The April to October "mega rally for miners" occurred as I suggested it would . . . and now I've also been suggesting that investors need to be open to "several months of time in the consolidation hopper" before the next super-sized surge begins.

That surge, basis quality Elliott Wave counts, could take gold to somewhere between $6000-$9000.

Having said that, junior mine stock investors want more action than the seasonal doldrums offer. The good news is that they can get some of it (and potentially a lot) with some of my key "outside the CDNX and GDXJ box"

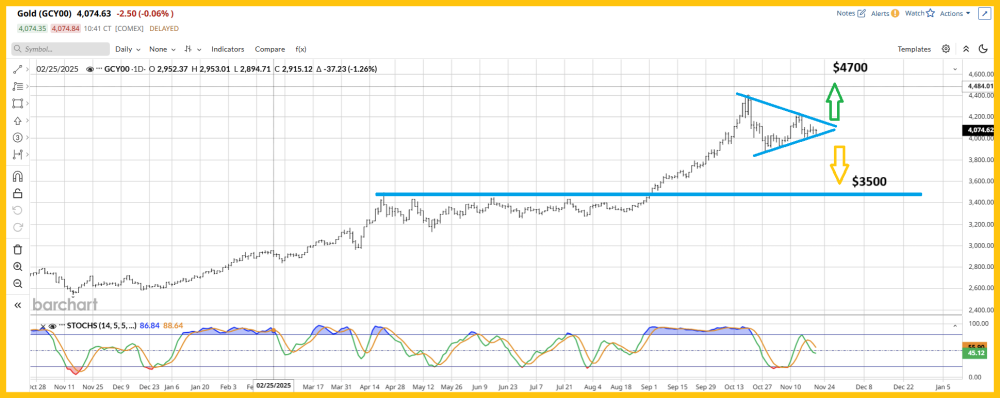

Here's a look at "supreme money" gold:

Gold is a bit perky today as the Fed tries to save the outrageously overvalued U.S. stock market (and the over-indebted government) with fresh talk of another cut in rates.

It's perky today, but overall seasonal softness could override the short-term excitement in another week or so.

Here's a look at the GDXJ ETF:

Until GDXJ either rises over $112 or dips to $72, there's not much for investors to do, although there are plays for gamblers.

Here's a look at the CDNX:

It's likely putting in a short-term bottom just above the key 815 support zone.

Even without the panicking Fed in play, the markets are poised for a surge, but the panic is going to add "juice" to some of the mining stock leaders.

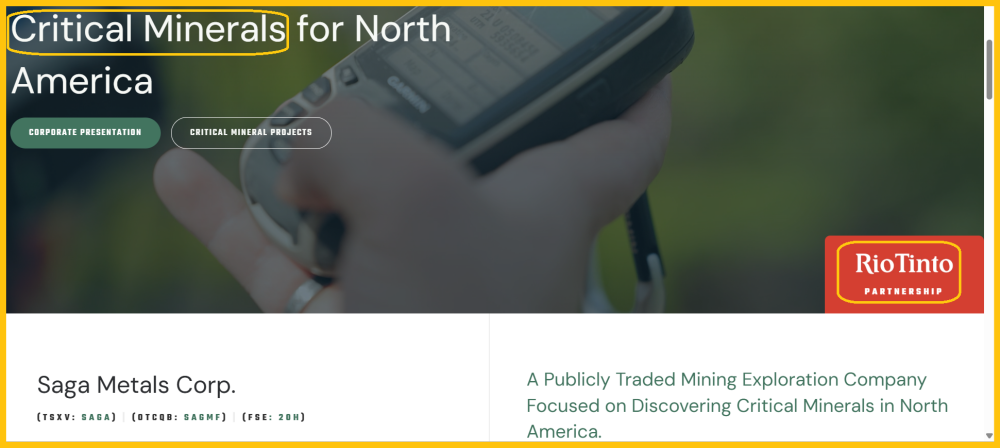

Here's a look at one of them: http://galacticupdates.com/wp-content/uploads/2025/11/2025nov21sag1.png Note the partnership with Rio Tinto. The US government is the catalyst for a global "critical miners" race that resembles the Klondike gold rush!

Here's a look at the weekly chart for Saga Metals Corp. (SAGA:TSXV; SAGMF:OTCQB; 20H:FSE):

The stock is breaking out of a nice double bottom pattern. The target price is only about $0.64, but given the size of the pattern and the critical minerals theme, it's likely to be a multi-bagger in short order.

Here's a snapshot of an even hotter CDNX-listed stock:

Critical minerals are hot, and AI is even hotter. Minehub is bringing AI to commodity company supply chains, and the action is solid.

Here's a key Minehub Technologies Inc. (MHUB:TSXV; MHUBF:OTCQB) chart:

Minehub should probably rename itself "Moonhub," because that's where this chart suggests it's going . . . to the moon.

A massive inverse H&S pattern is in play. Eager investors can buy some grub stakes right now and more on a breakout over the neckline, at about $1.50!

Junior mining stocks are now the world's most exciting asset class, and unlike the regular AI stocks, the commodity-focused players are incredibly undervalued, making the reward-to-risk ratio about as good as it can get!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "GDXJ: The Next Hot Shots!" report. I highlight some of the most exciting component stocks in this ETF, with winning buy and sell tactics included for investors! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?