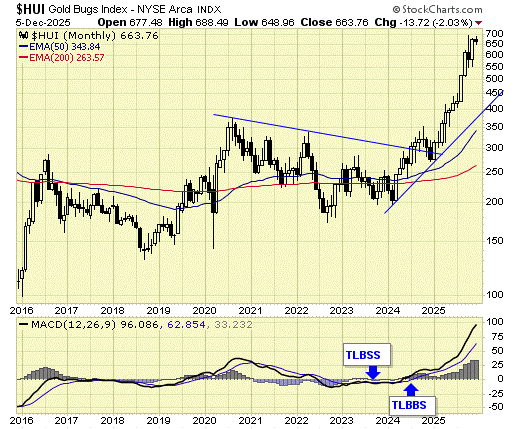

The cycle is up.

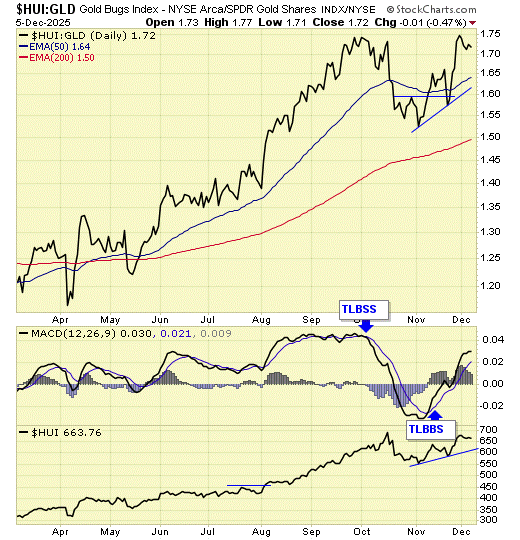

Signals and set-ups:

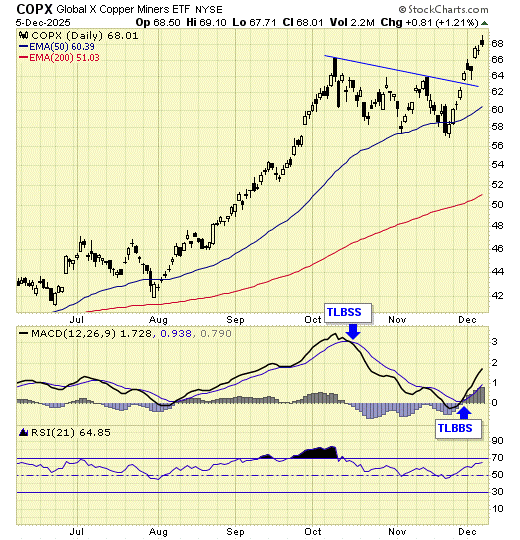

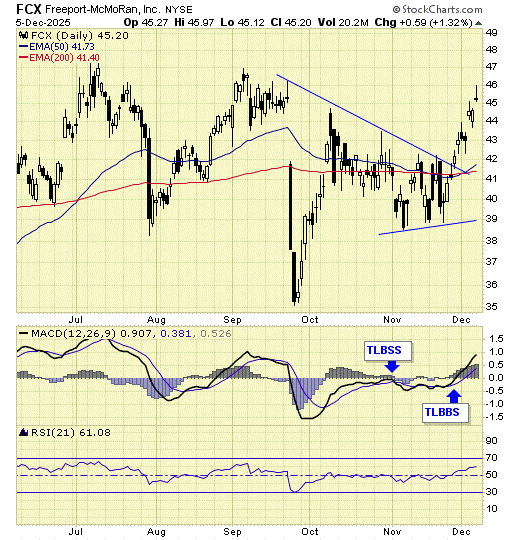

- TLBBS – trend line break buy signal

- TLBSS – trend line break sell signal

Investors:

During a long-term buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200-day exponential moving average (EMA).

Traders:

Simply buy and sell upon buy/sell signals on the daily charts, or cost average in at cycle bottoms when prices are at or near the daily 200 EMA, and cost average out at cycle tops when prices are above the daily 50ema.

Allocations:

Will be conservative when volatility is high, and aggressive when volatility is low.

Current Signals:

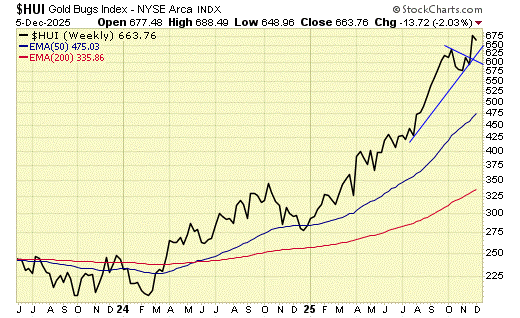

- Long term – on buy signal.

- Short term – on buy signals.

The gold and silver sectors are on a long-term buy signal, triggered at 295.

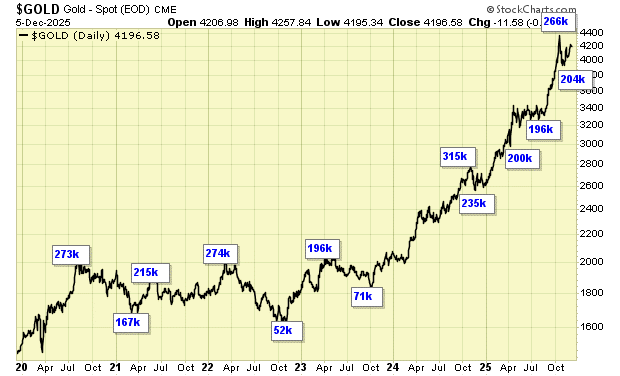

Speculation, according to COT data, has dropped to levels of previous bottoms.

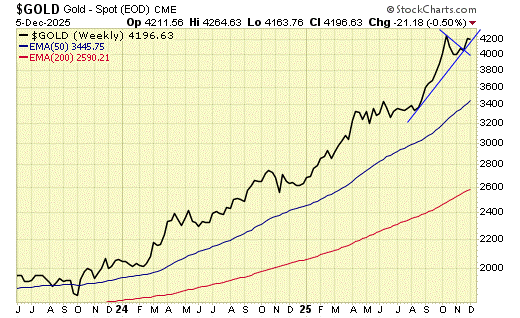

Overall, higher gold prices are expected.

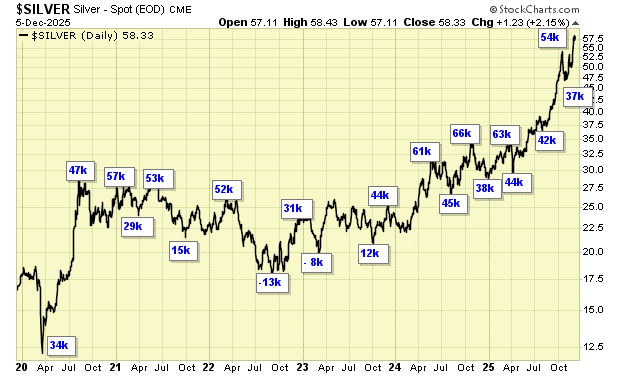

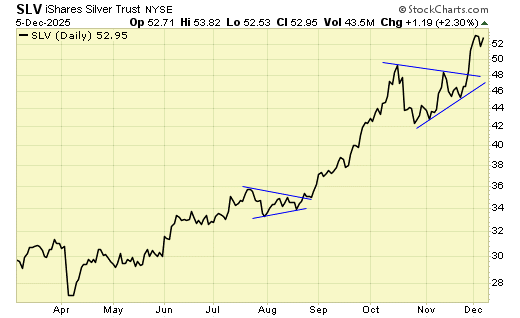

Speculation, according to COT data, has dropped to levels of previous bottoms.

Overall, higher silver prices are expected.

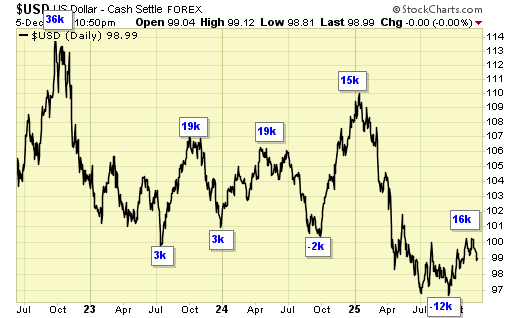

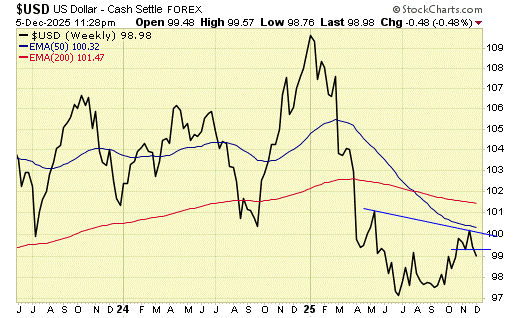

Speculation, according to COT data, has reached levels of previous tops.

Expect an overall lower dollar.

Our ratio is on a buy signal.

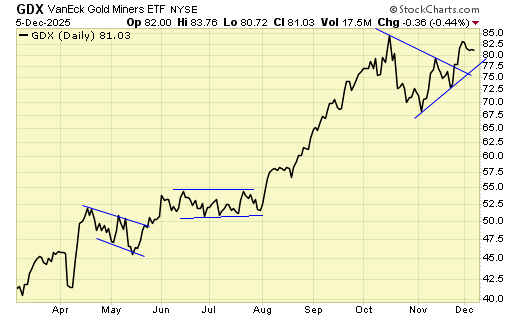

In a bull market and when the trend is up, gold stocks outperform gold.

The trend is up for gold stocks.

The trend is up for gold.

The trend is down for the U.S. dollar.

A breakout has occurred in the VanEck Gold Miners ETF (GDX:NYSEARCA).

A breakout has occurred in the iShares Silver Trust (ETF) (SLV:NYSE).

Summary:

- Long term (monthly chart) – on buy signal.

- Short term (daily chart) – on buy signals.

The cycle is up.

The trend is up for gold and gold stocks, while the dollar is down.

We are holding long positions.

As for other metals. . .

- COPX – TLBBS

- Buy signal triggered at 64.30.

Look at Freeport-McMoRan Inc. (FCX:NYSE).

- FCX – TLBBS

- Buy signal triggered at 42.15.

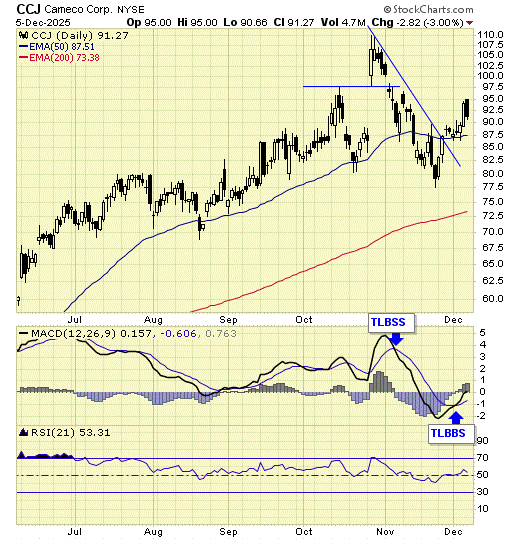

Look at Cameco Corp. (CCO:TSX; CCJ:NYSE).

- CCJ – TLBBS

- Buy signal triggered at 88.23.

| Want to be the first to know about interesting Silver, Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Jack Chan: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Jack Chan Disclosures

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.