Every bull market has a handful of junior companies that quietly rebuild while few are paying attention. They consolidate, simplify their story, acquire real assets, and wait patiently for the market cycle to turn. When that recognition finally arrives, the move can be sudden and meaningful.

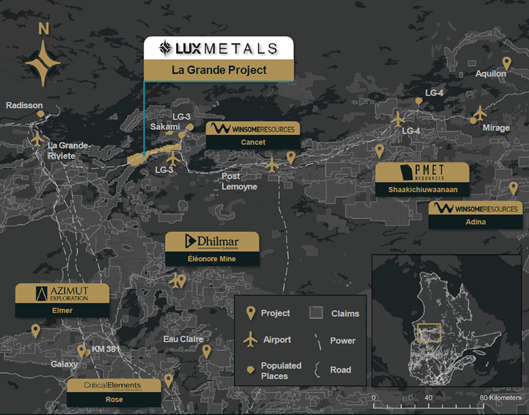

That may be what is beginning to unfold at Lux Metals Corp (LXM:TSXV; BBBMF:OTCMKTS), a junior gold exploration company that has recently repositioned itself around a high-grade gold system in Quebec's James Bay region. Formerly known as Huntsman Exploration, the company has completed a corporate reset and is now centered on its newly acquired La Grande Gold Project, an asset with real scale, excellent infrastructure, and an extensive high-grade drill database.

With gold holding near historic highs and early signs of life returning to the TSX Venture Exchange, Lux is one of those charts and stories that is starting to matter again.

About the Company

Lux Metals Corp. is a TSX Venture–listed exploration company focused on advancing high-quality Canadian gold assets.

The company's flagship asset is the La Grande Gold Project in James Bay, Quebec, complemented by the earlier-stage Lux Lake Project in Saskatchewan.

La Grande is a large, district-scale land package totaling more than 15,000 hectares and extending roughly 40 kilometers along a prospective Archean greenstone belt. By northern Quebec standards, the project benefits from excellent infrastructure, including all-season road access and nearby hydroelectric power. Importantly, it is located in proximity to producing and past-producing gold operations, including Newmont Corp.'s (NEM:NYSE; NGT:TSX; NEM:ASX) Éléonore Mine.

Lux's strategy is straightforward. The company is consolidating a proven gold system, applying modern structural and geological modeling, and advancing the project toward a new phase of drilling aimed at expanding known high-grade zones while testing underexplored extensions across the broader property.

The La Grande Gold Project: A Proven High-Grade System

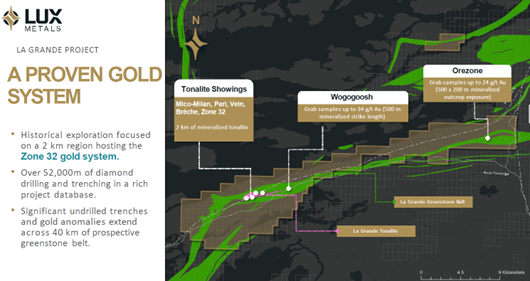

The La Grande Project is not a grassroots exploration play. Historical operators completed more than 52,000 meters of diamond drilling, generating a substantial technical database that clearly demonstrates the presence of a robust gold system.

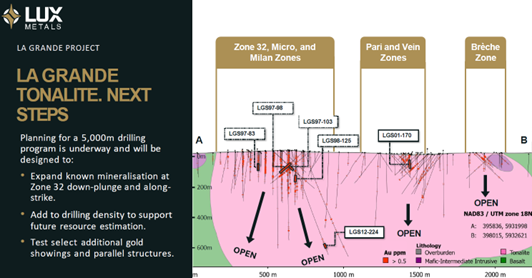

The standout feature of the project is Zone 32, a high-grade, intrusion- and shear-hosted gold zone developed within the La Grande tonalite. Zone 32 has been drilled over approximately 600 meters of strike and to depths exceeding 350 meters and remains open in all directions.

Historical drill results include long, continuous intervals of strong grade, highlighted by:

- 83.8 meters grading 7.95 g/t gold

- 38.5 meters grading 4.32 g/t gold

- 36.0 meters grading 3.37 g/t gold

Multiple sub-vertical veins, in places up to approximately 30 meters wide, have been identified from surface to depth. This points to a structurally controlled system with meaningful scale and continuity. Beyond Zone 32, additional showings and parallel structures extend across the broader land package, offering district-level upside that has not yet been systematically tested with modern exploration techniques.

Lux is currently completing data verification and target refinement work. Planning is underway for a 5,000-meter drill program designed to expand known mineralization, improve drill density within Zone 32, and test new targets ahead of potential future resource definition.

A Wider Historical View of the Area

On the reference picture above, readers can see an important historical data point that often gets overlooked: La Grande's inclusion in the broader James Bay gold discovery pipeline. A presentation from Sirios Resources highlights La Grande as hosting a historical gold resource of approximately 400,000 ounces, placing it alongside other known deposits in the region and confirming that this is not a conceptual exploration idea, but part of a proven gold district.

The project sits along the margins of the Opinaca Geological Subprovince, which is considered highly prospective for gold deposits (such as the world-class Elenore Gold Mine and Cheecho Gold Deposit), and is in the same greenstone belt as Plex and Corvet Est. While this historical estimate is not compliant with current NI 43-101 standards and should be treated as conceptual in nature, it reinforces the scale potential of the system and helps explain why Lux's focus on data verification, modern structural modeling, and step-out drilling could unlock meaningful upside from a project that has seen limited systematic exploration in over a decade.

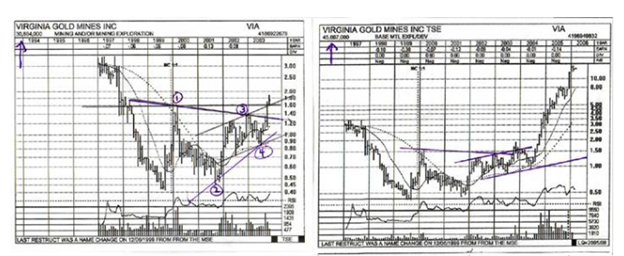

Reflections of Past Discoveries

One of the enduring lessons in junior exploration is that the biggest upside often comes from companies working ground that has been overlooked, dismissed, or simply ignored while capital and attention chase the headline discovery next door. The historical charts of Virginia Gold Mines and Great Bear Resources are good reminders of how quickly that perception can change.

In both cases, early skepticism gave way to powerful re-ratings once the market recognized that these companies were operating within the same geological systems as major discoveries, just earlier in the cycle. At the time, most investors were focused on the Éléonore discovery and later the Éléonore Mine itself, while the surrounding ground was largely sidelined. Virginia quietly built a resource and was eventually acquired by Goldcorp, rewarding patience and conviction. Today, the technical evidence suggests Lux Metals may be following a similar path.

By acquiring a large, underexplored land package in the same James Bay geological corridor, Lux is positioned on ground that has already proven it can host significant gold systems, and history shows that when the market finally looks beyond the main discovery, the upside can be substantial.

The original article on the Great Bear discovery posted on Streetwise can be found here.

The Lux Lake Project: Additional Upside in Saskatchewan

In addition to La Grande, Lux controls the Lux Lake Project in Saskatchewan, which provides additional exploration upside.

The Lux Lake property is situated along a major northeast–southwest structural corridor dominated by metamorphic assemblages and is contiguous with the Ramp Metals–Rottenstone Property. This neighboring property hosts the Ranger Prospect, where Ramp reported high-grade results of 72.55 g/t gold over 7.5 meters.

Historical sampling and limited drilling north of the Lux Lake Property have returned encouraging results, including:

- 72.55 g/t gold over 7.5 meters at the Ranger trend

- 1.22 g/t gold over 1 meter at the Rogue showing

- 1.09 g/t platinum and 0.67 g/t palladium, along with 0.19 percent nickel over 1.75 meters at the Olsen target

Minimal gold-focused exploration has been conducted across the Lux Lake property to date, leaving open the possibility for future discovery-driven upside as market conditions and capital availability improve.

Management and Board

One of the understated strengths at Lux Metals is the technical depth of its leadership team.

The company is led by Carl Ginn, P.Geo., President and CEO, a professional geologist with more than a decade of experience in gold and battery metals exploration across North America. His background includes work with Goldcorp in the Red Lake and Timmins districts, as well as participation in Aston Minerals' Boomerang discovery team.

The board and senior leadership collectively bring experience from organizations such as Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTNTF:OTCMKTS), Fortescue Metals Group Ltd. (FMG:ASX), Newmont, O3 Mining Inc. (TSXV:OIII; OTCQX:OIIIF), Bonterra Resources Inc. (BTR:TSX.V; BONXF:OTCMKTS; 9BR:FSE), Sprott Mining, and Vale Inco (VALE:NYSE). This is a group that has navigated multiple commodity cycles and understands both discovery and the discipline required to advance projects responsibly in a capital-constrained market.

Share Structure and Valuation

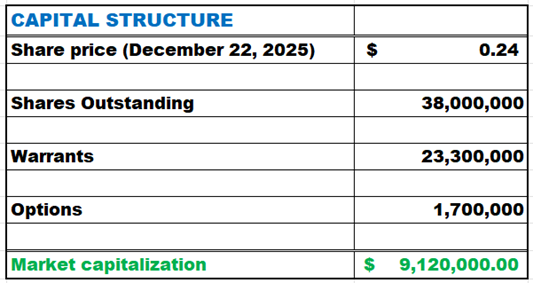

As of mid-November, Lux Metals had approximately 38.5 million shares outstanding, with an additional 23.3 million warrants and 1.7 million options. At a recent share price near CA$0.24, the company's market capitalization was approximately CA$9 million.

For a company controlling a large, high-grade gold system with extensive historical drilling, solid infrastructure, and a clear path toward renewed exploration, this valuation places Lux firmly in the under-the-radar category.

Technical Analysis: Same Way Down, Same Way Up

Lux Metals spent several years in a prolonged corrective phase, retracing nearly its entire prior advance. That decline has now resolved into a rounded base characterized by rising lows, improving volume, and a decisive move back above key moving averages.

The long-term downtrend has been broken, and the stock is now working through a classic point of recognition zone. The first upside target near CA$0.22 has already been achieved. Above that, the chart projects intermediate targets at CA$0.40 and CA$0.60, levels that align with prior resistance and consolidation areas. If the broader pattern continues to unfold, the longer-term measured move points toward a big-picture target near CA$1.15.

Volume expansion on up days and strengthening momentum indicators suggest this is more than a short-term bounce. Structurally, the chart reflects a familiar pattern in junior markets, where stocks often move higher in a mirror image of their prior decline following extended accumulation.

Conclusion: A Speculative Gold Setup with Leverage

Lux Metals Corp. is not a production story, and it does not need to be at this stage. What it offers instead is leverage to a high-grade gold system in a top-tier jurisdiction, supported by a substantial historical database, a clear exploration plan, and a technical setup that suggests renewed investor interest.

With gold prices holding firm, risk capital gradually returning to the junior exploration space, and drilling activity on the horizon, Lux fits the profile of a speculative gold opportunity that could surprise on the upside if execution matches the geology.

Based on the combination of project quality in an overlooked, unexplored gold district, experienced management, and improving technical structure, Lux Metals Corp (LXM:TSXV; BBBMF:OTCMKTS), I rank the shares as a Speculative Buy at the current price of CA$0.25.

Investors interested in following upcoming exploration plans and corporate updates can find more information at the company's website here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Rio Tinto Plc.

- John Newell: I, or members of my immediate household or family, own securities of: Lux Metals. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.