculative opportunity in the silver space. At current levels, we are issuing a Speculative Buy rating at ~ CA$6.50.

It's still early, but royalty companies are often built quietly before the market fully appreciates their leverage. For investors looking for exposure to silver through a royalty structure rather than direct mining risk, Silver Crown deserves a close look.

Investors who want to follow upcoming exploration plans and corporate updates can find more information at the company's website here: www.silvercrownroyalties.com

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver Crown Royalties Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver Crown Royalties Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.