West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) has provided a mid-fourth quarter operational update on the Madsen Mine, highlighting production gains, infrastructure improvements, and expanded site leadership as the company continues ramp-up activities in Ontario's Red Lake Gold District.

Ore production at the Madsen Mine increased by 24% in October compared to September, following the implementation of underground waste rock storage in mid-September. This initiative freed up haulage capacity, allowing more efficient movement of ore from underground to surface. The mine's daily tonnage has reportedly continued to move closer to anticipated commercial production rates.

Recent infrastructure enhancements include the arrival of three four-yard scoops and construction components for the mine's maintenance shop. The final haul truck is expected to arrive shortly, which will complete the mobile fleet. According to West Red Lake Gold, high equipment availability is central to supporting operational efficiency at the site.

The company has also made key additions to the Madsen management team. Sean McCormack, previously General Manager at Wesdome's Kiena Mine, joined as Mine General Manager earlier this year. Additional hires include Bright Asamoah as Chief Engineer, James Armstrong as Mill Manager, and William Curry as Senior Operations Manager. These appointments bring significant experience from major mining operations across Canada and Ghana.

Gold Steadies as Long-Term Value Narrative Gains Ground

On November 11, Kitco News reported that gold prices experienced a slight retreat after reaching a three-week high, with December gold futures settling at US$4,113.10 per ounce. The movement was attributed to short-term profit-taking. Silver prices remained relatively stable at US$50.54 per ounce. Despite the pullback, gold continued to track toward one of its strongest calendar-year performances since 1979, supported by investor expectations of potential Federal Reserve interest rate cuts and broader macroeconomic uncertainty.

In a separate commentary published on November 12, Matthew Piepenburg emphasized gold's historical resilience as a store of value amid economic volatility. He cited the long-term decline of fiat currencies and the erosion of purchasing power as key reasons why investors have turned to gold during periods of monetary instability and inflationary stress.

On November 16, Shad Marquitz of Excelsior Prosperity examined the sustained rise in gold prices and questioned the disconnect between metal performance and equity valuations in the precious metals sector. He pointed out that gold had appreciated from US$250 per ounce in 2001 to around US$4,000 in 2025, highlighting its ability to preserve value across decades. Marquitz wrote that "gold simply preserves one's purchasing power over the long haul" and described it as "hard money" in contrast to fiat currency.

Marquitz also noted that the current bull cycle began in late 2015, with gold up roughly 400% from its US$1,045.40 low. However, he observed that many publicly traded gold producers have not reflected this growth in their valuations, despite what he described as historically strong margins. He stated, "These PM producers are literally printing the most 'hard money' that they ever have at these metals prices," raising questions about why equity performance has not kept pace with underlying commodity prices.

Analysts Reiterate Positive Ratings on West Red Lake Gold Amid Madsen Ramp-Up and Rowan Drill Success

On October 7, Matthew O'Keefe of Cantor Fitzgerald reported that West Red Lake Gold Mines Ltd. produced 7,055 ounces of gold in the third quarter of 2025, marking a 34% increase over the previous quarter. The company processed 35.7 kilotonnes of ore at an average grade of 5.4 grams per tonne. O'Keefe noted that key infrastructure upgrades, including underground waste storage and shaft skipping, were advancing on schedule and expected to enhance overall efficiency.

O'Keefe maintained a Buy rating and CA$1.80 per share price target, based on an equal-weighted valuation approach of 0.8x net asset value and 6.0x forecasted 2026 cash flow per share. He highlighted that West Red Lake Gold was trading at a discount to peers, with a multiple of 0.4x NAV versus a peer range of 0.8x to 1.0x.

In a report dated October 8, Taylor Combaluzier of Red Cloud Securities confirmed that operations at the Madsen Mine had resumed ahead of schedule and remained on track to meet 2026 production targets. He emphasized the operational benefits of the underground waste storage system, which freed up trucking capacity for ore haulage.

Combaluzier reported that all 7,055 ounces produced in Q3 had been sold at an average realized price of US$3,456 per ounce, generating gross proceeds of approximately CA$33 million. He reiterated a Buy rating and increased his price target to CA$2.30 per share, citing a discounted cash flow model that includes contributions from both Madsen and Rowan. Combaluzier also noted that funds raised through charity flow-through shares would be allocated to pre-feasibility work at Rowan, including engineering and drilling.

On October 9, Craig Stanley of Raymond James pointed to continued progress at Madsen alongside high-grade intercepts from the Austin Zone at Rowan. Highlighted results included 7.75 meters grading 139.45 grams per tonne gold, with a subinterval of 2.00 meters at 532.25 grams per tonne. Stanley noted that the mineralization tracked known plunge trends and demonstrated vertical continuity over 600 meters.

He rated the company Outperform with a CA$1.75 price target, citing ramp-up momentum and exploration potential.

In his October 29 edition, Chen Lin of the What's Chen Buying? What's Chen Selling? newsletter commented on the company's share price decline relative to recent financings. He stated, "West Red Lake Gold Mines Ltd. went down big, well below [the] last financing without warrants as the company made good progress. I have been picking up shares."

A week later, on November 6, Jeff Clark of TheGoldAdvisor.com highlighted the impact of recent drilling on the long-term outlook for Madsen. "The latest drilling at West Red Lake Gold Mines' Madsen supports the longer-term growth case," he wrote, adding that the results "strengthen confidence that the company will have multiple, well-defined high-grade zones to mine as production stabilizes and expands." Clark also referenced the Rowan project, stating that "combined with the Rowan drilling underway, the broader plan to build a 100 Koz/year platform remains credible."

Most recently, on November 10, Robert Sinn of Goldfinger Capital commented on the alignment between market conditions and the company's operational progress. "With record high and rising gold prices, West Red Lake Gold Mines Ltd. couldn't have had better timing with the ramp-up of production at the Madsen gold mine," he wrote. Sinn also noted the company's continued focus on exploration, stating that "the company is staying aggressive in its exploration approach because it believes in the discovery potential at Madsen and within the Red Lake District."

A Clearer Path Forward for Madsen and Beyond

West Red Lake Gold's ramp-up at Madsen marks a significant step in its broader strategy to establish itself as a mid-tier producer in the Red Lake region. The company has outlined three primary operational priorities: achieving commercial production at Madsen, growing production through the Rowan deposit, and pursuing new acquisitions that align with its operational strengths.

According to the company's investor materials, key milestones for Madsen include activating shaft skipping at 350 tonnes per day, completing rolling stock deliveries, and achieving operational stability through enhanced underground infrastructure. Daily ore production and model-to-actual grade reconciliation have been tracking positively, with the mine averaging 95% gold recovery over the first three quarters of 2025.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO)

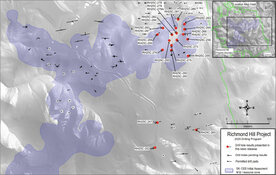

West Red Lake Gold has also identified several near-term development targets, including the South Austin high-grade panel, which comprises 14% of the second-half 2025 planned ounces and is expected to drive the 2026 mine plan. Additionally, work continues at the Rowan project, where a Preliminary Economic Assessment outlined toll milling potential for 35,200 ounces of annual production over five years with a post-tax net present value of US$125 million.

With infrastructure largely in place, ramp-up advancing, and strategic drilling campaigns underway, the company continues to build toward its stated goal of producing over 100,000 ounces of gold annually from Red Lake by 2028.

Ownership and Share Structure 1

Strategic investor Sprott Resource Lending Corp. holds about 7% of West Red Lake Gold. Institutions own about 12%, while management, insiders, and advisors hold around 2%. The remaining shares are held by retail investors.

The company's market capitalization is CA$362 million, with a 52-week stock price range of CA$0.52 - CA$1.18.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.