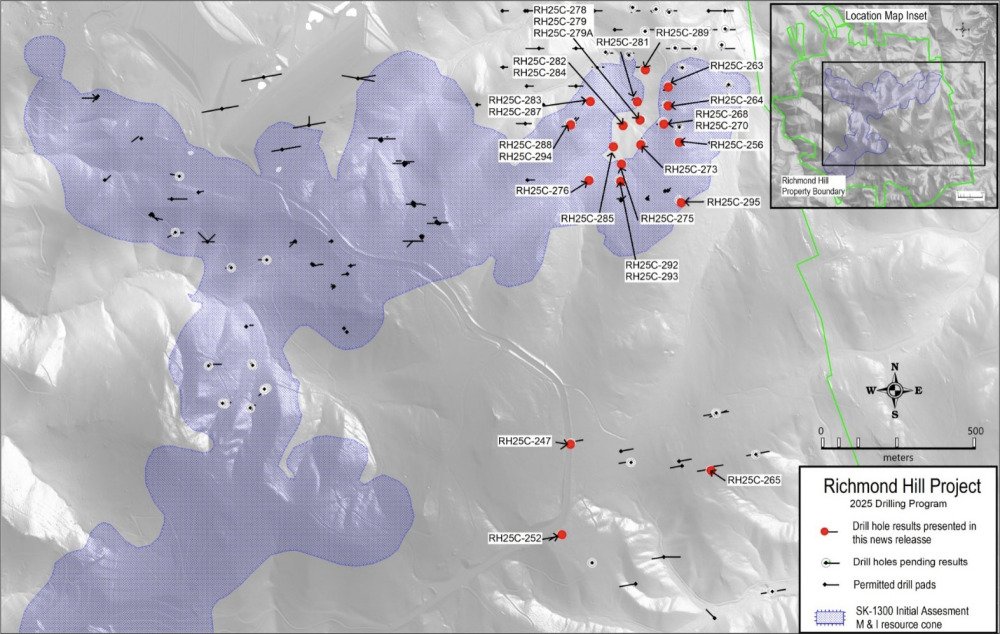

Dakota Gold Corp. (DC:NYSE American) announced assay results from 26 drill holes completed as part of its ongoing 2025 drilling campaign at the Richmond Hill Oxide Heap Leach Gold Project in the historic Homestake District of South Dakota, according to a November 19 release.

The results include the first assays from expansion drilling in the northeastern section of the project. Drilling continues to confirm high-grade gold mineralization in the northern part of Richmond Hill, reinforcing the Company’s strategy to prioritize initial mining in this area. Dakota Gold currently has two drills active on site and anticipates completing approximately 27,500 meters of drilling during the 2025 campaign.

"The drill results announced today continue to validate the scale and quality of Richmond Hill, which hosts one of the largest undeveloped heap leach gold resources in the United States," said President and Chief Operating Officer Jack Henris. "The continuity and pervasive nature of the near-surface deposit support a project that is low-cost, long-life, and delivers high margins, as highlighted in our Initial Assessment with Cash Flow earlier this year. With metallurgical drilling for the 2025 campaign now complete, we are advancing heap leach column testing and look forward to sharing those results as they are completed.”

Highlights From Update

Expansion and infill drill holes in the northeastern corner of the project area are intersecting significantly higher-grade gold than the average resource grade, including RH25C-278 intersecting 1.75 grams per tonne gold (g/t Au) over 19.9 meters and RH25C-295 intersecting 2.15 g/t Au over 30 meters, Dakota said in the release. The expansion drilling in this area has the potential to enhance the resource based on previous drilling and current resources. The mineralization in the northeast is only constrained by drilling and remains open.

According to the company, metallurgical drill holes across the northern project area continue to intercept high-grade gold, reducing risk for the project and increasing confidence in the resource. This includes RH25C-270 intersecting 2.26 g/t Au over 29.2 meters and RH25C-288 intersecting 4.15 g/t Au over 14.5 meters. The metallurgical drilling results highlight the low-risk nature of the deposit with widespread mineralization.

Dakota said its core drilling operations continue to be active in the northeastern section of the project, with additional assay results from the expansion and infill of the open mineralization expected through the fourth quarter of 2025 and into 2026.

The core drilling at the project is aimed at collecting metallurgical samples for column testing, conducting condemnation drilling beneath proposed site infrastructure for mine planning, performing infill drilling to enhance the existing resource, and carrying out expansion drilling where the resource remains open, Dakota said. The drill results will contribute to updates for both the oxide and sulfide resources in the Feasibility Study.

The set of assay results reported November 19 includes data from metallurgical drilling in the northern project area, the company noted. These drill results will refine the modeled boundaries and enhance the accuracy of the geo-metallurgical domains for the Feasibility Study and mine planning.

Additionally, the holes were designed to gather samples for metallurgical tests across a range of grades, rock types, and conditions — such as oxide, transitional, and sulfide — to create composites for heap leach column tests, Dakota said.

Analyst: High Gold Grades Over Impressive Widths

In a flash update note on November 19, Canaccord Genuity Capital Markets Analyst Peter Bell called the results a positive development for Dakota.

The results included the first assays from expansion drilling in the northeastern corner of the project. The analyst particularly noted the grades of expansion holes RH25C-278, which returned 1.75 g/t Au over 19.9 meters; and RH25C-295, which returned 2.15 g/t Au over 5.5 meters.

Similarly, infill and metallurgical drilling in the northern project area continue to demonstrate continuity of mineralization, which should be favorable for the upcoming resource update and feasibility study, Bell wrote. He calculated an average grade and width of 1.67 g/t Au and approximately 10 meters, respectively, which is significantly higher than the average measured and indicated resource grade of 0.463 g/t Au. Expansion holes drilled in the southeastern part of the project did not yield significant results, he said, although results from four holes in this area are still pending.

"Overall, the results released this morning are encouraging, in our view, intersecting high gold grades over impressive widths," Bell wrote. "The results serve to validate the current resource at Richmond Hill and provide support for resource growth. With metallurgical drilling for the 2025 campaign now complete, the company is advancing heap leach column testing. Dakota has a strong balance sheet of US$33 million (Sept 30, 2025) in cash, which on our numbers has the company fully funded through the completion of its feasibility study."

He continued, "We have a SPECULATIVE BUY rating and US$14 target price. Our target is predicated on a 0.9x multiple applied to our forward curve-derived operating NAV less net debt and other corporate adjustments."

The Catalyst: Firm Says Gold Rally 'Will Likely Go On'

The gold market is striving to maintain its position well above the initial support level of US$4,000 per ounce, as significantly outdated employment data reveals some underlying strength in the U.S. labor market, according to Neils Christensen of Kitco News on November 20.

Following the 43-day government shutdown — the longest on record — the U.S. Labor Department has finally released September’s nonfarm payrolls data, indicating the economy added 119,000 jobs, he wrote. This job growth exceeded expectations, as consensus forecasts predicted an increase of 53,000. However, the unemployment rate rose more than anticipated, climbing to 4.4%. Economists had expected it to remain steady at 4.3%. Despite this increase, the Labor Department noted that the labor market has seen little change since April.

Although the headline figures surpassed expectations, revisions to summer employment data continued to reflect a slowing labor market, Christensen said. August’s employment numbers were adjusted downward, showing a loss of 4,000 jobs. Similarly, July’s figures were revised down to 72,000 jobs, compared to the previous estimate of 79,000. The gold market is not experiencing any significant reaction to the outdated employment data. Spot gold last traded at US$4,081.70 an ounce, up 0.12% on the day.

According to Morgan Stanley on October 22, gold's rally "will likely go on."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dakota Gold Corp. (DC:NYSE American)

The precious metal reached new highs this fall, but the rally encountered a setback, with prices dropping by as much as 6%, marking the largest single-day decline in 12 years. Despite this, gold has surged approximately 50% in 2025, solidifying its position as one of the year's top-performing assets, the firm said.

The price increases are a response to significant policy, geopolitical, and economic events this year, including tariffs, the Israel-Hamas conflict, concerns about the Federal Reserve’s independence, and the U.S. government shutdown. Morgan Stanley Research anticipates the rally will persist and has revised its 2026 gold forecast upward to US$4,400 per ounce, a notable increase from its previous estimate of US$3,313. This new forecast suggests an additional gain of about 10% from early October to the end of next year.

"Investors are watching gold not just as a hedge against inflation, but as a barometer for everything from central bank policy to geopolitical risk," Morgan Stanley Metals & Mining Commodity Strategist Amy Gower said. "We see further upside in gold, driven by a falling U.S. dollar, strong ETF buying, continued central bank purchases, and a backdrop of uncertainty supporting demand for this safe-haven asset."

Ownership and Share Structure1

Twelve insiders own 12.57% of Dakota Gold and numerous institutions hold 48.52% of Dakota in aggregate. Top institutions include Orion Resource Partners (USA) LP with 6.34%, The Vanguard Group with 4.25%, BlackRock Institutional Trust Co. N.A. with 4.31%, and Van Eck Associates Corp. with 3%. The rest is in retail.

Dakota Gold has 113.26 million outstanding shares, and its market cap is US$470.04 million. Its 52-week range is US$2.05–5.51 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dakota Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

- Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.