The Year of our Lord 2018 was a strange one. Not only was it the year that I officially became a "senior citizen," but it was also the year that President Donald Trump first met with new North Korean leader Kim Jong Un in an effort to persuade him to refrain from building long-range ballistic missiles with nuclear warheads with an attack radius that could include the western United States. While I was completely successful in making it to "senior citizenship," the Donald was not so successful in dissuading the North Korean leader in dismantling his nuclear program and with the Chinese watching every American move like a proverbial hawk, the American president allowed his ADHD affliction to get the better of him, quickly losing interest in North Korea, and instead, initiating a trade war with China.

2018 was also the worst year for stocks since 2008, with December being the worst since 1931. There was a "Santa Claus Rally" in 2018, but it was only after Treasury Secretary Mnuchin held an emergency call on Christmas Eve with members of the so-called "Plunge Protection Team," a group that includes top officials from the Federal Reserve, Securities and Exchange Commission, and Commodity Futures Trading Commission. In a carefully choreographed press release, Mnuchin assured the investing public that the stock market was "not about to collapse," despite fears over trade wars and tariffs that year, which were hauntingly similar to the current environment here in 2025.

After the Mnuchin cheerleading exercise, stocks embarked upon a vintage month-end "Santa Claus Rally" not unlike the one we got on Friday due to comments from New York Federal Reserve President John Williams, who signaled support for another interest rate cut. If there was a betting window that allowed one to place wagers on a Fed governor or regional president making stock-friendly remarks through the carefully-chosen financial news networks, all one would need do is get a late quote on the S&P 500 and if it is down more than 2% on the day, place a large bet on someone from the Fed cheerleading by the next morning in order to "calm the markets."

Anyone who thinks the dual mandate of the Fed is represented by "maximum full employment" and "price stability" had better add "a rising technology NASDAQ" to the list. It is like spring following winter and morning following night.

The two charts shown below provide us with an interesting analog between 2018 and 2025, in that they are scarily similar.

You will note that markets rallied from the month of April in both years and kept moving at a torrid pace, hitting record highs before stalling out in Q4/2018, and while it was late September back in 2018, when stocks topped out, it took until late October this year for the top to be set. Every color commentator on CNBC, including Mad Money's Jim Cramer, has been talking about what to do when stocks go into "melt-up mode" next month as the most widely-expected and totally-presumed year-end rally arrives on a massive tsunami of "AI" records and augmented expectations of economic expansion.

The rocket scientists at the Bureau of Labour Statistics decided to report September but omit October in their data delivery exercises, such that the impact of a lack of government spending during the shutdown would not skew the "trend" of economic data. This way, with the government once again in full "spend" mode, they can gather the data and report a more normalized November, allowing the Fed to leave the Fed Funds rate unchanged in the December meeting.

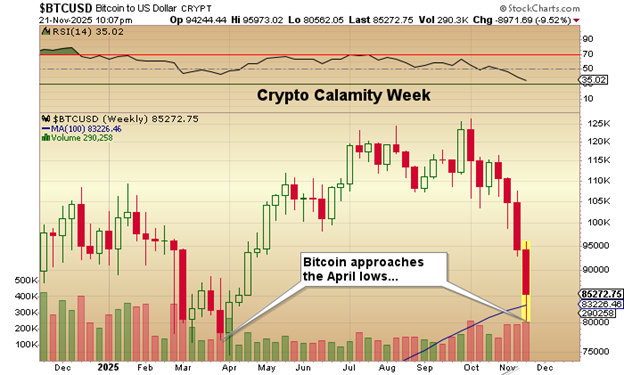

Another serious casualty of this week was all those "laser-eyed," fuzzy-cheeked youngsters who have been stacking Bitcoin while extolling all holders of gold and silver and their associated mining stocks to "Switch to Bitcoin!" something that, in all 47 years of following the sector, I have never heard suggested in reverse. By that, I mean that in all my years, I have never heard or read of a gold bug suggesting that anyone holding anything other than gold or silver sell their Bitcoin or technology stocks or their oil and gas stocks in order to support the price of gold.

You see, the one thing that has always bothered me about the Bitcoin "story" was that the main players like Strategy Inc.'s (MSTR:NASDAQ) Michael Saylor, or Jack Dorsey, or Cathy Wood are constantly out on the speaking circuit or on the major financial media like CNBC and YouTube drumming up dollar support for Bitcoin.

Surprisingly, it is not simply "talking up one's book." What really bothers me is that if there was an intrinsic value to Bitcoin, there would not have been over the years since its introduction three full 70% drawdowns in price. Furthermore, I found it unconscionable that back in October as gold was hitting $4,400 and was the lead story in every financial report for the whole week, just like clockwork we saw tweet after tweet and email after email with one of the crypto kings or queens staring at you through the screen with the same contrived message: "Sell your gold and buy Bitcoin before you lose all your money." There was nary a shred of subtlety in the messaging, and it reeked of desperation as the only way that a Ponzi scheme survives is by attracting new investors whose capital injection takes out the sellers and keeps the game afloat.

So, here we are with Bitcoin now officially in "bear market territory," down 32.85% from its peak on October 6 at $126,110. With the 100-week moving average at $83,226, it closed just above that level Friday night at $84,680 and looks as though the April lows around $70k are in the crosshairs. For the record, I have no dog in this hunt, but I do use Bitcoin as a leading indicator for risk assets, including technology, AI, and "meme" stocks, which have tended to attract the majority of the "hot money" in today's Fed-fueled market. I have been tracking the close correlation between the NASDAQ (as represented by the QQQ:US) and Bitcoin since 2000, and I merely use it as a technical barometer of risk. I cast no judgment on its merits or lack thereof as a "store of value" and let the world deal with the elevated volatility on its own.

Gold had a minor decline this week, but when compared to the NASDAQ and Bitcoin, it was a solidly safe haven in what was a market maelstrom until Friday, by holding fast above the 20-dma with its close at $4,057.30. The 20-dma resides at $4,040.56, after which there is the 50-dma at $3,891.81 and then my personal target, the 100-dma at $3,690.33.

I actually like the way gold is acting this week, because with all the equity market turmoil, one might have expected some liquidity concerns to have created pressure on the metals as a group. Mind you, silver went out for the week under the "magic $50 level" after getting smoked for 1.37% to end the Friday session. That type of action has served as an omen in the past.

What the nervous perma-bulls in the gold arena are missing are two things:

1) that the market can correct all the way to the 100-dma in a 16.9% drawdown and still be happily ensconced in a secular bull market and well within the secular uptrend that began in earnest last August after Fed Chairman Jerome Powell signalled an end to the monetary tightening designed to cure that "transitory inflation" that just never seemed to go away and 2) that I am never going to respond to snarky emails that begin with "YOU DON"T GET IT" and then list the ten reasons for owning gold about which I was writing when they were in diapers.

Gold is working off the egregiously overbought conditions that were so prevalent back in the week of October 13-20, where daily, weekly, and monthly RSI readings were simultaneously above 80. We are not yet there, but the longer gold trades sideways while silver refrains from doing anything silly, the sooner the secular uptrend reasserts itself. "After all, this is a bull market," to coin a phrase, and lest we forget it, as corrections are the kindling that fuels the bull market furnace.

The junior mining space felt a little "off" this week, and I think that there are reasons far deeper than those related to corporate fundamentals or the underlying commodity prices. I speak with many subscribers from all over the world and whether they are from Europe or the U.S. or Canada, I am getting the increasing impression that there is a growing amount of pain out there, and I do not care what the story is behind the junior miner sitting in a person's portfolio, when the bank comes knocking on your door for more collateral to underpin your mortgage or credit line, the first asset to go is not your car or your house; it's your stock portfolio.

I know from bear markets of yore, raising a family on one income, the number of occasions where I was forced to sell enough shares of my beloved Foo Foo Mines or Underground Airlines in order to pay the mortgage or get new drapes installed because Fido the Wonderdog decided to eat them. I live in Canada, well outside of the Greater Toronto Area (or "GTA") as it is called, and I can tell you that the current correction in the real estate market has increased the number of listings exponentially. As a baby-boomer, I know firsthand how a primary residence became the "Divine Pension Plan" for most members of my generation.

Sadly, thanks largely to the policies of the Bank of Canada and the various governments (both Liberal and Conservative), over the past 30 years they allowed wealthy immigrants and foreign investment flows to compete with native-born buyers that goosed the average home price not only just "higher" but to astronomical levels that now are deemed "unaffordable" for the vast majority of new arrivals and also for white collar graduates that reside in double-income households.

In fact, without the financial assistance of baby-boomer parents, few Gen-X or Millennial families residing in regions that are close to the high-paying jobs can come anywhere close to affording a decent home. While all was fine and good while the housing mania was alive and well in the major urban centers like Toronto, Montreal, and Vancouver, it is now not "fine and good" and with the mortgage rates rising in response to the idiotic monetary and fiscal moves that dropped billions of dollars into the Canadian economy (and trillions into the global economy), carrying a $1.5 million debt load on a $2 million home in a suburb of downtown Toronto that demands a 3-hour daily commute to work and back is not the kind of lifestyle that promotes heathy marriages and happy children.

The societal impact of what I call "boomer mistakes" would stand up in a court of my peers, but the problem is that the boomers are not the generation that has been setting policy largely since the late 90s. The last boomer to serve as Prime Minister of the Dominion of Canada was Stephen Harper, a boomer member of the Conservative party that served until his job was surreptitiously stolen by a Gen-X-er Liberal called Justin Trudeau. Those two regimes, with leadership by both Liberal and Conservative governments, allowed the resource-rich Canadian economy to self-destruct under the weight of completely ill-advised and poorly constructed policies.

I am reminded of my son-in-law, Ezekiel, who was born and raised in Argentina. He tells me stories of the country described to him by his parents and grandparents before the socialists rose to power and turned the second-highest standard of living in the world into Third-World status. It is a fact that prior to the Perons, Argentina was the Jewel of South America, rich in agriculture, ranching, manufacturing, and innovation. The Argentina of 1950 sounded a lot like Canada of the 1950s.

Rich in resources, a well-educated society, plenty of freedoms, and respect for both liberty, personal privacy, and the Rule of Law. It took decades of misery before the Argentinian people took the bit in their teeth and elected Milei to flush the endless socialist programs down the drain. In Canada, we are still staring at the TV screen, listening to political panderers and compromised "pitchmen" like Kevin O'Leary, thinking in full and eager enthusiasm that what we are being fed is actually good for us.

In my beloved United States, not where I was born but where I was educated, it is a known fact that the vast majority of Canadian hockey players who have lived in St. Louis wound up retiring and staying in that historic Midwest city. What just happened in New York City with the election of Mamdani is coming to a Midwest city near you and by that, I would suggest that as capitalist and freedom-loving as are the vast majority of Americans that I grew to know and admire over a 47 year career, the boomers in the U.S. committed all the same errors that boomers in Canada and the U.K. and Germany and Japan all made, and there is now nothing that can be done to reverse the outrage felt by the underclasses that own nothing.

So, I carefully segway back into the topic of the junior miners. Investors in this sector are feeling the bite of the weakening economy for the same reason that Bitcoin is getting trashed and why the Russell 2000 only recently eclipsed the highs seen in late 2020. Small-cap stocks always get murdered when the prospect of recession becomes the reality of recession. Fear not, I say, as the spectre of a global recession is more than terrifying to policy-makers in every central bank on the planet. Unsustainable sovereign debt levels require robust growth to allow robust tax collections required to meet interest payments on that debt, and politicians will stop at nothing short of self-immolation in order to keep the fiscal spigots wide open and gushing.

However, until we get the "all clear" signal from Jerome Powell accompanied by confirmation of a broadening of economic activity into sectors other than AI and information technology, investors that have been throwing caution to the wind employing investment strategies like FOMO and YOLO may be pulling in their speculative horns a tad as we approach the terminus of what has been a spectacular year, at least for those more fortunate members of society that could actually afford to own stocks.

I conclude the weekly missive with a thought for you all. We all know the Nvidia Corp. (NVDA:NASDAQ) story and how the emergence since 2000 of artificial intelligence has increased demand for the microchips that are the monopolistic domain of a company trading at 52 times earnings and 43.2 times sales while sporting a market cap of in excess of $4 trillion. Not only is it using its role as a monopoly to increase and fortify the barriers to entry for potential competitors, but it is totally reliant on the entire technology called "LLM" ("Large Language Model") for its existence, a technology that may or may not work.

I listened to a podcast last evening between Grant Williams (the best interview content provider to be found on the planet because one needs to have an intellect before listening to him) and the brilliant Julien Garran, fund manager at U.K.-based MacroStrategy.

Before I proceed, for the record, on Thursday morning, into the huge 5% spike in NVDA stock to over $195 per share, I elected to go short by way of some put options. I did this a full two days before listening to this interview, which gave no indication that the topic of discussion would be about "AI" and its incestuous verging upon fraudulent infrastructure. Here is a snippet from Julien Garran's recent paper on the LLM AI "bubble."

"Make no mistake, I think that this is the biggest and most dangerous bubble the world has ever seen. The misallocation of capital in the US, which also includes housing, VC, and crypto, is already 17 times the dot-com bubble and four times the 2008 real estate bubble. And as it unwinds, it will not just threaten substantial economic malaise, it will threaten to overturn the entire globalist agenda, and the new financial order that developed with the advent of Thatcher and Reagan from 1979 and 1982, accelerated with the fall of the Berlin Wall in 1988, and sped up again with China's accession into the WTO in 2002. The LLM AI bust will be as important a backdrop to the next phase in global macro as the savings and loan crisis was enforcing the pace of US reflation from 1991 that saw the dramatic rise of the Southeast Asian economies at markets of South Korea and Taiwan in the early ‘90s. Except this time, unlike 1994, the train has no brakes. We are increasingly likely to see reflation, inflation, and the rise of the Indian middle class along with the fall of AI emerge as the dominant macro themes of the second half of the 2020s."

These are very strong words coming from an individual who has obviously done a great deal of research dating back more than a few years. He knows what a "bubble" looks like. He further goes on to say in the interview:

"And so for me, I think this <bubble bursting> upends the standard economics of the last 40 years, where most of the time the U.S has seen a lot of capital flowing in, the dollar has been relatively strong, and you've seen a disinflation boom with tech winning and resources and blue collar workers losing. This type of environment is going to be one where there's a lot of capital flowing out. You're going to see emerging markets and resources winning. And on a relative basis, you're going to see blue collar workers doing better than tech, which is going to deflate in an environment with higher rates and stronger activity."

The well-documented thesis of LLM AI being a massive bubble lies at the very feet of everything I have been trying to say but have avoided saying largely because it might detract from my microeconomic views on gold, silver, and copper. All "bubbles" are born from the womb of easy money/central bank stimuli. The self-imagined rock stars that are running NVidia, Microsoft Corp. (MSFT:NASDAQ), Apple Inc. (AAPL:NASDAQ), and the notorious Tesla Inc. (TSLA:NASDAQ) are all part of the same incestuous coven of stock promoters that have learned all the right words and phrases that force the big investors around the globe "over the wall" creating self-reinforcing cult-like behaviours in things like LLM AI, crypto, and electric vehicles advertised as "self-driving" while the evidence remains that they cannot.

The message readers should take home with them is the singular most important line in the interview: "You're going to see emerging markets and resources winning."

No question that I am suffering from confirmation bias, a cognitive bias (a type of mental shortcut) that describes the human tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs, expectations, or hypotheses, while actively ignoring or downplaying information that contradicts them.

When you are overweight, resource stocks the way I am, you will of course forgive me, as I hope will my banker, my margin clerk, and the lady standing in the kitchen with a rolling pin in her hand.

| Want to be the first to know about interesting Cryptocurrency / Blockchain and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc. and Nvidia.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Tesla Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.