The Gold Silver Ratio (GSR) has been quietly rolling over for months, and the message it's sending is anything but quiet: silver is about to outperform in spectacular fashion.

For most of the past two decades, the Gold Silver Ratio has hovered between 65:1 and 85:1, reflecting market preference for gold's monetary safety over silver's mixed role as an industrial and monetary metal. But historically, when the ratio pushes toward extremes, especially above 85:1, it sets the stage for explosive reversion, with silver playing a dramatic game of catch-up.

That reversion is now in motion. And based on both technical pattern recognition and fundamental imbalance, it may only be just beginning.

Gold Silver Ratio Breakdown: A Mirror of 2011?

The first chart in this series shows the Gold Silver Ratio forming two smaller rising wedge fractals inside a larger wedge, not unlike the pattern seen leading into the 2011 silver surge. The current pattern broke support just above 90:1 and is now sliding toward the mid-60s. Historically, when the GSR loses these key trendlines, the collapse is swift, and silver takes off.

The last time this happened, in 2010–2011, silver exploded from $18 to $49 in under 12 months. And in 1980, the Gold Silver Ratio dropped below 17:1 as silver entered a parabolic phase alongside runaway inflation and systemic distrust of fiat.

Where Could Silver Go?

Let's run the numbers using today's gold price of $4,343/oz:

- At 38:1 (2011-style reversion): Silver = $114/oz

- At 17:1 (1980 peak): Silver = $255/oz

- At 50:1 (long-term average): Silver = $86/oz

- At 30:1 (projected target): Silver = $145/oz

And if silver repeats the magnitude of its previous two bull market runs, as projected in the third chart below, the upside could be even more shocking.

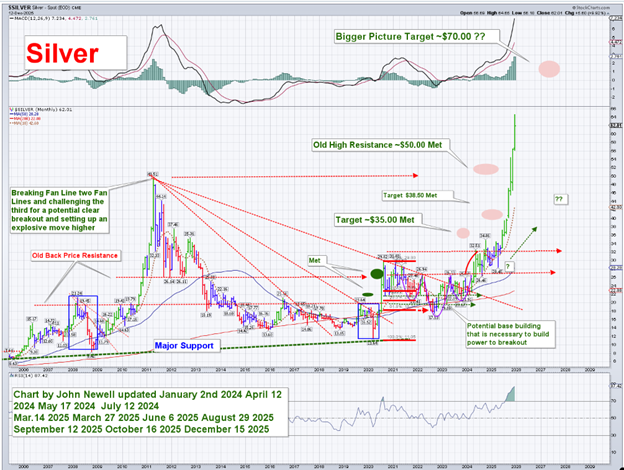

Silver Breakout: Fan Lines Falling Fast

The second chart (monthly) shows silver has broken above multiple descending fan lines and major historical resistance, including the $35, $38.50, and $50 levels. With each breakout, momentum has built. Now, silver is attacking the final long-term trendline with force.

This kind of move isn't random. It is the technical confirmation that silver is transitioning from a multi-year base to a multi-year markup phase, a structural breakout, not a short-term trade.

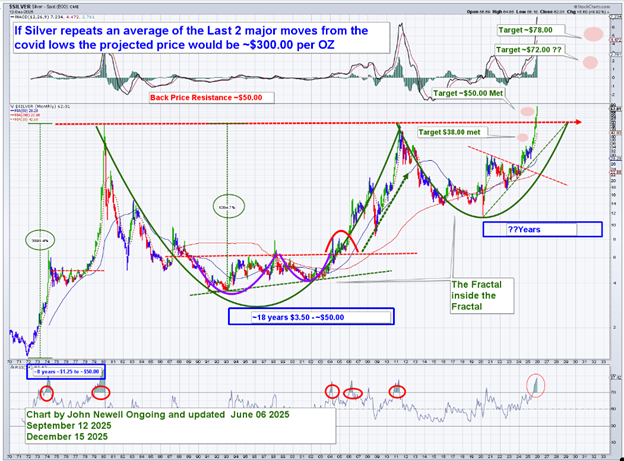

The Fractal Within the Fractal $300/oz in Sight?

This third chart pulls back even further, spanning 50 years, and shows the kind of base building and explosive upside potential that only comes once a generation. It's a classic "fractal within a fractal" formation, where patterns from the 1970s and early 2000s are repeating again, only this time, from a much higher launchpad.

If silver matches the average percentage gain from the last two cycles, the target projects north of $300/oz. This is a long-term projection, not a near-term forecast, but it gives a sense of what's possible when silver's full monetary and industrial roles converge at scale.

Fundamental Fuel: Supply Squeeze Meets Industrial Tsunami

Silver's technical setup is compelling, but the fundamental drivers are what give it explosive torque:

- Industrial demand from EVs, solar, energy storage, and defense is surging

- Silver is in its fifth consecutive annual supply deficit, according to industry data

- Above-ground inventories are shrinking across global exchanges

- Institutional and sovereign silver holdings remain underweight, especially relative to gold

- BRICS nations are accelerating efforts to build non-dollar monetary systems — and silver may play a growing role

This is no longer a simple precious metals story; it's a global currency reset in slow motion. And silver's dual identity, as both a commodity and a monetary asset, gives it a unique advantage.

Silver Always Lags: Until It Leads

Every precious metal bull market has a final chapter, and in every chapter, silver becomes the star.

In 1980, silver's final surge came after gold had already peaked.

In 2011, it was silver that stole the show during the parabolic leg.

In 2025, history may be preparing to rhyme once more.

With the Gold Silver Ratio breaking down, silver breaking out, and inflation-adjusted highs still far ahead, the asymmetry of the trade is becoming harder to ignore. The ratio compression that's underway is not just a signal; it's a seismic rotation of capital within the precious metals complex.

Conclusion: From Undervalued to Unstoppable?

The gold-to-silver ratio doesn't just track relative value, it maps the emotional turning points of capital: from fear to confidence, from hoarding to speculation, from preservation to acceleration. When this ratio turns, it often marks the beginning of silver's leadership phase, and that's exactly what the current setup is signaling.

At ~70:1, silver still trades far outside its historical norms. But the groundwork has been laid for a sharp reversion: the multi-decade technical pattern is breaking down, the fundamentals are tightening with each passing month, and a generational reallocation into real assets is underway.

This is more than just another leg in a commodity cycle; it's a structural repricing. One that reflects silver's dual role in the future global economy: as critical infrastructure for electrification and energy, and as a neutral, portable form of wealth in a fractured, de-dollarizing world.

Technically, the charts speak for themselves. Silver has emerged from a long, grinding base, taken out every resistance level back to 1980, and is now challenging the last trendlines standing. When those fall, price discovery begins.

But emotionally, psychologically, we are still early. Most investors don't own silver. Many don't even track it. That's why silver always lags, until it leads. And when it leads, it tends to do so with speed and scale that leaves even seasoned traders stunned.

This moment is not just an opportunity; it's a turning point. A chance to position ahead of the wave, while the signals are still developing and the crowd is still asleep. Silver is not just cheap. It's ready.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.