Torr Metals Inc. (TMET:TSX.V) has completed around 2,100 meters of diamond drilling across seven drill holes at the Bertha target, part of the company's 332-square-kilometer Kolos copper-gold project in south-central British Columbia, the company announced on November 19.

The drilling focused on a notable moderate-chargeability induced polarization (IP) geophysical anomaly, identified as a supergene oxidation horizon, along with a nearby highly promising conductivity-chargeability contact zone, where a picrite unit forms the footwall to the oxidation horizon. Assay results are pending, with holes 25-KO-01 through 25-KO-06 currently submitted to the laboratory, the company said.

"With approximately 2,100 meters drilled at Bertha and plans to extend the program to 2,800 meters, we are steadily defining a system that exhibits strong comparisons to the redox and structural framework described at the nearby New Afton copper-gold mine," President and Chief Executive Officer Malcolm Dorsey said. "Having now completed drilling across the initial width of the target area, our focus shifts to a major stepout to the west to evaluate the down-plunge and dip extent of the system beyond 500 meters. The presence of high-grade copper at surface in the Bertha exploration pit highlights the importance of testing both the picrite contact and the adjoining large, structurally controlled chargeability system to depth, further emphasizing Bertha's potential as a significant hydrothermal-supergene copper-gold target."

Importantly, this chargeability-conductivity contact is visible at the surface within the historical Bertha exploration pit, which previously reported 30 tonnes at 2.14% copper (Cu) from limited past production of native copper and chalcocite mineralization. Torr recently confirmed the copper-rich potential of this contact zone through a rock grab sample assaying 16.9% Cu, according to an August 13 release by the company.

In addition to the broad chargeability anomaly, the company interprets this contact as a significant redox and structural interface that served as a focal point for hydrothermal supergene copper mineralization, a geological setting similar to the upper levels of the New Afton copper-gold mine, among the highest grade copper-gold porphyries in British Columbia, located approximately 28 kilometers to the north-northeast.

For investors seeking exposure to a new copper discovery narrative in one of Canada's safest and most productive mining regions, Newell considers Torr Metals a Speculative Buy.

Based in Edmonton, Torr is committed to discovering new copper and gold prospects within well-established and easily accessible mining districts throughout Canada. These areas benefit from existing infrastructure and a rising demand for immediate resources.

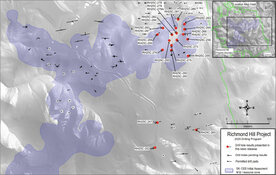

Torr's wholly owned, district-scale properties are strategically positioned for cost-effective, year-round exploration and development. Kolos and the strategically optioned 57 km² Bertha Property are located in southern British Columbia's renowned Quesnel Terrane, just 30 kilometers southeast of the Highland Valley Copper Mine, Canada's largest open-pit copper operation, and 40 kilometers south of Kamloops along Highway 5.

In northern Ontario, the 261 km² Filion Gold Project spans a largely unexplored greenstone belt with significant high-grade orogenic gold potential. It is situated just off Trans-Canada Highway 11, about 42 kilometers from Kapuskasing and 202 kilometers by road from the Timmins mining camp, home to world-class gold mines like Hollinger, McIntyre, and Dome.

Drill Target Highlights

The chargeability anomaly indicates scale potential and strong structural controls, Torr said. The overall geometry of the chargeability anomaly appears to be controlled by the contact with the footwall picrite unit, identified by its strong conductivity. The orientation of this contact shifts from a northwest dip in the southeastern portion of the anomaly (tested by holes 25-KO-01 to 03) to a north to northeast dip within the western portion (tested by holes 25-KO-04 to 07).

The contact between a reducing picrite and an oxidized intrusive-volcanic complex defines a prime redox boundary where copper-bearing fluids are reduced to produce native copper and chalcocite, a key process observed within supergene environments such as at the Bertha exploration pit and New Afton, the company noted.

Finally, drill testing confirmed the depth and orientation of the targeted system.

"Torr has drilled across the moderate dips of the chargeability anomaly and picrite boundary in both the northern and southern areas to depths greater than 400 vertical meters," it said in the November 19 release. "Hole 25-KO-07 is advancing to greater depth to evaluate potential down-dip extensions of the main system. Additionally, a greater than 300-meter stepout to the west at the Bertha South occurrence is planned to test the along strike and down-plunge extensions of the chargeability anomaly."

Geological Interpretation

The oxidation of primary sulfides at the Bertha exploration pit is believed to have generated copper-bearing fluids that moved downward and laterally until they encountered iron-rich picrite lenses and the cohesive picrite footwall, Torr said in the release.

At these redox boundaries, copper was reduced and reprecipitated as native copper (Cu) and chalcocite (Cu2S), concentrating along the picrite contacts. The conductive picrite likely served as both a chemical trap and a relatively impermeable structural barrier, directing mineralization along its contact with adjacent intrusive rocks and Nicola Group volcanics, the company said.

Additionally, hydrothermal-magmatic veining and brecciation associated with a sulfide-bearing intrusive pulse may have further concentrated mineralization within, and along the base of, the oxidized lithological contact between the picrite and Nicola volcanic units, enhancing permeability, fluid flow, and copper deposition within the system.

Analyst: Project Drawing Interest

1As copper exploration gains traction in British Columbia's Quesnel Trough, Torr is positioning itself for a potential new discovery, according to analyst John Newell of John Newell & Associates on October 6.

With several undrilled copper-gold porphyry centers, strong infrastructure, and a streamlined share structure, the Kolos project is drawing interest as it launches its inaugural drill program, he noted.

The Quesnel Trough is "home to some of Canada's largest and longest-lived copper mines, including Highland Valley (Teck), New Afton (New Gold), and Copper Mountain (Hudbay)," Newell wrote.

The company's projects provide "exposure to both copper and gold discovery opportunities across Canada, with Kolos leading the near-term news flow as the first drill program begins in Q4 2025," he added.

For investors seeking exposure to a new copper discovery narrative in one of Canada's safest and most productive mining regions, Newell considers Torr Metals a Speculative Buy at the current price of CA$0.15. The technical price targets are set at CA$0.24, CA$0.48, and a longer-term target between CA$0.60 and CA$0.65, contingent on a confirmed discovery-driven breakout, Newell said.

The Catalyst: Copper Vital as an Electrical Conductor

Copper is crucial to the energy transition due to its vital role as an electrical conductor. The metal's prices are expected to rise this fall, driven by seasonal demand and ongoing supply constraints, offering traders lucrative opportunities, Don Dawson reported for Yahoo! Finance on October 6.

Home builders are stockpiling copper for spring construction, particularly for wiring and plumbing, with demand peaking from September to March. This seasonal trend, coupled with global economic factors, creates an ideal trading window, he explained.

Meanwhile, Dawson reported that the global copper supply is anticipated to face a 300,000-metric-ton shortfall in 2025 due to production challenges in Chile and Peru, including labor strikes and mine disruptions. Increasing price volatility is exacerbated by low inventories on the London Metal Exchange, sometimes covering less than a day's demand, Dawson wrote. The energy transition — driven by electric vehicles, solar power, and AI-driven data centers — continues to boost demand, with copper consumption rising annually since 2020, the story noted.

The gold market is working to keep its position well above the initial support level of US$4,000 per ounce, as significantly outdated employment data reveals some underlying strength in the U.S. labor market, according to Neils Christensen of Kitco News on November 20.

Following the 43-day government shutdown — the longest on record — the U.S. Labor Department has finally released September’s nonfarm payrolls data, indicating the economy added 119,000 jobs, he wrote. This job growth exceeded expectations, as consensus forecasts predicted an increase of 53,000. However, the unemployment rate rose more than anticipated, climbing to 4.4%. Economists had expected it to remain steady at 4.3%. Despite this increase, the Labor Department noted that the labor market has seen little change since April.

Although the headline figures surpassed expectations, revisions to summer employment data continued to reflect a slowing labor market, Christensen said. August’s employment numbers were adjusted downward, showing a loss of 4,000 jobs. Similarly, July’s figures were revised down to 72,000 jobs, compared to the previous estimate of 79,000. The gold market is not experiencing any significant reaction to the outdated employment data. Spot gold last traded at US$4,081.70 an ounce, up 0.12% on the day.

According to Morgan Stanley on October 22, gold's rally "will likely go on." The precious metal reached new highs this fall, but the rally encountered a setback, with prices dropping by as much as 6%, marking the largest single-day decline in 12 years. Despite this, gold has surged approximately 50% in 2025, solidifying its position as one of the year's top-performing assets, the firm said. The price increases are a response to significant policy, geopolitical, and economic events this year, including tariffs, the Israel-Hamas conflict, concerns about the Federal Reserve’s independence, and the U.S. government shutdown.

Morgan Stanley Research anticipates the rally will persist and has revised its 2026 gold forecast upward to US$4,400 per ounce, a notable increase from its previous estimate of US$3,313. This new forecast suggests an additional gain of about 10% from early October to the end of next year.

"Investors are watching gold not just as a hedge against inflation, but as a barometer for everything from central bank policy to geopolitical risk," Morgan Stanley Metals & Mining Commodity Strategist Amy Gower said. "We see further upside in gold, driven by a falling U.S. dollar, strong ETF buying, continued central bank purchases, and a backdrop of uncertainty supporting demand for this safe-haven asset."

Ownership and Share Structure2

About 13% of the company is owned by insiders and close associates and about 6% by institutions. The rest is retail and high-net-worth investors.

Top shareholders include Torr Resources Corp. (owned by CEO Malcolm Dorsey) with 4.77%, John Williamson with 3.41%, Sean Richard William Mager with 0.78%, and CEO Malcolm Dorsey with 0.07%.

Torr has a market cap of CA$10.95 million and 83.82 million shares outstanding. It trades in a 52-week range between CA$0.08 and CA$0.18 per share.

| Want to be the first to know about interesting Copper, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Disclosure for the quote from the John Newell article published on October 6, 2025

- For the quoted article (published on October 6, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: John Newell of John Newell and Associates was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

2. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.